Snapchat Valuation Nears $18 Billion

May 26 2016 - 7:00PM

Dow Jones News

Snapchat Inc. keeps growing and raising cash, though its

valuation hasn't changed much recently.

The startup featuring disappearing messages raised more than

$1.8 billion in an investment round that stretched over more than a

year, people familiar with the matter said. Several new investors,

including Sequoia Capital, Spark Capital, Meritech Capital Partners

and Dragoneer Investment Group participated in the funding, which

valued Snapchat at close to $18 billion, the people said.

That valuation is higher than the $16 billion at which investors

valued Snapchat in March 2015, because it includes the additional

money from the latest funding round. All investors in that round

bought common shares of the company for $30.72 apiece, the people

said.

Snapchat has attracted a wide range of investors eager to own a

piece of one of the most popular and rapidly growing mobile apps.

Venture firms such as Sequoia and Spark rarely make an initial

investment in a tech company so richly valued, a sign that they

believe Snapchat could over time rival social-networking giant

Facebook Inc., which has a market capitalization of roughly $342

billion.

Snapchat's willingness to extend the latest funding round at the

same share price could reflect the cooler funding environment over

the past year, a period in which many startups have seen investors

mark down the value of their shares. It also could reflect an

effort by Snapchat to temper expectations while growing its nascent

advertising business.

Snapchat expects revenue of $250 million to $300 million this

year, more than four times as much as last year's $60 million,

according to a person who has been briefed on its financials. The

company has worked with publishers to add disappearing news

articles and videos to its app and this year struck deals with

Viacom Inc. and ad tracker Nielsen to appeal to more

advertisers.

Snapchat's funding round and financial projections were reported

earlier by technology blog TechCrunch.

Mutual-fund giant Fidelity Investments, which has invested more

than $175 million in two chunks beginning in March 2015, raised

concerns around Snapchat's growth prospects when it marked down its

shares in the company by 25% late last year. During the first

quarter of this year, Fidelity marked the shares back up to its

$30.72 purchase price.

In all, Snapchat has raised closed to $3 billion in funding from

investors including Benchmark, General Catalyst Partners,

Lightspeed Venture Partners, Coatue Management, DST Global, Yahoo

Inc. and Alibaba Group Holding Ltd.

In another sign of investor interest, most of Snapchat's

investors agreed to receive common shares, instead of preferred

stock. Startup investors typically receive preferred shares giving

them certain rights over common stockholders. Those privileges can

include voting rights and, perhaps most important, getting paid

back first in the event of an acquisition or liquidation.

Write to Douglas MacMillan at douglas.macmillan@wsj.com

(END) Dow Jones Newswires

May 26, 2016 18:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

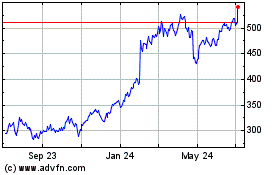

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Mar 2024 to Apr 2024

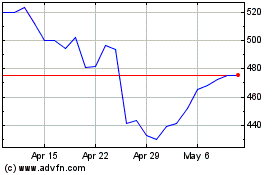

Meta Platforms (NASDAQ:META)

Historical Stock Chart

From Apr 2023 to Apr 2024