Shipping Tycoon Angelicoussis Expects Trump Bump, Not Trade War

November 18 2016 - 10:40AM

Dow Jones News

Greek shipping magnate John Angelicoussis expects

President-elect Donald Trump to generate new business for the

ailing shipping industry through infrastructure spending and

increased energy production.

"There is no question that he is going to be positive for

shipping in terms of infrastructure expansion. The U.S. needs a

hell of a lot of infrastructure," Mr. Angelicoussis told The Wall

Street Journal in a rare interview.

Mr. Angelicoussis has three separate companies operating a fleet

of 133 supertankers, dry bulk vessels and liquefied-natural-gas

carriers, worth around $6.9, billion, the world's sixth largest in

terms of value, according to maritime data provider

VesselsValue.

Most of the ships are chartered to oil and commodity majors

including Exxon Mobil Corp., BHP Billiton Ltd. and Cargill Corp.

The billionaire has been the top buyer of dry bulk vessels over the

past year and also splashed $1 billion for eight crude oil and LNG

tankers in June.

Mr. Trump has vowed to pump billions into projects to upgrade

U.S. infrastructure. But his pledge to tear up global trade deals

such as the North American Free Trade Agreement and the

Trans-Pacific Partnership could cause pain for shipping industry at

a time when global trade is forecast to grow by just 1.7% this

year, marking the slowest pace since the 2008 financial crisis,

according the World Trade Organization.

Mr. Angelicoussis hopes Mr. Trump won't engage in a trade war

with China. "Shipping lives off China," he said. "There will be no

winners in a trade war. We should leave them alone and continue to

trade." Since Mr. Trump's election, the Baltic Dry Index, a measure

of the cost to ship raw materials like cement, copper and iron ore,

has risen steadily, closing Thursday at a 23-month high.

Mr. Angelicoussis said Mr. Trump's promise to boost oil drilling

and tackle export regulations will benefit his tanker business with

ships bringing in heavy fuel for the U.S. market and shipping out

lighter fuel to export markets. "There will be far more activity in

oil and gas," he said.

Mr. Angelicoussis said he expects the Organization of the

Petroleum Exporting Countries to reach an agreement to cut

production at their Nov. 30 meeting.

"Brent is low at around $46 [per barrel] because most expect no

agreement," he said. "But I think there will be one because OPEC

needs it. A price of $50 to $60 is good for the Arabs because they

can make money, but not overdo it."

At that price he predicts China and India will continue building

their oil reserves, saying China wants to double its 250 million

barrels and India seeks to substantially boost its 100 million

barrels in reserve.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

November 18, 2016 10:25 ET (15:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

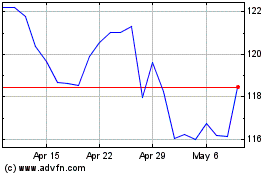

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Mar 2024 to Apr 2024

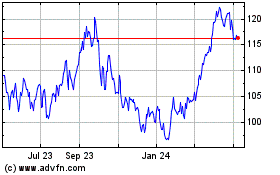

Exxon Mobil (NYSE:XOM)

Historical Stock Chart

From Apr 2023 to Apr 2024