Sika Chairman Digs In Over Saint-Gobain Battle - Update

February 26 2016 - 7:48AM

Dow Jones News

By John Revill

ZURICH--Construction and automotive chemicals maker Sika AG is

preparing for the long haul as it seeks to fend off a hostile $2.78

billion takeover from French rival Saint-Gobain SA, the chairman of

the Swiss company said Friday.

Baar-based Sika has been embroiled in a takeover battle for more

than a year after Saint-Gobain offered to buy the controlling stake

held by the company's founding family without making an offer to

other shareholders, which include billionaire Bill Gates.

Chairman Paul Hälg said Friday that Sika's position had been

boosted by the company posting its highest ever annual profit.

"I am very pleased that these strong results support our defense

of Sika against Saint-Gobain," said Mr. Hälg, who the founding

family have tried to replace.

He said the results showed that Sika's business hadn't been

damaged by the "difficult situation" with Saint-Gobain, that Sika

could be successful as an independent company, and didn't need

Saint-Gobain.

"The way we have organized ourselves means we can work in this

way for a long time," Mr. Hälg said. Sika--whose products have been

used in The Shard building in London--was prepared to continue

resisting Saint-Gobain for as long as it takes, he said.

The takeover sparked fierce opposition because Paris-based

Saint-Gobain has proposed to buy only the 16% stake held by Sika's

founding Burkard family for 2.75 billion Swiss francs ($2.78

billion). Buying the family's investment vehicle gives control of

Sika as it has 52% of the voting rights in the Swiss company.

Sika's management has responded by limiting the family's voting

rights to 5%, a move that is now being disputed in Swiss courts

with a decision expected this summer, although appeals could be

lodged by either side.

Mr. Hälg said Sika had made an alternative proposal to buy the

Burkard family's stake, "but they don't want to see it."

"I am very confident with our legal arguments," he said. "I

don't think that will be the end of it in the summer."

Earlier Friday, Sika reported a 5.4% rise in net profit for 2015

of 465.1 million Swiss francs ($469.8 million) in the 12 months to

Dec. 31, up from 441.2 million francs a year earlier, beating

analyst expectations.

Sales dipped 1.5% to 5.49 billion francs from 5.57 billion

francs in 2014, as the strength of the Swiss currency took a toll,

though were slightly ahead of analyst expectations for 5.47 billion

francs.

A spokesman for Cascade Investment LLC, the investment vehicle

controlled by Bill and Melinda Gates, said they continued to

"fiercely oppose" a Saint-Gobain takeover.

"There needs to be a solution that fits all the investors and

not just members of one family, and we would like Saint-Gobain to

walk away," the spokesman said.

This looks unlikely with Saint-Gobain repeating its commitment

to the deal.

"We are both patient and committed to completing the

Sika-transaction," said Saint-Gobain CEO Pierre-André de Chalendar

as the Paris company reported its full-year earnings on

Thursday.

Write to John Revill at john.revill@wsj.com

(END) Dow Jones Newswires

February 26, 2016 07:33 ET (12:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

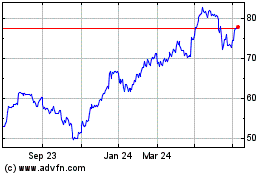

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cie de SaintGobain (EU:SGO)

Historical Stock Chart

From Apr 2023 to Apr 2024