Sherwin-Williams Co. has agreed to buy Valspar Corp. for more

than $9 billion, a deal that would help the paint maker get better

access to big-box retailers like Lowe's, where Valspar is a big

seller, and expand abroad.

Sherwin-Williams will pay $113 a share in cash, a 35% premium to

Valspar's closing price on Friday. Based on a fully diluted share

count, which typically includes instruments that can be converted

into stock, the deal is worth about $9.3 billion.

Valspar shareholders already have made out well, with the stock

more than doubling in the past five years, far outstripping the

S&P 500 index.

The Wall Street Journal reported earlier Sunday that the

companies were in talks to combine.

The purchase would give Sherwin another brand and more access to

do-it-yourself painters, who tend to buy their supplies at big

retailers rather than at the contractor-oriented stores owned by

Sherwin.

Retailers such as Home Depot Inc., Lowe's Cos. and Wal-Mart

Stores Inc. have been taking market share away from independent

paint stores.

Valspar is particularly strong at Lowe's and Ace hardware

stores. Sherwin has long relied heavily on its own stores for paint

sales, but last year began selling a new HGTV brand at Lowe's,

taking some space from rivals, such as Valspar.

The deal also would help Sherwin take a larger chunk of global

paint sales. The company's long-standing logo shows a can of red

paint being poured over a globe, bearing the slogan, "Cover the

earth."

Mostly, though, the Cleveland company has covered the U.S.,

which accounts for about 84% of its sales. The Valspar acquisition

would reduce the U.S. share to about 76% by adding sales in Asia

and Europe, according to the company.

"It gives us the scale and platform" to expand in Europe and

Asia, Chief Executive John G. Morikis said in an interview Sunday.

He was promoted to CEO effective Jan. 1, succeeding Christopher

Connor.

Valspar sells paint for houses and buildings—what it calls

architectural coatings—in China and Australia, where Sherwin hasn't

had any significant presence in that product line. Valspar also has

strength in two other areas that Sherwin has been absent from:

coatings for food and beverage packaging and for steel coils.

The combined Sherwin and Valspar would have had coatings sales

last year of about $15.6 billion, outstripping rival PPG Industries

Inc.'s $14.2 billion and Amsterdam-based AkzoNobel NV's $11.1

billion, according to Sherwin.

The global coatings market—including paint and coatings used on

cars, ships and myriad other products—generates about $130 billion

of sales a year, according to PPG.

No decision had been made on whether Gary Hendrickson, chairman

and CEO of Valspar, would stay with the combined company, Mr.

Morikis said.

Sherwin valued the Valspar deal at $11.3 billion, including the

assumption of debt.

The deal includes an unusual cut to the purchase price should

antitrust regulators demand aggressive divestitures. If Sherwin is

forced to sell businesses representing more than $650 million of

Valspar's 2015 revenue, the price drops by $8 a share. Sherwin

could walk away entirely if divestitures climb to $1.5 billion of

revenue, a provision that is more common.

The potential price cut is a nuanced way to handle antitrust

risk, which is usually dealt with more bluntly with all-or-nothing

walkaway rights and termination fees.

But it means Valspar shareholders likely would be voting on a

deal without knowing for sure how much they would get paid, which

could complicate approval.

The companies said they believe there is minimal risk of

antitrust pushback and that the provisions "provide

Sherwin-Williams and Valspar with greater closing certainty."

Sherwin said it expects the deal to immediately add to earnings,

excluding one-time costs, and projected $280 million in annual

synergies, which normally come from cutting overlapping

expenses.

It has been a busy stretch for chemical-company mergers, a

category that coatings sellers would fall under. Late last year,

chemicals manufacturers Dow Chemical Co. and DuPont Co. signed a

deal worth a combined $120 billion.

In February, government-owned China National Chemical Corp.,

known as ChemChina, capped a string of acquisitions with a $43

billion deal to buy Swiss pesticide and seed provider Syngenta

AG—the biggest foreign takeover attempt by a Chinese company to

date.

Write to Dana Mattioli at dana.mattioli@wsj.com, Liz Hoffman at

liz.hoffman@wsj.com and James R. Hagerty at bob.hagerty@wsj.com

Corrections & Amplifications: The equity value of the deal

is $9.3 billion. An earlier version of this article calculated the

value based on Valspar's basic share count, instead of the diluted.

(March 20)

(END) Dow Jones Newswires

March 20, 2016 21:15 ET (01:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

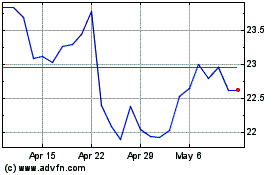

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

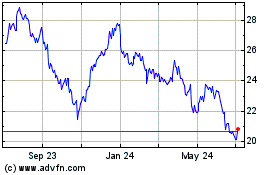

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Apr 2023 to Apr 2024