As filed with the Securities and Exchange Commission on April 11, 2016

REGISTRATION NO.

333-

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

The9 Limited

(Exact name of Registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

|

|

|

|

|

Cayman Islands

|

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

Building No. 3, 690 Bibo Road

Zhang Jiang Hi-Tech Park

Pudong New Area, Pudong

Shanghai 201203

People’s Republic of China

Tel: +86-21-5172-9999

(Address and telephone number of Registrant’s principal executive offices)

Law Debenture Corporate Services Inc.

400 Madison Avenue, 4th Floor

New York, New York 10017

(212) 750-6474

(Name,

address and telephone number of agent for service)

Copies to:

|

|

|

|

|

George Lai

Chief Financial Officer

The9 Limited

Building

No. 3, 690 Bibo Road

Zhang Jiang Hi-Tech Park

Pudong New Area, Pudong

Shanghai 201203

People’s Republic of China

Tel: +86-21-5172-9999

|

|

Haiping Li, Esq.

Skadden, Arps, Slate, Meagher & Flom LLP

c/o 42/F, Edinburgh Tower

The Landmark

15

Queen’s Road Central

Hong Kong

+852-3740-4700

|

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this registration statement.

If the only securities being registered on this form are to be offered pursuant to dividend or interest reinvestment plans, please

check the following box.

¨

If any of the securities being registered on this

form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box.

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become

effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

¨

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount to be

registered

(1)

|

|

Proposed maximum

offering price per

ordinary share

(3)

|

|

Proposed maximum

aggregate

offering price

(3)

|

|

Amount of

registration fee

|

|

Ordinary shares, par value

US$0.01 per share

|

|

16,474,355

(2)

|

|

$2.325

|

|

$38,302,875.4

|

|

$3,857.1

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended, this registration statement shall be deemed to cover any additional number of ordinary shares that may be issued from time to time to prevent

dilution as a result of a distribution, split, combination or similar transaction.

|

|

(2)

|

Consists of (i) up to 11,695,511 ordinary shares issuable upon conversion of the 12% senior convertible notes and (ii) up to 4,778,844 ordinary shares issuable upon exercise of the warrants held by the selling

shareholder identified in the prospectus forming part of this registration statement. These ordinary shares may be represented by American depositary shares, or ADSs. American depositary shares issuable upon deposit of the ordinary shares registered

hereby have been registered under a separate registration statement on Form F-6 (File No. 333-156635). Each American depositary share represents one ordinary share.

|

|

(3)

|

The proposed maximum aggregate offering price, estimated solely for the purpose of calculating the registration fee, has been computed pursuant to Rule 457(c) promulgated under the Securities Act of 1933, as amended,

and is based on the average of the high and low sales prices of the registrant’s ADSs on April 5, 2016, as reported on The NASDAQ Global Market.

|

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall

thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said

Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling

shareholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated April 11, 2016

PROSPECTUS

The9 Limited

16,474,355 Ordinary Shares

Represented by 16,474,355 American Depositary Shares

This prospectus

relates to the proposed resale from time to time of up to 16,474,355 ordinary shares of The9 Limited, par value US$0.01 per share, to be represented by up to 16,474,355 American Depositary Shares, also referred to as the ADSs, by the selling

shareholder identified in the “Selling Shareholder” section in this prospectus, or the Selling Shareholder, or their transferees, pledgees, donees or other successors in interest. The ordinary shares underlying the ADSs being offered by

the Selling Shareholder consists of (i) up to 11,695,511 ordinary shares issuable upon conversion of the senior secured convertible notes in the aggregate principal amount of US$40,050,000, or the Convertible Notes, and (ii) up to

4,778,844 ordinary shares issuable upon exercise of the warrants in the aggregate principal amount of US$9,950,000, or the Warrants, held by the Selling Shareholder.

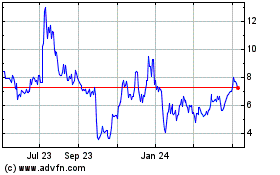

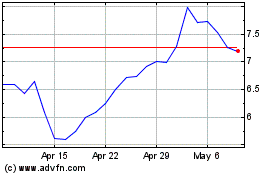

The ADSs are listed on The NASDAQ Global Market, or NASDAQ, under the symbol “NCTY.” On April 8, 2016, the last reported sale

price of the ADSs on NASDAQ was $2.28 per ADS.

Investing in the ADSs involves risks. See “

Risk

Factors

” beginning on page 6 of this prospectus.

The Selling Shareholder may offer and sell the securities from time to time

at fixed prices, at market prices or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods. The names of any underwriters may be stated in the applicable prospectus

supplement, if any such prospectus supplement is prepared. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in which the securities may be sold by the Selling Shareholder.

We are not selling any ADSs and will not receive any of the proceeds from the sale of ADSs by the Selling Shareholder.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus or any accompanying prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the U.S. Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. Under this shelf process, the Selling Shareholder may sell the securities described in this prospectus in one or more offerings. This prospectus provides you with a general description of the securities the

Selling Shareholder may offer. This prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement. We have omitted parts of the registration statement in accordance with the rules

and regulations of the SEC. Statements contained in this prospectus and any accompanying prospectus supplement about the provisions or contents of any agreement or other documents are not necessarily complete. If the SEC rules and regulations

require that an agreement or other document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters. This prospectus may be supplemented by a prospectus supplement that

may add, update or change information contained or incorporated by reference in this prospectus. You should read both this prospectus and any prospectus supplement or other offering materials together with additional information described under the

headings “Where You Can Find More Information” and “Incorporation of Documents by Reference.”

You should rely only on

the information contained or incorporated by reference in this prospectus and in any supplement to this prospectus or, if applicable, any other offering materials we may provide you. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, the Selling Shareholder is not and any underwriter or agent is not, making an offer to sell these securities in any

jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, any accompanying prospectus supplement or any other offering materials is accurate only as of the date on their respective

cover, and you should assume that the information appearing in any document incorporated or deemed to be incorporated by reference in this prospectus or any accompanying prospectus supplement is accurate only as of the date that document was filed

with the SEC. Our business, financial condition, results of operations and prospects may have changed since those dates.

In addition,

this prospectus and any accompanying prospectus supplement do not contain all the information set forth in the registration statement, including exhibits, that we have filed with the SEC on Form F-3 under the U.S. Securities Act of 1933, as amended,

or the Securities Act. We have filed certain of these documents as exhibits to our registration statement and we refer you to those documents. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects

by the filed exhibit.

In this prospectus, unless otherwise indicated or the context otherwise requires,

|

|

•

|

|

“ADSs” refers to American depositary shares, each of which represents one of our ordinary shares;

|

|

|

•

|

|

“The9,” “we,” “us,” “our company” and “our” refer to The9 Limited, its subsidiaries and its consolidated affiliated entities;

|

|

|

•

|

|

“China” or “PRC” refers to the People’s Republic of China, excluding, for purposes of this prospectus only, Taiwan, Hong Kong and Macau;

|

|

|

•

|

|

“Renminbi” or “RMB” refers to the legal currency of China;

|

|

|

•

|

|

“U.S. GAAP” refers to generally accepted accounting principles in the United States; and

|

|

|

•

|

|

“US$,” “dollars” or “U.S. dollars” refers to the legal currency of the United States.

|

1

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important

information to you by referring you to another document filed by us with the SEC. Any information referenced this way is considered part of this prospectus, and any information that we file after the date of this prospectus with the SEC will

automatically update and supersede this information. We incorporate by reference into this prospectus the following documents:

|

|

•

|

|

Our annual report on Form 20-F for the year ended December 31, 2015, filed with the SEC on April 11, 2016;

|

|

|

•

|

|

The description of our ordinary shares contained in our registration statement on Form 8-A (File No. 000-51053), filed with the SEC on November 30, 2004, and any amendment or report filed for the purpose of

updating such description;

|

|

|

•

|

|

any future annual reports on Form 20-F filed with the SEC after the date of this prospectus and prior to the termination of the offering of the securities offered by this prospectus; and

|

|

|

•

|

|

any future reports on Form 6-K that we furnish to the SEC after the date of this prospectus that are identified in such reports as being incorporated by reference into the registration statement of which this

prospectus forms a part.

|

Our annual report on Form 20-F for the fiscal year ended December 31, 2015 filed with

the SEC on April 11, 2016 contains a description of our business and audited consolidated financial statements with a report by our independent auditors. These financial statements were prepared in accordance with U.S. GAAP.

Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to,

but not filed with, the SEC. Copies of all documents incorporated by reference in this prospectus, other than exhibits to those documents unless such exhibits are specially incorporated by reference in this prospectus, will be provided at no cost to

each person, including any beneficial owner, who receives a copy of this prospectus on the written or oral request of that person made to:

The9 Limited

Building No. 3,

690 Bibo Road

Zhang Jiang Hi-Tech Park

Pudong New Area, Pudong

Shanghai

201203

People’s Republic of China

Tel: +86-21-5172-9999

Attention:

Investor Relations Department

You should rely only on the information that we incorporate by reference or provide in this prospectus. We

have not authorized anyone to provide you with different information. Neither we nor the Selling Shareholder is making any offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the

information contained or incorporated in this prospectus by reference is accurate as of any date other than the date of the document containing the information.

2

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference in this prospectus contain forward-looking statements that relate to our current

expectations and views of future events. Our forward-looking statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Risk Factors,” which may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. These statements are made under the “safe harbor” provisions of

the U.S. Private Securities Litigations Reform Act of 1995. You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,” “continue” or other similar expressions, although not all forward-looking statement contain

these words. Forward-looking statements include, but are not limited to, statements relating to:

|

|

•

|

|

our ability to successfully launch and operate additional games in China and overseas;

|

|

|

•

|

|

our ability to develop, license or acquire additional online games that are attractive to users;

|

|

|

•

|

|

the maintenance and expansion of our relationships with game distributors and online game developers, including our existing licensors;

|

|

|

•

|

|

uncertainties in and the timeliness of obtaining necessary governmental approvals and licenses for operating any new online game;

|

|

|

•

|

|

risks inherent in the online game business;

|

|

|

•

|

|

risks associated with our future acquisitions and investments;

|

|

|

•

|

|

our ability to compete effectively against our competitors;

|

|

|

•

|

|

risks associated with our corporate structure and the regulatory environment in China; and

|

|

|

•

|

|

other risks outlined in our filings with the SEC.

|

We would like to caution you not to place

undue reliance on forward-looking statements and you should read these statements in conjunction with the cautionary statements included in this prospectus and in the “Risk Factors” section in our most recent annual report on Form 20-F

incorporated by reference herein. Those risks are not exhaustive. We operate in an emerging and evolving environment. New risk factors emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess

the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. We do not undertake any obligation to update

or revise the forward-looking statements except as required under applicable law. You should read this prospectus and the documents incorporated by reference in this prospectus completely and with the understanding that our actual future results may

be materially different from what we expect.

3

OUR COMPANY

We primarily operate proprietary and licensed online games, including MMOFPSs, mobile games and TV games. We have developed proprietary games,

including Firefall and Song of Knights, and are developing several proprietary mobile games. We have also obtained an exclusive license to operate CrossFire 2, an MMOFPS in development, in China through a joint venture. We also develop and operate

the business of “Fun Box,” a home entertainment set top box, which enables online video and video games on TV, through a joint venture.

We generate our online game service revenues primarily through an item-based revenue model, under which players play games for free, but they

are charged for in-game items, such as performance-enhancing items, clothing and accessories. Our customers typically access our online games through personal computers, mobile devices or TVs. They purchase in-game items primarily through our Pass9

payment system, or by using prepaid cards purchased at online game platforms. Pass9 is a proprietary, fully integrated online membership management and payment system, which offers one-stop account management and payment services to our customers.

To ensure quality customer service and seamless operations, we maintain a powerful technology platform consisting of numerous servers and network devices located in four Internet data centers in China.

As mobile business has become increasingly popular in China, we are also developing our mobile application platforms. We established a mobile

business unit in April 2010 and started to expand into the mobile business. We also operate our proprietary mobile advertising platform, Juzi, and a mobile app education business.

Our principal executive offices are located at Building No. 3, 690 Bibo Road, Zhang Jiang Hi-Tech Park, Pudong New Area, Pudong, Shanghai

201203, People’s Republic of China. Our telephone number at this address is +86-21-5172-9999.

4

ABOUT THIS OFFERING

This prospectus relates to the proposed resale from time to time by the Selling Shareholder of up to 16,474,355 ordinary shares to be

represented by ADSs, consisting of (i) up to 11,695,511 ordinary shares issuable upon conversion of the senior secured convertible notes in the aggregate principal amount of US$40,050,000, or the Convertible Notes, and (ii) up to 4,778,844

ordinary shares issuable upon exercise of the warrants in the aggregate principal amount of US$9,950,000, or the Warrants, which are held by the Selling Shareholder. The Selling Shareholder acquired the Convertible Notes and the Warrants pursuant to

the Convertible Note and Warrant Purchase Agreement entered into on November 24, 2015, or the Agreement, by and among our company, the Selling Shareholder and the parties listed in Schedule 1 attached thereto, pursuant to Regulation S under the

Securities Act of 1933.

Pursuant to the Agreement, we issued the Convertible Notes and the Warrants to the Selling Shareholder on

December 11, 2015. The Convertible Notes are divided into three tranches, including (i) Tranche A Convertible Notes in the aggregate principal amount of US$22,250,000, which are convertible into ADSs at an initial conversion price of

US$2.60 per ADS; (ii) Tranche B Convertible Notes in the aggregate principal amount of US$13,350,000, which are convertible into ADSs at an initial conversion price of US$5.20 per ADS; and (iii) Tranche C Convertible Notes in the aggregate

principal amount of US$4,450,000, which are convertible into ADSs at an initial conversion price of US$7.80 per ADS, provided that at no time shall the Selling Shareholder be entitled to convert any portion of the Convertible Notes into ADSs if

subsequent to such conversion the Selling Shareholder holds more than 20% of the our total outstanding and issued ordinary shares. The initial conversion prices are subject to customary anti-dilution adjustments. The Convertible Notes bear interest

at a rate of 12% per year, payable when the principal amount of the Convertible Notes becomes due. The Convertible Notes are due in 2018, subject to an extension of two years at the discretion of the Selling Shareholder, or the Extension

Option. The Convertible Notes are secured by a pledge of our 100% equity interests in two of our wholly-owned subsidiaries in China, including The9 Computer Technology Consulting (Shanghai) Co., Ltd. and China The9 Interactive (Shanghai) Limited,

and a mortgage over our office building in Shanghai which we currently use as our principal executive offices.

The Warrants are divided

into the four tranches, including (i) Tranche I Warrants in the aggregate principal amount of US$5,000,000, which are exercisable for ADSs at an initial exercise price of US$1.50 per ADS; (ii) Tranche A Warrants in the aggregate principal

amount of US$2,750,000, which are exercisable for ADSs at an initial exercise price of US$2.60 per ADS; (iii) Tranche B Warrants in the aggregate principal amount of US$1,650,000, which are exercisable for ADSs at an initial exercise price of

US$5.20 per ADS; and (iv) Tranche C Convertible Notes in the aggregate principal amount of US$550,000, which are exercisable for ADSs at an initial exercise price of US$7.80 per ADS. The initial exercises prices are subject to customary

anti-dilution adjustments. The Tranche I Warrants are exercisable at any time prior to the date that is 60 months from their issuance date of December 11, 2015. The Tranche A Warrants, Tranche B Warrants and Tranche C Warrants are exercisable

at any time prior to the third anniversary of their issuance date of December 11, 2015 or, in the event the Selling Shareholder extends the maturity date of the Convertible Notes by exercising the Extension Option, the fifth anniversary of

their issuance date of December 11, 2015.

Pursuant to the Agreement, we agreed to register the ordinary shares issuable upon

conversion of the Convertible Notes and exercise of the Warrants on a registration statement on F-3, and use our best efforts to cause such registration statement to be declared effective by the SEC as promptly as possible after the initial filing.

We are registering such shares in the registration statement which includes this prospectus.

Additional information regarding the

Convertible Notes and the Warrants are provided in the annual report on Form 20-F for the fiscal year ended December 31, 2015, which we filed with the SEC on April 11, 2016, and which is incorporated herein by reference.

5

RISK FACTORS

Investing in the ADSs involves risk. Before investing in any securities that may be offered pursuant to this prospectus, you should carefully

consider the risk factors and uncertainties set forth under the heading “Item 3. Key Information—D. Risk Factors” in our annual report on Form 20-F for the year ended December 31, 2015, which is incorporated in this

prospectus by reference, as updated by our subsequent filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act, and, if applicable, in any accompanying prospectus supplement subsequently filed relating to a specific

offering or sale.

6

OFFER STATISTICS AND EXPECTED TIMETABLE

The Selling Shareholder identified in this prospectus may sell from time to time up to 16,474,355 ADSs, representing 16,474,355 of our

ordinary shares, consisting of (i) up to 11,695,511 ordinary shares issuable upon conversion of the Convertible Notes, and (ii) up to 4,778,844 ordinary shares issuable upon exercise of the Warrants.

We shall keep the shelf registration statement current and cause it to remain effective to permit the prospectus under the shelf registration

statement or any subsequent registration statement to be usable by the registrable securities holders until the earlier of (i) such time as all of the registrable securities covered here have been publicly sold by the holders, or (ii) the

date that all registrable securities covered here may be sold by the holders pursuant to Rule 144 without any restriction.

7

USE OF PROCEEDS

We will not receive any proceeds from the sale of ADSs by the Selling Shareholder.

8

SELLING SHAREHOLDER

We are registering, in the registration statement which includes this prospectus, the ordinary shares issuable upon conversion

of the Convertible Notes and exercise of the Warrants held by Splendid Days Limited, or the Selling Shareholder, to permit the sale of ADSs representing these ordinary shares from time to time after the date of this prospectus. We have no assurance

that the Selling Shareholder will sell any of the ordinary shares registered for resale hereunder. See “Plan of Distribution.” In addition, the Selling Shareholder may sell the ADSs pursuant to this prospectus or in privately negotiated

transactions. Accordingly, we cannot estimate the number of ADSs representing ordinary shares that the Selling Shareholder will sell under this prospectus. Information about the Selling Shareholder may change over time.

The following table, to our knowledge, sets forth information regarding the beneficial ownership of our ordinary shares of the Selling

Shareholder as of the latest practicable date as indicated in the footnotes thereto. As of the date of this prospectus, we have 37,283,929 ordinary shares outstanding, including 26,971,530 ordinary shares issued to the depositary for the ADS program

and reserved for future grants under our share incentive plan. Beneficial ownership is determined in accordance with the rules of the SEC. The information provided in the table below is based in part on information provided by or on behalf of the

Selling Shareholder.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ordinary Shares

Beneficially Owned Before

the Offering

(1)

|

|

|

Ordinary Shares

Being Offered

|

|

|

Ordinary Shares

Beneficially Owned

After the

Offering

(2)

|

|

|

|

|

Number

|

|

|

%

|

|

|

|

Number

|

|

|

%

|

|

|

Selling Shareholder:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Splendid Days Limited

(3)

|

|

|

11,974,826

|

(5)

|

|

|

24.3

|

|

|

|

16,474,355

|

(4)

|

|

|

—

|

|

|

|

—

|

|

Notes:

|

(1)

|

Beneficial ownership is determined in accordance with the rules and regulations of the SEC and includes voting or investment power with respect to our ordinary shares. In computing the number of shares beneficially

owned by a person and the percentage ownership of that person, we have included shares that the person has the right to acquire within 60 days, including through the exercise of any option, warrant or other right or the conversion of any other

security. These shares, however, are not included in the computation of the percentage ownership of any other person.

|

|

(2)

|

The Selling Shareholder might not sell any or all of the ordinary shares offered by this prospectus and as a result, we cannot estimate the number of ordinary shares that will be held by the Selling Shareholder after

completion of the offering. However, for purposes of this table, we have assumed that, after completion of the offering, none of the ordinary shares covered by this prospectus will be held by the Selling Shareholder.

|

|

(3)

|

According to the Schedule 13D filed by the Selling Shareholder and other reporting persons with the SEC on December 21, 2015, the Selling Shareholder, a British Virgin Islands company, Ark Pacific Investment

Management Limited, a company organized under the laws of Cayman Islands, Ark Pacific Special Opportunities Fund I, L.P., an exempted limited partnership organized under the laws of Cayman Islands, and Ng Chi Keung Kenneth, a PRC citizen, share the

voting and dispositive power over the ordinary shares issuable upon conversion of the Convertible Notes and exercise of the Warrants held by the Selling Shareholder. In addition, according to the same Schedule 13D, the Selling Shareholder and Ark

Pacific Investment Management Limited entered into certain Participation Agreements, effective as of December 4, 2015, with each of Ark Pacific Special Opportunities Fund I, L.P., Quality Event Limited, Pacman I Limited, Pacman II Limited and

Fortune Profile Limited, or collectively, the Participants. According to the Schedule 13D, pursuant to the Participation Agreements, the Selling Shareholder granted risk participation interests to the Participants of the Selling Shareholder’s

interest in, to and under an aggregate principal amount of US$27,777,777 of the Convertible Notes and the Warrants in consideration for US$20,050,000. Accordingly, each Participant has acquired beneficial ownership over certain number of ordinary

shares issuable upon conversion of the Convertible Notes and exercise of the Warrants held by the Selling Shareholder. The address for Splendid Days Limited is Sea Meadow House, Blackburne Highway, (P.O. Box 116), Road Town, Tortola, British Virgin

Islands.

|

9

|

(4)

|

The total number of ordinary shares being offered represents the aggregate number of ordinary shares issuable to the Selling Shareholder assuming full conversion of the Convertible Notes at the applicable initial

conversion prices and full exercise of the Warrants at the applicable initial exercise prices, consisting of (i) 8,557,692 ordinary shares issuable upon conversion of all the Tranche A Convertible Notes at the initial conversion price of

US$2.60 per ADS, (ii) 2,567,307 ordinary shares issuable upon conversion of all the Tranche B Convertible Notes at the initial conversion price of US$5.20 per ADS, (iii) 570,512 ordinary shares issuable upon conversion of all the Tranche C

Convertible Notes at the initial conversion price of US$7.80 per ADS, (iv) 3,333,333 ordinary shares issuable upon exercise of all the Tranche I Warrants at the initial exercise price of US$1.5 per ADS, (v) 1,057,692 ordinary shares

issuable upon exercise of all the Tranche A Warrants at the initial exercise price of US$2.60 per ADS, (vi) 317,307 ordinary shares issuable upon exercise of all the Tranche B Warrants at the initial exercise price of US$5.2 per ADS,

(vii) 70,512 ordinary shares issuable upon exercise of all the Tranche C Warrants at the initial exercise price of US$7.80 per ADS. The total number of ordinary shares being offered disregards the restriction under the Agreement on the ability

of the Selling Shareholder to convert any portion of the Convertible Notes if subsequent to such conversion the Selling Shareholder holds more than 20% of our total outstanding and issued ordinary shares (the “20% restriction”).

|

|

(5)

|

The total number of ordinary shares beneficially owned by the Selling Shareholder reported herein represents the aggregate number of ordinary shares that the Selling Shareholder beneficially owned as of

December 21, 2015, as reported on the Schedule 13D filed by the Selling Shareholder and other reporting persons with the SEC on December 21, 2015, consisting of (i) an aggregate 7,195,982 ordinary shares issuable upon conversion of

the Convertible Notes, which took into account the 20% restriction, and (ii) an aggregate 4,778,844 ordinary shares issuable upon exercise of the Warrants.

|

10

DESCRIPTION OF SHARE CAPITAL

We are an exempted company incorporated in the Cayman Islands and our affairs are governed by our memorandum and articles of association and

the Companies Law (2013 Revision) of the Cayman Islands, which is referred to as the Companies Law below.

As of the date of this annual

report, our authorized share capital is US$2,500,000, consisting of 250,000,000 ordinary shares, par value of US$0.01 each. As of the date of this prospectus, we have 37,283,929 ordinary shares outstanding, which includes 26,971,530 ordinary shares

issued to The Bank of New York Mellon, our ADS depositary, for bulk issuance of ADSs held by us and reserved for future issuances upon the exercise of options under our share incentive plan. All our issued and outstanding ordinary shares are fully

paid.

Our Memorandum and Articles of Association

The following are summaries of material provisions of our currently effective amended and restated memorandum and articles of association and

the Companies Law insofar as they relate to the material terms of our ordinary shares.

General

. All of our outstanding

ordinary shares are fully paid and non-assessable. Certificates representing the ordinary shares are issued in registered form. Our shareholders may freely hold and vote their shares.

Dividends

. The holders of our ordinary shares are entitled to such dividends as may be declared by our board of directors

subject to the Companies Law.

Voting Rights

. Each ordinary share is entitled to one vote on all matters upon

which the ordinary shares are entitled to vote. Voting at any meeting of shareholders is by show of hands unless a poll is demanded. A poll may be demanded by any shareholder or shareholders together holding at least ten percent of the shares given

a right to vote at the meeting, present in person or by proxy.

A quorum required for a meeting of shareholders consists of

holders of not less than one-third of all outstanding shares entitled to vote. Shareholders’ meetings shall, if required by the Companies Law, be held annually. Annual general meetings and extraordinary general meetings may be convened by our

board of directors on its own initiative. Extraordinary general meetings shall be convened by our board of directors upon a request to the directors by shareholders holding in aggregate at least 33% of our voting share capital. Advance notice of at

least seven business days is required for the convening of our annual general meeting and other shareholders meetings.

An ordinary

resolution to be passed by the shareholders requires the affirmative vote of a simple majority of the votes attaching to the ordinary shares cast in a general meeting, while a special resolution requires the affirmative vote of no less than

two-thirds of the votes attaching to the ordinary shares cast in a general meeting and includes a unanimous written resolution expressly passed as a special resolution. A special resolution is required for important matters such as a change of name,

a decrease of our share capital, or amending the memorandum and articles of association. Holders of the ordinary shares may effect certain changes by ordinary resolution, including an increase of our share capital, the consolidation and division of

all or any of our share capital into shares of a larger amount than our existing share capital, and the cancellation of any shares.

Transfer of Shares

. Subject to the restrictions of our articles of association, as applicable, any of our shareholders may

transfer all or any of his or her ordinary shares by an instrument of transfer in the usual or common form or any other form approved by our board. The transferor shall be deemed to remain the holder of the shares until the name of the transferee is

entered in the register of members in respect thereof.

Liquidation

. On a return of capital on winding up or

otherwise (other than on conversion, redemption or purchase of shares), assets available for distribution among the holders of ordinary shares shall be distributed among the holders of the ordinary shares as the liquidator deems fair. If our assets

available for distribution are insufficient to repay all of the paid-up capital, the assets will be distributed so that the losses are borne by our shareholders proportionately.

11

Calls on Shares and Forfeiture of Shares

. Our board of directors may from time to

time make calls upon shareholders for any amounts unpaid on their shares in a notice served to such shareholders at least 14 days prior to the specified time and place of payment. The shares that have been called upon and remain unpaid on the

specified time are subject to forfeiture.

Redemption and Repurchase of Shares

. Subject to the provisions of

the Companies Law and our articles of association, we may issue shares on terms that are subject to redemption, at our option or at the option of the holders, on such terms and in such manner as may be determined by our board of directors. Our

company may also repurchase any of our shares provided that the manner of such purchase has been approved by ordinary resolution of our shareholders or the manner of such purchase is in accordance with our articles of association. Under the

Companies Law, the redemption or repurchase of any share may be paid out of our company’s profits or out of the proceeds of a fresh issue of shares made for the purpose of such redemption or repurchase, or out of capital (including share

premium account and capital redemption reserve) if our company can, immediately following such payment, pay its debts as they fall due in the ordinary course of business. In addition, under the Companies Law no such share may be redeemed or

repurchased (a) unless it is fully paid up, (b) if such redemption or repurchase would result in there being no shares outstanding, or (c) if our company has commenced liquidation.

Variation of Rights of Shares

. All or any of the special rights attached to any class of shares may, subject to the provisions

of the Companies Law, be varied either with the written consent of a majority of the issued shares of that class or with the sanction of an ordinary resolution passed at a general meeting of the holders of the shares of that class.

Inspection of Books and Records

. Holders of our ordinary shares will have no general right under Cayman Islands law

to inspect or obtain copies of our list of shareholders or our corporate records. However, each annual report on Form 20-F that we file with the SEC includes, among other things, annual audited financial statements and certain shareholding

information for our directors and officers and principal shareholders.

Differences in Corporate Law

The Companies Law is modeled after that of English law but does not follow recent English law statutory enactments. In addition, the Companies

Law differs from laws applicable to Delaware corporations and their shareholders. Set forth below is a summary of the significant differences between the provisions of the Companies Law applicable to us and the laws applicable to Delaware

corporations and their shareholders.

Mergers and Similar Arrangements

. The Companies Law permits mergers and consolidations

between Cayman Islands companies and between Cayman Islands companies and non-Cayman Islands companies. For these purposes:

|

|

•

|

|

a “merger” means the merging of two or more constituent companies and the vesting of their undertaking, property and liabilities in one of such companies as the surviving company; and

|

|

|

•

|

|

a “consolidation” means the combination of two or more constituent companies into a consolidated company and the vesting of the undertaking, property and liabilities of such companies to the consolidated

company.

|

In order to effect such a merger or consolidation, the directors of each constituent company must approve a

written plan of merger or consolidation, which must then be authorized by:

|

|

•

|

|

a special resolution of the shareholders of each constituent company; and

|

|

|

•

|

|

such other authorizations, if any, as may be specified in such constituent company’s articles of association.

|

The plan of merger or consolidation must be filed with the Registrar of Companies together with a declaration as to the solvency of the

consolidated or surviving company, a declaration as to the assets and liabilities of each constituent company and an undertaking that a copy of the certificate of merger or consolidation will be given to the members and creditors of each constituent

company that notification of the merger or consolidation will be published in the Cayman Islands Gazette. Dissenting shareholders have the right to be paid the fair value of their shares if they follow the required procedures, subject to certain

exceptions. The fair value of the shares will be determined by the Cayman Islands court if it cannot be agreed among the parties. Court approval is not required for a merger or consolidation which is effected in compliance with these statutory

procedures.

12

In addition, there are statutory provisions that facilitate the reconstruction and amalgamation

of companies, provided that the arrangement is approved by a majority in number of each class of shareholders or creditors with whom the arrangement is to be made, and who must in addition represent three-fourths in value of each such class of

shareholders or creditors, as the case may be, that are present and voting either in person or by proxy at a meeting, or meetings, convened for that purpose. The convening of the meetings and subsequently the arrangement must be sanctioned by the

Grand Court of the Cayman Islands. While a dissenting shareholder has the right to express to the court the view that the transaction ought not to be approved, the court can be expected to approve the arrangement if it determines that:

|

|

•

|

|

the statutory provisions as to majority vote have been met;

|

|

|

•

|

|

the shareholders have been fairly represented at the meeting in question and the statutory majority are acting bona fide without coercion of the minority to promote interests adverse to those of the class;

|

|

|

•

|

|

the arrangement is such that may be reasonably approved by an intelligent and honest man of that class acting in respect of his interest; and

|

|

|

•

|

|

the arrangement is not one that would more properly be sanctioned under some other provision of the Companies Law.

|

When a take-over offer is made and accepted by holders of 90% of the shares affected within four months, the offeror may, within a two month

period commencing on the expiration of such four month period, require the holders of the remaining shares to transfer such shares on the terms of the offer. An objection can be made to the Grand Court of the Cayman Islands but this is unlikely to

succeed in the case of an offer which has been so approved unless there is evidence of fraud, bad faith or collusion.

If the arrangement

and reconstruction is thus approved, the dissenting shareholder would have no rights comparable to appraisal rights, which would otherwise ordinarily be available to dissenting shareholders of Delaware corporations, providing rights to receive

payment in cash for the judicially determined value of the shares.

Shareholders’ Suits

. The Cayman Islands courts can

be expected to follow English case law precedents. The Cayman Islands courts can be expected to apply and follow common law principles (namely the rule in Foss v Harbottle and the exceptions thereto) that permit a minority shareholder to commence a

class action against the company or a derivative action in the name of the company to challenge (1) an act that is outside the company’s corporate powers or that is illegal, (2) an act constituting a fraud against the minority

shareholders where the wrongdoers are themselves in control of the company, and (3) an action requiring a resolution passed by a qualified or special majority that has not been obtained.

Directors’ Fiduciary Duties

. Under Delaware corporate law, a director of a Delaware corporation has a fiduciary duty to the

corporation and its shareholders. This duty has two components: the duty of care and the duty of loyalty. The duty of care requires that a director act in good faith, with the care that an ordinarily prudent person would exercise under similar

circumstances. Under this duty, a director must inform himself of, and disclose to shareholders, all material information reasonably available regarding a significant transaction. The duty of loyalty requires that a director act in a manner he

reasonably believes to be in the best interests of the corporation, he must not use his corporate position for personal gain or advantage. This duty prohibits self-dealing by a director and mandates that the best interest of the corporation and its

shareholders take precedence over any interest possessed by a director, officer or controlling shareholder and not shared by the shareholders generally. In general, actions of a director are presumed to have been made on an informed basis, in good

faith and in the honest belief that the action taken was in the best interests of the corporation. However, this presumption may be rebutted by evidence of a breach of one of the fiduciary duties. Should such evidence be presented concerning a

transaction by a director, a director must prove the procedural fairness of the transaction, and that the transaction was of fair value to the corporation.

13

As a matter of Cayman Islands law, a director of a Cayman Islands company is in the position of a

fiduciary with respect to the company and therefore it is considered that he owes the following duties to the company — a duty to act in good faith in the best interests of the company, a duty not to make a personal profit out of his position

as director (unless the company permits him to do so), a duty not to put himself in a position where the interests of the company conflict with his personal interest or his duty to a third party and a duty to exercise powers for the purpose for

which such powers were intended. A director of a Cayman Islands company owes to the company a duty to act with skill and care. It was previously considered that a director need not exhibit in the performance of his duties a greater degree of skill

than may reasonably be expected from a person of his knowledge and experience. However, there are indications that the English and Commonwealth courts are moving towards an objective standard with regard to the required skill and care and these

authorities are likely to be followed in the Cayman Islands.

Shareholder Action by Written Consent

. Under the Delaware

General Corporation Law, a corporation may eliminate the right of shareholders to act by written consent by amendment to its certificate of incorporation. Cayman Islands law and our articles of association provide that shareholders may approve

corporate matters by way of written resolution signed by or on behalf of each shareholder who would have been entitled to vote on such matter at a general meeting without a meeting being held.

Shareholder Proposals

. Under the Delaware General Corporation Law, a shareholder has the right to put any proposal before the

annual meeting of shareholders, provided it complies with the notice provisions in the governing documents. A special meeting may be called by the board of directors or any other person authorized to do so in the governing documents, but

shareholders may be precluded from calling special meetings. Cayman Islands law and our articles of association allow our shareholders holding not less than 33 per cent of the paid up voting share capital of our company to requisition a

shareholder’s meeting.

Cumulative Voting

. Under the Delaware General Corporation Law, cumulative voting

for elections of directors is not permitted unless the corporation’s certificate of incorporation specifically provides for it. Cumulative voting potentially facilitates the representation of minority shareholders on a board of directors since

it permits the minority shareholder to cast all the votes to which the shareholder is entitled on a single director, which increases the shareholder’s voting power with respect to electing such director. As permitted under Cayman Islands law,

our articles of association do not provide for cumulative voting.

Removal of Directors

. Under the Delaware

General Corporation Law, a director of a corporation may be removed with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation provides otherwise. Under our articles of association, directors

can be removed with or without cause, but only by the vote of a majority of the holders of our shares voting at a general meeting or the unanimous written resolution of all shareholders.

Transactions with Interested Shareholders

. The Delaware General Corporation Law contains a business combination statute

applicable to Delaware public corporations whereby, unless the corporation has specifically elected not to be governed by such statute by amendment to its certificate of incorporation, it is prohibited from engaging in certain business combinations

with an “interested shareholder” for three years following the date that such person becomes an interested shareholder. An interested shareholder generally is a person or group who or which owns or owned 15% or more of the target’s

outstanding voting stock within the past three years. This has the effect of limiting the ability of a potential acquiror to make a two-tiered bid for the target in which all shareholders would not be treated equally. The statute does not apply if,

among other things, prior to the date on which such shareholder becomes an interested shareholder, the board of directors approves either the business combination or the transaction which resulted in the person becoming an interested shareholder.

This encourages any potential acquiror of a Delaware public corporation to negotiate the terms of any acquisition transaction with the target’s board of directors.

Cayman Islands law has no comparable statute. As a result, we cannot avail ourselves of the types of protections afforded by the Delaware

business combination statute. However, although Cayman Islands law does not regulate transactions between a company and its significant shareholders, it does provide that such transactions must be entered into bona fide in the best interests of the

company and for a proper purpose and not with the effect of constituting a fraud on the minority shareholders.

14

Dissolution; Winding Up

. Under the Delaware General Corporation Law, unless the

board of directors approves the proposal to dissolve, dissolution must be approved by shareholders holding 100% of the total voting power of the corporation. Only if the dissolution is initiated by the board of directors may it be approved by a

simple majority of the corporation’s outstanding shares. Delaware law allows a Delaware corporation to include in its certificate of incorporation a supermajority voting requirement in connection with dissolutions initiated by the board. Under

the Companies Law, our company may be dissolved, liquidated or wound up by either an order of the courts of the Cayman Islands or by a special resolution, or by an ordinary resolution on the basis that our company is unable to pay its debts as they

fall due. The court has authority to order winding up in a number of specified circumstances including where it is, in the opinion of the court, just and equitable to do so.

Variation of Rights of Shares

. Under the Delaware General Corporation Law, a corporation may vary the rights of a class of

shares with the approval of a majority of the outstanding shares of such class, unless the certificate of incorporation provides otherwise. Under our articles of association, if our share capital is divided into more than one class of shares, we may

vary the rights attached to any class only with the written consent of the holders of at least a majority of the shares of such class or with the sanction of a resolution passed by at least a majority of the holders of such class present in person

or by proxy at a separate general meeting of the holders of the shares of that class.

Amendment of Governing Documents

.

Under the Delaware General Corporation Law, a corporation’s governing documents may be amended with the approval of a majority of the outstanding shares entitled to vote, unless the certificate of incorporation provides otherwise. As permitted

by Cayman Islands law, our memorandum and articles of association may be amended with the vote of at least two-third holders of our shares at a general meeting or the unanimous written resolution of all shareholders.

Anti-Takeover Provisions in Memorandum and Articles of Association

. Some provisions of our memorandum and articles of

association may discourage, delay or prevent a change in control of our company or management that shareholders may consider favorable, including provisions that:

|

|

•

|

|

authorize our board of directors to issue preference shares in one or more series and to designate the price, rights, preferences, privileges and restrictions of such preference shares without any further vote or action

by our shareholders; and

|

|

|

•

|

|

create a classified board of directors pursuant to which our directors are elected for staggered terms, which means that shareholders can only elect, or remove, a limited number of directors in any given year.

|

However, under Cayman Islands law, our directors may only exercise the rights and powers granted to them under our

memorandum and articles of association for a proper purpose and for what they believe in good faith to be in the best interests of our company.

Rights of Non-Resident or Foreign Shareholders

. There are no limitations imposed by our memorandum and articles of association

on the rights of non-resident or foreign shareholders to hold or exercise voting rights on our shares. In addition, there are no provisions in our memorandum and articles of association governing the ownership threshold above which shareholder

ownership must be disclosed.

Inspection of Books and Records

. Under the Delaware General Corporation Law, any

shareholder of a corporation may for any proper purpose inspect or make copies of the corporation’s stock ledger, list of shareholders and other books and records. Holders of our shares will have no general right under Cayman Islands law to

inspect or obtain copies of our list of shareholders or corporate records. However, we will provide our shareholders with annual audited financial statements.

History of Change of Share Capital

The

following is a summary of changes to our share capital in the past three years.

On December 8, 2010, we granted 1,500,000 ordinary

shares to Jun Zhu, our chairman and chief executive officer, which will only be vested if our company achieves certain income targets and the shares are not entitled to dividends until they become vested. Of such shares, 500,000 ordinary shares were

vested and issued to Incsight Limited, a company wholly owned by Jun Zhu, in November 2015.

15

In November 2015, in connection with the grant of options to certain of our directors and

employees under our share incentive plan in November 2015, we issued 8,000,000 ordinary shares to The Bank of New York Mellon, our ADS depositary, which are represented by ADSs held by us on reserve to facilitate future delivery of ADSs upon

exercise of the options.

Shareholder Rights Plan

On January 8, 2009, our board of directors declared a dividend of one ordinary share purchase right, or a Right, for each of our ordinary

shares outstanding at the close of business on January 22, 2009. As long as the Rights are attached to the ordinary shares, we will issue one Right (subject to adjustment) with each new ordinary share so that all such ordinary shares will have

attached Rights. When exercisable, each Right will entitle the registered holder to purchase from us one ordinary share at a price of US$19.50 per ordinary share, subject to adjustment.

The Rights will expire on January 8, 2019, subject to our right to extend such date and are exercisable only if a person or group obtains

ownership of or announces a tender offer for 15% or more of our voting securities (including ADSs representing our ordinary shares). Upon exercise, all Rights holders except the potential acquirer will be entitled to acquire our shares or the

acquirer’s shares at a discount. We are entitled to redeem the Rights in whole at any time on or before the acquisition by a person or group of 15% or more of our voting securities (which for these purposes include ADSs representing ordinary

shares), or exchange the Rights, in whole or in part, at an exchange ratio of one ordinary share, and of other securities, cash or other assets deemed to have the same value as one ordinary share, per Right, subject to adjustment.

16

DESCRIPTION OF AMERICAN DEPOSITARY SHARES

American depositary shares

The Bank of

New York Mellon, as depositary, will register and deliver American depositary shares, also referred to as ADSs. Each ADS represents one ordinary share (or a right to receive one ordinary share) deposited with the principal Hong Kong office of The

Hongkong and Shanghai Banking Corporation Limited, as custodian for the depositary. Each ADS will also represent any other securities, cash or other property which may be held by the depositary. The depositary’s corporate trust office at which

the ADSs are administered is located at 101 Barclay Street, New York, New York 10286. The Bank of New York Mellon’s principal executive office is located at 225 Liberty Street, New York, New York 10286.

You may hold ADSs either (A) directly (i) by having an American depositary receipt, also referred to as an ADR, which is a

certificate evidencing a specific number of ADSs, registered in your name, or (ii) by having ADSs registered in your name in the direct registration system, or (B) indirectly by holding a security entitlement in ADSs through your broker or

other financial institution. If you hold ADSs directly, you are a registered ADS holder, also referred to as an ADS holder. This description assumes you are an ADS holder. If you hold the ADSs indirectly, you must rely on the procedures of your

broker or other financial institution to assert the rights of ADS holders described in this section. You should consult with your broker or financial institution to find out what those procedures are.

The direct registration system, also referred to as DRS, is a system administered by The Depository Trust Company, also referred to DTC, under

which the depositary may register the ownership of uncertificated ADSs, which ownership is confirmed by periodic statements sent by the depositary to the registered holders of uncertificated ADSs.

As an ADS holder, we will not treat you as one of our shareholders and you will not have shareholder rights. Cayman Islands law governs

shareholder rights. The depositary will be the holder of the shares underlying your ADSs. As a registered holder of ADSs, you will have ADS holder rights. A deposit agreement among us, the depositary, ADS holders and all other persons indirectly or

beneficially holding ADSs sets out ADS holder rights as well as the rights and obligations of the depositary. New York law governs the deposit agreement and the ADSs.

The following is a summary of the material provisions of the deposit agreement. For more complete information, you should read the entire

deposit agreement and the form of ADR. See “Where You Can Find More Information” for directions on how to obtain copies of those documents.

Dividends and other distributions

How will you

receive dividends and other distributions on the shares?

The depositary has agreed to pay to ADS holders the cash dividends or

other distributions it or the custodian receives on shares or other deposited securities, after deducting its fees and expenses. You will receive these distributions in proportion to the number of ordinary shares your ADSs represent.

Cash

.

The depositary will convert any cash dividend or other cash distribution we pay on the shares into

U.S. dollars, if it can do so on a reasonable basis and can transfer the U.S. dollars to the United States. If that is not possible or if any government approval is needed and cannot be obtained, the deposit agreement allows the depositary to

distribute the foreign currency only to those ADS holders to whom it is possible to do so. It will hold the foreign currency it cannot convert for the account of the ADS holders who have not been paid. It will not invest the foreign currency and it

will not be liable for any interest.

Before making a distribution, any withholding taxes, or other governmental charges

that must be paid will be deducted. The depositary will distribute only whole U.S. dollars and cents and will round fractional cents to the nearest whole cent. If the exchange rates fluctuate during a time when the depositary cannot convert the

foreign currency, you may lose some or all of the value of the distribution.

17

Shares.

The depositary may, and shall if we so request in writing, distribute

additional ADSs representing any shares we distribute as a dividend or free distribution. The depositary will only distribute whole ADSs. It will sell shares which would require it to deliver a fractional ADS and distribute the net proceeds in the

same way as it does with cash. If the depositary does not distribute additional ADSs, the outstanding ADSs will also represent the new shares.

Rights to purchase additional shares.

If we offer holders of our securities any rights to subscribe for additional shares or any

other rights, the depositary may make these rights available to ADS holders. If the depositary decides it is not legal and practical to make the rights available but that it is practical to sell the rights, the depositary will use reasonable efforts

to sell the rights and distribute the proceeds in the same way as it does with cash. The depositary will allow rights that are not distributed or sold to lapse. In that case, you will receive no value for them.

If the depositary makes rights available to ADS holders, it will exercise the rights and purchase the shares on your behalf. The depositary

will then deposit the shares and deliver ADSs to the persons entitled to them. It will only exercise rights if you pay it the exercise price and any other charges the rights require you to pay.

U.S. securities laws may restrict transfers and cancellation of the ADSs represented by shares purchased upon exercise of rights. For example,

you may not be able to trade these ADSs freely in the United States. In this case, the depositary may deliver restricted depositary shares that have the same terms as the ADSs described in this section except for changes needed to put the necessary

restrictions in place.

Other distributions.

The depositary will send to ADS holders anything else we distribute on

deposited securities by any means it thinks is legal, fair and practical. If it cannot make the distribution in that way, the depositary has a choice. It may decide to sell what we distributed and distribute the net proceeds, in the same way as it

does with cash. Or, it may decide to hold what we distributed, in which case ADSs will also represent the newly distributed property. However, the depositary is not required to distribute any securities (other than ADSs) to ADS holders unless it

receives reasonably satisfactory evidence from us that it is legal to make that distribution.

The deposit agreement

provides that if the Rights as defined under “Description of Share Capital—Shareholder Rights Plan” become exerciseable, the depositary would establish procedures to permit holders of ADSs to exercise the Rights and purchase new

shares that would be deposited for delivery of additional ADSs,

but only

if the shares underlying the Rights are registered under the Securities Act or the depositary receives an opinion satisfactory to it to the effect that the shares

underlying the Rights may be offered and sold without registration. The depositary has no liability for anything done or not done pursuant to a distribution of Rights in the absence of gross negligence, bad faith or willful misconduct by the

depositary.

The depositary is not responsible if it decides that it is unlawful or impractical to make a distribution available to any

ADS holders. We have no obligation to register ADSs, shares, rights or other securities under the Securities Act. We also have no obligation to take any other action to permit the distribution of ADSs, shares, rights or anything else to ADS holders.

This means that you may not receive the distributions we make on our shares or any value for them if it is illegal or impractical for us to make them available to you.

Deposit, withdrawal and cancellation

How are ADSs

issued?

The depositary will deliver ADSs if you or your broker deposit shares or evidence of rights to receive shares with the

custodian. Upon payment of its fees and expenses and of any taxes or charges, such as stamp taxes or stock transfer taxes or fees, the depositary will register the appropriate number of ADSs in the names you request and will deliver the ADSs to or

upon the order of the person or persons that made the deposit.

How can ADS holders withdraw the deposited securities?

You may surrender your ADSs at the depositary’s corporate trust office. Upon payment of its fees and expenses and of any taxes or charges,

such as stamp taxes or stock transfer taxes or fees, the depositary will deliver the shares and any other deposited securities underlying the ADSs to the ADS holder or a person the ADS holder designates at the office of the custodian. Or, at your

request, risk and expense, the depositary will deliver the deposited securities at its corporate trust office, if feasible.

18

How do ADS holders interchange between certificated ADSs and uncertificated ADSs?

You may surrender your ADR to the depositary for the purpose of exchanging your ADR for uncertificated ADSs. The depositary will cancel that

ADR and will send to the ADS holder a statement confirming that the ADS holder is the registered holder of uncertificated ADSs. Alternatively, upon receipt by the depositary of a proper instruction from a registered holder of uncertificated ADSs

requesting the exchange of uncertificated ADSs for certificated ADSs, the depositary will execute and deliver to the ADS holder an ADR evidencing those ADSs.

Voting rights

How do you vote?

ADS holders may instruct the depositary how to vote the number of deposited shares their ADSs represent. The depositary will notify ADS holders

of shareholders’ meetings and arrange to deliver our voting materials to them if we ask it to. Those materials will describe the matters to be voted on and explain how ADS holders may instruct the depositary how to vote. For instructions to be

valid, they may reach the depositary by a date set by the depositary.

Otherwise, you won’t be able to exercise your right to vote

unless you withdraw the shares. However, you may not know about the meeting enough in advance to withdraw the shares.

The depositary will

try, as far as practical, subject to the laws of the Cayman Islands and of our articles of association or similar documents, to vote or to have its agents vote the shares or other deposited securities as instructed by ADS holders. The depositary

will only vote or attempt to vote as instructed. If the depositary does not receive your instructions by the date the depositary sets, the depositary will vote the number of shares represented by your ADSs as recommended by our board of directors,

unless we notify the depositary that (i) we do not wish the depositary to vote those shares, (ii) substantial opposition exists or (iii) the matter to be voted on would have a material adverse effect on the rights of holders of our

ordinary shares.

We cannot assure you that you will receive the voting materials in time to ensure that you can instruct the depositary

to vote your shares. In addition, the depositary and its agents are not responsible for failing to carry out voting instructions or for the manner of carrying out voting instructions. This means that you may not be able to exercise your right to

vote and there may be nothing you can do if your shares are not voted as you requested.

We have agreed, to the extent practicable, to

give the depositary notice of a shareholders’ meeting sufficiently in advance of the meeting date to enable the depositary to vote deposited shares in accordance with the deposit agreement.

Fees and expenses

|

|

|

|

|

Persons depositing or withdrawing shares or ADS holders must

pay:

|

|

For:

|

|

$5.00 (or less) per 100 ADSs (or portion of 100 ADSs)

|

|

Issuance of ADSs, including issuances resulting from a distribution of shares or rights or other property

|

|

|

|

Cancellation of ADSs for the purpose of withdrawal, including if the deposit agreement terminates

|

|

|

|

|

$.02 (or less) per ADS

|

|

Any cash distribution to ADS holders

|

|

|

|

|

A fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited for issuance of ADSs

|

|

Distribution of securities distributed to holders of deposited securities which are distributed by the depositary to ADS holders

|

|

$.02 (or less) per ADSs per calendar year

|

|

Depositary services

|

|

Registration or transfer fees

|

|

Transfer and registration of shares on our share register to or from the name of the depositary or its agent when you deposit or withdraw shares

|

|

|

|

|

Expenses of the depositary

|

|

Cable, telex and facsimile transmissions (when expressly provided in the deposit agreement)

|

|

|

|

Converting foreign currency to U.S. dollars

|

|

|

|

|

Taxes and other governmental charges the depositary or the custodian has to pay on any ADSs or shares underlying ADSs, such as stock transfer taxes, stamp duty or withholding taxes

|

|

As necessary

|

|

Any charges incurred by the depositary or its agents for servicing the deposited securities

|

|

As necessary

|

19

The depositary collects its fees for delivery and surrender of ADSs directly from investors

depositing shares or surrendering ADSs for the purpose of withdrawal or from intermediaries acting for them. The depositary collects fees for making distributions to investors by deducting those fees from the amounts distributed or by billing ADS

holders for the fees. The depositary may collect its annual fee for depositary services by deduction from cash distributions or by directly billing investors or by charging the book-entry system accounts of participants acting for them. The

depositary may collect any of its fees by deduction from any cash distribution payable to ADS holders that are obligated to pay those fees. The depositary may generally refuse to provide fee-attracting services until its fees for those services are

paid.

From time to time, the depositary may make payments to us to reimburse and / or share revenue from the fees collected from ADS

holders, or waive fees and expenses for services provided, generally relating to costs and expenses arising out of establishment and maintenance of the ADS program. In performing its duties under the deposit agreement, the depositary may use

brokers, dealers or other service providers that are affiliates of the depositary and that may earn or share fees or commissions.

The

depositary may convert currency itself or through any of its affiliates and, in those cases, acts as principal for its own account and not as agent, advisor, broker or fiduciary on behalf of any other person and earns revenue, including, without

limitation, transaction spreads, that it will retain for its own account. The revenue is based on, among other things, the difference between the exchange rate assigned to the currency conversion made under the deposit agreement and the rate that

the depositary or its affiliate receives when buying or selling foreign currency for its own account. The depositary makes no representation that the exchange rate used or obtained in any currency conversion under the deposit agreement will be the

most favorable rate that could be obtained at the time or that the method by which that rate will be determined will be the most favorable to ADS holders, subject to the depositary’s obligations under the deposit agreement. The methodology used

to determine exchange rates used in currency conversions is available upon request.

Payment of taxes

You will be responsible for any taxes or other governmental charges payable on your ADSs or on the deposited securities represented by any of