TIDMSOLO

RNS Number : 8081J

Solo Oil Plc

14 September 2016

For Immediate Release

14 September 2016

Solo Oil plc

("Solo" or the "Company")

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2016

Chairman's Statement

The Company has continued to advance its portfolio of oil and

gas investments in the first half of 2016 with several major

milestones occurring in that period; most significantly the signing

of a gas sales agreement for Kiliwani North in Tanzania in January

followed in April by first gas from the project, and the successful

testing of the Horse Hill oil discovery in the UK providing

considerable support to the concept of a commercial discovery.

Whilst market conditions remain somewhat volatile and uncertain the

Company has taken prudent measures to cut costs and to focus on the

existing core assets in Tanzania and the UK.

Highlights for the period include:

Tanzania

-- Gas Sales Agreement ("GSA") was executed with the Tanzanian

Petroleum Development Corporation ("TPDC") for a price of US$3.00

per mmBTU

-- First gas was achieved from Kiliwani North-1 ("KN-1") on 4 April 2016

-- Commissioning of the Song Songo Island Gas Plant was

completed and testing of the KN-1 well up to over 30 mmscfd was

undertaken

-- Solo increased its interest in KN-1 from 6.175% to 7.175% and

holds an option to increase its interest to up to 8.75% as project

performance milestones are achieved

-- Following the mid-year, first revenue from Kiliwani North was received in line with the GSA

-- A 12-month extension of the Ruvuma PSA was granted by TPDC

and endorsed by the Tanzanian Minister of Petroleum

-- Ruvuma PSA operator Aminex plc announced its intention to

drill two Ntorya appraisal wells starting in 2016 and that site

preparation for the first well, Ntorya-2, was underway

United Kingdom

-- Horse Hill-1 well ("HH-1") was tested with the Kimmeridge

Limestones produced at natural flow rates of over 460 and 900

barrels of oil per day gross ("bopd") from naturally fractured

intervals in the Lower and Upper Kimmeridge respectively

-- Pumped production, constrained by pump size, of up to a gross

320 bopd was obtained from the Portland Sandstone reservoir during

testing of that interval at HH-1 in March

-- The Company was formally awarded a 30% working interest in

PEDL 331 on the Isle of Wight and announced its intention, with

operator UK Oil and Gas Investments ("UKOG"), to pursue the

previously discovered Arreton-2 field as part of an initial work

program

-- The resources of the HH-1 Portland discovery were upgraded in

July by 200 percent in a reserves report by Xodus for UKOG

Corporate

-- On 7 April the Company raised a total of GBP0.8 million

before financing costs through the allotment of 320 million shares

in private placements at a price of 0.25p

-- Following the AGM on 10 August the Board was restructured

with the appointment of Dan Maling as Finance Director and the

retirement of Sandy Barblett as a non-executive director, to be

replaced by Don Strang the former Finance Director

Review of Investments for the period:

1. Tanzania, Kiliwani North (7.175% interest)

In 2014 Solo agreed with Aminex to acquire up to a 13% working

interest in the Kiliwani North Development Licence ("KNDL") on

Songo Songo Island. The Kiliwani North-1 ("KN-1") well was drilled

by Aminex and its partners in 2008 and discovered gas in a 60 metre

column in the Lower Cretaceous. Based on well test results Kiliwani

North-1 is expected to be flowed at a rate of up to 30 mmscfd once

on stream through a short tie-in pipeline to the Songo Songo Island

gas processing facility, and from there to the newly constructed

36-inch pipeline to Dar es Salaam.

Solo acquired an initial 6.5% interest in the KNDL project for

US$3.5 million in 2015 and subsequently announced its intention to

increase its stake to 10% through the acquisition of three

additional tranches of project equity linked to project milestones

at the Company's option. Solo's original stake of 6.5% was

subsequently reduced by way TPDC's back-in to the project for a 5%

interest which reduced Solo's holding to 6.175%. Back-in by the

State Company is viewed as a positive move since it aligns the KNDL

partnership with national objectives.

The condition precedent for further acquisition of project

equity by Solo was the signature of a gas sales agreement ("GSA")

which was achieved in January 2016. The subsequently agreed tranche

milestones were the commencement of gas production which was

achieved in April 2016, the receipt of first cash revenue and the

declaration of commercial (post-commissioning) gas production under

the take-or-pay arrangements of the GSA. The first of these

milestones has been reached and Solo has increased its direct

participation to 7.175%. Receipt of first revenue occurred in

August 2016 and the Company has elected not to increase equity in

KNDL to 8.425% in order to focus on investments in the Ruvuma PSC.

The Company retains the option to increase its KNDL stake by a

further 1.575% to 8.75% when commercial operations are officially

declared.

The GSA signed with TPDC for KN-1 gas contains payment

guarantees in US Dollars ("US$") and is linked to a price

escalation formula commencing at US$3.00 per million BTU ("mmBTU")

and rising from January 2016. The main contract phase is a

depletion contract with take-or-pay provisions for 85% of the daily

minimum quantity of gas to be supplied, initially set at a gross 20

mmscfd. Payment for gas during the commissioning phase is based on

the agreed tariff on an "as supplied" basis and no minimum quantity

is guaranteed under the contract. Commissioning of the Songo Songo

Island gas processing plant commenced in early April 2016 and was

essentially complete by end July.

Independently verified gas in place was confirmed by LR Senergy

in a CPR in May 2015. LR Senergy computed gross mean gas in place

of 44 bcf of which 28 bcf have been attributed as best estimate

contingent resources. These contingent resources will be converted

to reserves once the GSA comes into full force on commercial gas

production, which anticipated to be in the third or fourth quarter

of 2016.

2. Tanzania, Ruvuma Basin (25% interest)

Solo holds a 25% interest in the Ruvuma Petroleum Sharing

Agreement ("Ruvuma PSA") in the south-east of Tanzania covering an

area of approximately 3,447 square kilometres of which

approximately 90% lies onshore and the balance offshore. The Ruvuma

PSA is in a region of southern Tanzania where very substantial gas

discoveries have been made offshore in recent years and where gas

has also been discovered onshore and along the coastal islands at

Ntorya, Mnazi Bay and Songo Songo Island.

The Ntorya gas-condensate discovery, made in 2012 and operated

by Aminex plc ("Aminex"), represents the most immediate

commercialisation opportunity in the Ruvuma PSC. The Ntorya-1 well

was flow testing over a 3.5 metres zone at the top of the gross 25

metre gas bearing interval produced at a maximum gross flow rate of

20.1 million cubic feet per day ("mmscfd") and 139 barrels per day

("bpd") of 53 degree API condensate through a 1-inch choke. The

well is currently suspended as a discovery for subsequent

additional testing or production. An early production scheme

involving local use of the gas or its conversion to power is under

consideration.

Based on an infill 2D seismic programme around Ntorya-1 a

re-estimation of the discovered and prospective resources in the

Likonde-Ntorya area was made and subsequently audited by Senergy

(GB) Limited ("LR Senergy") who issued a Competent Person's Report

("CPR") in May 2015. LR Senergy estimated that Ntorya contains a

gross 158 bcf of proven gas in place, of which they attribute a

gross 70 bcf as best estimate contingent resources. Overall in the

Ruvuma PSA, LR Senergy estimate gross 4.17 trillion cubic feet

("tcf") of discovered and undiscovered gas in place. Contingent

resources are expected to be converted to reserves once a

commercial development and export scheme is approved.

The partners in the Ruvuma PSA are planning the drilling of two

appraisal well in order to firm up these resource volumes and to

commence gas sales negotiations. Two appraisal well locations have

been selected, Ntorya-2 and -3, and it is anticipated that the

first of these wells could be spudded before end 2016. At the time

of this report site preparation is well advanced at Ntorya-2

location.

In order to fund the drilling of the appraisal wells Solo is

again considering a farmout of a portion of its 25% interest in

return for a financial carry on the appraisal. Solo is currently

contacting potentially interested parties and hopes to finalise

arrangements prior to the spudding of Ntorya-2. The Company remains

open minded as to farmout arrangements and will consider offers on

their merits.

3. Horse Hill, Weald Basin, UK (6.5% interest)

In 2014 the Company acquired a 10% interest in a special purpose

company, Horse Hill Developments Limited ("HHDL"), which became the

operator and 65% interest holder in two Petroleum Exploration and

Development Licences, PEDL 137 and 246, in the northern Weald Basin

between Gatwick Airport and London.

The PEDL 137 licence covers 99.29 square kilometres (24,525

acres) to the north of Gatwick Airport in Surrey and contains the

Horse Hill discovery and several other exploration leads. PEDL 246

covers an area of 43.58 square kilometres (10,769 acres) and lies

immediately adjacent and to the east of PEDL 137.

The Horse Hill-1 ("HH-1") well commenced drilling operations in

September 2014 and reached total depth at 8,870 feet MD in November

2014. Evaluation of electric logs and other data collected from the

well resulted in the announcement on 24 October 2014 of a

conventional Upper Portlandian Sandstone oil discovery. Subsequent

analysis of the Kimmeridge, Oxfordian and Liassic sections in the

well indicated that there was also substantial in place oil in the

naturally fractured Kimmeridge Limestones and associated

mudstones.

Approval for the testing of all three oil bearing zones was

granted in late 2015 and the tests commenced in early February

2016. Tests lead to naturally flowing oil rates of the Kimmeridge

Limestones at a gross rate of 460 bopd from the Lower interval and

900 bopd from the upper interval. The Portland Sandstone was placed

on pump to stimulate flow and achieved a maximum gross stable rate

in excess of 320 bopd. These flow rates substantially exceeded the

expectations for the well and rank alongside some of the highest

rates ever achieved on test for any UK onshore well.

Following the testing of the Portland Sandstone, when higher

productivity and a lower than expected water cut were observed,

further analysis on the electric logs has led to a 200% increase in

the anticipated gross oil in place at this stratigraphic level.

Previous estimates of oil in place within the Portland Sandstone

were 7.7 mmbbls per square mile and were increased to 22.9 mmbbls.

Based on the original closure estimated by Xodus in 2015 this would

increase the overall oil in place within the Horse Hill Portlandian

discovery to 62.5 mmbbls.

The relevant licences have been extended to permit further work

and UKOG has indicated that it hopes to perform long term testing

on all three zones as part of a wider appraisal program that

includes 3D seismic and further drilling. Planning permission is

presently being sought for the next phase of testing which will

establish the parameters of any development scheme and the

commerciality of production from the various oil bearing

intervals.

4. PEDL 331, Isle of Wight, UK (30% interest)

An application was made jointly with UK Oil and Gas Investments

plc ("UKOG") and Angus Energy Limited (who subsequently sold this

interest to Doriemus plc ("Doriemus")) for a 200 square kilometre

onshore block in the south and central portion of the Isle of Wight

in the UK 14(th) Landward Licensing Round. Solo holds a 30%

interest in this joint venture.

The UK Oil and Gas Authority ("OGA") have now issued the

licence, PEDL 331, to the UKOG-Solo-Doriemus partnership. Based on

work by UKOG and confirmed by independent work by Solo Arreton-2,

originally drilled in 1974 but never tested, is now considered to

be an oil discovery on the Arreton Main Field. When taken together

with the adjacent prospects Xodus has calculated a P50 gross oil in

place estimate of 219 mmbbls in conventional reservoirs within the

Purbeck, Portland and Inferior Oolite limestone reservoirs at

Arreton. Arreton Main is considered by Xodus to contain most likely

(P50) contingent resource net to Solo's interest in PEDL 331 of 4.7

mmbbls.

UKOG will become operator of PEDL 331 and has commenced

discussions with the local planning authorities and expects to seek

regulatory consents to appraise the Arreton Main oil discovery in

the coming years.

5. Burj Africa, Nigeria, West Africa (20% interest)

Between 2013 and 2015 Solo made an investment various ventures

aimed at accessing known reserves in fields in Nigeria. These have

resulted in a 20% interest in Burj Petroleum Africa Limited ("Burj

Africa") a company which had applied for various undeveloped fields

in the 2014 Nigerian Marginal Fields Bid Round ("Marginal Fields

Round") along with joint venture partners Global Oil and Gas

("Global") and Truvent Consulting.

Two adjacent marginal fields have been applied for containing 10

wells previously drilled by an international major oil and gas

company. These fields are believed by Burj Africa and its partners

to contain gross proven, probable and possible recoverable oil

reserves of 59.3 mmbbls, approximately 13.5 mmbbls net to Burj

Africa after payment of royalties.

Award of these blocks and any subsequent operations continues to

be subject to Nigerian government approval. Recent developments in

the world oil markets and specific to Nigeria have significantly

delayed the issue of new licences under the envisaged Marginal

Fields Round. The Company continues to monitor developments in

Nigeria and looks forward to further news in due course.

6. Ontario, Canada (28.56% interest)

Solo holds an interest in 23,500 acres of petroleum leases in

southern Ontario which contain a number of Ordovician reefal

structures which contain variously oil, gas and condensate. The

operator, Reef Resources Inc., has been unable to raise the

necessary funds to continue the development of the Ausable gas

condensate field and no alternative has so far been found to unlock

the potential. Solo's management continues to seek ways to advance

or monetise the investment made in the Ausable and adjacent Airport

fields, and hopes to report progress in due course. No material

progress has however been achieved in 2016 year to date.

7. Morocco

In 2015 Solo acquired a small seed interest in the shares

Canadian listed oil and gas company, Maxim Resources, with a view

to acquiring an interest in a possible onshore gas production asset

in Morocco. This is a very early stage seed investment and will be

reported on more fully as the project takes shape.

Financial Results

During the year to date in order to fund its ongoing investments

the Company raised gross proceeds of GBP0.8 million in new equity

by way of the placing of 320 million new shares at 0.25p each.

The Company's operating loss for the period was GBP373,000 (30

June 2015: GBP372,000 loss). In addition, further charges of

GBP37,000 (30 June 2015: GBP679,000) relates to the provision for

potential losses on the financial instrument (the Equity Swap

Agreement) with YA Global Master SPV Ltd as announced on 24

September 2014 and GBP2,000 (30 June 2015: GBP49,000) for finance

charges.

Immediate Outlook

The Company has made significant advances in its investments in

Tanzania and the UK in the last reporting period and is now on

production and receiving revenue from its Kiliwani North

investment. The Ruvuma PSC which holds the Ntorya gas condensate

discovery has been extended and is targeted for early appraisal

drilling. The Horse Hill discovery has yielded exceptionally high

flow rates at all three productive levels and further long term

testing is now planned to design a commercial development.

Additionally, the Company has added prospective acreage including

the Arreton-2 discovery in a new onshore licence in the Isle of

Wight, providing further material prospectivity and oil production

potential for future years.

Short term focus will be maintained on the Tanzania and UK

portfolio whilst energy market volatility persists. The Company is

increasingly focussed on cost efficiency in its small head office

function and anticipates further reductions in costs in the second

half of the year.

Neil Ritson

Chairman

14 September 2016

Competent Person's statement:

The information contained in this document has been reviewed and

approved by Neil Ritson, Chairman for Solo Oil Plc. Mr Ritson is a

member of the Society of Petroleum Engineers, a Fellow of the

Geological Society, an Active Member of the American Association of

Petroleum Geologists and has over 38 years relevant experience in

the oil industry.

Glossary and Notes

2D seismic seismic data collected using

the two-dimensional common depth

point method

---------------------- -----------------------------------------

3D three-dimensional

---------------------- -----------------------------------------

AIM London Stock Exchange Alternative

Investment Market

---------------------- -----------------------------------------

API American Petroleum Institute

---------------------- -----------------------------------------

barrel or bbl 45 US gallons

---------------------- -----------------------------------------

bbls barrels of oil

---------------------- -----------------------------------------

bcf billion cubic feet

---------------------- -----------------------------------------

best estimate the most likely estimate of a

or P50 parameter based on all available

data, also often termed the P50

(or the value of a probability

distribution of outcomes at the

50% confidence level)

---------------------- -----------------------------------------

billion 10 to the power 9

---------------------- -----------------------------------------

bopd barrels of oil per day

---------------------- -----------------------------------------

contingent resources those quantities of petroleum

estimated, at a given date, to

be potentially recoverable from

known accumulations, but the

associated projects are not yet

considered mature enough for

commercial development due to

one or more contingencies

---------------------- -----------------------------------------

CPR Competent Persons Report

---------------------- -----------------------------------------

discovery a petroleum accumulation for

which one or several exploratory

wells have established through

testing, sampling and/or logging

the existence of a significant

quantity of potentially moveable

hydrocarbons

---------------------- -----------------------------------------

electric logs tools used within the wellbore

to measure the rock and fluid

properties of the surrounding

formations

---------------------- -----------------------------------------

GIIP gas initially in place

---------------------- -----------------------------------------

GSA gas sales agreement

---------------------- -----------------------------------------

HH-1 Horse Hill-1 well

---------------------- -----------------------------------------

HHDL Horse Hill Developments Limited

---------------------- -----------------------------------------

KN-1 Kiliwani North-1 well

---------------------- -----------------------------------------

KNDL Kiliwani North Development Licence

---------------------- -----------------------------------------

m thousand (ten to the power 3)

---------------------- -----------------------------------------

mm million (ten to the power 6)

---------------------- -----------------------------------------

mmbbls million barrels of oil

---------------------- -----------------------------------------

mmscf million standard cubic feet of

gas

---------------------- -----------------------------------------

mmscfd million standard cubic feet of

gas per day

---------------------- -----------------------------------------

OGA UK Oil and Gas Authority (formally

the Department of Energy and

Climate Change)

---------------------- -----------------------------------------

oil in place stock tank oil initially in place,

or STOIIP those quantities of oil that

are estimated to be in known

reservoirs prior to production

commencing

---------------------- -----------------------------------------

pay reservoir or portion of a reservoir

formation that contains economically

producible hydrocarbons. The

overall interval in which pay

sections occur is the gross pay;

the portion of the gross pay

that meets specific criteria

such as minimum porosity, permeability

and hydrocarbon saturation are

termed net pay

---------------------- -----------------------------------------

PEDL Petroleum Exploration and Development

License

---------------------- -----------------------------------------

permeability the capability of a porous rock

or sediment to permit the flow

of fluids through the pore space

---------------------- -----------------------------------------

petrophysics the study of the physical and

chemical properties of rock formations

and their interactions with fluids

---------------------- -----------------------------------------

play a set of known or postulated

oil or gas accumulations sharing

similar geologic properties

---------------------- -----------------------------------------

porosity the percentage of void space

in a rock formation

---------------------- -----------------------------------------

prospective resources those quantities of petroleum

which are estimated, at a given

date, to be potentially recovered

from undiscovered accumulations

---------------------- -----------------------------------------

proven reserves those quantities of petroleum,

which, by analysis of geoscience

and engineering data, can be

estimated with reasonable certainty

to be commercially recoverable

(1P), from a given date forward,

from known reservoirs and under

defined economic conditions,

operating methods, and government

regulations

---------------------- -----------------------------------------

probable reserves those additional reserves which

analysis of geoscience and engineering

data indicate are less likely

to be recovered than Proved Reserves

but more certain to be recovered

than Possible Reserves. It is

equally likely that actual remaining

quantities recovered will be

greater than or less than the

sum of the estimated Proved plus

Probable Reserves (2P)

---------------------- -----------------------------------------

possible reserves those additional reserves which

analysis of geoscience and engineering

data suggest are less likely

to be recoverable than Probable

Reserves. The total quantities

ultimately recovered from the

project have a low probability

to exceed the sum of Proved plus

Probable plus Possible (3P) Reserves,

which is equivalent to the high

estimate scenario

---------------------- -----------------------------------------

PSA petroleum sharing agreement

---------------------- -----------------------------------------

PRMS Petroleum Resources Management

System

---------------------- -----------------------------------------

reserves those quantities of petroleum

anticipated to be commercially

recovered by application of development

projects to known accumulations

from a given date forward under

defined conditions

---------------------- -----------------------------------------

reservoir a subsurface rock formation containing

an individual natural accumulation

of moveable petroleum

---------------------- -----------------------------------------

SPE Society of Petroleum Engineers

---------------------- -----------------------------------------

tcf trillion cubic feet

---------------------- -----------------------------------------

trillion 10 to the power 12

---------------------- -----------------------------------------

unconventional widely accepted to mean those

reservoir hydrocarbon reservoirs that are

tight; that is have low permeability

---------------------- -----------------------------------------

The estimates provided in this statement are based on the

Petroleum Resources Management System ("PRMS") published by the

("SPE") and are reported consistent with the SPE's 2011 guidelines.

All definitions used in the announcement have the meaning given to

them in the PRMS.

For further information:

Solo Oil plc

Neil Ritson/Daniel

Maling +44 (0) 20 3794 9230

Beaumont Cornish Limited

Nominated Adviser and

Joint Broker

Roland Cornish +44 (0) 20 7628 3396

Shore Capital

Joint Broker

Pascal Keane /Jerry

Keen +44 (0) 20 7408 4090

Cassiopeia Services

Investor and Media

Relations

Stefania Barbaglio +44 (0) 79 4969 0338

CONDENSED INTERIM INCOME STATEMENT

Six months Six months Year ended

ended ended

Notes 30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Revenue - - -

Gross profit - - -

Administrative expenses (373) (372) (906)

------------ ------------ ------------

Operating (loss) (373) (372) (906)

Impairment charge - - (875)

Finance costs (2) (49) (386)

Finance revenue - - -

Provision for losses on

financial instrument (37) (679) (606)

------------ ------------ ------------

(Loss) on ordinary activities

before taxation (412) (1,100) (2,773)

Income tax (expense) - - -

------------ ------------ ------------

Retained (Loss) for the

period attributable to

equity holders of the

Company (412) (1,100) (2,773)

------------ ------------ ------------

Loss per share (pence)

Basic and diluted 2 (0.01) (0.02) (0.04)

------------ ------------ ------------

CONDENSED INTERIM STATEMENT OF OTHER COMPREHENSIVE INCOME

Six months Six months Year ended

ended ended

Notes 30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Loss for the period (412) (1,100) (2,773)

Decrease in value of Available

for sale assets (14) (41) (78)

Total comprehensive income (426) (1,141) (2,851)

------------ ------------ ------------

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

As at As at As at

Notes 30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Non-current assets

Intangible assets 11,783 11,515 11,392

Available for sale assets 1,203 1,809 1,192

Total non-current assets 12,986 13,324 12,584

Current assets

Trade and other receivables 3 791 1,123 523

Derivative financial instrument - - -

Cash and cash equivalents 362 1,344 824

------------ ------------ ------------

Total current assets 1,153 2,467 1,347

------------ ------------ ------------

Total assets 14,139 15,791 13,931

------------ ------------ ------------

Current liabilities

Trade and other payables (183) (176) (234)

Derivative financial instrument (351) (189) (314)

Borrowings - (477) (112)

Total liabilities (534) (842) (660)

------------ ------------ ------------

Net assets 13,605 14,949 13,271

============ ============ ============

Equity

Share capital 588 556 556

Deferred share capital 1,831 1,831 1,831

Share premium reserve 25,805 25,062 25,077

Share-based payments 884 936 884

AFS reserve (96) (45) (82)

Retained loss (15,407) (13,391) (14,995)

------------ ------------ ------------

Total equity attributable

to equity holders of the

parent 13,605 14,949 13,271

============ ============ ============

CONDENSED INTERIM STATEMENT OF CASH FLOWS

Six months Six months Year ended

ended ended

30 June 30 June 31 December

2016 2015 2015

(Unaudited) (Unaudited) (Audited)

GBP 000's GBP 000's GBP 000's

Cash outflow from operating

activities

Operating loss (373) (372) (906)

Adjustments for:

Share-based payments - - -

(Increase)/decrease in

receivables (268) (149) 451

(Decrease)/increase in

payables (51) (4) 54

Foreign exchange loss (9) 8 6

------------ ------------ ------------

Net cash (outflow) from

operating activities (701) (517) (395)

------------ ------------ ------------

Cash flows from investing

activities

Interest received - - -

Payments to acquire intangible

assets (391) (2,472) (2,649)

Payment to acquire derivative

financial instrument - - (110)

Payments to acquire available

for sale investment (8) (133) (132)

Net cash outflow from

investing activities (399) (2,605) (2,891)

------------ ------------ ------------

Cash flows from financing

activities

Repayments of borrowings (122) (396) (754)

Proceeds from borrowings - 336 336

Finance costs - (49) (62)

Proceeds on issuing of

ordinary shares 800 2,700 2,700

Cost of issue of ordinary

shares (40) (146) (131)

------------ ------------ ------------

Net cash inflow from

financing activities 638 2,445 2,089

------------ ------------ ------------

Net (decrease)/increase

in cash and cash equivalents (462) (677) (1,197)

Cash and cash equivalents

at beginning of period 824 2,021 2,021

Cash and cash equivalents

at end of period 362 1,344 824

============ ============ ============

CONDENSED STATEMENT OF CHANGES IN EQUITY

Share capital Deferred Share premium Share based AFS Accumulated Total

share capital payments reserve losses

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Balance at 31

December

2014 501 1,831 22,360 936 (4) (12,291) 13,333

Loss for the

period - - - - - (2,773) (2,773)

Decrease in value

of

Available for

sale

assets - - - - (78) - (78)

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

comprehensive

income - - - - (78) (2,773) (2,851)

Share issue 55 - 2,848 - - - 2,903

Cost of share

issue - - (131) - - - (131)

Share-based

payment

charge - - - 17 - - 17

Share options

expired - - - (69) - 69 -

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

contributions

by and

distributions

to

owners of the

Company 55 - 2,717 (52) - 69 2,789

-------------- --------------- -------------- ------------ --------- ------------ ---------

Balance at 31

December

2015 556 1,831 25,077 884 (82) (14,995) 13,271

Loss for the

period - - - - - (412) (412)

Decrease in value

of

Available for

sale

assets - - - - (14) - (14)

-------------- --------------- -------------- ------------ --------- ------------ ---------

Total

comprehensive

income - - - - (14) (412) (426)

Share capital

issued 32 - 768 - - - 800

Cost of share

issue - - (40) - - - (40)

Total

contributions

by and

distributions

to

owners of the

Company 32 - 728 - - - 760

Balance at 30 June

2016 588 1,831 25,805 884 (96) (15,407) 13,605

-------------- --------------- -------------- ------------ --------- ------------ ---------

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION

1 BASIS OF PREPARATION

The financial information has been prepared under the historical

cost convention and on a going concern basis and in accordance with

International Financial Reporting Standards and IFRIC

interpretations adopted for use in the European Union ("IFRS") and

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

The condensed interim financial information for the period ended

30 June 2016 has not been audited or reviewed in accordance with

the International Standard on Review Engagements 2410 issued by the

Auditing Practices Board. The figures were prepared using

applicable accounting policies and practices consistent with those

adopted in the statutory accounts for the period ended 31 December

2015. The figures for the period ended 31 December 2015 have been

extracted from these accounts, which have been delivered to the

Registrar of Companies, and contained an unqualified audit

report.

The condensed interim financial information contained in this

document does not constitute statutory accounts. In the opinion of

the directors the financial information for this period fairly

presents the financial position, result of operations and cash

flows for this period.

This Interim Financial Report was approved by the Board of

Directors on 14 September 2016.

Statement of compliance

These condensed company interim financial statements have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union with the

exception of International Accounting Standard ('IAS') 34 - Interim

Financial Reporting. Accordingly the interim financial statements

do not include all of the information or disclosures required in

the annual financial statements and should be read in conjunction

with the Company's 2015 annual financial statements.

2 LOSS PER ORDINARY SHARE

The calculation of earnings per share is based on the loss after

taxation divided by the weighted average number of share in issue

during the period:

Six months to Six months to Year ended

30 June 2016 30 June 2015 31 December 2015

(Unaudited) (Unaudited) (Audited)

Net loss after taxation (GBP 000's) (412) (1,100) (2,773)

Weighted average number of ordinary shares used in calculating

basic earnings per share (millions) 5,780.4 5,292.9 5,417.2

Basic loss per share (pence) (0.01) (0.02) (0.04)

As the inclusion of the potential ordinary shares would result

in a decrease in the loss per share they are considered to be

anti-dilutive and, as such, a diluted loss per share is not

included.

3 TRADE AND OTHER RECEIVABLES

Six months to Six months to Year ended

30 June 2016 30 June 2015 31 December 2015

Current trade and other receivables (Unaudited) (Unaudited) (Audited)

Loan to HHDL 658 360 369

Prepayments 22 96 66

Other debtors 111 667 88

-------------- -------------- -----------------

Total 791 1,123 523

-------------- -------------- -----------------

4 EVENTS AFTER THE REPORTING DATE.

There are no events after the end of the reporting date to

disclose.

5 A copy of this interim statement is available on the Company's

website www.solooil.co.uk.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR GGUGWBUPQURC

(END) Dow Jones Newswires

September 14, 2016 04:33 ET (08:33 GMT)

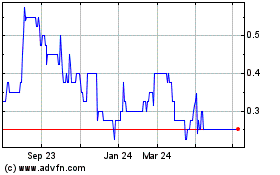

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

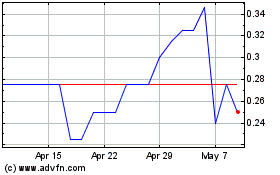

Scirocco Energy (LSE:SCIR)

Historical Stock Chart

From Apr 2023 to Apr 2024