TIDMSMDS

RNS Number : 5333F

Smith (DS) PLC

23 February 2015

23 February 2015

DS Smith Plc

Proposed acquisition of Duropack and trading update

Proposed acquisition of Duropack

DS Smith Plc ("DS Smith"), the leading provider of recycled

corrugated packaging in Europe, is pleased to announce the proposed

acquisition of the Duropack business ("the acquisition") for

approximately EUR300m (c.GBP220m). Duropack, a recycled corrugated

board packaging business with market-leading positions across South

Eastern Europe, is being acquired from CP Group 2 BV, a One Equity

Partners subsidiary.

The acquisition is highly complementary to DS Smith's geographic

footprint and transforms our position in higher-growth South

Eastern European geographies, further strengthening our

pan-European capabilities to our existing customer base in addition

to providing access to new customers.

Duropack has number one or two market positions in many of the

geographies in which it operates and, combined with DS Smith's

existing operations in Hungary, Slovakia and Austria, will have a

leading position across South Eastern Europe.

The business is well invested with high quality assets and

operates a "short paper, long fibre" model similar to that of DS

Smith.

In 2014 the business delivered EBITDA of EUR41 million and EBIT

of EUR22 million on turnover of EUR273 million. Cost synergies of

EUR12 million, are expected to be realised within three years of

ownership. The additional investment required to integrate the

acquisition is c.EUR13 million, incurred over the first two years.

This will be funded by cash savings, driven by working capital

efficiencies and tight cash management.

The total consideration, including the assumption of debt, is

expected to be circa EUR300 million, subject to customary

post-closing adjustments, representing a post synergy multiple of

5.7 times EBITDA.

The acquisition is being financed from existing debt facilities.

It will be immediately accretive to earnings per share and generate

a return above our cost of capital during the second year of

ownership.

The acquisition is subject to competition clearance, which we

expect in calendar Q2, with completion shortly thereafter.

Trading update

In the three month period to 31 January 2015, the business has

continued to perform in line with our plans. Volumes have been

ahead of the run-rate achieved in the first half of the year and

remained positive in all regions, with Central Europe and Italy

particularly strong. We are delighted by the initial customer

reaction to our recent acquisition of Andopack and performance

there has been in line with our expectations.

On 30 January 2015, we completed the disposal of our testliner

mill in Nantes, France, which had capacity of c. 60 thousand

tonnes. This transaction is in line with our strategy to exit paper

manufacturing which does not sufficiently complement our Packaging

business. There will be an exceptional charge of GBP9 million, of

which GBP7 million is non-cash.

Our outlook remains positive as the business continues to

perform in line with our medium term financial targets, despite

economic headwinds in many of our markets, and the Board views the

future with confidence.

Miles Roberts, Chief Executive of DS Smith said:

"Duropack is an excellent business and a highly complementary

fit. It is a further important step in our strategy to leverage our

scale and strengthen our geographic footprint. Duropack has high

quality assets with market leading positions. We look forward to it

contributing to the overall growth of DS Smith in attractive

markets where we were previously under-represented.

Since our half-year, we have continued to make good progress

with our customers, benefitting from our differentiated commercial

offering and the ongoing roll out of our design centres. Our volume

performance has been strong, as the rapidly changing retail

environment and consumer buying patterns make well-designed

recycled packaging increasingly relevant."

Enquiries:

DS Smith Plc +44 (0)20 7756 1800

Hugo Fisher, Group Communications Director

Rachel Stevens, Investor Relations Manager

Bell Pottinger

John Sunnucks +44 (0)20 3772 2549

Ben Woodford +44 (0)20 3772 2566

Conference call

There will be a conference call this morning at 08:30am (London

time) for investors and analysts, hosted by Miles Roberts, Group

Chief Executive, and Adrian Marsh, Group Finance Director. Log in

details are +44 (0) 20 3003 2666 (standard access) or 0808 109 0700

(UK Toll Free) Password: DS Smith. Slides to accompany the call

will be available on our website approximately 15 minutes in

advance of the call. A play-back facility of this call will be

available until 2 March 2015. The dial-in number is: +44 (0) 20

3350 6902, access pin: 7058484#. A recording and transcript of the

call will also be available through the Investor Relations section

of our website: www.dssmith.com

Further details on Duropack

Geographic presence: 14 corrugated packaging sites, 2 paper

mills and 18 recycling sites across 9 countries comprising Austria,

Hungary, Bosnia, Bulgaria, Macedonia, Serbia, Slovakia, Croatia and

Slovenia.

Volumes: c.565msm corrugated packaging, c. 208kt testliner

production and c. 160kt recycled paper collection.

Financial details: Gross assets of EUR281 million as at 31

December 2014; 2014 profit before tax of EUR15 million.

NOTES TO EDITORS

DS Smith is a leading provider of corrugated packaging in Europe

and of specialist plastic packaging worldwide, operating across 25

countries and employing 21,500 people. Our vision is to become the

leader in recycled packaging for consumer goods through offering

great service, quality, innovation and environmental solutions to

our customers. Formore information, visit www.dssmith.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQSEDFWSFISEIE

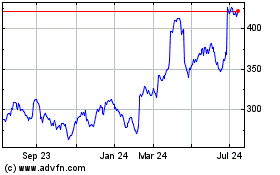

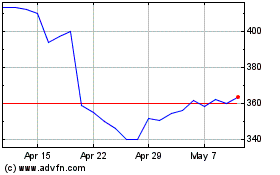

Smith (ds) (LSE:SMDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Smith (ds) (LSE:SMDS)

Historical Stock Chart

From Apr 2023 to Apr 2024