TIDMSOLO

RNS Number : 0301S

Solo Oil Plc

28 September 2017

For Immediate Release

28 September 2017

Solo Oil plc

("Solo" or the "Company")

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2017

Chairman's Statement

The Company continues to make significant progress with the

major investments in its portfolio. During the first half 2017

successful appraisal drilling and testing at Ntorya-2 in Tanzania

led to an upgrade in the gross in place gas resources to 1.34

trillion cubic feet ("tcf"). As a result of this substantial

resource upgrade and an independent engineering study, a 25-year

development licence has been applied for in the third-quarter. Gas

sales continued at Kiliwani North at an average rate of about 15

mmscfd in the year to June with net revenues of over GBP450,000

booked during the period.

Meanwhile in the UK the drilling success in several analogous

Weald Basin projects has further de-risked the Horse Hill-1 oil

discovery where long-term flow tests are now planned prior to a

development plan being submitted.

The period also saw the Company invest in a strategic helium

exploration project in Tanzania where technical studies will be

completed in early 2018 and where drilling is hoped to be carried

out next year.

Highlights:

Tanzania

-- Ntorya-2 appraisal well was drilled and successfully flow

tested during the period and has been suspended for future gas

production

-- At Ntorya-2 a total 51 metres gross sandstone reservoir

section was encountered 74 metres shallower than in Ntorya-1

-- A restricted test flowed at 17 mmscfd of gas (equivalent to approximately 2,830 boepd)

-- Unrisked gross resource estimates for the Ntorya appraisal

area increased to 1,344 bcf Pmean GIIP

-- Solo now holds net resources of approximately 335 bcf Pmean

GIIP in the Ruvuma Basin, which the Company estimates to be in

excess of 200 bcf (35 million barrels oil equivalent) of contingent

resources, net to its 25% interest

-- io oil & gas consulting, a Baker Hughes (a GE Company)

and McDermott joint venture, were appointed to prepare a gas

commercialisation study to assist with the development of the

Ntorya field

-- A Development Plan for the Ntorya gas condensate field was

submitted to the Tanzania Petroleum Development Corporation

("TPDC") for approval during September 2017

-- Average production from Kiliwani North-1 ("KN-1") was

approximately 15 mmscfd for the first half of 2017

-- KN-1 gas is sold and paid for in US Dollars and the current

gas price is $3.27 per mmscf, a contract price that is not affected

by movements in global markets for oil and natural gas

-- Solo acquired a 10% interest in Helium One Limited during the

period as an early entry opportunity into the what is estimated to

be a US$6bn/year global helium market

-- Helium One's Rukwa Project in Tanzania is independently

estimated by Netherland, Sewell and Associates Inc. ("NSAI") to

contain unrisked most likely prospective recoverable helium volumes

close to 100 bcf

United Kingdom

-- In late 2016 an application was submitted to Surrey County

Council for the further development of Horse Hill, including

long-term flow tests and further drilling and seismic data

acquisition, if appropriate. Determination of the planning consent

is anticipated in October 2017

-- UK Environment Agency has approved the proposed long-term

testing of HH-1 and further work as envisaged under the planning

application.

-- Following the successful testing at Horse Hill-1 ("HH-1")

various operators have drilled additional wells in the Kimmeridge

Limestone play in the Weald Basin and have demonstrated the

widespread occurrence of the play, further supporting the regional

significance of the naturally fractured oil bearing reservoir

Corporate & Financial

-- Revenues from the sale of gas at Kiliwani totalled

GBP451,000, exceeding the Company's G&A for the period

-- The Company issued GBP4.55 million in new equity during the

period to pay for Ntorya-2 well testing costs and acquisition of

10% in Helium One

-- Post period end shareholders approved a 20 for 1

consolidation of the Company's issued share capital.

Review of Investments:

1. Tanzania

Many of Solo's investments are in Tanzania, a stable democratic

republic in East Africa, where gas exploration efforts have been

highly successful in recent years. Solo, and its operating partner

Aminex plc ("Aminex"), currently produces gas that is sold to TPDC

under a gas sales agreement signed in 2016. This gas, from Kiliwani

North-1, is used domestically and is important to the development

of the local energy market in Tanzania. Gas produced and utilised

in Tanzania is largely unaffected by issues that have arisen with

resources destined for export following changes in the legislation

regarding hydrocarbon and mining law recently announced by the

Tanzanian government. The nationally significant onshore Ntorya gas

discovery made by Solo and Aminex is expected to be developed

solely for local consumption and therefore expected to continue to

have TPDC's full support as Tanzania seeks to grow its indigenous

energy provision.

Changes to the mining code that have recently been announced

will affect Helium One's project, however, the economics of natural

helium are compelling and Solo's view having taken independent

legal advice and in view of the phase of the project is that the

changes proposed will not materially influence the viability of the

project which, if confirmed by drilling, would represent a world

class source of helium.

Ruvuma Basin (25% interest)

Solo holds a 25% interest in the Ruvuma Petroleum Sharing

Agreement ("Ruvuma PSA") in the south-east of Tanzania covering an

area of approximately 3,447 square kilometres of which

approximately 90% lies onshore and the balance offshore. The Ruvuma

PSA is in a region of southern Tanzania where very substantial gas

discoveries have been made offshore in recent years and where gas

has also been discovered onshore and along the coastal islands at

Ntorya, Mnazi Bay, Kiliwani North and Songo Songo.

The Ntorya gas-condensate discovery, made in 2012 and operated

by Aminex, represents the most immediate commercialisation

opportunity in the Ruvuma PSC. The Ntorya-1 well was flow testing

over a 3.5 metres zone at the top of the gross 25 metre gas bearing

interval produced at a maximum gross flow rate of 20.1 mmscfd and

139 bpd of 53 degree API condensate through a 1-inch choke. The

well is suspended as a discovery for subsequent additional testing

or production.

Based on an infill 2D seismic programme around Ntorya-1 a

re-estimation of the discovered and prospective resources in the

Likonde-Ntorya area was made and subsequently audited by LR Senergy

who issued a CPR in May 2015. LR Senergy estimated that Ntorya

contained a gross 153 bcf of proven gas in place, of which they

attributed a gross 70 bcf as best estimate contingent resources.

Overall in the Ruvuma PSA, LR Senergy estimated gross 4.17 tcf of

discovered and undiscovered gas in place.

In order to further appraise the Ntorya gas condensate discovery

made in the Ntorya-1 well it was decided to drill an up-dip well,

Ntorya-2, at a location approximately 1.5 kilometres east of the

discovery well. The location was prepared in late 2016 along with a

possible further appraisal site, Ntorya-3, located further up-dip

to the east. The Caroil-2 rig was moved to site in December and the

well spudded on 21 December 2016.

During early 2017 drilling continued on prognosis with 17-inch

casing set at 1,326 metres in early January and the well reached

the anticipated reservoir section at a depth of 2,593 metres in

early February 2017. A gross gas bearing sandstone reservoir

interval of 51 metres thickness was encountered and the well was

deepened to a final total depth of 2,795 metres, with a 7-inch

liner set prior to testing. A 34 metre interval of the gross

reservoir was perforated and flowed dry gas at a stabilised rate of

17 mmscfd through a 40/64-inch choke. Analysis of the well during

testing and interpretation of electric logs strongly suggests that

high mud weights, used to control gas influx during drilling, had

caused formation damage around the well bore and these effects were

reducing the test flows. Remedial operations prior to production

would be used to target higher flow rates.

As a result of the new data from Ntorya-2 and a reassessment of

all available data including a new seismic interpretation the gross

most likely in place gas in the Ntorya discovery was increased some

9-fold from 153 bcf in the LR Senergy report in May 2015 to 1,344

bcf. The Company is fully satisfied that such volumes, now

discovered, are commercially exploitable and along with the

operator has applied for a 25-year development licence covering the

entire Ntorya field area. An early production scheme involving

local use of the gas or its conversion to power or CNG is also

under consideration.

Once a development licence has been awarded, Solo and Aminex

will carry out an approved work programme, yet to be agreed with

the Tanzanian authorities, which may potentially include 3D seismic

acquisition and further drilling including the Ntorya-3 well at a

cost similar to the Ntorya-2 well drilled in 2017.

Solo is currently assessing its options with regards to its

future participation in the project. Amongst such considerations is

further proportionate investment, project financing of an early

production scheme, a possible farm-down, or sale of all or some of

its 25% interest in the discovery in order to monetise its

investment in the Ruvuma PSC and return funds to the Company to

deploy elsewhere.

The Ruvuma PSA comprises two licence areas: the Mtwara Licence

and the Lindi Licence. As well as the Ntorya wells, several further

prospects in the Ruvuma acreage on both Licences have been

identified from the 2014/2015 mapping, including potential

prospects at Likonde and Namisange. During 2016 formal ministerial

approval was obtained for a one-year extension to the Mtwara

Licence of the Ruvuma PSA, to 8 December 2017. Although the Lindi

Licence technically expired on 28 January 2017, negotiations are

ongoing for an extension to this licence to enable the work

commitments to be carried out in conjunction with the Mtwara

Licence area. The operator has also applied for a two-year

extension to the Mtwara Licence, which includes the Ntorya

appraisal licence, and Solo has a reasonable expectation that both

extensions will be granted.

Under the terms of the Ruvuma PSA, after the approval of a

development plan, TPDC may elect to contribute 15% of development

costs in order to obtain a participating interest of 15% in

production and revenues.

Kiliwani North (7.55% interest)

In 2014, Solo agreed with Aminex to acquire up to a 13% working

interest in the Kiliwani North Development Licence ("KNDL") on

Songo Songo Island. The Kiliwani North-1 ("KN-1") well was drilled

by Aminex and its partners in 2008 and discovered gas in a 60 metre

column in the Lower Cretaceous.

Solo acquired an initial 6.5% interest in the KNDL project for

US$3.5 million in 2015 and subsequently announced its intention to

increase its stake to up to 10% through the acquisition of three

additional tranches of project equity linked to project milestones

at the Company's option.

The condition precedent for further acquisition of project

equity by Solo was the signature of a gas sales agreement ("GSA"),

which was achieved in January 2016. The subsequently agreed tranche

milestones were the commencement of gas production, which was

achieved in April 2016, the receipt of first cash revenue and the

declaration of commercial (post-commissioning) gas production under

the take-or-pay arrangements of the GSA. The first of these

milestones has been reached and Solo increased its direct

participation to 7.55%, which would reduce subject to TPDC back-in

rights to 7.175%. Since production has continued under the

commissioning terms of the Kiliwani North GSA and as the final

tranche required TPDC to confirm a commercial operations date

Aminex and Solo Oil have consequently not completed the final

tranche of the asset sale agreement and have mutually agreed to the

termination of the 2016 agreement

The GSA signed with TPDC for KN-1 gas contains payment

guarantees in US Dollars and is linked to a price escalation

formula commencing at US$3.00 per million British Thermal Units

("mmBTU") and rising from January 2016. Following commissioning

KN-1 has been produced at a rate of roughly 15 mmscfd being the

call on gas being made by TPDC. Overall gas market development

continues to lag supply in Tanzania, however, this is expected to

change to a supply shortage in future years as new power projects

and industrial usage increases. Due to a higher than specified

calorific value for the gas and an advantageous effect of the sales

contract's indexation allowance, gas has been sold during the

reporting period at approximately US$3.27 per mcf.

A resource report by LR Senergy, completed in May 2015,

attributed approximately 28 bcf gross best estimate contingent

resource to the Kiliwani North field. As a result of continued

production following a long period when the well was shut-in, the

wellhead pressure is now declining and Aminex is reviewing possible

alternatives for remediation in the future to maximise recoverable

resources. Aminex is planning to update its resource report for

this asset and has prepared a programme to re-enter the Kiliwani

North-1 well to gather downhole data, potentially as early as later

in the year.

As previously advised, TPDC has notified Aminex that it intends

to take up its 5% share of production in accordance with the Nyuni

East Songo Songo PSA which governs the Kiliwani North Development

Licence. However, it has not yet finalised its participation in the

joint operating agreement and Solo's working interest therefore

remains at 7.55%.

Helium One (10% interest)

Solo entered into a sale and purchase agreement with Helium One

Limited ("Helium One") to acquire an initial 10% stake in Helium

One with an option to acquire a further 10% stake. Helium One owns

exploration licences in a number of highly prospective and

extremely rare helium properties in Tanzania. Netherland &

Sewell Associates International has independently assessed the most

mature of the projects, at Rukwa, in the East African Rift Valley

as having the gross potential for close to 100 bcf of helium in

place. With current world helium demand of approximately 6 bcf per

annum the Rukwa project represents a material potential

contribution to future helium supply.

Originally identified by means of helium macro-seeps the

prospects under investigation have been mapped using soil

geochemistry anomalies and are in part mapped on legacy 2D seismic

data acquired previously during failed hydrocarbon exploration. The

identified macro-seepage indicates high concentrations of helium

(up to in excess of 10% by volume) in association with nitrogen

that may be trapped in the subsurface. Helium One recently acquired

an airborne gravity and magnetic survey and plans to integrate the

interpretation of that data into their subsurface modelling before

acquiring additional 2D seismic to further define traps for

drilling, potentially as early as 2018.

World helium demand has been growing at a rate of about 3 per

cent per annum over the last decade and is a vital component of

many modern technologies, notably Magnetic Resonance Imaging

("MRI") devices used in modern medicine. As a result of its unique

properties as a super fluid, it plays a vital role in devices which

use super conducting magnets; as in MRI machines. As an inert gas

helium is also vital in the production of many critical electronic

components such as disk drives and fibre optics and for industrial

testing, purging and leak detection. Helium, as a lifting gas in

hybrid air vehicles (and other forms of airship), has also begun to

have increased significance. Though relatively abundant in the

earth's atmosphere, helium is lighter than air and is progressively

being lost to space and it is extremely difficult to recycle

effectively.

The current supply of helium comes from several large deposits

in the USA and as an impurity removed from hydrocarbon gas in a

number of liquefied natural gas ("LNG") projects such as in Qatar

and Algeria. However, the US government has been selling its

strategic reserve and will close the facility for international

sales no later than 2021, after which there is projected to be a

significant shortage of helium available on world markets. In June

2017, several countries abruptly cut diplomatic relations with

Qatar and imposed trade and travel bans. The ramifications for

global helium supply were significant, with both Qatari plants

being turned off for a period of approximately 3 weeks, as exports

of helium could not pass the trade blocks. While only a temporary

aberration, it did highlight the fragility of the helium supply

chain, and reliance on Qatar (more so in 2021 when the USA

government ceases sales). Helium One is one of the only known

large, high-volume, standalone helium resource projects that if

successful, could provide much needed stability to global

supply.

The Helium One Tanzania projects have excellent supply economics

and, once liquefied, the helium could be transported to world

markets via the deep-water port at Dar es Salaam. Given the

competitive demand for crude helium on world markets Solo and

Helium One would expect to sell helium at the wellhead through an

off-take agreement with a large industrial gas company who would

liquefy and transport the helium to market. With weak supply-demand

fundamentals helium prices, which are currently approximately

US$145 per million cubic feet (crude helium), are expected to rise

significantly.

Solo completed its acquisition of an initial 10% interest in

Helium One on 22 March 2017 through the payment of GBP1.2 million

in cash and the issue to Helium One of 236,842,105 shares at an

issue price of 0.54p in Solo Oil plc.

Since Solo's investment, Helium One have been focussing on

evolving its subsurface technical data set and preparing its

prospect database ready for possible drilling in 2018. Subsequent

to period end Helium One has also engaged SRK Consulting to prepare

a scoping study on the Songwei prospect; one of 28 prospects within

the Rukwa area. Plans have also been made to start to reprocess the

existing legacy 2D seismic data with Solo's technical

assistance.

2. United Kingdom

Solo's principal investments to date in the UK have been in the

Weald Basin, south of London, where the Horse Hill-1 ("HH-1") was

drilled and identified a thick section of oil bearing naturally

fractured Kimmeridge Limestones. A well drilled recently at

Broadford Bridge ("BB-1") some 30 kilometres to the southwest of

HH-1, has revealed the continuation of similar naturally fractured

and oil saturated Kimmeridgian age limestones and shales as were

seen at HH-1. Logs and cores from the BB-1 well as reported show

extensive natural fracturing throughout the entire Kimmeridge

section, including a previously unidentified potential oil bearing

fracture-zone below the lowest Kimmeridge Limestone, KL1, now

designated KL0 and that results indicate a possible gross vertical

thickness of the Kimmeridge continuous oil deposit of up to around

1,200 feet. Solo remains confident that with additional drilling a

regionally significant new oil play will emerge and the Company is

assessing its future investment strategy in this new play.

Horse Hill, Weald Basin (6.5% interest)

In 2014, the Company acquired a 10% interest in a special

purpose company, Horse Hill Developments Limited ("HHDL"), which

became the operator and 65% interest holder in two Petroleum

Exploration and Development Licences, PEDL 137 and 246, in the

northern Weald Basin between Gatwick Airport and London. PEDL 137

covers 99.29 square kilometres (24,525 acres) to the north of

Gatwick Airport in Surrey. PEDL 246 covers an area of 43.58 square

kilometres (10,769 acres) and lies immediately adjacent and to the

east of PEDL 137.

The HH-1 well commenced drilling operations in September 2014

and reached total depth at 8,870 feet MD in November 2014.

Evaluation of electric logs and other data collected from the well

resulted in the announcement on 24 October 2014 of a conventional

Upper Portlandian Sandstone oil discovery. Subsequent analysis of

the Kimmeridge, Oxfordian and Liassic sections in the well

indicated that there was also substantial in place oil in the

naturally fractured Kimmeridge Limestones and associated

mudstones.

Approval for the testing of all three oil bearing zones was

granted in late 2015 and the tests commenced in early February

2016. Tests lead to naturally flowing oil rates of the Kimmeridge

Limestones at a gross rate of 460 bopd from the Lower interval and

900 bopd from the upper interval. The Portland Sandstone was placed

on pump to stimulate flow and achieved a maximum gross stable rate

in excess of 320 bopd. These flow rates substantially exceeded the

expectations for the well and rank alongside some of the highest

rates ever achieved on test for any UK onshore well.

Following the testing of the Portland Sandstone, where higher

productivity and a lower than expected water cut were observed,

further analysis on the electric logs has led to a 200% increase in

the anticipated gross oil in place at this stratigraphic level.

Previous estimates of oil in place within the Portland Sandstone

were 7.7 mmbbls per square mile and were increased to 22.9 mmbbls

per square mile. Based on the original closure estimated by Xodus

in 2015 this would increase the overall gross oil in place within

the Horse Hill Portlandian discovery to 62.5 mmbbls.

The relevant licences have been extended to permit further work

and UK Oil and Gas Investments plc ("UKOG") has indicated that it

hopes to perform long term testing on all hydrocarbon bearing zones

as part of a wider appraisal program that includes 3D seismic and

further drilling. In September 2017 the Environment Agency granted

the necessary permits to HHDL to carry out extended well tests,

drill a side-track well from the existing HH-1 and drill and test a

new borehole at the HH-1 site. A planning application in relation

to the proposed activities has been submitted to Surrey County

Council ("SCC"). We have been informed by HHDL that SCC has

confirmed that the planning application is now scheduled to be

determined at the October 2017 meeting of its planning

committee.

Isle of Wight, PEDL 331 (30% interest)

An application was made jointly with UK Oil and Gas Investments

plc ("UKOG") and Angus Energy Limited ("Angus") for a 200 square

kilometre onshore block in the south and central portion of the

Isle of Wight in the UK 14(th) Landward Licensing Round. Solo holds

a 30% interest in the joint venture.

The UK Oil and Gas Authority ("OGA") have now issued the

licence, PEDL 331, to the UKOG-Solo-Angus partnership. Based on

work by UKOG and confirmed by independent work by Solo Arreton-2,

originally drilled in 1974 but never tested, is now considered to

be an oil discovery on the Arreton Main Field. When taken together

with the adjacent prospects Xodus has calculated a P50 gross oil in

place estimate of 219 mmbbls in conventional reservoirs within the

Purbeck, Portland and Inferior Oolite limestone reservoirs at

Arreton. Arreton Main is considered by Xodus to contain most likely

(P50) contingent resource net to Solo's interest in PEDL 331 of 4.7

mmbbls.

UKOG will become operator of PEDL 331 and has commenced

discussions with the local planning authorities and expects to seek

regulatory consents to appraise the Arreton Main oil discovery in

the coming years.

3. Other investments

The Company holds two other investments that remain under active

review, but have had only minimal expenditure in the reporting

period.

Burj Africa, Nigeria, West Africa (20% interest)

Between 2013 and 2015 Solo made an investment into various

ventures aimed at accessing known reserves in fields in Nigeria.

These have resulted in a 20% interest in Burj Petroleum Africa

Limited ("Burj Africa") a company which had applied for various

undeveloped fields in the 2014 Nigerian Marginal Fields Bid Round

("Marginal Fields Round") along with joint venture partners Global

Oil and Gas and Truvent Consulting.

Recent developments in the world oil markets and specific to

Nigeria have significantly delayed the issue of new licences under

the envisaged Marginal Fields Round. The Company continues to

monitor developments in Nigeria and looks forward to further news

in due course.

Ontario, Canada (28.56% interest)

Solo holds an interest in 23,500 acres of petroleum leases in

southern Ontario, which contain a number of Ordovician reefal

structures that contain variously oil, gas and condensate. The

operator, Reef Resources Inc., has been unable to raise the

necessary funds to continue the development of the Ausable gas

condensate field and no alternative has so far been found to unlock

the potential. Solo's management continues to seek ways to advance

or monetise the investment made in the Ausable and the adjacent

Airport fields, and hopes to report progress in due course.

Financial Results

The Company's operating loss for the period was GBP306,000 (30

June 2016: GBP373,000 loss). Revenue from Kiliwani North gas sales

of GBP451,000 covered Solo's G&A expenditure for the interim

period. In addition, further charges of GBP197,000 related to the

expensing of share based director options as announced in October

2016, which are treated as a non-cash accounting entry.

The Company issued GBP4.55 million in new equity during the

period to pay for Ntorya-2 well testing costs and acquisition of an

initial 10% in Helium One. The Helium One acquisition was made at

an average share price of 0.56p (equivalent to 11.1p post the

recent Share Consolidation).

At the Company's AGM in July a 20 for 1 share consolidation was

approved by shareholders. The numbers of shares in issue were

reduced on the basis of 20 existing ordinary share being

consolidated into one new ordinary share of 0.20p. Following the

Share Consolidation the Company had 392,337,801 shares in

issue.

Immediate Outlook

Solo has made significant advances in its investments in

Tanzania in the last reporting period, especially in the Ntorya

gas-condensate discovery which has been further appraised by the

Ntorya-2 well with a resultant 9-fold increase in the estimated in

place gas resources. A new Competent Persons Report for these in

place resources and likely contingent resources will be

commissioned shortly. Receipt of the requested 25-year development

licence for Ntorya, which is expected in late 2017, will allow the

finalisation of plans to commercialise Ntorya; which in Solo's case

may involve the full or partial sale, or farmout, of the Company's

equity position depending on negotiating advantageous commercial

terms with a third-party.

Production from the Kiliwani North-1 well has averaged

approximately 15 mmscfd in the half-year to June 2017 and revenues

from this underpin the Company's G&A expenditure, allowing all

new funding to be directed to the Company's investment portfolio.

Observed pressure decline in the well, if appropriately managed, is

not expected to markedly affect revenues in 2017.

The Horse Hill discovery made in 2016 yielded exceptionally high

flow rates at all three productive levels on test and is shortly

expected to receive further longer-term testing in order to help

design a commercial development. Solo is currently reviewing the

recent drilling and testing by other operators in the Weald Basin

with a view to assessing future investment potential within the

basin.

The Company has made an initial investment in a natural helium

exploration opportunity in Tanzania which it sees as a potentially

world class helium deposit with very compelling economics and

market dynamics. Further technical work in the next year is

expected, subject to the availability of financing, anticipated to

be from new strategic partners, to lead to initial drilling on

these helium prospects in 2018.

Neil Ritson

Executive Chairman

27 September 2017

Competent Person's statement:

The information contained in this document has been reviewed and

approved by Neil Ritson, Chairman for Solo Oil Plc. Mr Ritson is a

member of the Society of Petroleum Engineers, a Fellow of the

Geological Society, an Active Member of the American Association of

Petroleum Geologists and has over 39 years relevant experience in

the oil industry.

Glossary and Notes

2D seismic seismic data collected using

the two-dimensional common depth

point method

---------------------- -----------------------------------------

3D three-dimensional

---------------------- -----------------------------------------

AIM London Stock Exchange Alternative

Investment Market

---------------------- -----------------------------------------

API American Petroleum Institute

---------------------- -----------------------------------------

barrel or bbl 45 US gallons

---------------------- -----------------------------------------

bbls barrels of oil

---------------------- -----------------------------------------

bcf billion cubic feet

---------------------- -----------------------------------------

best estimate the most likely estimate of a

or P50 parameter based on all available

data, also often termed the P50

(or the value of a probability

distribution of outcomes at the

50% confidence level)

---------------------- -----------------------------------------

billion 10 to the power 9

---------------------- -----------------------------------------

bopd barrels of oil per day

---------------------- -----------------------------------------

boepd barrels of oil equivalent per

day

---------------------- -----------------------------------------

Bpd barrels per day

---------------------- -----------------------------------------

contingent resources those quantities of petroleum

estimated, at a gin date, to

be potentially recoverable from

known accumulations, but the

associated projects are not yet

considered mature enough for

commercial development due to

one or more contingencies

---------------------- -----------------------------------------

CPR Competent Persons Report

---------------------- -----------------------------------------

discovery a petroleum accumulation for

which one or several exploratory

wells have established through

testing, sampling and/or logging

the existence of a significant

quantity of potentially moveable

hydrocarbons

---------------------- -----------------------------------------

electric logs tools used within the wellbore

to measure the rock and fluid

properties of the surrounding

formations

---------------------- -----------------------------------------

G&A general and administrative expenditure

---------------------- -----------------------------------------

GIIP gas initially in place

---------------------- -----------------------------------------

GSA gas sales agreement

---------------------- -----------------------------------------

HH-1 Horse Hill-1 well

---------------------- -----------------------------------------

HHDL Horse Hill Developments Limited

---------------------- -----------------------------------------

KN-1 Kiliwani North-1 well

---------------------- -----------------------------------------

KNDL Kiliwani North Development Licence

---------------------- -----------------------------------------

m thousand (ten to the power 3)

---------------------- -----------------------------------------

mm million (ten to the power 6)

---------------------- -----------------------------------------

mmbbls million barrels of oil

---------------------- -----------------------------------------

mmscf million standard cubic feet of

gas

---------------------- -----------------------------------------

mmscfd million standard cubic feet of

gas per day

---------------------- -----------------------------------------

MD measured depth

---------------------- -----------------------------------------

OGA UK Oil and Gas Authority (formally

the Department of Energy and

Climate Change)

---------------------- -----------------------------------------

oil in place stock tank oil initially in place,

or STOIIP those quantities of oil that

are estimated to be in known

reservoirs prior to production

commencing

---------------------- -----------------------------------------

pay reservoir or portion of a reservoir

formation that contains economically

producible hydrocarbons. The

overall interval in which pay

sections occur is the gross pay;

the portion of the gross pay

that meets specific criteria

such as minimum porosity, permeability

and hydrocarbon saturation are

termed net pay

---------------------- -----------------------------------------

PEDL Petroleum Exploration and Development

License

---------------------- -----------------------------------------

permeability the capability of a porous rock

or sediment to permit the flow

of fluids through the pore space

---------------------- -----------------------------------------

petrophysics the study of the physical and

chemical properties of rock formations

and their interactions with fluids

---------------------- -----------------------------------------

play a set of known or postulated

oil or gas accumulations sharing

similar geologic properties

---------------------- -----------------------------------------

porosity the percentage of void space

in a rock formation

---------------------- -----------------------------------------

prospective resources those quantities of petroleum

which are estimated, at a given

date, to be potentially recovered

from undiscovered accumulations

---------------------- -----------------------------------------

proven reserves those quantities of petroleum,

which, by analysis of geoscience

and

engineering data, can be estimated

with reasonable certainty to

be commercially recoverable (1P),

from a given date forward, from

known reservoirs and under defined

economic conditions, operating

methods, and government regulations

---------------------- -----------------------------------------

probable reserves those additional reserves which

analysis of geoscience and engineering

data indicate are less likely

to be recovered than Proved Reserves

but more certain to be recovered

than Possible Reserves. It is

equally likely that actual remaining

quantities recovered will be

greater than or less than the

sum of the estimated Proved plus

Probable Reserves (2P)

---------------------- -----------------------------------------

possible reserves those additional reserves which

analysis of geoscience and engineering

data suggest are less likely

to be recoverable than Probable

Reserves. The total quantities

ultimately recovered from the

project have a low probability

to exceed the sum of Proved plus

Probable plus Possible (3P) Reserves,

which is equivalent to the high

estimate scenario

---------------------- -----------------------------------------

PSA petroleum sharing agreement

---------------------- -----------------------------------------

PRMS Petroleum Resources Management

System

---------------------- -----------------------------------------

reserves those quantities of petroleum

anticipated to be commercially

recovered by application of development

projects to known accumulations

from a given date forward under

defined conditions

---------------------- -----------------------------------------

reservoir a subsurface rock formation containing

an individual natural accumulation

of moveable petroleum

---------------------- -----------------------------------------

Share Consolidation on 24 July 2017 the numbers of

Company shares in issue were

reduced on the basis of 20 existing

existing ordinary share being

consolidated into one new ordinary

share of 0.20p

---------------------- -----------------------------------------

SPE numbers of shares in issue were

reduced on the basis of 20 existing

existing ordinary share being

consolidated into one new ordinary

share of 0.20p

---------------------- -----------------------------------------

tcf trillion cubic feet

---------------------- -----------------------------------------

trillion 10 to the power 12

---------------------- -----------------------------------------

unconventional widely accepted to mean those

reservoir hydrocarbon reservoirs that are

tight; that is have low permeability

---------------------- -----------------------------------------

The estimates provided in this statement are based on the

Petroleum Resources Management System ("PRMS") published by the

("SPE") and are reported consistent with the SPE's 2011 guidelines.

All definitions used in the announcement have the meaning given to

them in the PRMS.

Unless otherwise stated all figures are net to Solo's

interest.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

For further information:

Solo Oil plc

Neil Ritson / Dan Maling +44 (0) 20 3794 9230

Beaumont Cornish Limited

Nominated Adviser and

Joint Broker

Roland Cornish/Rosalind

Hill Abrahams +44 (0) 20 7628 3396

Shore Capital

Joint Broker

Jerry Keen +44 (0) 20 7408 4090

Beaufort Securities

Joint Broker

Jon Belliss +44 (0) 20 7382 8300

Buchanan (PR)

Ben Romney / Chris

Judd / Henry Wilson +44 (0) 20 7466 5000

CONDENSED INTERIM INCOME STATEMENT

Six months Six months Year ended

ended ended

Notes 30 June 30 June 31 December

2017 2016 2016

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Revenue 451 - 501

Administrative expenses:

G&A 450 357 725

Share based expense 197 - 49

Exchange loss / (gain) 110 16 (53)

------------ ------------ ------------

Loss from operation (306) (373) (220)

Amortisation costs (310) - (275)

Finance costs - (2) (29)

Provision for losses on - (37) -

financial instrument

------------ ------------ ------------

(Loss) on ordinary activities

before taxation (616) (412) (524)

Income tax - - -

------------ ------------ ------------

Retained (Loss) for the

period attributable to

equity holders of the

Company (616) (412) (524)

------------ ------------ ------------

Loss per share (pence)

Basic and diluted 2 (0.008) (0.010) (0.010)

------------ ------------ ------------

CONDENSED INTERIM STATEMENT OF OTHER COMPREHENSIVE INCOME

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2017 2016 2016

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Loss for the period (616) (412) (524)

Decrease in value of Available

for sale assets (3) (14) (34)

Total comprehensive income (619) (426) (558)

------------ ------------ ------------

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

As at As at As at

30 June 30 June 31 December

2017 2016 2016

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Non-current assets

Intangible assets 14,868 11,783 10,231

Oil & gas properties 2,173 - 2,483

Available for sale assets 1,176 1,203 1,181

Total non-current assets 18,217 12,986 13,895

Current assets

Trade and other receivables 1,151 791 1,336

Cash and cash equivalents 526 362 600

------------ ------------ ------------

Total current assets 1,677 1,153 1,936

------------ ------------ ------------

Total assets 19,894 14,139 15,831

------------ ------------ ------------

Current liabilities

Trade and other payables (603) (183) (444)

Derivative financial - (351) -

instrument

Total liabilities (603) (534) (444)

------------ ------------ ------------

Net assets 19,291 13,605 15,387

============ ============ ============

Equity

Share capital 785 588 699

Deferred share capital 1,831 1,831 1,831

Share premium reserve 31,799 25,805 27,559

Share-based payments 1,130 884 933

AFS reserve (119) (96) (166)

Retained loss (16,135) (15,407) (15,519)

------------ ------------ ------------

Total equity attributable

to equity holders of

the parent 19,291 13,605 15,387

============ ============ ============

CONDENSED INTERIM STATEMENT OF CASH FLOWS

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2017 2016 2016

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Cash outflow from operating

activities

Operating loss (306) (373) (220)

Adjustments for:

Share-based payments 197 - 49

Decrease/(increase) in

receivables 185 (268) (813)

Increase/(decrease) in

payables 159 (51) 210

Foreign exchange loss 2 (9) 93

------------ ------------ ------------

Net cash (outflow) from

operating activities 237 (701) (681)

------------ ------------ ------------

Cash flows from investing

activities

Payments to acquire intangible

assets (4,637) (391) (1,597)

Payments to acquire available

for sale investment - (8) (450)

Net cash outflow from

investing activities (4,637) (399) (2,047)

------------ ------------ ------------

Cash flows from financing

activities

Repayments of borrowings - (122) (119)

Finance costs - - (2)

Proceeds on issuing of

ordinary shares 4,550 800 2,800

Cost of issue of ordinary

shares (224) (40) (175)

------------ ------------ ------------

Net cash inflow from

financing activities 4,326 638 2,504

------------ ------------ ------------

Net (decrease) in cash

and cash equivalents (74) (462) (224)

Cash and cash equivalents

at beginning of period 600 824 824

Cash and cash equivalents

at end of period 526 362 600

============ ============ ============

CONDENSED STATEMENT OF CHANGES IN EQUITY

Share capital Deferred Share premium Share based AFS Accumulated Total

share capital payments reserve losses

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Balance at 31

December

2015 556 1,831 25,077 884 (82) (14,995) 13,271

-------------- --------------- -------------- ------------ --------- ------------ ---------

Loss for the

period - - - - - (524) (524)

Decrease in

value of

Available for

sale assets - - - - (34) - (34)

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

comprehensive

income - - - - (34) (524) (558)

Share issue 143 - 2,657 - - - 2,800

Cost of share

issue - - (175) - - - (175)

Share-based

payment

charge - - - 49 - - 49

Share options - - - - - - -

expired

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

contributions

by and

distributions

to owners of

the Company 143 - 2,482 49 - - 2,674

Balance at 31

December

2016 699 1,831 27,559 933 (116) (15,519) 15,387

-------------- --------------- -------------- ------------ --------- ------------ ---------

Loss for the

period - - - - - (616) (616)

Decrease in

value of

Available for

sale assets - - - - (3) - (3)

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

comprehensive

income - - - - (3) (616) (619)

Share capital

issued 86 - 4,464 - - - 4,550

Cost of share

issue - - (224) - - - (224)

Share-based

payment

charge - - - 197 - - 197

Total

contributions

by and

distributions

to

owners of the

Company 86 - 4,240 197 - - 4,523

Balance at 30

June 2017 785 1,831 31,799 1,130 (119) (16,135) 19,291

-------------- --------------- -------------- ------------ --------- ------------ ---------

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION

1 BASIS OF PREPARATION

The financial information has been prepared under the historical

cost convention and on a going concern basis and in accordance with

International Financial Reporting Standards and IFRIC

interpretations adopted for use in the European Union ("IFRS") and

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

The condensed interim financial information for the period ended

30 June 2017 has not been audited or reviewed in accordance with

the International Standard on Review Engagements 2410 issued by the

Auditing Practices Board. The figures were prepared using

applicable accounting policies and practices consistent with those

adopted in the statutory accounts for the period ended 31 December

2016. The figures for the period ended 31 December 2016 have been

extracted from these accounts, which have been delivered to the

Registrar of Companies, and contained an unqualified audit

report.

The condensed interim financial information contained in this

document does not constitute statutory accounts. In the opinion of

the directors the financial information for this period fairly

presents the financial position, result of operations and cash

flows for this period.

This Interim Financial Report was approved by the Board of

Directors on 27 September 2017.

Statement of compliance

These condensed company interim financial statements have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union with the

exception of International Accounting Standard ('IAS') 34 - Interim

Financial Reporting. Accordingly the interim financial statements

do not include all of the information or disclosures required in

the annual financial statements and should be read in conjunction

with the Company's 2016 annual financial statements.

2 LOSS PER ORDINARY SHARE

The calculation of earnings per share is based on the loss after

taxation divided by the weighted average number of share in issue

during the period:

Six months to Six months to Year ended

30 June 2017 30 June 2016 31 December 2016

(Unaudited) (Unaudited) (Audited)

Net loss after taxation (GBP 000's) (616) (412) (524)

Weighted average number of ordinary shares used in calculating

basic earnings per share (millions) 7,537.5 5,780.4 6,091.4

Basic loss per share (pence) (0.008) (0.010) (0.010)

As the inclusion of the potential ordinary shares would result

in a decrease in the loss per share they are considered to be

anti-dilutive and, as such, a diluted loss per share is not

included.

3 EVENTS AFTER THE REPORTING DATE.

On 24 July 2017 at the Company's AGM, it was approved via an

ordinary resolution to consolidate every 20 existing ordinary

shares into one new ordinary share.

The consolidation has been structured in such a way so that each

of the new ordinary shares created shall have a nominal value of

0.20p each. This was achieved by a consolidation of every 20

existing ordinary shares into 1 new ordinary share. Such new

ordinary shares will have the same rights and be subject to the

same restrictions (save as to par value) as the existing ordinary

shares. As a result the Company now has 392,337,801 New Ordinary

Shares in issue.

4 A copy of this interim statement is available on the Company's

website www.solooil.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR PGUQUBUPMGBM

(END) Dow Jones Newswires

September 28, 2017 02:01 ET (06:01 GMT)

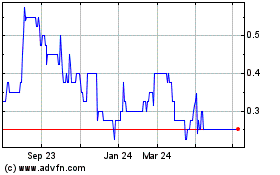

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

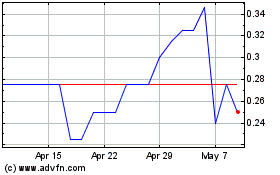

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Apr 2023 to Apr 2024