Socié té Gé né rale's Retail Bank Offsets Choppy Markets

May 04 2016 - 1:40AM

Dow Jones News

PARIS—French bank Socié té Gé né rale SA on Wednesday reported

an increase in first-quarter net profit, as a debt valuation

adjustment and a strong retail banking performance helped offset

lower trading revenue from choppy markets.

The Paris-based lender, France's third-largest listed bank by

assets, said net profit rose 6% to €924 million ($1.06 billion) in

the three months through March, from €868 million a year earlier.

Revenue was down 3% at €6.18 billion.

The bank booked a €145 million gain in the first quarter because

of an accounting rule that permits lenders to post paper profit

when the value of their own credit declines.

Socié té Gé né rale also said Wednesday it would cut costs by

another €220 million at its investment bank by 2017, in addition to

ongoing restructuring efforts. The bank had already announced cost

cuts worth €323 million by 2017.

Socié té Gé né rale's first-quarter earnings highlight the

progressive recovery of the European economy, as investment picks

up and loan defaults decline. As with French rival BNP Paribas SA,

higher retail banking revenue helped make up for a weak investment

banking business, hurt by sharp declines in securities trading amid

concerns about low energy prices and interest rates.

Its retail bank in France posted a net profit of €328 million,

up 18% from the same quarter last year, while net profit for its

international retail banking and financial services division more

than doubled to €300 million. In Russia, where Socié té Gé né rale

owns one of the country's largest private lenders, Rosbank, it

posted an €18 million first-quarter loss compared with a €89

million loss a year ago.

However, its global banking and investor solution business—which

includes investment banking, security services and asset

management—posted a 15% drop in net profit to €454 million in the

first quarter from €532 million a year ago.

Overall profit growth this quarter enabled Socié té Gé né rale

to continue to stockpile additional capital to meet strict new

banking regulation in Europe.

The bank said its core tier one ratio, which compares top

quality capital such as equity and retained earnings with

risk-weighted assets, stood at 11.1% in March, up from 10.9% in

December.

Socié té Gé né rale has said it targeted a core tier one ratio

of 11.5% to 12% by 2019.

The bank's leverage ratio, which measures capital held by the

bank against its total assets, was stable at 4% at the end of

March.

BNP Paribas, France's largest listed bank by assets, said

Tuesday first-quarter net profit rose 10% to €1.81 billion from

€1.65 billion a year ago. Cré dit Agricole SA reports earnings on

May 12.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

May 04, 2016 01:25 ET (05:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

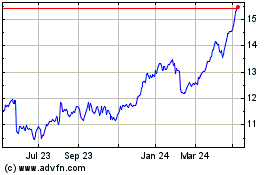

Credit Agricole (EU:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

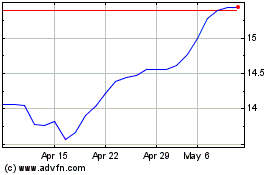

Credit Agricole (EU:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024