TIDMSVT

RNS Number : 6346Z

Severn Trent PLC

12 December 2014

12 December 2014

Severn Trent Plc - Severn Trent Water response to Final

Determination

Note: 2012/13 prices unless stated otherwise

Ofwat has today published the Final Determination for Severn

Trent Water for the period 2015 to 2020 ("AMP6").

The Final Determination is a detailed document which will take

time to analyse and consider fully. From an initial analysis this

morning, we welcome the progress that has been made since the Draft

Determination through our constructive dialogue with Ofwat, but we

are disappointed on two points.

Firstly, Ofwat has reduced the allowed weighted average cost of

capital (WACC) for the wholesale business to 3.6% from 3.7%in the

Draft Determination of 29 August, giving a WACC for the appointed

business of 3.74%, compared to 3.85% in the Draft

Determination.

We also note that two maintenance schemes proposed, totaling

around GBP60 million, remain excluded. While we disagree with this

outcome, given stakeholder support we continue to include these

projects in our own total expenditure plans for 2015 to 2020 of

GBP5.6 billion.

Despite these points, the Final Determination includes the

Birmingham Resilience main scheme, Scenario A in the Draft

Determination, plus GBP50 million of the associated community risk

schemes, which were previously excluded from the Draft

Determination. We also note that wholesale totex in the Final

Determination of GBP5,623 million is broadly in line with the Draft

Determination and our revised business plan (see table 1).

We are pleased that legacy adjustments have been reduced by

around 30% to GBP58 million (14/15 year end prices) and based on

the Final Determination we anticipate our Regulatory Capital Value

(RCV) in April 2015 in nominal terms to be GBP7.8 billion(1) , with

average growth of 5% p.a. over the period to give an expected RCV

in 2020 of around GBP10 billion.(1)

We also note the revised Outcome Delivery Incentives package,

including positive changes to the ODI related to Birmingham

Resilience.

As Ofwat has highlighted today, customers will benefit from

higher levels of investment over the next 5 years, with bills

falling in real terms. Severn Trent Water customers will continue

to have the lowest combined average bills in the land over

AMP6.

The publication of the Final Determination is the culmination of

the price review process. There now follows a period of 2 months

during which Severn Trent Water can decide whether to appeal the

Final Determination to the Competition and Markets Authority (CMA).

The new price limits take effect in April 2015.

Liv Garfield, Chief Executive, said: "We have today received the

Final Determination from Ofwat, a complex document with a huge

volume of information to analyse. We will take the time necessary

to review its content and conclusions thoroughly before responding

to Ofwat and our stakeholders in February 2015. In the meantime we

continue to make good progress in preparing the business for AMP6.

We are proud that Severn Trent customers have the lowest average

combined bills in the land, and with bills falling in real terms

over the next 5 years, this is set to be the case until 2020, when

bills will be around GBP60 below the industry average.(2) "

The Ofwat Final Determination proposes the following for Severn

Trent Water:

TABLE 1

Severn Trent Water Ofwat Draft Determination Ofwat Final Determination

June revised business (inc. Birmingham

plan resilience)

Wholesale Totex GBP5,606m GBP5,586m GBP5,623m

(inc. pensions)

Retail Revenues GBP757m GBP728m GBP743m

Wholesale WACC 3.7% 3.7% 3.6%

PAYG rate 57.2% 57.2% 58.8%

Return on regulated 1.1% - 9.6% 1.0% - 9.2% 0.7% - 9.0%

equity

Regulatory Capital GBP10.1 billion GBP10.1 billion GBP10.0 billion

Value (RCV) in

2020(1)

1. Nominal, assumes year end 2.5% RPI for 14/15 and an average of 3.3% year end RPI for 2015-2020

2. In 2014/15 prices. Source: Ofwat

Enquiries:

0207 353 4200 (on the

Liv Garfield Severn Trent Plc day)

Chief Executive 02477 715000

0207 353 4200 (on the

Mike McKeon Severn Trent Plc day)

Finance Director 02477 715000

0207 353 4200 (on the

Rob Salmon Severn Trent Plc day)

Head of Communications 02477 715000

0207 353 4200 (on the

John Crosse Severn Trent Plc day)

Head of Investor Relations 02477 715000

Katharine Wynne /

Martha Walsh Tulchan Communications 0207 353 4200

Cautionary statement regarding Forward Looking Statements

This document contains statements that are, or may be deemed to

be, 'forward-looking statements' with respect to Severn Trent's

financial condition, results of operations and business and certain

of Severn Trent's plans and objectives with respect to these

items.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

'anticipates', 'aims', 'due', 'could', 'may', 'will', 'would',

'should', 'expects', 'believes', 'intends', 'plans', 'projects',

'potential', 'reasonably possible', 'targets', 'goal' or

'estimates' and, in each case, their negative or other variations

or comparable terminology. Any forward-looking statements in this

document are based on Severn Trent's current expectations and, by

their very nature, forward-looking statements are inherently

unpredictable, speculative and involve risk and uncertainty because

they relate to events and depend on circumstances that may or may

not occur in the future.

Forward-looking statements are not guarantees of future

performance and no assurances can be given that the forward-looking

statements in this document will be realised. There are a number of

factors, many of which are beyond Severn Trent's control, that

could cause actual results, performance and developments to differ

materially from those expressed or implied by these forward-looking

statements. These factors include, but are not limited to: the

Principal Risks disclosed in our Annual Report as at May 2013

(which have not been updated since); changes in the economies and

markets in which the group operates; changes in the regulatory and

competition frameworks in which the group operates; the impact of

legal or other proceedings against or which affect the group; and

changes in interest and exchange rates.

All written or verbal forward-looking statements, made in this

document or made subsequently, which are attributable to Severn

Trent or any other member of the group or persons acting on their

behalf are expressly qualified in their entirety by the factors

referred to above. Subject to compliance with applicable laws and

regulations, Severn Trent does not intend to update these

forward-looking statements and does not undertake any obligation to

do so,

Nothing in this document should be regarded as a profits

forecast.

This document is not an offer to sell, exchange or transfer any

securities of Severn Trent Plc or any of its subsidiaries and is

not soliciting an offer to purchase, exchange or transfer such

securities in any jurisdiction. Securities may not be offered, sold

or transferred in the United States absent registration or an

applicable exemption from the registration requirements of the US

Securities Act of 1933 (as amended).

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCGMMMZMZDGDZM

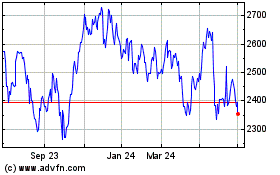

Severn Trent (LSE:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

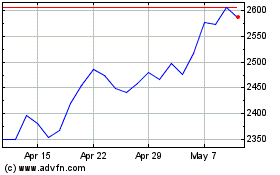

Severn Trent (LSE:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024