Cash-strapped SolarCity Corp. is trying to cut marketing costs

amid competition from smaller upstarts using cheaper sales

tactics—such as paying Uber drivers to pitch solar panels to

passengers.

Big solar companies such as SolarCity and Vivint Solar Inc. have

been engaged in a fierce battle to amass market share, analysts

say, and have spent heavily on old-fashioned advertising, telephone

and door-to-door canvassing, and booths at retail outlets to

acquire new customers. But the companies are spending more than

they are taking in, and the costs are proving hard to sustain.

SolarCity spent $751 million in 2015 on sales, administrative

and research costs, 88% more than its annual revenue of $400

million and the $399 million it spent the previous year. Through

June, it had spent $438 million this year, 42% more than its

revenue of $308 million. Its cash declined to $146 million on June

30 from $421 million a year earlier.

Seeking to survive as a stand-alone company until its proposed

merger with Tesla Motors Inc., SolarCity has begun selling more

solar panels to homeowners for cash, rather than its traditional

business of leasing the panels and retaining ownership. It is also

planning to sell outside investors more shares than it owns.

Earlier this month, SolarCity raised $305 million through once

such cash equity transaction with Quantum Strategic Partners Ltd.,

the hedge fund of billionaire investor George Soros. Last month, it

sold $100 million of bonds to its chairman, Elon Musk, who is also

Tesla's chief executive, and SolarCity's two top executives.

Cutting costs is also a crucial part of its plan. SolarCity has

stopped buying television ads but is still advertising on the

internet, selling door to door and setting up booths at Home Depot

Inc. and Best Buy Co. stores. Its sales and marketing costs should

drop further after its planned merger with Tesla Motors, when the

combined company would sell panels at Tesla's auto showrooms, said

Chief Executive Lyndon Rive.

"We had a lot of headwinds that hit us" this year, Mr. Rive

said, noting that Nevada regulators last December terminated

lucrative state incentives for rooftop solar, dealing a major blow

to home solar companies.

Another challenge: Competition from smaller solar installers,

who are using lower-cost methods to reach people. Online

marketplaces such as Project Sunroof, a unit of Alphabet Inc.'s

Google, connect homeowners with installers and other online

networks, such as Pick My Solar and PowerScout, which solicit bids

from local installers to help consumers get the best local

deal.

Regional and smaller firms supplied about 48% of the home solar

market earlier this year, up from 47% at the end of 2015, according

to GTM Research.

One such online network, Geosteller, is testing an unusual sales

tactic: using Uber and Lyft drivers to sell panels to riders.

The privately held company has enlisted about 50 drivers in New

York, Boston, San Francisco, Los Angeles, Washington, Dallas and

Miami, who can snag commissions that start at about $1,000 per sale

of solar systems. Home solar systems average about $18,840 per

six-kilowatt array, according to GTM.

Geosteller Chief Executive David Levine said the method is

showing promise: drivers have generated about 220 sales since

June.

"I don't feel like I'm selling something. I'm giving them

information and showing them the savings potential with solar,"

said Quin Yowell, 51, who drives part-time for Uber and Lyft to

supplement his income at Whole Foods in the Washington, D.C.,

area.

Mr. Yowell, who has sold three systems so far, said he doesn't

bother passengers who are talking or texting on mobile phones, or

otherwise seem occupied.

Uber and Lyft declined to comment.

Big marketing spending is unusual for a consumer technology that

most customers buy after hearing about from a friend, neighbor or

family member, said Hugh Bromley, an analyst at research firm

Bloomberg New Energy Finance.

Home solar companies with a high-cost business model could face

a "death spiral" of rising costs and lower sales as growth slows,

he added.

Bloomberg New Energy Finance is predicting 0.3% growth in the

home solar market in 2017, due to a nationwide drop in conventional

power prices and reductions in state solar incentives.

GTM Research and the Solar Energy Industries Association predict

19% growth next year, down from an expected 23% increase in

residential installations this year and a 66% jump in 2015.

"We're not yet hitting the point where growth stops entirely,

but the curve is undeniably slowing down," said Shayle Kann, senior

vice president at GTM.

SolarCity has lowered its forecast for the volume of panels it

plans to install this year to 900 to 1,000 megawatts, down from

1,250 megawatts earlier this year.

Write to Cassandra Sweet at cassandra.sweet@wsj.com

(END) Dow Jones Newswires

September 22, 2016 13:15 ET (17:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

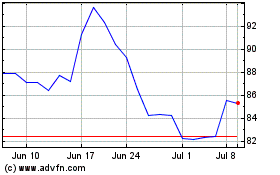

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

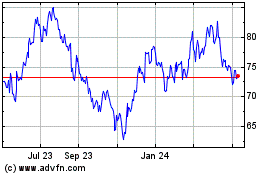

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024