UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

ARROWHEAD

PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

46-0408024

|

|

(State of incorporation or organization)

|

|

(I.R.S. Employer Identification no.)

|

|

|

|

|

225 South Lake Avenue, Suite 1050, Pasadena, California

|

|

91101

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

|

|

|

|

If this form relates to the registration of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c), please check the following box. ☒

|

|

If this form relates to the registration of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), please check the following box. ☐

|

|

|

|

|

|

Securities Act registration statement file number to which this form relates:

|

|

Not Applicable

|

|

|

|

(if applicable)

|

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

to be so registered

|

|

Name of each exchange on which

each class is to be registered

|

|

Rights to Purchase Series D Junior

Participating Preferred Stock

|

|

NASDAQ Global Select Market

|

Securities to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

ARROWHEAD PHARMACEUTICALS, INC.

INFORMATION REQUIRED IN REGISTRATION STATEMENT

|

Item 1.

|

Description of Registrant’s Securities to be Registered.

|

On March 21, 2017,

Arrowhead Pharmaceuticals, Inc., a Delaware corporation (the “

Company

”), entered into a Rights Agreement (as defined below) pursuant to an authorization and declaration by the Board of Directors of the Company (the

“Board”) of a dividend distribution of one right (each, a “

Right

” and together with all other such rights distributed or issued pursuant to the Rights Agreement (as defined below), the “

Rights

”) for each

outstanding share of common stock, par value $0.001, of the Company (the “

Common Stock

”). The dividend was payable to holders of record as of the close of business on March 22, 2017 (the “

Record Date

”) and the

dividend distribution was made on March 22, 2017.

The following is a summary description of the Rights. This summary is intended to

provide a general description only and is subject to the detailed terms and conditions of the Rights Agreement, dated as of March 21, 2017, by and between the Company and Computershare Trust Company, N.A., as rights agent (the “

Rights

Agent

”), a copy of which is attached as Exhibit 4.1 to the Company’s Current Report on

Form 8-K,

filed on March 23, 2017, and is incorporated herein by reference (the “

Rights

Agreement

”).

Issuance of Rights

Each holder of Common Stock as of the Record Date will receive a dividend of one Right per share of Common Stock. One Right will also be issued

together with each share of Common Stock issued by the Company after the Record Date and prior to the Distribution Date (as defined below), and in certain circumstances, after the Distribution Date. New certificates for Common Stock issued after the

Record Date will contain a notation incorporating the Rights Agreement by reference.

Until the Distribution Date:

|

|

•

|

|

the Rights will not be exercisable;

|

|

|

•

|

|

the Rights will be evidenced by the certificates for Common Stock (or, in the case of book entry shares, by notation in book entry) and not by separate rights certificates; and

|

|

|

•

|

|

the Rights will be transferable by, and only in connection with, the transfer of Common Stock.

|

Distribution Date

The Rights are not

exercisable until the Distribution Date. As of and after the Distribution Date, the Rights will separate from the Common Stock and each Right will become exercisable to purchase one

one-thousandth

of a share

of Series D Junior Participating Preferred Stock, par value $0.001 per share, of the Company (each whole share, a share of “

Preferred

2

Stock

”) at a purchase price of $20 (such purchase price, as may be adjusted, the “

Purchase Price

”). This portion of a share of Preferred Stock would give the holder

thereof approximately the same dividend, voting and liquidation rights as would one share of Common Stock, with any variations set forth in the Certificate of Designation, Preferences, and Rights of Series D Junior Participating Preferred Stock, a

copy of which is attached as Exhibit 3.1 to the Company’s Current Report on

Form 8-K,

filed on March 23, 2017. Prior to exercise, the Right does not give its holder any dividend, voting or

liquidation rights.

The “

Distribution Date

” is the earlier of:

|

|

•

|

|

Ten (10) Business Days following a public announcement that a person has become an “Acquiring Person” by acquiring beneficial ownership of 15% or more of the Common Stock then outstanding (or, in the case

of a person that had beneficial ownership of 15% or more of the outstanding Common Stock on the date that the Rights Agreement was executed, by obtaining beneficial ownership of any additional shares of Common Stock) other than as a result of

repurchases of Common Stock by the Company or certain inadvertent acquisitions; and

|

|

|

•

|

|

Ten (10) business days (or such later date as the Board shall determine prior to the time a person becomes an Acquiring Person) after the commencement of a tender offer or an exchange offer by or on behalf of any

person (other than the Company and certain related entities) that, if completed, would result in such person becoming an Acquiring Person.

|

Beneficial Ownership

A person will be

deemed to “beneficially own” any Common Stock if such person or any affiliated or associated persons of such person:

|

|

•

|

|

is considered a “beneficial owner” of the Common Stock under

Rule 13d-3

of the General Rules and Regulations under the Securities Exchange Act of 1934, as amended

and as in effect on the date of the Rights Agreement;

|

|

|

•

|

|

has the right to acquire the Common Stock, either immediately or in the future, pursuant to any agreement, arrangement or understanding (other than a customary underwriting agreement relating to a bona fide public

offering of the Common Stock) or upon the exercise of conversion rights, exchange rights, rights, warrants or options, or otherwise, except that a person will not be deemed to be a beneficial owner of (a) securities tendered pursuant to a

tender offer or an exchange offer by or on behalf of such person or any affiliated or associated persons of such person until the tendered securities are accepted for purchase or exchange, (b) securities issuable upon the exercise of a Right

before the occurrence of a Triggering Event (as defined below), or (c) securities issuable upon the exercise of a Right after the occurrence of a Triggering Event if the Rights are originally issued Rights or were issued in connection with an

adjustment to originally issued Rights;

|

3

|

|

•

|

|

has the right to vote or dispose of the Common Stock pursuant to any agreement, arrangement, or understanding (other than a right to vote arising from the granting of a revocable proxy or consent that is not also then

reportable on a Schedule 13D); or

|

|

|

•

|

|

has an agreement, arrangement, or understanding with another person who beneficially owns Common Stock and the agreement, arrangement, or understanding is for the purpose of acquiring, holding, voting, or disposing of

any securities of the Company (other than customary underwriting agreements relating to a bona fide public offering of Common Stock or a right to vote arising from the granting of a revocable proxy or consent that is not also then reportable on a

Schedule 13D).

|

Certain synthetic interests in securities created by derivative positions—whether or not such

interests are considered to be ownership of the underlying common stock or are reportable on a Schedule 13D—are treated as beneficial ownership of the number of shares of Common Stock equivalent to the economic exposure created by the

derivative position, to the extent actual shares of Common Stock are directly or indirectly held by counterparties to the derivatives contracts. Swaps dealers unassociated with any control intent or intent to evade the purposes of the Rights

Agreement are excepted from such imputed beneficial ownership.

Issuance of Rights Certificates

As soon as practicable after the Distribution Date, the Company or the Rights Agent will mail rights certificates to holders of record of

Common Stock as of the close of business on the Distribution Date (other than an Acquiring Person or any Associate or Affiliate of an Acquiring Person) and, thereafter, the separate rights certificates alone will evidence the Rights.

Expiration of Rights

The Rights will

expire on the earliest of (a) 5:00 p.m., New York time, on March 21, 2018, (b) the time at which the Rights are redeemed (as described below), and (c) the time at which the Rights are exchanged in full (as described below) (the earliest of

(a), (b) and (c) being herein referred to as, the “

Expiration Date

”).

Change of Exercise of Rights Following Certain Events

The following described events are referred to as “

Triggering Events

.”

|

|

•

|

|

Flip-In

Event

. In the event that a person becomes an Acquiring Person, each holder of a Right will thereafter have the right to receive, upon exercise, Common Stock (or, in

certain circumstances, other securities, cash, or other assets of the Company) having a value equal to two times the Purchase Price. Notwithstanding any of the foregoing, following the occurrence of a person becoming an Acquiring Person, all Rights

that are, or (under certain circumstances specified in the Rights Agreement) were, beneficially owned by any Acquiring Person (or by certain related parties) will be null and void.

|

4

For example, at a purchase price of $20 per Right, following the occurrence of a person becoming

an Acquiring Person, each Right not owned by the Acquiring Person (or by certain related parties) would entitle its holder to purchase $40 worth of Common Stock (or, in certain circumstances, other securities, cash, or other assets of the Company)

for $20. Assuming that the Common Stock has a per share value of $2 at such time, the holder of each valid Right would be entitled to purchase 20 shares of Common Stock (or, in certain circumstances, other securities, cash, or other assets of the

Company) for $20.

|

|

•

|

|

Flip-Over Events

. In the event that, at any time after a person has become an Acquiring Person, (i) the Company engages in a merger or other business combination transaction in which the Company is not the

continuing or surviving corporation or other entity, (ii) the Company engages in a merger or other business combination transaction in which the Company is the continuing or surviving corporation and the Common Stock of the Company are changed

or exchanged, or (iii) 50% or more of the Company’s assets or earning power is sold or transferred, each holder of a Right (except Rights that have previously been voided as set forth above) shall thereafter have the right to receive, upon

exercise, common shares of the acquiring company having a value equal to two times the Purchase Price.

|

Redemption

At any time prior to the earlier of (a) the Distribution Date and (b) the Expiration Date, the Board may direct the Company to redeem

the Rights in whole, but not in part, at a price of $0.01 per Right (payable in cash, Common Stock, or other consideration deemed appropriate by the Board). Immediately upon the action of the Board directing the Company to redeem the Rights, the

Rights will terminate and the only right of the holders of Rights will be to receive the $0.01 redemption price.

Exchange of Rights

At any time after a person becomes an Acquiring Person, but before any person acquires beneficial ownership of 50% or more of the outstanding

Common Stock, the Board may direct the Company to exchange the Rights (other than Rights owned by such person or certain related parties, which will have become null and void), in whole or in part, at an exchange ratio of one share of Common Stock

per Right (subject to adjustment). The Company may substitute shares of Preferred Stock (or shares of a class or series of the Company’s preferred stock having equivalent rights, preferences, and privileges) for Common Stock at an initial rate

of one

one-thousandth

of a share of Preferred Stock (or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences, and privileges) per share of Common Stock.

Immediately upon the action of the Board directing the Company to exchange the Rights, the Rights will terminate and the only right of the holders of Rights will be to receive the number of shares of Common Stock (or one

one-thousandth

of a share of Preferred Stock or of a share of a class or series of the Company’s preferred stock having equivalent rights, preferences, and privileges) equal to the number of Rights held by such

holder multiplied by the exchange ratio.

5

Adjustments to Prevent Dilution; Fractional Shares

The Board may adjust the Purchase Price, the number of shares of Preferred Stock or other securities or assets issuable upon the exercise of a

Right, and the number of Rights outstanding to prevent dilution that may occur (a) in the event of a stock dividend on, or a subdivision, combination, or reclassification of, the Preferred Stock, (b) in the event of a stock dividend on, or

a subdivision or combination of, the Common Stock, (c) if holders of the Preferred Stock are granted certain rights, options, or warrants to subscribe for Preferred Stock or convertible securities at less than the current market price of the

Preferred Stock, or (d) upon the distribution to holders of the Preferred Stock of evidences of indebtedness or assets (excluding regular periodic cash dividends) or of subscription rights or warrants (other than those referred to above).

With certain exceptions, no adjustment in the Purchase Price will be required until cumulative adjustments amount to at least 1% of the

Purchase Price. No fractional shares of Preferred Stock will be issued (other than fractions that are integral multiples of one

one-thousandth

of a share of Preferred Stock), and in lieu thereof, an adjustment

in cash may be made based on the market price of the Preferred Stock on the last trading date prior to the date of exercise.

No Stockholder Rights

Prior to Exercise; Tax Considerations

Until a Right is exercised, the holder thereof, as such, will have no rights as a stockholder of

the Company, including, without limitation, the right to vote or to receive dividends. While the distribution of the Rights will not be taxable to stockholders or to the Company, stockholders may, depending upon the circumstances, recognize taxable

income in the event that the Rights become exercisable for Common Stock (or other consideration) of the Company or for common shares of the acquiring company or in the event of the redemption of the Rights as set forth above.

Amendment of Rights Agreement

The

Company, by action of the Board, may supplement or amend any provision of the Rights Agreement in any respect without the approval of any registered holder of Rights, including, without limitation, in order to (a) cure any ambiguity,

(b) correct or supplement any provision contained in the Rights Agreement that may be defective or inconsistent with other provisions of the Rights Agreement, (c) shorten or lengthen any time period under the Rights Agreement, or

(d) otherwise change, amend, or supplement any provisions of the Rights Agreement in any manner that the Company deems necessary or desirable; provided, however, that no supplement or amendment made after a person becomes an Acquiring Person

shall adversely affect the interests of the registered holders of rights certificates (other than an Acquiring Person or any affiliated or associated persons of an Acquiring Person or certain of their transferees) or shall cause the Rights Agreement

to become amendable other than in accordance with the amendment provision contained therein. Without limiting the foregoing, the Company, by action of the Board, may at any time before any person becomes an Acquiring Person amend or supplement the

Rights Agreements to make provisions of the Rights Agreement inapplicable to a particular transaction by which a person might otherwise become an Acquiring Person or to otherwise alter the terms and conditions of the Rights Agreement as they may

apply with respect to any such transaction.

6

The following exhibits are filed as a part of this Registration Statement:

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

3.1

|

|

Certificate of Designation, Preferences, and Rights of Series D Junior Participating Preferred Stock of Arrowhead Pharmaceuticals, Inc. (incorporated by reference to Exhibit 3.1 to the Form

8-K

(File

No. 000-21898)

filed with the SEC on March 23, 2017).

|

|

|

|

|

3.2

|

|

Amended and Restated Certificate of Incorporation of Arrowhead Research Corporation (incorporated by reference to Exhibit 3.3 to the Form

8-K

(File

No. 000-21898)

filed with the SEC on April 6, 2016).

|

|

|

|

|

3.3

|

|

Amended and Restated Bylaws of Arrowhead Pharmaceuticals, Inc. (incorporated by reference to Exhibit 3.4 to the Form

8-K

(File

No. 000-21898)

filed

with the SEC on April 6, 2016).

|

|

|

|

|

4.1

|

|

Rights Agreement dated as of March 21, 2017, by and between Arrowhead Pharmaceuticals, Inc. and Computershare Trust Company, N.A., as rights agent, which includes as Exhibit B the Form of Rights Certificate (incorporated by

reference to Exhibit 4.1 to the Form

8-K

(File

No. 000-21898)

filed with the SEC on March 23, 2017).

|

7

SIGNATURE

Pursuant to the requirements of Section 12 of the Securities Exchange Act of 1934, the registrant has duly caused this registration

statement to be signed on its behalf by the undersigned, thereto duly authorized.

Date: March 23, 2017

|

|

|

|

|

ARROWHEAD PHARMACEUTICALS, INC.

|

|

|

|

|

By:

|

|

/s/ Kenneth Myszkowski

|

|

|

|

Kenneth Myszkowski

|

|

|

|

Chief Financial Officer

|

8

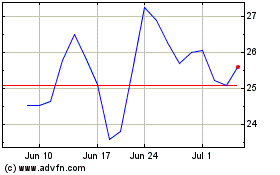

Arrowhead Pharmaceuticals (NASDAQ:ARWR)

Historical Stock Chart

From Mar 2024 to Apr 2024

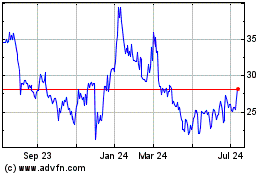

Arrowhead Pharmaceuticals (NASDAQ:ARWR)

Historical Stock Chart

From Apr 2023 to Apr 2024