UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM SD

Specialized Disclosure Report

TALON INTERNATIONAL, INC.

(Exact Name of Issuer as Specified in its Charter)

|

Delaware |

1 13669 |

95-4654481 |

|

(State or Other Jurisdiction of |

(Commission File Number) |

(I.R.S. Employer |

|

Incorporation or Organization) |

|

Identification No.) |

| |

|

|

| |

|

|

|

21900 Burbank Boulevard, Suite 270 |

|

91367 |

|

Woodland Hills, California |

|

(Zip Code) |

|

(Address of Principal Executive Offices) |

|

|

| |

|

|

|

Nancy Agger-Nielsen |

(818) 444-4100 |

|

(Name and telephone number, including area code, of the person to contact in connection with this report.) |

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

[X] Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

Item 1.01 – Conflict Minerals Disclosure and Report

Talon International, Inc. (“Talon”) manufactures and distributes a full range of apparel accessories including zippers and trim items to manufacturers of fashion apparel, specialty retailers and mass merchandisers.

Talon has determined that “conflict minerals” are necessary to the functionality or production of its products. Conflict minerals are defined by the SEC as columbite-tantalite (coltan), cassiterite, gold, wolframite, or their derivatives, which are limited to tantalum, tin, and tungsten. During 2014, Talon contracted for the manufacture of products containing conflict minerals but did not directly manufacture products containing conflict minerals.

Talon conducted a “reasonable country of origin inquiry” regarding conflict minerals used in its products. That reasonable country of origin inquiry was designed to determine whether conflict minerals were present in Talon products originated in the Democratic Republic of the Congo or an adjoining country (collectively defined as the “Covered Countries”) or arose from recycled or scrap sources.

After exercising due diligence applying guidance from the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (OECD 2011), an internationally recognized due diligence framework, Talon has concluded that it is unable to determine whether its products contain conflict minerals that directly or indirectly finance or benefit armed groups in any of the Covered Countries. Consequently, Talon products produced in calendar year 2014 are “DRC Conflict Undeterminable.”

Item 1.02 – Exhibit

Talon International, Inc.’s Conflict Minerals Report is filed as Exhibit 1.01 to this Form SD and is also available at Talon’s website at www.talonzippers.com, under “Investors”.

Section 2 – Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

|

Dated: May 29, 2015 |

|

/s/ Nancy Agger-Nielsen |

|

| |

|

|

|

|

|

|

Nancy Agger-Nielsen |

|

| |

|

Chief Financial Officer |

|

|

|

|

(Principal Financial and Accounting Officer) |

|

Exhibit 1.01

Talon International, Inc.

Conflict Minerals Report

For the Year Ended December 31, 2014

This Conflict Minerals Report of Talon International, Inc. (“Talon” or the “Company”, “we”, “us” or “our”) for the year ended December 31, 2014 is presented to comply with Rule 13p-1 under the Securities and Exchange Act of 1934 (the “Rule”). Certain terms in this Report are defined in the Rule and the reader is referred to those sources and to SEC Release No. 34-67716 issued by the Securities and Exchange Commission on August 22, 2012 for such definitions.

The Rule was adopted by the Securities and Exchange Commission (“SEC”) to implement reporting and disclosure requirements related to “conflict minerals” as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The Rule imposes certain reporting obligations on SEC registrants whose manufactured products contain conflict minerals which are necessary to the functionality or production of their products. Conflict minerals are defined as cassiterite, columbite-tantalite (coltan), gold, wolframite, or their derivatives, which are limited to tin, tantalum and tungsten for the purposes of this assessment. The Rule applies to registrants whatever the geographic origin of the conflict minerals and whether or not they fund armed conflict.

For products which contain necessary conflict minerals, the registrant must conduct in good faith a “reasonable country of origin inquiry” (“RCOI”) designed to determine whether any of the conflict minerals originated in the Democratic Republic of the Congo or an adjoining country (collectively defined as the “Covered Countries”). If, based on its RCOI, the registrant determines or reasonably believes that its necessary conflict minerals contained in its products originated from sources other than the Covered Countries, or did come from recycled or scrap sources, the registrant must describe its RCOI and the due diligence efforts it undertook in making its determination in a Specialized Disclosure Report on Form SD. Alternatively, if, based on its RCOI, the registrant knows or has reason to believe that any of the necessary conflict minerals contained in its products originated or may have originated in a Covered Country and knows or has reason to believe that those necessary conflict minerals may not be solely from recycled or scrap sources, or if the registrant is unable to determine the source of the conflict minerals, the registrant must conduct due diligence as a method to conclude if the necessary conflict minerals contained in those products did or did not directly or indirectly finance or benefit armed groups in the Covered Countries and file a Conflict Minerals Report as an exhibit to Form SD.

This report has not been subject to an independent private sector audit as allowed under Rule 13p-1, which provides general temporary accommodation for the first two years following November 13, 2012 and an additional two years for smaller reporting companies as defined in Rule 12b-2 of the Exchange Act.

This report has been prepared by management of Talon International, Inc. The information includes the activities of all Talon’s consolidated entities.

Talon specializes in the manufacturing and distribution of a full range of apparel accessories including zippers and trim items to manufacturers of fashion apparel, specialty retailers and mass merchandisers. Talon manufactures and distributes zippers under the Talon® brand name. Talon also provides full service outsourced trim design, sourcing and management services and supply of specified trim items and we develop and sell stretch fabrics that utilize a patented technology. Talon has approximately 212 employees worldwide and maintains sales and distribution operations across the United States, Europe and Asia. Talon’s principal executive offices are located at 21900 Burbank Boulevard, Suite 270, Woodland Hills, CA 91367.

Talon’s product lines are classified in the following categories: zippers, trim and Tekfit® items. Zippers include a full line of custom metal, coil and plastic zippers bearing the Talon brand name or logo. Trim products include a full range of apparel accessory components used in manufacturing and packaging a garment including rivets, buttons, patches, and printed paper goods such as labels and hangtags supplied to apparel manufacturers often as a comprehensive turnkey sourcing solution. Tekfit describes Talon’s proprietary, patented process which creates a line of stretchable fabric waistbands and other products containing patented Tekfit stretch technology.

We conducted an analysis of our products and found that the above SEC defined “conflict minerals” tin, tantalum, tungsten and gold (“3TG”) can be found in Talon’s metal zippers and trim products. These trim products include: metal fasteners and decorative items such as buttons, rivets, hooks and snaps.

Based upon Talon’s internal assessment, the non-metal based trim products (such as leather patches, and printed labels and hangtags) and Tekfit products do not contain conflict minerals. Accordingly, for the purpose of this report only Talon’s zippers and metal based trim products are subject to the RCOI and this report.

|

3. |

Supply Chain Overview and Reasonable Country of Origin Inquiry |

Because Talon contracts for third parties to manufacture its products, Talon is several levels removed from the actual mining of conflict minerals. Talon does not make purchases of raw ore or unrefined conflict minerals and makes no purchases in the Covered Countries.

Talon has conducted a “reasonable country of origin inquiry,” or RCOI, to determine which Talon products contain conflict minerals and whether such conflict minerals originated in any of the Covered Countries. In order to manage the scope of this task, Talon relied upon its suppliers to provide information on the origin of the 3TG contained in components and materials supplied to Talon, including sources of 3TG that are supplied to Talon’s suppliers from sub-tier suppliers. Talon has integrated responsible sourcing of minerals requirements into its Conflict Minerals Policy and Supplier Code of Conduct. Talon’s suppliers provide the 3TG sourcing information to Talon per the Talon Conflict Minerals Policy and Supplier Code of Conduct.

Talon conducted supplier training sessions designed to educate its suppliers regarding the relevant, emerging SEC requirements and Talon’s due diligence expectations.

In addition, Talon has performed a comprehensive analysis of our product components, and the role that our suppliers play throughout our manufacturing and product delivery processes. Talon defined the scope of its conflict minerals due diligence by identifying its current suppliers that provide components or engage in manufacturing activities that are likely to contain 3TG.

Talon adopted the standard Conflict Minerals reporting templates established by the Conflict-Free Sourcing Initiative (“CFSI”), and launched its conflict minerals due diligence communication survey to these suppliers who supplied our zipper and trim products in 2014. Based on those responses, Talon determined that conflict minerals present in certain of its products, as well as conflict minerals utilized in the production of certain supplier parts, may have originated in a Covered Country and were not from scrap or recycled sources. Therefore, in accordance with the Rule, Talon proceeded to engage in due diligence regarding the sources and chain of custody of its conflict minerals.

|

4. |

Reasonable Country of Origin Inquiry Conclusion |

Talon conducted an analysis of its products and found that the above SEC defined “conflict minerals” tin, tantalum, tungsten and gold (or “3TG”) can be found in Talon’s zippers and certain trim products. Therefore, these products that Talon sources are subject to the reporting obligations of Rule 13p-1.

Talon’s due diligence efforts for products produced in calendar year 2014 were unable to precisely determine whether or not all supplier parts in its supply chain contain necessary conflict minerals or, in the alternative, utilized conflict minerals in their manufacture that benefited armed groups in the Covered Countries. Consequently, Talon has concluded that the products manufactured by or for Talon during 2014 are “DRC conflict undeterminable.”

|

5. |

Conflict Minerals Status Analysis and Conflict Status Conclusion |

Talon has concluded that its products in calendar year 2014 are “DRC conflict undeterminable.” We have reached this conclusion because we have been unable to determine the origin of all of the 3TG used in our zippers and trim products.

Talon’s due diligence measures included various aspects which are summarized in the following portions of this report.

| |

6.1. |

Adoption of Conflict Minerals Policy |

Talon has adopted the following Conflict Minerals Policy, which is posted on our website at: www.talonzippers.com under “Investors”:

Talon International, Inc.

Conflict Minerals Policy

We support ending the violence and human rights violations in the mining of certain minerals from a location described as the “Conflict Region”, which is situated in the eastern portion of the Democratic Republic of the Congo (“DRC”) and surrounding countries. As a result the U.S. Securities and Exchange Commission (“SEC”) adopted final rules to implement reporting and disclosure requirements related to “conflict minerals,” as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. The rules require manufacturers who file certain reports with the SEC to disclose whether the products they manufacture or contract to manufacture contain “conflict minerals” that are “necessary to the functionality or production” of those products.

The definition of “conflict minerals” refers to gold, as well as tin, tantalum, and tungsten, the derivatives of cassiterite, columbite-tantalite, and wolframite, regardless of where they are sourced, processed or sold. The U.S. Secretary of State may designate other minerals in the future. We support these requirements to further the humanitarian goal of ending violent conflict in the DRC and in surrounding countries, which has been partially financed by the exploitation and trade of “conflict minerals”.

OUR COMMITMENT:

| |

1. |

Support the aims and objectives of the U.S. legislation on the supply of “conflict minerals”. |

| |

2. |

Do not knowingly procure specified metals that originate from facilities in the “Conflict Region” that are not certified as “conflict free”. |

| |

3. |

Ensure compliance with these requirements, and ask our suppliers to undertake reasonable due diligence with their supply chains to assure that specified metals are being sourced only from: |

| |

• |

Mines and smelters outside the “Conflict Region” or |

| |

• |

Mines and smelters which have been certified by an independent third party as “conflict free” if sourced within the “Conflict Region”. |

This due diligence includes having our suppliers provide written evidence documenting that raw materials used to produce gold, tin, tantalum and tungsten, used in the materials to manufacture components and products supplied to Talon International, originate from outside the “Conflict Region” or if they originate from within the “Conflict Region”, that the mines or smelters be certified as “conflict free” by an independent third party. The aim is to ensure that only “conflict free” materials and components are used in products that we procure.

If we discover the use of these minerals produced in facilities that are considered to be “non-conflict free”, in any material, parts or components we procure, we will take appropriate actions to transition product to be “conflict free”.

6.2. Due Diligence Process

| |

6.2.1. |

Design of our Due Diligence and Standard Utilized |

Our due diligence processes and efforts have been developed in conjunction with the 2nd edition of the Organization for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”) and the related supplements for gold and for tin, tantalum and tungsten. Talon designed our due diligence process, management and measures to conform in all material respects with the framework OECD Guidance.

Our conflict minerals due diligence process includes: the development of a Conflict Minerals Policy, establishment of governance structures with cross functional team members and senior executives, communication to, and engagement of, suppliers, due diligence compliance process and measurement, record keeping and escalation procedures.

| |

6.2.2. |

Management Systems |

| |

|

|

| |

|

As described above, Talon has adopted a company policy regarding Conflict Minerals which is posted on our website at: www.talonzippers.com under “Investors” |

| |

|

|

| |

6.2.3. |

Internal Team |

Talon has established a management system for complying with the applicable rules. Talon’s management system includes the development of a Conflict Minerals Task Force led by our Vice President Operations, Chief Financial Officer and Chief Executive Officer and a team of subject matter experts from relevant functions such as purchasing, quality assurance, and manufacturing operations. The team of subject matter experts is responsible for implementing our conflict minerals compliance strategy and is led by our Associate Director of Quality Assurance and Compliance, who acts as our conflict minerals program manager. Senior management is briefed about the results of our due diligence efforts on a regular basis.

| |

6.2.4. |

Supplier Engagement |

With respect to the OECD requirement to strengthen engagement with suppliers, Talon has engaged with our suppliers to conduct outreach, training and archive the received responses to our RCOI. Feedback from this engagement has allowed Talon to render the conclusions and statements annotated in this report.

| |

6.2.5. |

Escalation Procedure |

Talon has established a Conflict Minerals Policy and due diligence survey, which are communicated with all our suppliers. We also created follow-up processes (including e-mail communication) to identify and escalate any identified issues associated with non-responsive or problematic responses to our RCOI.

Talon has established our due diligence compliance process and set forth documentation and record maintenance mechanism to ensure the retaining of relevant documentation in electronic and hard copy forms.

| |

6.3. |

Identification and Assessment of Risk in the Supply Chain |

Because of our size, the breath and complexity of our products and the constant evolution of our supply chain, it is difficult to identify actors downstream from our direct suppliers.

We have identified 46 direct suppliers for our zippers and trim products. Of this, 20 metal hardware suppliers are within the scope of our RCOI and 26 non-metal hardware suppliers are not within the scope of the RCOI. Of the suppliers that are within the scope of the RCOI, we received 20 responses to our request for information. We have relied on these supplier’s responses to provide us with information about the source of conflict minerals contained in the products supplied to us. Our direct suppliers are similarly reliant upon information provided by their suppliers.

| |

6.4. |

Carry out Independent Third Party Audit of Supply Chain Due Diligence at Identified Points in the Supply Chain |

Talon does not have a direct relationship with 3TG smelters and refiners, nor do we perform direct audits of these entities that provide our supply chain the 3TG. However, we do rely upon the industry (for example, EICC and CFSI) efforts to influence smelters and refineries to get audited and certified through CFSI’s CFS program.

|

7. |

Steps to be Taken to Mitigate Risk and Maturing Due Diligence Program |

As Talon moves towards developing our due diligence program in 2015, Talon intends to take the following steps to continue to mitigate any possible risk that the necessary conflict minerals in our products could benefit armed groups in the DRC or adjoining counties.

| |

● |

Enhance supplier communication, training and escalation process to improve due diligence data accuracy and completion. |

| |

● |

Continue to influence additional smelters to obtain CFS status through our supply chain, where possible. |

| |

● |

Talon will work with suppliers who are sourcing from non-Conflict Free smelters to move towards using Conflict Free smelters within a reasonable time frame. That time frame will be dependent on the criticality of the specific part and the availability of alternative suppliers. |

In addition to this Report, for further information about our supply chain conflict minerals policy, including our approach for supply chain due diligence and supplier expectation, please see that policy at www.talonzippers.com under “Investors.”

| |

8.1. |

Due Diligence Process |

We conducted a survey of Talon’s active suppliers described above using the template developed jointly by the companies of Electronic Industry Citizenship Coalition® (EICC®) and the Global e-Sustainability Initiative (GeSI), known as the CFSI Reporting Template (the “Template”). The Template was developed to facilitate disclosure and communication of information regarding smelters that provide material to a company’s supply chain. It includes questions regarding a company’s conflict-free policy, engagement with its direct suppliers, and a listing of the smelters the company and its suppliers use. In addition, the template contains questions about the origin of conflict minerals included in their products, as well as supplier due diligence. Written instructions and recorded training illustrating the use of the tool is available on CFSI’s website. The Template is being widely adopted by many companies in their due diligence processes related to conflict minerals.

At the outset of Talon’s 2014 RCOI, it elected to survey its entire known component and outsourced manufacturing supply chain, which consisted of 46 suppliers. During the process of our review, Talon identified 20 suppliers who were within the scope of RCOI.

Talon created and has maintained a database of this information a copy of which has been included as part of this report. The declared sources represent a summary of all available information, which has been declared by Talon’s suppliers in response to the due diligence program.

| |

8.3. |

Efforts to Determine Country of Origin or 3TG |

Tracing materials back to their mine of origin is a complex aspect of responsible sourcing in Talon’s supply chain. By adopting methodology outlined by the CFSI’s joint industry programs and outreach initiatives and requiring that Talon’s suppliers conform with the same standards that meet the OECD guidelines and report to Talon using the Template, Talon has determined that the smelters and refiners Talon gathered from our supply chain represent the most reasonable known mine of origin information available. Through this industry joint effort, Talon made reasonable determination of the mines or locations of origin of the 3TG in its supply chain. Talon also requested that all of its suppliers support the initiative by following the sourcing initiative and working to align their declared sources with the “Known” and “Conflict Free” lists of sourced metals.

| |

8.4. |

Smelters and Refiners Identified |

At Talon, we adopted the CFSI’s industry approach and traced back the origin of 3TG by identifying smelters, refineries or recyclers and scrap supplier sources. Talon leveraged CFSI and its CFS program to trace the mine of origin of the 3TG to its ore level. The CFS program audits smelters and refineries to ensure that all certified smelters and refineries only use the ores that are conflict free from the DRC and covered countries.

As a result of Talon’s due diligence program, Talon has identified two smelters and refineries from which 3TG used in Talon’s supply chain originated. Both of these smelters and refineries are identified as CFSI’s known smelters and refineries and both are on the list of CFSI’s certified Conflict Free Smelters (CFS) list and considered to be conflict free.

Set forth below are the facilities, which to the extent known, processed the necessary conflict minerals identified by Talon supply chain during 2014:

|

Metal |

Smelter |

Country |

|

Tin |

Yunnan Tin Group (Holding) Company Limited. |

China |

|

Gold |

Shandong Zhaojin Gold & Silver Refinery Co., Ltd. |

China |

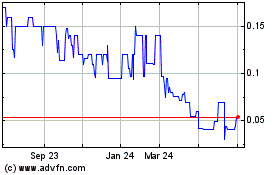

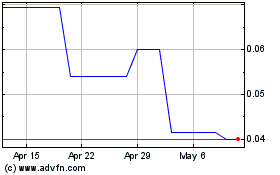

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Talon (PK) (USOTC:TALN)

Historical Stock Chart

From Apr 2023 to Apr 2024