As filed with the Securities and Exchange Commission on December 30, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Ryerson Holding Corporation

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

26-1251524

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

227 W. Monroe St., 27th Floor

Chicago, Illinois 60606

(312) 292-5000

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark S. Silver

Executive Vice President, General Counsel & Secretary

Ryerson Holding Corporation

227 W. Monroe St., 27

th

Floor

Chicago, Illinois 60606

(312) 292-5000

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Cristopher Greer, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New

York, New York 10019

(212) 728-8000

Facsimile: (212) 728-9214

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the

only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☐

If this form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting

company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

(2)

|

|

Proposed

Maximum

Offering

Price

Per Share

(2)(3)

|

|

Proposed

Maximum

Aggregate

Offering Price

(2)(3)

|

|

Amount of

Registration Fee

(4)

|

|

Common Stock, $0.01 par value per share

(1)

|

|

21,037,500

|

|

$14.03

|

|

$295,156,125

|

|

$34,208.59

|

|

|

|

|

|

(1)

|

The registrant is hereby registering for sale from time to time by certain selling stockholders named in this registration statement of up to 21,037,500 shares of our common stock.

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), the securities registered hereunder include such indeterminate number of securities as may be issued with respect to

the securities being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

(3)

|

Estimated solely for the purposes of calculating the registration fee pursuant to Rule 457(c) of the rules and regulations under the Securities Act. The calculations of the proposed maximum offering price per share and

the proposed maximum aggregate offering price are based on the average of the high $14.45 and the low $13.60 sale prices of our common stock reported on the New York Stock Exchange on December 29, 2016.

|

|

(4)

|

The registration fee has been calculated in accordance with Rule 457(c) under the Securities Act.

|

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell

these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where

the offer or sale is not permitted.

Subject to Completion dated December 30, 2016

PROSPECTUS

21,037,500 Shares

RYERSON HOLDING CORPORATION

Common Stock

The selling

stockholders named in this prospectus may offer and sell up to 21,037,500 shares of our common stock, par value $0.01 per share, from time to time in one or more offerings. The registration of the offer and sale of the common stock covered by this

prospectus does not necessarily mean that any of the common stock will be offered or sold by the selling stockholders. For information on the selling stockholders, please see the section entitled “Selling Stockholders” beginning on page 6

of this prospectus.

The common stock may be offered from time to time by the selling stockholders in any manner described under the

section entitled “Plan of Distribution” beginning on page 10 of this prospectus. The selling stockholders may sell the common stock on any stock exchange, market or trading facility on which the shares of common stock are traded or in

private transactions, at fixed or negotiated prices, directly to purchasers or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions. We will not receive any proceeds from

the sale of our common stock by the selling stockholders, but we will incur expenses in connection with the offering.

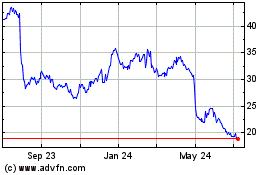

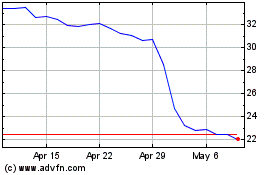

Our common stock

currently trades on the NYSE under the symbol “RYI.” On December 29, 2016, the last reported sale price of our common stock on the NYSE was $13.95 per share.

Investing in the common stock involves a high degree of risk. Please carefully read the section entitled “Risk Factors” beginning

on page 6 of this prospectus and any other risk factors included in any accompanying prospectus supplement and in the documents incorporated by reference in this prospectus or any prospectus supplement for a discussion of the factors you should

carefully consider before deciding to purchase our common stock.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is

, 201 .

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, using a

“shelf” registration process. Under this shelf registration process, the selling stockholders may, from time to time, sell the offered securities in one or more offerings or sales.

In certain circumstances, we may provide a prospectus supplement that will contain specific information about the terms of a particular

offering and the selling stockholders. The prospectus supplement, or information incorporated by reference in this prospectus or any prospectus supplement that is of a more recent date, may also add, update or change information contained in this

prospectus. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in the

prospectus supplement. You should read both this prospectus and any prospectus supplement together with the additional information described below under the heading “Where You Can Find More Information.” We may also authorize one or more

free writing prospectuses to be provided to you that may contain material information relating to these offerings.

You should rely only

on the information contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing prospectus filed by us with the SEC. We have not authorized anyone to provide you with different

information. If information is given or representations are made, you may not rely on that information or representation as having been authorized by us. This prospectus and any accompanying prospectus supplement do not constitute an offer to sell

or the solicitation of an offer to buy securities other than the securities described in such accompanying prospectus supplement or an offer to sell or the solicitation of an offer to buy the securities in any circumstances in which such offer or

solicitation is unlawful. You should assume that the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related free writing prospectus is accurate only as of their respective dates,

unless the information specifically indicates that another date applies. Our business, financial condition, results of operations and prospects may have changed materially since those dates.

We are not making any representation to any purchaser regarding the legality of an investment by such purchaser under any legal investment or

similar laws or regulations. You should not consider any information in this prospectus to be legal, business or tax advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice regarding an

investment in our securities.

Market data used throughout this prospectus and the documents incorporated in this prospectus by reference,

including information relating to our relative position in the industries in which we conduct our business, is based on the good faith estimates of our management, which estimates are based upon their review of internal surveys, independent industry

publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. Although we are not

aware of any misstatements regarding the market and industry data presented in this prospectus, our estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading

“Disclosure Regarding Forward-Looking Statements” and “Risk Factors.”

1

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

(Cautionary Statements Under the Private Securities Litigation Reform Act of 1995)

This prospectus contains “forward-looking statements” within the meaning of federal and state securities laws. Such statements can be

identified by the use of forward-looking terminology such as “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans” or “anticipates” or the negative

thereof or other variations thereon or comparable terminology, or by discussions of strategy. Readers are cautioned that any such forward-looking statements are not guarantees of future performance and may involve significant risks and

uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact the metals distribution industry and our business are:

|

|

•

|

|

cyclicality of our business, due to the cyclical nature of our customers’ businesses;

|

|

|

•

|

|

impairment of goodwill that could result from, among other things, volatility in the markets in which we operate;

|

|

|

•

|

|

remaining competitive and maintaining market share in the highly volatile and fragmented metals distribution industry, in which price is a competitive tool and in which customers who purchase commodity products are

often able to source metals from a variety of sources;

|

|

|

•

|

|

managing the costs of purchased metals relative to the price at which we sell our products during periods of rapid price escalation, when we may not be able to pass through pricing increases fully to our customers

quickly enough to maintain desirable gross margins, or during periods of generally declining prices, when our customers may demand that price decreases be passed fully on to them more quickly than we are able to obtain similar discounts from our

suppliers;

|

|

|

•

|

|

our substantial indebtedness and the covenants in instruments governing such indebtedness;

|

|

|

•

|

|

the failure to effectively integrate newly acquired operations;

|

|

|

•

|

|

regulatory and other operational risks associated with our operations located outside of the United States;

|

|

|

•

|

|

fluctuating operating results depending on seasonality;

|

|

|

•

|

|

potential damage to our information technology infrastructure;

|

|

|

•

|

|

certain employee retirement benefit plans are underfunded and the actual costs could exceed current estimates;

|

|

|

•

|

|

future funding for postretirement employee benefits may require substantial payments from current cash flow;

|

|

|

•

|

|

prolonged disruption of our processing centers;

|

|

|

•

|

|

ability to retain and attract management and key personnel;

|

|

|

•

|

|

ability of management to focus on North American and foreign operations;

|

|

|

•

|

|

termination of supplier arrangements;

|

|

|

•

|

|

the incurrence of substantial costs or liabilities to comply with, or as a result of violations of, environmental laws;

|

|

|

•

|

|

the impact of new or pending litigation against us;

|

|

|

•

|

|

a risk of product liability claims;

|

|

|

•

|

|

our risk management strategies may result in losses;

|

2

|

|

•

|

|

currency fluctuations in the U.S. dollar versus the Canadian dollar and the Chinese renminbi;

|

|

|

•

|

|

management of inventory and other costs and expenses; and

|

|

|

•

|

|

consolidation in the metals producer industry, in which we purchase products, which could limit our ability to effectively negotiate and manage costs of inventory or cause material shortages, either of which would

impact profitability.

|

These forward-looking statements involve a number of risks and uncertainties that could cause actual

results to differ materially from those suggested by the forward-looking statements. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth in this prospectus under “Risk Factors”

or any accompanying prospectus supplement and in the documents we file from time to time with the SEC that are incorporated by reference in this prospectus or any accompanying prospectus supplement. Moreover, we caution you not to place undue

reliance on these forward-looking statements, which speak only as of the date they were made. We do not undertake any obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date

of this prospectus or to reflect the occurrence of unanticipated events.

3

SUMMARY

This summary highlights information contained or incorporated by reference elsewhere in this prospectus. This summary is not complete and does

not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus, including the documents incorporated by reference, carefully before making an investment decision, especially

the risks discussed under “Risk Factors” and our audited financial statements and the notes to those financial statements, which are incorporated by reference in this prospectus. The summary contains forward-looking statements that involve

risk and uncertainties. Our actual results may differ based on certain factors, including those set forth in “Risk Factors” and “Disclosure Regarding Forward-Looking Statements.”

This prospectus relates to the sale of up to 21,037,500 shares of common stock that may be offered and sold from time to time by the selling

stockholders named in this prospectus. We are registering the offer and sale of the shares to satisfy certain registration rights we have granted to the selling stockholders pursuant to the terms of an investors rights agreement. See “Selling

Stockholders.” We will not receive any of the proceeds from the sale of the shares hereunder. See “Use of Proceeds.”

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “we,” “us,”

“our,” the “Company” and “Ryerson” refer to Ryerson Holding Corporation and its direct and indirect subsidiaries, except as expressly stated otherwise or unless the context requires otherwise.

The Company

We believe we

are one of the largest processors and distributors of metals in North America measured in terms of sales, with operations in North America and China. Our industry is highly fragmented with the largest companies accounting for only a small percentage

of total market share. Our customer base ranges from local, independently owned fabricators and machine shops to large, international original equipment manufacturers. We process and distribute a full line of over 65,000 products in stainless steel,

aluminum, carbon steel and alloy steels and a limited line of nickel and red metals in various shapes and forms. More than 75% of the products we sell are processed to meet customer requirements. We use various processing and fabricating techniques

to process materials to a specified thickness, length, width, shape and surface quality pursuant to customer orders. For the year ended December 31, 2015, we purchased 1.8 million tons of materials from suppliers throughout the world.

We operate over 90 facilities across North America and five facilities in China. Our service centers are strategically located in close

proximity to our customers, which allows us to quickly process and deliver our products and services, often within the next day of receiving an order. We own, lease or contract a fleet of tractors and trailers, allowing us to efficiently meet our

customers’ delivery demands. In addition, our scale enables us to maintain low operating costs. Our operating expenses as a percentage of sales for the year ended December 31, 2015 were 14.5%.

In addition to providing a wide range of flat and long metals products, we offer numerous value-added processing and fabrication services such

as sawing, slitting, blanking, cutting to length, leveling, flame cutting, laser cutting, edge trimming, edge rolling, roll forming, tube manufacturing, polishing, shearing, forming, stamping, punching, rolling shell plate to radius and beveling to

process materials to a specified thickness, length, width, shape and surface quality pursuant to specific customer orders. Our value proposition also includes providing a superior level of customer service and responsiveness, technical services and

inventory management solutions. Our breadth of services allows us to create long-term partnerships with our customers and enhances our profitability.

We serve approximately 40,000 customers across a wide range of manufacturing end markets. We believe the diverse end markets we serve reduce

the volatility of our business in the aggregate. Our geographic network and broad range of products and services allow us to serve large, international manufacturing companies across multiple locations.

4

Principal Executive Offices

Our principal executive offices are located at 227 W. Monroe St., 27

th

Floor, Chicago,

Illinois 60606 and our telephone number is (312) 292-5000. Our website is located at http://www.ryerson.com. We do not incorporate the information contained on, or accessible through, our corporate website into this prospectus, and such

information should not be considered to be part of this prospectus. You should not rely on any such information in making your decision whether to purchase our common stock.

5

RISK FACTORS

Investing in our common stock involves risk. Prior to making a decision about investing in our common stock, you should carefully consider the

specific factors discussed under the heading “Risk Factors” in our most recent annual report on Form 10-K and in our most recent quarterly reports on Form 10-Q, which are incorporated herein by reference and may be amended, supplemented or

superseded from time to time by other reports we file with the SEC in the future. If any of these risks actually occurs, our business, results of operations and financial condition could suffer. In that case, the trading price of our common stock

could decline, and you could lose all or a part of your investment.

USE OF PROCEEDS

The common stock to be offered and sold using this prospectus will be offered and sold by the selling stockholders named in this prospectus or

in any supplement to this prospectus. We will not receive any proceeds from the sale of the common stock by the selling stockholders.

SELLING STOCKHOLDERS

This prospectus relates to the possible sale by RYPS, LLC (“RYPS”), an affiliate of Platinum Equity, LLC (“Platinum”), or

its affiliates, who we refer to in this prospectus as “selling stockholders,” of up to an aggregate maximum amount of 21,037,500 shares of our common stock that were issued and outstanding prior to the original filing date of the

registration statement of which this prospectus forms a part. We are registering the offer and sale of the common stock in response to a request from RYPS to file a registration statement, a right that we granted pursuant to an investors rights

agreement (the “Investor Rights Agreement”) entered into in connection the initial public offering of 11 million shares of our common stock completed on August 13, 2014 (the “IPO”). We are registering all of this common

stock in order to permit the selling stockholders to offer the common stock for sale from time to time.

The following table sets forth

the name of each selling stockholder, the number of shares of common stock owned by or attributable to such selling stockholder immediately prior to this registration (which includes the shares offered by this prospectus and which was prepared based

on information supplied to us by the selling stockholders as of December 30, 2016, the number of shares of common stock offered hereby and registered by the registration statement of which this prospectus is a part and the number of shares of common

stock to be owned by each selling stockholder after the maximum number of shares being offered hereby are sold, which assumes that all shares of common stock covered by this prospectus will be sold by the selling stockholders and that no additional

shares of common stock of the Company are subsequently bought or sold by the selling stockholders. However, because the selling stockholders may offer from time to time all, some or none of their shares of common stock under this prospectus, or in

another permitted manner, no assurances can be given as to the actual number of shares of common stock that will be sold by the selling stockholders or that will be held by the selling stockholders after completion of the sales. In addition, we do

not know how long the selling stockholders will hold their shares before selling them.

In the table below, the percentage of shares

beneficially owned is based on 37,132,019 shares of common stock outstanding as of November 1, 2016, determined in accordance with Rule 13d-3 under the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Number of Shares

Owned Prior to the

Registration

|

|

|

Shares of Common Stock

Covered by this Registration

Statement

|

|

|

Ownership After the Covered

Shares are Sold

|

|

|

|

|

|

Number of

Shares

|

|

|

Percent

|

|

|

RYPS

|

|

|

21,037,500

|

|

|

|

21,037,500

|

|

|

|

0

|

|

|

|

0

|

%

|

6

Material Relationships

RYPS is an affiliate of Platinum. One of our subsidiaries, Joseph T. Ryerson & Son, Inc. (“JT Ryerson”), was party to a corporate

advisory services agreement with Platinum Equity Advisors, LLC (“Platinum Advisors”), an affiliate of Platinum, pursuant to which Platinum Advisors provided JT Ryerson certain business, management, administrative and financial advice.

Under the services agreement, JT Ryerson paid an annual advisory fee to Platinum Advisors of no greater than $5 million, as well as paying Platinum Advisors’ out-of-pocket expenses incurred in connection with providing management services to JT

Ryerson. The services agreement terminated on the closing of the IPO.

The Investor Rights Agreement provides for, among other things,

demand, piggyback and Form S-3 registration rights and board nomination rights. The Investor Rights Agreement provides that Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P.,

Platinum Equity Capital Partners II, L.P., Platinum Equity Capital Partners-PF II, L.P., Platinum Equity Capital Partners-A II, L.P. and Platinum Rhombus Principals, LLC and their permitted transferees, including RYPS (the “Platinum

Parties”), may make written demands of us to require us to register the shares of our common stock owned by the Platinum Parties; provided, however that we will not be obligated to effect more than two such demand registrations. In addition,

the Platinum Parties have piggyback registration rights entitling them to require us to register shares of our common stock owned by them in connection with any registration statements filed by us after the completion of the IPO, subject to certain

exceptions. The Investor Rights Agreement provides that we will indemnify the Platinum Parties against losses suffered by them in connection with any untrue or alleged untrue statement of a material fact contained in any prospectus, offering

circular, or other document delivered or made available to investors (or in any related registration statement or any amendment or supplement thereto) or any omission or alleged omission to state therein a material fact required to be stated therein

or necessary to make the statement therein not misleading, except insofar as the same may be caused by or contained in any information furnished in writing to us by the Platinum Parties for use therein.

The Investor Rights Agreement provides that for so long as the Platinum Parties collectively beneficially owns at least (i) 30% of the voting

power of the outstanding capital stock of the Company, the Platinum Parties will have the right to nominate for election to the Board no fewer than that number of directors that would constitute a majority of the number of directors if there were no

vacancies on the Board, (ii) at least 15% but less than 30% of the voting power of the outstanding capital stock of the Company, the Platinum Parties will have the right to nominate two directors, and (iii) at least 5% but less than 15% of the

voting power of the outstanding capital stock of the Company, the Platinum Parties will have the right to nominate one director. The agreement also provides that if the size of the Board is increased or decreased at any time, the Platinum

Parties’ nomination rights will be proportionately increased or decreased, respectively, rounded up to the nearest whole number. The Investor Rights Agreement was negotiated among management and the Platinum Parties, and we believe the Investor

Rights Agreement is on arm’s length terms.

Mary Ann Sigler, Eva M. Kalawski, Jacob Kotzubei and Philip E. Norment, four current

members of our board of directors, are affiliated with Platinum.

DESCRIPTION OF CAPITAL STOCK

General

The following summary describes

the material terms of our capital stock. However, you should refer to the actual terms of the capital stock contained in our amended and restated certificate of incorporation and applicable law. Our amended and restated certificate of incorporation

provides that our authorized capital stock will consist of 100 million shares of common stock, par value $0.01 per share, and 7 million shares of preferred stock, par value $0.01 per share, that are undesignated as to series.

As of November 1, 2016, there were 37,132,019 shares of our common stock, par value $0.01 per share, outstanding.

7

Common Stock

The holders of common stock are entitled to one vote for each share held of record on all matters submitted to a vote of stockholders and are

not entitled to cumulative votes with respect to the election of directors. The holders of common stock are entitled to receive dividends as may be declared by our Board of Directors out of legally available funds. Upon our liquidation, dissolution

or winding up, the holders of common stock are entitled to share ratably in all assets that are legally available for distribution after payment of all debts and other liabilities, subject to the prior rights of any holders of preferred stock then

outstanding. The holders of common stock have no other preemptive, subscription, redemption, sinking fund or conversion rights. All outstanding shares of our common stock are fully paid and nonassessable. The shares of common stock to be issued upon

completion of the offering will also be fully paid and nonassessable. The rights, preferences and privileges of holders of common stock are subject to, and may be negatively impacted by, the rights of the holders of shares of any series of preferred

stock which we may designate and issue in the future.

Anti-Takeover Provisions of Delaware Law

We are subject to Section 203 of the Delaware General Corporation Law. In general, Section 203 prohibits a publicly held Delaware

corporation from engaging in a business combination with an interested stockholder for a period of three years following the date the person became an interested stockholder, unless the business combination or the transaction in which the person

became an interested stockholder is approved in a prescribed manner. Generally, a business combination includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally, an

interested stockholder is a person who, together with affiliates and associates, owns or, in the case of affiliates or associates of the corporation, within three years prior to the determination of interested stockholder status, owned 15% or more

of a corporation’s voting stock.

The existence of this provision could have anti-takeover effects with respect to transactions not

approved in advance by our Board of Directors, such as discouraging takeover attempts that might result in a premium over the market price of our common stock. For these purposes Platinum, does not constitute “interested stockholders.”

Stockholders are not entitled to cumulative voting in the election of directors. The authorization of undesignated preferred stock makes

it possible for our Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to effect a change of control of our company. The foregoing provisions of our amended and

restated certificate of incorporation and the Delaware General Corporation Law may have the effect of deterring or discouraging hostile takeovers or delaying changes in control of our company.

Charter and Bylaws Anti-Takeover Provisions

Our amended and restated certificate of incorporation and our amended and restated bylaws each provide that on and following the date that

Platinum no longer beneficially owns a majority of the voting power of all of our capital stock, any action required or permitted to be taken by our stockholders at an annual meeting or special meeting of the stockholders may only be taken at such

annual or special meeting, and not by written consent without a meeting, if it is properly brought before such annual or special meeting.

Our amended and restated certificate of incorporation provides that our Board of Directors will be divided into three classes of directors,

with the number of directors in each class to be as nearly equal as possible. Our classified board staggers terms of the three classes and, following our IPO, was implemented through one, two and three-year terms for the initial three classes,

followed in each case by full three-year terms. With a classified board, only one-third of the members of our Board of Directors are elected each year. This classification of directors has the effect of making it more difficult for stockholders to

change the composition of our Board of Directors. Our amended and restated certificate of incorporation and our amended and restated bylaws provide that the number of directors will be fixed from time to time exclusively pursuant to a resolution

adopted by our Board of Directors, but must consist of not less than three directors. This provision prevents stockholders from circumventing the provisions of our classified board.

8

Our amended and restated certificate of incorporation provides that, on and following the date

that Platinum no longer beneficially owns a majority of the voting power of all of our capital stock, the affirmative vote of the holders of at least 66 2/3% of the voting power of our issued and outstanding capital stock, voting together as a

single class, is required for the following:

|

|

•

|

|

alteration, amendment or repeal of the staggered Board of Directors provisions in our amended and restated certificate of incorporation; and

|

|

|

•

|

|

alteration, amendment or repeal of certain provisions of our amended and restated bylaws, including the provisions relating to our stockholders’ ability to call special meetings, notice provisions for stockholder

business to be conducted at an annual meeting, requests for stockholder lists and corporate records, nomination and removal of directors and filling of vacancies on our Board of Directors.

|

Our amended and restated certificate of incorporation provides for the issuance by the Board of Directors of up to 7 million shares of

preferred stock, with voting power, designations, preferences and other special rights. The issuance of preferred stock could decrease the amount of earnings and assets available for distribution to the holders of common stock or could adversely

affect the rights and powers, including voting rights, of holders of common stock. In certain circumstances, such issuance could have the effect of decreasing the market price of the common stock. Preferred stockholders could also make it more

difficult for a third party to acquire our company. No shares of preferred stock are outstanding and we currently have no plans to issue any shares of preferred stock.

Our amended and restated bylaws establish an advance notice procedure for stockholders to bring matters before special stockholder meetings,

including proposed nominations of persons for election to our Board of Directors. These procedures specify the information stockholders must include in their notice and the timeframe in which they must give us notice. At a special stockholder

meeting, stockholders may only consider nominations or proposals specified in the notice of meeting. A special stockholder meeting for any purpose may only be called by our Board of Directors, our Chairman, our Chief Executive Officer or, prior to

the date that Platinum no longer beneficially owns a majority of the voting power of all of our capital stock, the holders of a majority of the voting power of our then outstanding voting stock.

Our amended and restated bylaws do not give the Board of Directors the power to approve or disapprove stockholder nominations of candidates or

proposals regarding other business to be conducted at a meeting. However, our amended and restated bylaws may have the effect of precluding the conduct of that item of business at a meeting if the proper procedures are not followed. These provisions

may discourage or deter a potential third party from conducting a solicitation of proxies to elect its own slate of directors or otherwise attempting to obtain control of our company.

The foregoing provisions of our amended and restated certificate of incorporation, our amended and restated bylaws and the Delaware General

Corporation Law may have the effect of deterring or discouraging hostile takeovers or delaying changes in control of the company.

Limitation on

Liability and Indemnification of Directors and Officers

Our amended and restated certificate of incorporation and bylaws limit our

directors’ and officers’ liability to the fullest extent permitted under Delaware corporate law. Specifically, our directors and officers are not liable to us or our stockholders for monetary damages for any breach of fiduciary duty by a

director or officer, except for liability:

|

|

•

|

|

for any breach of the director’s or officer’s duty of loyalty to us or our stockholders;

|

|

|

•

|

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

9

|

|

•

|

|

under Section 174 of the Delaware General Corporation Law; or

|

|

|

•

|

|

for any transaction from which a director or officer derives an improper personal benefit.

|

If

the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of a director or officer of the Company shall be eliminated or limited

to the fullest extent permitted by the Delaware General Corporation Law, as so amended.

The provision regarding indemnification of our

directors and officers in our amended and restated certificate of incorporation will generally not limit liability under state or federal securities laws.

Delaware law and our amended and restated certificate of incorporation and bylaws provide that we will, in certain situations, indemnify any

person made or threatened to be made a party to a proceeding by reason of that person’s former or present official capacity with our company against judgments, penalties, fines, settlements and reasonable expenses including reasonable

attorney’s fees. Any person is also entitled, subject to certain limitations, to payment or reimbursement of reasonable expenses in advance of the final disposition of the proceeding. In addition, Ryerson is party to certain indemnification

agreements pursuant to which it has agreed to indemnify the employees who are party thereto.

The limitation of liability and

indemnification provisions in our amended and restated certificate of incorporation may discourage stockholders from bringing a lawsuit against directors for breach of their fiduciary duty. These provisions may also have the effect of reducing the

likelihood of derivative litigation against directors and officers, even though such an action, if successful, might otherwise benefit us and our stockholders. In addition, your investment may be adversely affected to the extent that, in a class

action or direct suit, we pay the costs of settlement and damage awards against directors and officers pursuant to these indemnification provisions.

Transfer Agent and Registrar

Our

transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, LLC.

Listing

Our common stock is listed on the New York Stock Exchange (“NYSE”) under the symbol “RYI.”

PLAN OF DISTRIBUTION

The selling stockholders may sell common stock from time to time pursuant to underwritten public offerings, negotiated transactions, block

trades or a combination of these methods. The selling stockholders may sell common stock separately or together:

|

|

•

|

|

through one or more underwriters or dealers;

|

|

|

•

|

|

directly to one or more purchasers.

|

The selling stockholders may distribute shares of our

common stock from time to time in one or more transactions:

|

|

•

|

|

at a fixed price or prices that may be changed;

|

|

|

•

|

|

at market prices or prevailing at the time of sale;

|

10

|

|

•

|

|

at prices related to such prevailing market prices; or

|

To the extent required by applicable regulations, the related

prospectus supplement will set forth the terms of each offering, including:

|

|

•

|

|

the name or names of any agents, dealers, underwriters or investors who purchase the common stock;

|

|

|

•

|

|

the purchase price of the common stock being offered;

|

|

|

•

|

|

the amount of any compensation, discounts, commissions or fees to be received by the underwriters, dealer or agents;

|

|

|

•

|

|

any over-allotment options under which underwriters may purchase additional common stock from us;

|

|

|

•

|

|

any discounts or concessions allowed or reallowed or paid to dealers;

|

|

|

•

|

|

any securities exchanges on which such common stock may be listed;

|

|

|

•

|

|

the terms of any indemnification provisions, including indemnification from liabilities under the federal securities laws; and

|

|

|

•

|

|

the nature of any transaction by an underwriter, dealer or agent during the offering that is intended to stabilize or maintain the market prices of the common stock.

|

Direct Sales and Sales Through Agents

The selling stockholders may solicit directly offers to purchase the common stock being offered by this prospectus. The selling stockholders

may also designate agents to solicit offers to purchase the common stock from time to time. The selling stockholders may sell the common stock being offered by this prospectus by any method permitted by law, including sales deemed to be an “at

the market” offering as defined in Rule 415(a)(4) under the Securities Act, including without limitation sales made directly on the NYSE, on any other existing trading market for our common stock or to or through a market maker.

If the selling stockholders utilize a dealer in the sale of the common stock being offered by this prospectus, the selling stockholders will

sell the common stock to the dealer, as principal. The dealer may then resell the common stock to the public at varying prices to be determined by the dealer at the time of resale.

Sales Through Underwriters or Dealers

If

the selling stockholders utilize an underwriter in the sale of the common stock being offered by this prospectus, the selling stockholders will execute an underwriting agreement with the underwriter at the time of sale and we will provide the name

of any underwriter in the prospectus supplement that the underwriter will use to make resales of shares of the common stock to the public. In connection with the sale of the common stock, the selling stockholders or the purchasers of common stock

for whom the underwriter may act as agent may compensate the underwriter in the form of underwriting discounts or commissions. The underwriter may sell the common stock to or through dealers, and the underwriter may compensate those dealers in the

form of discounts, concessions or commissions.

We will provide in the applicable prospectus supplement any compensation the selling

stockholders will pay to underwriters, dealers or agents in connection with the offering of the common stock, and any discounts, concessions or commissions allowed by underwriters to participating dealers. In compliance with guidelines of the

Financial Industry Regulatory Authority, or FINRA, the maximum consideration or discount to be received by any FINRA member or independent broker dealer may not exceed 8% of the aggregate amount of common stock offered pursuant to this prospectus

and any applicable prospectus supplement. Underwriters, dealers and

11

agents participating in the distribution of the common stock may be deemed to be underwriters within the meaning of the Securities Act, and any discounts and commissions received by them and any

profit realized by them on resale of the common stock may be deemed to be underwriting discounts and commissions. We may indemnify underwriters, dealers and agents against certain liabilities, including liabilities under the Securities Act, or

to contribute to payments they may be required to make in respect thereof. In the event that an offering made pursuant to this prospectus is subject to FINRA Rule 5121, the prospectus supplement will comply with the prominent disclosure

provisions of that rule.

The common stock may or may not be listed on a national securities exchange. To facilitate the offering of the

common stock, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the common stock. This may include over-allotments or short sales of the common stock, which involves

the sale by persons participating in the offering of more shares of common stock than the selling stockholders sold to them. In these circumstances, these persons would cover such over-allotments or short positions by making purchases in the open

market or by exercising their over-allotment option. In addition, these persons may stabilize or maintain the price of shares of the common stock by bidding for or purchasing the common stock in the open market or by imposing penalty bids, whereby

selling concessions allowed to dealers participating in the offering may be reclaimed if the common stock sold by them is repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the

market price of the common stock at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

Delayed Delivery Contracts

The selling

stockholders may authorize underwriters, dealers or agents to solicit offers by certain purchasers to purchase the common stock from them at the public offering price set forth in the prospectus supplement pursuant to delayed delivery contracts

providing for payment and delivery on a specified date in the future. The contracts will be subject only to those conditions set forth in the prospectus supplement, and the prospectus supplement will set forth any commissions the selling

stockholders pay for solicitation of these contracts.

Derivative Transactions

The selling stockholders may enter into derivative transactions with third parties. If the applicable prospectus supplement so indicates, in

connection with any derivative transaction, the third parties may sell the common stock covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use the common stock

pledged by the selling stockholders or borrowed from the selling stockholders or others to settle those sales or to close out any related open borrowings of common stock, and may use the common stock received from us in settlement of those

derivatives to close out any related open borrowings of common stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement or a post-effective amendment to the registration

statement of which this prospectus is a part. In addition, the selling stockholders may otherwise loan or pledge the common stock to a financial institution or other third party that in turn may sell the common stock short using this prospectus.

Such financial institution or other third party may transfer its economic short position to investors in the common stock or in connection with a concurrent offering of other common stock.

General Information

We are obligated to

list the common stock registered hereby on the NYSE. No assurance can be given as to the liquidity of the trading market for our common stock.

The underwriters, dealers and agents may engage in transactions with us, or perform services for us, in the ordinary course of business.

12

LEGAL MATTERS

Our counsel, Willkie Farr & Gallagher LLP, New York, New York, will issue an opinion regarding the validity of any shares of common

stock offered by this prospectus. If the validity of any shares of common stock is also passed upon by counsel for the underwriters of an offering of those shares of common stock, that counsel will be named in the prospectus supplement relating to

that offering.

EXPERTS

The consolidated financial statements of Ryerson Holding Corporation appearing in Ryerson Holding Corporation’s Annual Report (Form 10-K)

for the year ended December 31, 2015 including schedules appearing therein, and the effectiveness of Ryerson Holding Corporation’s internal control over financial reporting as of December 31, 2015, have been audited by

Ernst & Young LLP, independent registered public accounting firm, as set forth in their reports thereon included therein, and incorporated herein by reference. Such financial statements are, and audited financial statements to be included

in subsequently filed documents will be, incorporated herein in reliance upon the reports of Ernst & Young LLP pertaining to such financial statements and the effectiveness of our internal control over financial reporting as of the

respective dates (to the extent covered by consents filed with the Securities and Exchange Commission) given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

All periodic and current reports and other filings that we are required to file with the SEC are available free of charge from the SEC’s

website (http://www.sec.gov) or public reference room at 100 F Street N.E., Washington, D.C. 20549 (1-800-SEC-0330) or through our website at http://www.ryerson.com. Such documents are available as soon as reasonably practicable after electronic

filing of the material with the SEC. Copies of these reports (excluding exhibits) may also be obtained free of charge, upon written request to: Investor Relations, Ryerson Holding Corporation, 227 W. Monroe St., 27th Floor, Chicago, Illinois 60606.

We have filed with the SEC a registration statement on Form S-3 under the Securities Act of 1933, as amended, relating to the common

stock being offered by this prospectus. This prospectus, which constitutes part of that registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules which are part of the

registration statement. For further information about us and the common stock offered, see the registration statement and the exhibits and schedules thereto. Statements contained in this prospectus regarding the contents of any contract or any other

document to which reference is made are not necessarily complete, and, in each instance where a copy of a contract or other document has been filed as an exhibit to the registration statement, reference is made to the copy so filed, each of those

statements being qualified in all respects by the reference.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to you

by referring you to those documents. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by

reference our documents listed below and any future information filed (rather than furnished) with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act between the date of this prospectus and the date all common stock to which this

prospectus relates have been sold or the offering is otherwise terminated and also between the date of the initial registration

13

statement and prior to effectiveness of the registration statement, provided, however, that we are not incorporating any information furnished under Item 2.02 or Item 7.01 of any

Current Report on Form 8-K:

|

|

•

|

|

Annual Report on Form 10-K for the fiscal year ended December 31, 2015, filed with the SEC on March 9, 2016;

|

|

|

•

|

|

Quarterly Reports on Form 10-Q, for the fiscal quarter ended March 31, 2016, filed with the SEC on May 5, 2016, for the fiscal quarter ended June 30, 2016, filed with the SEC on August 9, 2016, and for the

fiscal quarter ended September 30, 2016, filed with the SEC on November 2, 2016; and

|

|

|

•

|

|

Current Reports on Form 8-K (in all cases other than information furnished rather than filed pursuant to any Form 8-K), filed January 25, 2016, March 24, 2016, April 29, 2016, May 11,

2016, May 12, 2016, May 24, 2016, July 18, 2016, July 20, 2016, July 25, 2016, August 9, 2016, September 15, 2016, September 30, 2016, November 2, 2016 and November 17, 2016.

|

You may request a copy of these filings at no cost, by writing or telephoning us at the following address:

Ryerson Holding Corporation

227

W. Monroe St., 27th Floor

Chicago, Illinois 60606

Telephone: (312) 292-5000

You should rely only on the information incorporated by reference or provided in this prospectus or any prospectus supplement. We have not

authorized anyone else to provide you with different information. We are not making an offer of the common stock in any state where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus

supplement is accurate as of any date other than the date on the front of those documents.

14

Common Stock

Prospectus

,

201

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

The following table sets forth the various

expenses payable by us in connection with the sale and distribution of the common stock being registered hereby. All amounts are estimated except the SEC registration fee.

|

|

|

|

|

|

|

SEC registration fee

|

|

$

|

34,208.59

|

|

|

Legal fees and expenses

|

|

|

*

|

|

|

Accounting fees and expenses

|

|

|

*

|

|

|

Printing fees and expenses

|

|

|

*

|

|

|

Miscellaneous

|

|

|

*

|

|

|

Total

|

|

|

$*

|

|

|

*

|

These fees are calculated based on the number of issuances and amount of securities offered and, accordingly, cannot be estimated at this time.

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

Our amended and restated certificate of

incorporation limits our directors’ and officers’ liability to the fullest extent permitted under Delaware corporate law. Specifically, our directors and officers are not liable to us or our stockholders for monetary damages for any breach

of fiduciary duty by a director or officer, except for liability:

|

|

•

|

|

for any breach of the director’s or officer’s duty of loyalty to us or our stockholders;

|

|

|

•

|

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

under Section 174 of the Delaware General Corporation Law; or

|

|

|

•

|

|

for any transaction from which a director or officer derives an improper personal benefit.

|

If

the Delaware General Corporation Law is amended to authorize corporate action further eliminating or limiting the personal liability of directors or officers, then the liability of our directors and officers shall be eliminated or limited to the

fullest extent permitted by the Delaware General Corporation Law, as so amended.

The provision regarding indemnification of our directors

and officers in our amended and restated certificate of incorporation does not generally limit liability under state or federal securities laws.

Delaware law and our amended and restated certificate of incorporation provide that we will, in certain situations, indemnify any person made

or threatened to be made a party to a proceeding by reason of that person’s former or present official capacity with our company against judgments, penalties, fines, settlements and reasonable expenses including reasonable attorney’s fees.

Any person is also entitled, subject to certain limitations, to payment or reimbursement of reasonable expenses in advance of the final disposition of the proceeding. In addition, certain employment agreements to which we are a party provide for the

indemnification of our employees who are party thereto.

We also maintain a directors’ and officers’ insurance policy pursuant

to which our directors and officers are insured against liability for actions taken in their capacities as directors and officers.

See Exhibit Index attached to this registration statement, which is

incorporated by reference herein.

II-1

(a) The undersigned registrant hereby undertakes:

|

|

1.

|

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

i.

|

To include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

ii.

|

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a

fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of common stock offered (if the total dollar value of common stock offered would not exceed that

which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission, or the SEC, pursuant to Rule 424(b) if, in the

aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

|

|

|

iii.

|

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

provided

,

however

, that paragraphs (1)(i), (1)(ii) and (1)(iii) above do not apply if the information required to

be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934, or the Exchange Act,

that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

2.

|

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the common stock offered therein,

and the offering of such common stock at that time shall be deemed to be the initial bona fide offering thereof

|

|

|

3.

|

To remove from registration by means of a post-effective amendment any of the common stock being registered which remain unsold at the termination of the offering.

|

|

|

4.

|

That, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

a.

|

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration

statement; and

|

|

|

b.

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of common stock in the offering described in the prospectus. As provided in Rule

430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the common stock in the registration statement to which

that prospectus relates, and the offering of such common stock at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the

registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will,

|

II-2

|

|

as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to such effective date.

|

|

|

5.

|

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution of the common stock,

|

the undersigned registrant undertakes that in a primary offering of common stock of the undersigned registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the common stock to the purchaser, if the common stock is offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to

the purchaser and will be considered to offer or sell such common stock to such purchaser:

|

|

i.

|

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

ii.

|

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

iii.

|

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its common stock provided by or on behalf of the undersigned registrant; and

|

|

|

iv.

|

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

(b) The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

registrant’s annual report pursuant to Section 13(a) or 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in the registration statement shall be deemed to be a new registration statement relating to the common stock offered therein, and the offering of the common stock at that time shall be deemed to be the initial bona fide offering

thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers

and controlling persons of the registrant pursuant to our amended and restated certificate of incorporation or bylaws, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification

is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a

director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the common stock being registered, the registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities

Act and will be governed by the final adjudication of such issue.

(d) The undersigned registrant hereby undertakes that:

|

|

1.

|

For purposes of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of

prospectus filed by the registrant pursuant to Rule 424(b) (1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

|

|

|

2.

|

For the purpose of determining any liability under the Securities Act, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the common stock

offered therein, and the offering of such common stock at that time shall be deemed to be the initial bona fide offering thereof.

|

II-3

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets

all the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Chicago, Illinois, on December 30, 2016.

|

|

|

|

|

RYERSON HOLDING CORPORATION

|

|

|

|

|

By:

|

|

/s/ Erich S. Schnaufer

|

|

Name:

|

|

Erich S. Schnaufer

|

|

Title:

|

|

Chief Financial Officer

|

POWER OF ATTORNEY

KNOW ALL BY THESE PRESENTS, that each individual whose signature appears below constitutes and appoints Mark S. Silver and Andrea Okun, each

as his or her true and lawful attorney-in-fact and agent for the undersigned, with full power of substitution, for and in the name, place and stead of the undersigned to sign and file with the Securities and Exchange Commission under the Securities

Act of 1933, as amended, (i) any and all pre-effective and post-effective amendments to this registration statement, (ii) any registration statement relating to this offering that is to be effective upon filing pursuant to Rule 462(b)

under the Securities Act of 1933, as amended, (iii) any exhibits to any such registration statement or pre-effective or post-effective amendments, (iv) any and all applications and other documents in connection with any such registration

statement or pre-effective or post-effective amendments, and generally to do all things and perform any and all acts and things whatsoever requisite and necessary or desirable to enable Ryerson Holding Corporation to comply with the provisions of

the Securities Act of 1933, as amended, and all requirements of the Securities and Exchange Commission.

Pursuant to the requirements of

the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Edward J. Lehner

Edward J. Lehner

|

|

President and Chief Executive Officer (Principal Executive Officer)

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Erich S. Schnaufer

Erich S. Schnaufer

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer)

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Kirk K. Calhoun

Kirk K. Calhoun

|

|

Director

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Court D. Carruthers

Court D. Carruthers

|

|

Director

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Eva M. Kalawski

Eva M. Kalawski

|

|

Director

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Jacob Kotzubei

Jacob Kotzubei

|

|

Director

|

|

December 30, 2016

|

II-4

|

|

|

|

|

|

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

/s/ Stephen P. Larson

Stephen P. Larson

|

|

Director

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Philip E. Norment

Philip E. Norment

|

|

Director

|

|

December 30, 2016

|

|

|

|

|

|

/s/ Mary Ann Sigler

Mary Ann Sigler

|

|

Director

|

|

December 30, 2016

|

II-5

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

1.1*

|

|

Form of Underwriting Agreement.

|

|

|

|

|

3.1

(1)

|

|

Form of Third Amended and Restated Certificate of Incorporation of Ryerson Holding Corporation.

|

|

|

|

|

3.2

(2)

|

|

Form of Amended and Restated Bylaws of Ryerson Holding Corporation.

|

|

|

|

|

4.1

(3)

|

|

Form of Common Stock Certificate of Ryerson Holding Corporation.

|

|

|

|

|

4.2

(2)

|

|

Form of Investor Rights Agreement, by and among Ryerson Holding Corporation, Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-PF, L.P., Platinum Equity Capital Partners-A, L.P., Platinum Equity Capital

Partners II, L.P., Platinum Equity Capital Partners-PF II, L.P., Platinum Equity Capital Partners-A II, L.P. and Platinum Rhombus Principals, LLC.

|

|

|

|

|

4.3

(4)

|

|

Amended and Restated Stockholders’ Agreement, dated as of March 31, 2009, by and among Rhombus Holding Corporation, Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-A, L.P., Platinum Equity Capital

Partners-PF, L.P., Platinum Equity Capital Partners II, L.P., Platinum Equity Capital Partners-A II, L.P., Platinum Equity Capital Partners-PF II, L.P., Platinum Rhombus Principals, LLC, and the stockholders party thereto.

|

|

|

|

|

4.4

(4)

|

|

Amendment to Amended and Restated Stockholders’ Agreement, dated as of April 1, 2009, by and among Rhombus Holding Corporation, Platinum Equity Capital Partners, L.P., Platinum Equity Capital Partners-A, L.P., Platinum Equity

Capital Partners-PF, L.P., Platinum Equity Capital Partners II, L.P., Platinum Equity Capital Partners-A II, L.P., Platinum Equity Capital Partners-PF II, L.P., Platinum Rhombus Principals, LLC, Moelis Capital Partners Opportunity Fund I, LP and

Moelis Capital Partners Opportunity Fund I-A, LP.

|

|

|

|

|

5.1

|

|

Opinion of Willkie Farr & Gallagher LLP.

|

|

|

|

|

23.1

|

|

Consent of Ernst & Young LLP.

|

|

|

|

|

23.2

|

|

Consent of Willkie Farr & Gallagher LLP (included in Exhibit 5.1).

|

|

|

|

|

24.1

|

|

Power of Attorney (included on the signature pages hereto).

|

|

*

|