Securities Registration (section 12(b)) (8-a12b)

February 25 2015 - 2:57PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF

THE SECURITIES EXCHANGE ACT OF 1934

Tyco

International plc

(Exact name of registrant as specified in its charter)

|

|

|

| Ireland |

|

98-0390500 |

| (Jurisdiction of Incorporation) |

|

(IRS Employer Identification Number) |

001-13836

(Commission File Number)

Unit 1202 Building 1000 City Gate

Mahon, Cork, Ireland

(Address of Principal Executive Offices, including Zip Code)

353-21-423-5000

(Registrant’s Telephone Number, including Area Code)

(FOR CO-REGISTRANTS, PLEASE SEE “TABLE OF CO-REGISTRANTS” ON THE FOLLOWING PAGE)

Securities to be registered pursuant to Section 12(b) of the Act:

|

|

|

| Title of each class

to be so registered |

|

Name of each exchange on which

each class is to be registered |

| 1.375% Notes Due 2025 |

|

New York Stock Exchange |

If this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General

Instruction A.(c), check the following box. x

If this form relates to the registration of a

class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d), check the following box. ¨

Securities Act registration statement file number to which this form relates:

333-200314

Securities

to be registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

TABLE OF CO-REGISTRANTS

|

|

|

|

|

|

|

| Exact Name

as Specified in its Charter |

|

State or Other

Jurisdiction

of Incorporation

or Organization |

|

I.R.S.

Employer

Identification

Number |

|

Address, including Zip Code and Telephone

Number of Principal Executive Offices |

| Tyco International Finance S.A.* |

|

Luxembourg |

|

98-0390500 |

|

29, Avenue de la Porte-Neuve

L-2227 Luxembourg, Luxembourg |

| Tyco International plc |

|

Ireland |

|

98-0390500 |

|

Unit 1202 Building 1000 City Gate

Mahon, Cork Ireland |

| Tyco Fire & Security Finance S.C.A. |

|

Luxembourg |

|

98-0518565 |

|

29, Avenue de la Porte-Neuve

L-2227 Luxembourg, Luxembourg |

| * |

Tyco International Finance S.A is the issuer of the debt securities registered hereby. The other listed co-registrants are guarantors of the debt securities. |

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Tyco International plc (the “Registrant”) has filed with the Securities and Exchange Commission (the “SEC”) a prospectus

supplement dated February 20, 2015 (the “Prospectus Supplement”) to a prospectus dated November 17, 2014 (the “Prospectus”), relating to securities to be registered hereunder included in the Registrant’s automatic

shelf Registration Statement on Form S-3 (File No. 333-200314), which became automatically effective on November 17, 2014.

Item 1.

Description of Registrant’s Securities to be Registered.

The Registrant and the Co-Registrants on this registration statement

(the “Co-Registrants”) register hereunder €500,000,000 aggregate principal amount of 1.375% Notes Due 2025 (the “Notes”) issued by the Registrant’s subsidiary, Tyco International Finance S.A., a Co-Registrant on this

registration statement. For a description of the securities to be registered hereunder, reference is made to the information under the heading “Description of Debt Securities and Guarantees of Debt Securities” of the Prospectus dated

November 17, 2014 (Registration No. 333-200314), as supplemented by the information under the heading “Description of the Notes and Guarantees” in the Registrant’s related Prospectus Supplement, dated February 20, 2015,

filed by the Registrant with the SEC on February 23, 2015 (Registration No. 333-200314). Such information is incorporated herein by reference and made a part of this registration statement in its entirety. Copies of such descriptions will

be filed with the New York Stock Exchange, Inc.

Item 2. Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Indenture, dated as of February 25, 2015, by and among Tyco International Finance S.A., as issuer, Tyco International plc and Tyco Fire & Security Finance S.C.A., as guarantors, and Deutsche Bank Trust Company Americas, as

trustee (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K filed with the SEC on February 25, 2015). |

|

|

| 4.2 |

|

First Supplemental Indenture, dated as of September 24, 2014, by and among Tyco International Finance S.A., as issuer, Tyco International plc and Tyco Fire & Security Finance S.C.A., as guarantors, Deutsche Bank Trust Company

Americas, as trustee and paying agent, and Deutsche Bank Luxembourg S.A., as security registrar, transfer agent and authenticating agent (incorporated by reference to Exhibit 4.2 to the Registrant’s Current Report on Form 8-K filed with the SEC

on February 25, 2015). |

|

|

| 4.3 |

|

Specimen of 1.375% Note Due 2025 (incorporated by reference to Annex A to Exhibit 4.2 to the Registrant’s Current Report on Form 8-K filed with the SEC on February 25, 2015). |

|

|

| 99.1 |

|

Prospectus dated November 17, 2014, and Supplemental Prospectus dated February 20, 2015, relating to the Notes (incorporated by reference to the prospectus and prospectus supplement filed by the Registrant on February 23, 2015

(Registration No. 333-200314)). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: February 25, 2015

|

|

|

| TYCO INTERNATIONAL PLC |

|

|

| By: |

|

/s/ Mark Armstrong |

| Name: |

|

Mark Armstrong |

| Title: |

|

Senior Vice President & Treasurer |

|

| TYCO FIRE & SECURITY FINANCE S.C.A. |

|

|

| By: |

|

/s/ Andrea Goodrich |

| Name: |

|

Andrea Goodrich |

| Title: |

|

Manager |

|

|

| By: |

|

/s/ Robert Sedgley |

| Name: |

|

Robert Sedgley |

| Title: |

|

Manager |

|

| TYCO INTERNATIONAL FINANCE S.A. |

|

|

| By: |

|

/s/ Peter Schieser |

| Name: |

|

Peter Schieser |

| Title: |

|

Managing Director |

Exhibit Index

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 4.1 |

|

Indenture, dated as of February 25, 2015, by and among Tyco International Finance S.A., as issuer, Tyco International plc and Tyco Fire & Security Finance S.C.A., as guarantors, and Deutsche Bank Trust Company Americas, as

trustee (incorporated by reference to Exhibit 4.1 to the Registrant’s Current Report on Form 8-K filed with the SEC on February 25, 2015). |

|

|

| 4.2 |

|

First Supplemental Indenture, dated as of September 24, 2014, by and among Tyco International Finance S.A., as issuer, Tyco International plc and Tyco Fire & Security Finance S.C.A., as guarantors, Deutsche Bank Trust Company

Americas, as trustee and paying agent, and Deutsche Bank Luxembourg S.A., as security registrar, transfer agent and authenticating agent (incorporated by reference to Exhibit 4.2 to the Registrant’s Current Report on Form 8-K filed with the SEC

on February 25, 2015). |

|

|

| 4.3 |

|

Specimen of 1.375% Note Due 2025 (incorporated by reference to Annex A to Exhibit 4.2 to the Registrant’s Current Report on Form 8-K filed with the SEC on February 25, 2015). |

|

|

| 99.1 |

|

Prospectus dated November 17, 2014, and Supplemental Prospectus dated February 20, 2015, relating to the Notes (incorporated by reference to the prospectus and prospectus supplement filed by the Registrant on February 25, 2015

(Registration No. 333-200314)). |

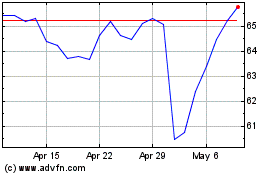

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

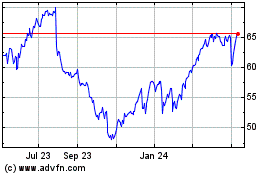

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2023 to Apr 2024