Siemens CEO Frets About America -- WSJ

February 02 2017 - 3:02AM

Dow Jones News

By Friedrich Geiger

MUNICH -- The chief executive of Siemens AG, one of the biggest

foreign corporate investors in the U.S., took aim at the Trump

administration Wednesday -- singling out its moves on immigration

and offering some of the toughest criticism yet by an overseas

business leader.

"What we are seeing worries us," Chief Executive Joe Kaeser

said. "America became great through immigrants...I hope that this

great country will recall what has made it great."

Mr. Kaeser is prominent among a clutch of executives running

Germany's large industrial manufacturers, many of which have relied

heavily on the U.S. for sales and as a place for investment.

Siemens is a big U.S. employer, with 50,000 workers in the U.S.

Last year, Mr. Kaeser voiced optimism about the business impact

of President Donald Trump's election. But on Wednesday he changed

tack in comments at a news conference ahead of Siemens' annual

shareholder meeting here. He took specific aim at Mr. Trump's

executive order Friday that suspends entry to the U.S. for refugees

and restricts visitors from seven, majority-Muslim countries that

Washington has singled as terrorism threats.

Mr. Kaeser appeared eager to explain his criticism, a stark

departure from the reluctance big global businesses often show in

commenting on politics in their overseas markets -- no more so than

in the button-down corporate culture that prevails in Germany,

which relies so much on exports.

The CEO of the industrial conglomerate said such caution

shouldn't mean avoiding all criticism of Mr. Trump. "One must not

mix up prudence with gestures of servility," Mr. Kaeser said.

Alluding to Germany's Nazi and Communist past, he said: "Perhaps we

Germans are a bit sensitive when it comes to walls and race."

Trump administration officials and their allies have argued that

the travel restrictions are needed to keep the U.S. safe from

potential terrorists, and say the measure has broad support.

The Trump travel order triggered broad political criticism in

Germany and around the world. But business leaders here have also

become worried about what new U.S. policies will mean for the

bottom line, given America's status as the top market for German

exports.

The Trump administration has recently taken wider aim at German

economic policy and business practices, criticizing what it says is

Germany's outsize sway in European economic policy-making and its

big trade surplus with the U.S.

Peter Navarro, Mr. Trump's top trade adviser, told the Financial

Times earlier this week that Germany was exploiting the U.S. and

other European Union countries with a "grossly undervalued euro."

German Chancellor Angela Merkel responded that Germany had always

supported the independence of the European Central Bank, and "we

seek to remain competitive with everyone else in global trade."

Berlin and the Obama administration had clashed on Germany's

large trade and current-account surpluses. Washington has accused

the German government of relying too much on exports, including

exports to the U.S., to feed growth while not doing enough to

stimulate domestic demand, which could attract more imports from

overseas. The U.S. imported $105 billion in goods from Germany last

year and exported only $45 billion to the country.

Mr. Trump has also taken aim at specific German companies. Last

month, in an interview with Germany's Bild Zeitung, he threatened

German car makers with a 35% tariff on cars imported into the U.S.

from their plants in Mexico.

"You go down Fifth Avenue, everybody has a Mercedes-Benz parked

in front of his house," Mr. Trump said in the interview before his

inauguration. "How many Chevrolets do you see in Germany? Maybe

none...you don't see anything at all over there. It's a one-way

street."

General Motors Co. doesn't sell Chevrolet models in Europe and

instead markets its popular Opel and Vauxhaul brands.

German Vice Chancellor Sigmar Gabriel responded that if U.S. car

makers want to sell more in Germany, "they just have to build

better cars."

Mr. Kaeser said Wednesday that Siemens is a major employer in

the U.S. and that it exports more from the U.S. than it imports to

the country

Write to Friedrich Geiger at friedrich.geiger@wsj.com

(END) Dow Jones Newswires

February 02, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

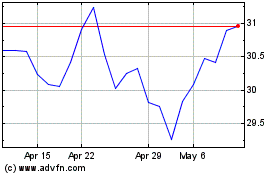

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

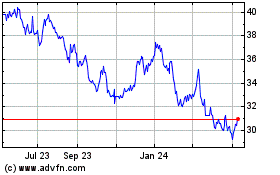

Roche (QX) (USOTC:RHHBY)

Historical Stock Chart

From Apr 2023 to Apr 2024