Shell Defers Decision on Louisiana LNG Investment

July 28 2016 - 6:42AM

Dow Jones News

By Selina Williams

LONDON--Royal Dutch Shell PLC is deferring a final investment

decision this year on a big facility to export liquefied natural

gas plant from Lake Charles, Louisiana, citing a current oversupply

of the fuel and affordability of the project amid lower oil prices,

the company's chief executive said Thursday.

It is the second delay Shell has made to a big LNG project.

Earlier this month the Anglo-Dutch oil giant said it was delaying

FID on an LNG export project in Kitimat in Canada.

"This is not the moment to commit to large-scale capital

outlays, even though the fundamentals of these projects in their

life cycle still look good," Ben Van Beurden said on a conference

call.

Shell's Chief Financial Officer Simon Henry said gearing at the

company, which in February completed a roughly $50 billion

acquisition of BG Group PLC, could increase further to its 30%

limit if oil prices don't rise from current levels.

Gearing, a measure of the extent to which a company's operations

are funded by debt, rose sharply to 28.1% at the end of the second

quarter, compared with 12.7% in the second quarter of 2015,

reflecting the BG acquisition, Shell said.

"It [gearing] may go up before it comes down again, simply

because the oil price today is at a level that we would not

generate positive cash flow unless we were doing the divestments,"

Mr. Henry said, referring to the company's plan to sell assets.

Shell's net debt at June 30, 2016 was $75.1 billion versus

$25.96 billion in the same period a year ago.

Write to Selina Williams at selina.williams@wsj.com

(END) Dow Jones Newswires

July 28, 2016 06:27 ET (10:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

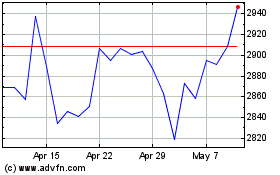

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

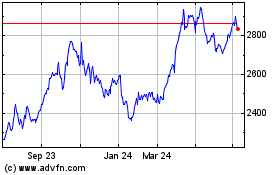

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024