As filed with the Securities and Exchange Commission on April 9, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

| England and Wales |

|

Not Required |

| (State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

Amarin Corporation plc

2 Pembroke House

Upper

Pembroke Street 28-32

Dublin 2, Ireland

+353 1 6699 020

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John F. Thero

President

and Chief Executive Officer

Amarin Corporation plc

c/o Amarin Pharma, Inc.

1430 Route 206

Bedminster, New Jersey 07921, USA

Telephone: (908) 719-1315

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Michael

H. Bison, Esq.

Goodwin Procter LLP

Exchange Place

53 State

Street

Boston, MA 02109

Telephone: (617) 570-1000

Facsimile: (617) 523-1231

Approximate

date of commencement of proposed sale to the public: From time to time or at one time after the effective date of the Registration Statement as the registrant shall determine.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the

following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

x |

|

|

|

|

| Non-accelerated filer |

|

¨ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

| |

| Title of Each Class of

Securities to be Registered |

|

Amount

to be

Registered |

|

Proposed

Maximum Offering

Price Per Share |

|

Proposed

Maximum Aggregate

Offering Price |

|

Amount of

Registration Fee (1) |

| Series A Convertible Preference Shares, par value £0.05 per share (2) |

|

352,150,790 (3) |

|

$0.15 |

|

$52,822,618.50 |

|

$6,137.99 |

| Ordinary Shares, par value £0.50 per share (4) |

|

35,215,079 (5) |

|

— |

|

— |

|

(6) |

| Total |

|

387,365,869 |

|

$0.15 |

|

$52,822,618.50 |

|

$6,137.99 |

| |

| |

| (1) |

Calculated pursuant to Rule 457(o) under the Securities Act. |

| (2) |

The Series A Convertible Preference Shares, par value £0.05 per share, (the “Series A Preference Shares”) are represented by American Depositary Shares (“Preference

ADSs”), each of which represents one Series A Preference Share. A separate Registration Statement on Form F-6 will be filed for the registration of Preference ADSs. |

| (3) |

Represents the number of Series A Preference Shares represented by the Preference ADSs issued to certain investors in a private placement on March 30, 2015. |

| (4) |

The ordinary shares, par value par value £0.50 per share, may be represented by American Depositary Shares (“Ordinary ADSs”), each of which currently represents one ordinary share. A

separate Registration Statement on Form F-6 has been filed for the registration of Ordinary ADSs and was declared effective on November 4, 2011 (Reg. File No. 333-176898). |

| (5) |

Consists of (a) 35,215,079 ordinary shares to be created by the consolidation and redesignation of the Series A Preference Shares at a rate of one ordinary share for ten Series A Preference Shares and (b) an

indeterminate number of additional ordinary shares as may from time to time be issued with respect to the foregoing securities as a result of equity splits, dividends, reclassifications, recapitalizations, combinations or similar events, which

shares shall be deemed registered hereunder pursuant to Rule 416 under the Securities Act. |

| (6) |

No separate consideration will be received for the ordinary shares created by the consolidation and redesignation of the Series A Preference Shares, and, therefore, no registration fee for those shares is required

pursuant to Rule 457(i) under the Securities Act. |

The registrant hereby amends this registration statement on such date

or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the

Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. The selling

shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these

securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED April 9, 2015

35,215,079 Ordinary Shares

Ordinary Shares, in the form of American Depositary Shares

352,150,790 Series A Preference Shares

Series A Preference Shares, in the form of American Depositary Shares

Offered by Selling Shareholders

This prospectus covers the resale

by the selling shareholders identified in this prospectus of up to an aggregate amount of (i) 352,150,790 Series A Convertible Preference Shares in the capital of the Company, par value £0.05 per share, which we refer to as the

Series A Preference Shares, represented by currently unregistered, restricted American Depositary Shares, which we refer to as Preference ADSs, that we issued in a private placement on March 30, 2015; and (ii) 35,215,079 ordinary shares in

the capital of the Company, par value £0.50 per share, which refer to as our ordinary shares and which are represented by American Depositary Shares (which we refer to as Ordinary ADSs), which would be created by the consolidation and

redesignation of the Series A Preference Shares at a rate of one ordinary share for ten Series A Preference Shares. We are not selling any ordinary shares or Series A Preference Shares under this prospectus and we will not receive any of the

proceeds from the sale or other disposition of ordinary shares or Series A Preference Shares by the selling shareholders.

The selling

shareholders may sell or otherwise dispose of the ordinary shares and Series A Preference Shares covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling shareholders may sell

or otherwise dispose of their ordinary shares and Series A Preference Shares in the section entitled “Plan of Distribution” beginning on page 19.

Any discount, concession, commissions and similar selling expenses attributable to the sale of ordinary shares and Series A Preference Shares

covered by this prospectus will be borne by the selling shareholders. We will pay all expenses (other than discounts, concessions, commissions and similar selling expenses) relating to the registration of the ordinary shares and Series A Preference

Shares with the Securities and Exchange Commission.

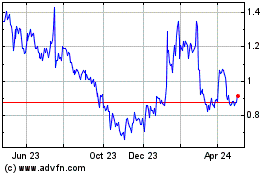

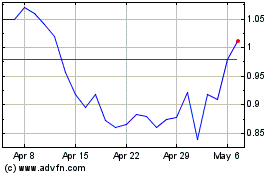

Our American Depositary Shares, or Ordinary ADSs, each of which currently represents

one ordinary share, are traded on the NASDAQ Capital Market under the symbol “AMRN”. The ordinary shares covered by this prospectus may later be represented by Ordinary ADSs, for which a separate Registration Statement on Form F-6 for the

registration of Ordinary ADSs issuable upon deposit of the ordinary shares was previously filed with the Securities and Exchange Commission and was effective on November 4, 2011 (Reg. File No. 333-176898). On April 8, 2015, the

closing price of our Ordinary ADSs on the NASDAQ Capital Market was $2.54 per share. The Series A Preference Shares are not currently listed on any exchange, and we do not intend to list the Series A Preference Shares on any exchange. The Series A

Preference Shares are represented by the Preference ADSs, for which a separate Registration Statement on Form F-6 will be filed.

Investing in our securities involves certain

risks. See “Risk Factors” beginning on page 4 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 9, 2015.

TABLE OF CONTENTS

PROSPECTUS SUMMARY

About Amarin Corporation plc

We are a

biopharmaceutical company with expertise in lipid science focused on the commercialization and development of therapeutics to improve cardiovascular health.

Our lead product, Vascepa® (icosapent ethyl) capsules, is approved by the U.S. Food

and Drug Administration, or FDA, for use as an adjunct to diet to reduce triglyceride levels in adult patients with severe (TG >500mg/dL) hypertriglyceridemia. Vascepa is available in the United States by prescription only. We began

selling and marketing Vascepa in the United States in January 2013. We sell Vascepa principally to a limited number of major wholesalers, as well as selected regional wholesalers and specialty pharmacy providers, or collectively, its Distributors,

that in turn resell Vascepa to retail pharmacies for subsequent resale to patients and health care providers. We market Vascepa through our sales force of approximately 150 sales professionals, including sales representatives and their managers. In

addition, in May 2014 we entered into a co-promotion agreement with Kowa Pharmaceuticals America, Inc. (Kowa Pharmaceuticals America) under which approximately 250 Kowa Pharmaceuticals America sales representatives devote a substantial portion of

their time to promoting Vascepa. We have recently entered into an agreement with Eddingpharm (Asia) Macao Commercial Offshore Limited related to the development and commercialization of Vascepa in Mainland China, Hong Kong, Macau and Taiwan. We

operate in one business segment.

Corporate Information

Amarin Corporation plc (formerly Ethical Holdings plc) is a public limited company listed in the United States on the NASDAQ Capital

Market. Amarin was originally incorporated in England as a private limited company on March 1, 1989 under the Companies Act 1985, and re-registered in England as a public limited company on March 19, 1993.

Our registered office is located at One New Change, London EC4M 9AF, England. Our principal executive offices are located at 2 Pembroke

House, Upper Pembroke Street 28-32, Dublin 2, Ireland. Our primary office in the United States is located at 1430 Route 206, Bedminster, New Jersey 07921. Our telephone number at that location is (908) 719-1315. Our website address is

www.amarincorp.com. Information contained on, or accessible through, our website is not a part of this prospectus.

For additional

information about our company, please refer to other documents we have filed with the SEC and that are incorporated by reference into this prospectus, as listed under the heading “Incorporation of Certain Information by Reference.”

Additional information about us can be found in our periodic and current reports filed with the SEC. Copies of our current and periodic reports filed with the SEC are available at the SEC Public Reference Room at 100 F Street, N.E., Washington, D.C.

20549, and online at www.sec.gov.

The Preference Private Placement

On March 30, 2015, we completed the private placement of Preference ADSs representing 352,150,790 of our Series A Preference Shares.

Ten of the Series A Preference Shares may be consolidated and redesignated at any time at the option of the applicable shareholder as one of our ordinary shares. Pursuant to the securities subscription agreement that we entered into with the

investors in the private placement, we agreed to file the registration statement of which this prospectus forms a part with the Securities and Exchange Commission, which we refer to as the SEC or the Commission, within 30 days after the target

closing date of the private placement to register the resale of the Preference ADSs, the Series A Preference Shares represented by Preference ADSs, the ordinary shares that would be created by the consolidation and redesignation of the Series A

Preference Shares and the Ordinary ADSs that would represent such ordinary shares.

1

THE OFFERING

| Series A Preference Shares Offered |

352,150,790 Series A Preference Shares, and the Preference ADSs that we issued in the private placement representing such Series A Preference Shares. |

| Ordinary Shares Offered |

35,215,079 ordinary shares that would be created by the consolidation and redesignation of the Series A Preference Shares and the Ordinary ADSs that would represent such ordinary shares. |

| Consolidation and Redesignation |

Each ten (10) Series A Preference Shares may be consolidated and redesignated as one ordinary share, subject to adjustments for subdivision or consolidation of the ordinary shares, at any time at the option of the holder of Preference ADSs;

except that the securities subscription agreement governing the private placement provides that a holder will be prohibited from consolidating its shares if, as a result, the holder and its affiliates would beneficially own more than 4.99%, or such

other percentage not in excess of 19.9% that each of the selling shareholders individually may later elect in their respective discretion, of the total number of the Company’s ordinary shares or Ordinary ADSs representing its ordinary shares

outstanding following such redesignation. |

| Liquidation Preference |

In the event of our liquidation, dissolution or winding up, holders of the Series A Preference Shares will receive a payment equal to $0.001 per Series A Preference Share before any proceeds are distributed to the holders of ordinary shares.

After the payment of this preferential amount, and subject to the rights of holders of any class or series of capital stock hereafter created specifically ranking by their terms senior to the Series A Preference Shares, holders of Series A

Preference Shares will participate ratably in the distribution of any remaining assets with the holders of ordinary shares and any other class or series of our capital stock hereafter created that participates with the ordinary shares in such

distributions. |

| Voting Rights |

The Series A Preference Shares will generally have no voting rights, except as required by law and except that the consent of holders of seventy-five percent (75%) of the then outstanding Series A Preference Shares will be required to alter

or change adversely the powers, preferences or rights attaching to the Series A Preference Shares or enter into any agreement with respect to the foregoing. |

| Dividends |

Holders of the Series A Preference Shares shall be entitled to receive, and we are required to pay, dividends (other than dividends in the form of ordinary shares) on the Series A Preference Shares equal (on an

as-if-consolidated-and-redesignated as- ordinary-shares basis) to and in the same form as dividends (other than dividends in the form of ordinary shares) actually paid on ordinary shares when, as and if such dividends (other than dividends in the

form of ordinary shares) are paid on the ordinary shares. |

2

| Use of Proceeds |

This prospectus relates to the securities that may be offered and sold from time to time by the selling shareholders who will receive all of the proceeds from any sale of the securities. We will not receive any of the proceeds from any sales of

the securities by the selling shareholders. However, we will pay certain registration expenses, including filing fees, listing fees, printing expenses and fees of our counsel and other advisers. |

| Listing |

Ordinary ADSs representing our ordinary shares are listed on the Nasdaq Capital Market under the symbol “AMRN.” There is no established public trading market for the Series A Preference Shares or Preference ADSs, and we do not expect

such a market to develop. We do not intend to list the Series A Preference Shares or Preference ADSs on any exchange. |

| Depositary |

Citibank, N.A., Citibank or its nominee. |

| Preference Deposit Agreement |

Preference Share Deposit Agreement, dated as of March 30, 2015, by and among the Company, the Depositary and all holders and beneficial owners of Preference ADSs issued thereunder, as supplemented by the Letter Agreement, dated as of

March 30, 2015, by and between the Company and the Depositary. |

3

RISK FACTORS

Investing in our securities involves significant risks. Before making an investment decision, you should carefully consider the risks and

other information we include or incorporate by reference in this prospectus and any prospectus supplement. In particular, you should consider the following risk factors and the risk factors under the heading “Risk Factors” in our most

recent Annual Report on Form 10-K, which are incorporated by reference in this prospectus, in each case as those risk factors are amended or supplemented by our subsequent filings with the SEC. If any of these risks actually occur, they may

materially harm our business, prospects, financial condition and results of operations. In this event, the market price of our securities could decline and you could lose part or all of your investment. Additional risks and uncertainties not

currently known to us or that we currently deem immaterial may also affect our business operations.

Risks Related to this Offering

The number of our ordinary shares, or Ordinary ADSs representing such ordinary shares, outstanding may increase substantially as a result

of our March 2015 private placement and the later consolidation and redesignation of the Series A Preference Shares represented by Preference ADSs issued thereunder, and some of the investors may then beneficially own significant blocks of our

ordinary shares; the ordinary shares and Series A Preference Shares resulting from the private placement will be generally available for resale in the public market upon registration under the Securities Act of 1933, as amended, or the Securities

Act.

In March 2015, we completed the private placement of Preference ADSs representing 352,150,790 Series A Preference Shares,

each ten (10) of which may be consolidated and redesignated into one (1) ordinary share in the capital of the Company. The consolidation and redesignation of the Series A Preference Shares would result in an additional 35,215,079 ordinary

shares outstanding, resulting in substantial dilution to shareholders who held our ordinary shares or Ordinary ADSs representing such ordinary shares prior to the private placement. Although the Series A Preference Shares do not have voting rights,

in general, upon consolidation and redesignation into ordinary shares some of the investors in the private placement could then have significant influence over the outcome of any shareholder vote, including the election of directors and the approval

of mergers or other business combination transactions.

Pursuant to the securities subscription agreement that we entered into with the

investors in the private placement, we agreed to file with the SEC the registration statement of which this prospectus forms a part to register the resale of the Series A Preference Shares represented by Preference ADSs issued in the private

placement and the ordinary shares issuable upon the consolidation and consolidation and redesignation of such Series A Preference Shares. Upon such registration and subsequent consolidation and redesignation, these securities will become generally

available for immediate resale in the public market. The market price of our ordinary shares could fall as a result of an increase in the number of shares available for sale in the public market.

If we do not obtain and maintain effectiveness of the registration statement, we will be required to pay certain liquidated damages,

which could be material in amount.

Pursuant to the terms of the securities subscription agreement, we have agreed to pay

liquidated damages to the investors in the private placement if (a) the registration statement of which this prospectus forms a part is not declared effective within 90 days after the closing of the private placement, if the SEC does not review

the registration statement, (b) the registration statement is not declared effective within 120 days after the closing of the private placement, if the SEC reviews the registration statement or (c) after effectiveness and subject to

certain specified exceptions, we suspend the use of the registration statement or the registration statement ceases to remain continuously effective as to all the securities for which it is required to be effective. We refer to each of these events

as a registration default. Subject to the specified exceptions, for each 30-day period or portion thereof during which a registration default remains uncured, we are obligated to pay liquidated damages to each investor in cash in an amount equal to

1% of the aggregate subscription price paid by each such investor in the private placement, up to a maximum of 8% of such aggregate subscription price. These amounts could be material, and any liquidated damages we are required to pay could have a

material adverse effect on our financial condition.

4

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into it contain forward-looking statements. Forward-looking statements relate to

future events or our future financial performance. We generally identify forward-looking statements by terminology such as “may,” “would,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “assume,” “intend,” “potential,”

“continue” or other similar words or the negative of these terms. These statements are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial

trends that we believe may affect our business, financial condition and results of operations. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in “Risk

Factors” and in our periodic filings with the SEC, incorporated by reference or included in this prospectus or any prospectus supplement. Accordingly, you should not place undue reliance upon these forward-looking statements. We cannot assure

you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, the timing of events and circumstances and actual results could differ materially from those projected in the forward-looking statements.

Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

| |

• |

|

our ability to generate revenue and otherwise maintain sufficient cash and other liquid resources to meet our operating and any debt service requirements; |

| |

• |

|

the success of our current and future research and development activities and clinical trials, including the timing and nature of any interim or final results of such trials; |

| |

• |

|

decisions by regulatory authorities regarding whether and when to approve our drug applications, as well as their decisions regarding labeling and other matters that could affect the commercial potential of our

products; |

| |

• |

|

the speed with which regulatory authorizations, pricing approvals and product launches may be achieved; |

| |

• |

|

whether we can execute on our existing strategic collaborations with respect to our products or product candidates; |

| |

• |

|

whether and when we will be able to enter into and consummate strategic collaborations with respect to our products or product candidates on acceptable terms; |

| |

• |

|

the success with which developed products may be commercialized and otherwise accepted by our approved markets; |

| |

• |

|

competitive developments affecting our products or product candidates, including generic and branded competition; |

| |

• |

|

the effect of possible domestic and foreign legislation or regulatory action affecting, among other things, pharmaceutical pricing and reimbursement, including under Medicaid and Medicare in the United States, and

involuntary approval of prescription medicines for over-the-counter use and the trend toward managed care and health care cost containment; |

| |

• |

|

our reliance on third party manufacturers and suppliers; |

| |

• |

|

our ability to protect our patents and other intellectual property; |

| |

• |

|

claims and concerns that may arise regarding the safety or efficacy of our products or product candidates; |

| |

• |

|

governmental laws and regulations affecting our operations, including those affecting taxation; and |

| |

• |

|

growth in costs and expenses. |

The forward-looking statements made or incorporated by

reference in this prospectus relate only to events as of the date on which the statements are made. We have included important factors in the cautionary statements included in this prospectus and incorporated herein by reference, including under the

caption entitled “Risk Factors” that we believe could cause actual results or events to differ materially from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or investments we may make. Except as required by law, we do not assume any intent to update any forward-looking statements after the date on which the statement is made, whether as a result of new

information, future events or circumstances or otherwise.

5

USE OF PROCEEDS

This prospectus relates to the securities that may be offered and sold from time to time by the selling shareholders who will receive all of

the proceeds from any sale of the securities. We will not receive any of the proceeds from any sales of the securities by the selling shareholders. However, we will pay certain registration expenses, including filing fees, listing fees, printing

expenses and fees of our counsel and other advisers.

RATIO OF EARNINGS TO FIXED CHARGES AND PREFERENCE

DIVIDENDS

The following table sets forth our historical consolidated ratio of earnings to fixed charges for the periods shown. As of

the date of this prospectus, we did not declare or pay any dividends on preference shares for the periods indicated. Therefore, the ratios of earnings to combined fixed charges and preference share dividends are the same as the ratios of earnings to

fixed charges presented below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

| Ratio of earnings to fixed charges (1) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| (1) |

Earnings were not sufficient to cover fixed charges. The dollar amount of the coverage deficiency for the years ended December 31, 2010, 2011, 2012, 2013 and 2014 was $250.1 million, $66.6 million, $170.1 million,

$169.4 million and $59.2 million, respectively. |

SELLING SHAREHOLDERS

In March 2015, we completed the private placement of Preference ADSs representing 352,150,790 of our Series A Preference Shares, which may be

consolidated and redesignated, upon certain conditions, as 35,215,079 of our ordinary shares at a rate of ten (10) Series A Preference Shares for one (1) ordinary share. This prospectus covers the possible resale by the selling

shareholders of any or all of the Series A Preference Shares represented by Preference ADSs issued and allotted in the private placement and the ordinary shares that will be created upon the consolidation and redesignation of such Series A

Preference Shares and the Ordinary ADSs representing such ordinary shares.

The table below, including the footnotes, lists the selling

shareholders and other information regarding the ownership of shares held by each of the selling shareholders based in part on information provided to us by the selling shareholders. Such information is as of March 31, 2015. The percentages of

shares owned after the offering are based on 176,960,199 ordinary shares outstanding, including 176,228,632 Ordinary ADSs representing such ordinary shares outstanding prior to the private placement, and include the maximum of 35,215,079 ordinary

shares to be created by the consolidation and redesignation of all of the Series A Preference Shares (on an as-if-consolidated-and-redesignated basis), for a total denominator of 212,175,278 ordinary shares.

The following table assumes that the selling shareholders will sell all of the ordinary shares and/or Series A Preference Shares offered by

them in this offering. However, the selling shareholders may offer all or some portion of our Series A Preference Shares, or any ordinary shares created by the consolidation and redesignation of the Series A Preference Shares to be held by them.

Accordingly, no estimate can be given as to the amount or percentage of our ordinary shares or Ordinary ADSs representing such ordinary shares that will be held by the selling shareholders upon termination of sales pursuant to this prospectus. In

addition, the selling shareholders identified below may have sold, transferred or disposed of all or a portion of their shares since the date on which they provided the information regarding their holdings in transactions exempt from the

registration requirements of the Securities Act. We do not know how long any of the selling shareholders will hold shares before selling them. Information concerning the selling shareholders may change from time to time. We will provide changed

information in a supplement to this prospectus if and when necessary and required. The term “selling shareholder” includes the shareholders listed below and their respective transferees, assignees, pledges, donees and other successors.

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of Selling Shareholder |

|

Ordinary

Shares/ADSs

Owned Prior

to Offering(1) |

|

|

Ordinary

Shares

Offered (1) |

|

|

Ordinary

Shares/ADSs

Owned

After Offering |

|

|

Percentage (2) |

|

| Baker Brothers Life Sciences, L.P.(3) |

|

|

28,822,047 |

|

|

|

26,792,186 |

|

|

|

2,029,861 |

|

|

|

* |

|

| 667, L.P.(4) |

|

|

2,315,409 |

|

|

|

2,139,560 |

|

|

|

175,849 |

|

|

|

* |

|

| Stonepine Capital, LP(5) |

|

|

8,406,440 |

|

|

|

3,750,000 |

|

|

|

4,656,440 |

|

|

|

2.19 |

|

| Broadfin Healthcare Master Fund(6) |

|

|

2,533,330 |

|

|

|

2,533,330 |

|

|

|

0 |

|

|

|

* |

|

| (1) |

Includes the maximum number of ordinary shares to be created by the consolidation and redesignation of all of the Series A Preference Shares (on an as-if-consolidated-and-redesignated basis) held by each selling

shareholder. |

| (2) |

Based on 176,960,199 shares of our ordinary shares or Ordinary ADSs representing such ordinary shares outstanding prior to the private placement, and including the maximum of 35,215,079 ordinary shares to be created by

the consolidation and redesignation of all of the Series A Preference Shares (on an as-if-consolidated-and-redesignated basis), for a total denominator of 212,175,278 ordinary shares. |

| (3) |

Baker Bros. Advisors LP is the investment adviser to Baker Brothers Life Sciences, L.P. (“BBLS”) and has voting and investment power over the shares directly held by BBLS. Julian C. Baker and Felix J. Baker

are the managing partners of Baker Bros. Advisors LP and may be deemed to be beneficial owners of securities of the Issuer directly held by the Funds, and may be deemed to have the power to vote or direct the vote of and the power to dispose or

direct the disposition of such securities. Baker Bros. Advisors LP, Julian C. Baker and Felix J. Baker disclaim beneficial ownership of the securities held directly by BBLS, except to the extent of their pecuniary interest. |

| (4) |

Baker Bros. Advisors LP is the investment adviser to 667, L.P. (“667”) and has voting and investment power over the shares directly held by 667. Julian C. Baker and Felix J. Baker are the managing partners of

Baker Bros. Advisors LP and may be deemed to be beneficial owners of securities of the Issuer directly held by 667 and may be deemed to have the power to vote or direct the vote of and the power to dispose or direct the disposition of such

securities. Baker Bros. Advisors LP, Julian C. Baker and Felix J. Baker disclaim beneficial ownership of the securities held directly by 667, except to the extent of their pecuniary interest. |

| (5) |

Stonepine Capital Management, LLC is the general manager of Stonepine Capital, L.P. Jon M. Plexico and Timothy P. Lynch, the managing members of Stonepine Capital Management, LLC, have voting and dispositive authority

over any shares held by Stonepine Capital, L.P. and disclaim beneficial ownership of such shares, except to the extent of their pecuniary interest therein. |

| (6) |

Broadfin Capital, LLC serves as investment adviser to Broadfin Healthcare Master Fund, LTD with the power to direct investments and/or sole power to vote the shares owned by Broadfin Healthcare Master Fund, LTD. Kevin

Kotler, a natural person, is the Managing Member of Broadfin Capital, LLC. Mr. Kotler has voting and dispositive power over the shares held by Broadfin Healthcare Master Fund, LTD. Mr. Kotler disclaims beneficial ownership of all shares beneficially

owned, except to the extent of his pecuniary interests in such shares. |

Relationships with Selling Shareholders

Except as described below, none of the selling shareholders has held any position or office with us or our affiliates within the last three

years or has had a material relationship with us or any of our predecessors or affiliates within the past three years.

DESCRIPTION OF SECURITIES

The selling shareholders may offer our ordinary shares, each of which may be represented by one

Ordinary ADS, or Series A Preference Shares, each ten (10) of which may be consolidated and redesignated into one (1) ordinary share, each one of which may be represented by one Preference ADS, from time to time under this prospectus in

the manner set forth in the manner set forth under “Plan of Distribution” below.

In the following summary, a

“shareholder” is the person registered in our register of members as the holder of the relevant securities, including ordinary shares that have been deposited in our Ordinary ADS facility with the Depositary and Series A Preference Shares

that have been deposited in our Preference ADS facility with the Depositary.

Description of Ordinary Shares

Dividends

Holders

of ordinary shares are entitled to receive such dividends as may be declared by the board of directors. All dividends are declared and paid according to the amounts paid up on the ordinary shares in respect of which the dividend is paid. To date

there have been no dividends paid to holders of ordinary shares.

Any dividend unclaimed after a period of twelve years from the date of

declaration of such dividend shall be forfeited and shall revert to us. In addition, the payment by the board of directors of any unclaimed dividend, interest or other sum payable on or in respect of an ordinary share into a separate account shall

not constitute us as a trustee in respect thereof.

Rights in a Liquidation

Holders of ordinary shares are entitled to participate in any distribution of assets upon a liquidation, subject to prior satisfaction of the

claims of creditors and preferential payments to holders of outstanding preference shares.

7

Voting Rights

Voting at any general meeting of ordinary shareholders is by a show of hands, unless a poll is demanded. A poll may be demanded by:

| |

• |

|

the chairman of the meeting; |

| |

• |

|

at least two shareholders entitled to vote at the meeting; |

| |

• |

|

any shareholder or shareholders representing in the aggregate not less than one-tenth of the total voting rights of all shareholders entitled to vote at the meeting; or |

| |

• |

|

any shareholder or shareholders holding shares conferring a right to vote at the meeting on which there have been paid up sums in the aggregate equal to not less than one-tenth of the total sum paid up on all the shares

conferring that right. |

In a vote by a show of hands, every shareholder who is present in person or by proxy at a general

meeting has one vote. In a vote on a poll, every shareholder who is present in person or by proxy shall have one vote for every share of which they are registered as the holder (provided that no shareholder shall have more than one vote on a show of

hands notwithstanding that he may have appointed more than one proxy to vote on his behalf). The quorum for a shareholders’ meeting is a minimum of two persons, present in person or by proxy. To the extent the Articles of Association provide

for a vote by a show of hands in which each shareholder has one vote, this differs from U.S. law, under which each shareholder typically is entitled to one vote per share at all meetings.

Unless otherwise required by law or the Articles of Association, voting in a general meeting is by ordinary resolution. An ordinary resolution

is approved by a majority vote of the shareholders present at a meeting at which there is a quorum. Examples of matters that can be approved by an ordinary resolution include:

| |

• |

|

the election of directors; |

| |

• |

|

the approval of financial statements; |

| |

• |

|

the declaration of final dividends; |

| |

• |

|

the appointment of auditors; or |

| |

• |

|

the grant of authority to issue shares. |

A special resolution requires the affirmative vote of

not less than three-fourths of the eligible votes. Examples of matters that must be approved by a special resolution include modifications to the rights of any class of shares, certain changes to the Articles of Association, or our winding-up.

Capital Calls

The

board of directors has the authority to make calls upon the shareholders in respect of any money unpaid on their shares and each shareholder shall pay to us as required by such notice the amount called on his shares. If a call remains unpaid after

it has become due and payable, and the fourteen days’ notice provided by the board of directors has not been complied with, any share in respect of which such notice was given may be forfeited by a resolution of the board.

Limitations on Ownership

Under English law and the Articles of Association, there are no limitations on the right of nonresidents of the United Kingdom or owners who

are not citizens of the United Kingdom to hold or vote our ordinary shares.

Description of the Series A Preference Shares

The material terms and provisions of the Series A Preference Shares, each of which are represented by the Preference ADSs and each ten

(10) of which may be consolidated and redesignated as one ordinary share represented by one Ordinary ADS, are summarized below. The following description is subject to, and qualified in its entirety by, the Series A Preference Share Terms,

which has been filed as an exhibit to the registration statement of which this prospectus forms a part. You should review a copy of the Series A Preference Share Terms for a complete description of the powers, preferences, rights, qualifications,

limitations and restrictions applicable to the Series A Preference Shares.

8

General

Our board of directors has the authority under the articles of association of the Company, without further action by shareholders, to issue

preference shares, par value £0.05 per share, in one or more series and to fix the rights, preferences, privileges, qualifications and restrictions granted to or imposed upon the preference shares, including dividend rights, conversion

rights, voting rights, rights and terms of redemption, and liquidation preference, any or all of which may be greater than the rights of the ordinary shares. Our board of directors has issued a series of preference shares designated as our Series A

Convertible Preference Shares with the rights and subject to the restrictions and limitations described in the Series A Preference Share Terms.

Rank

The Series A

Preference Shares will rank:

| |

• |

|

senior to our ordinary shares; |

| |

• |

|

senior to any class or series of our capital stock hereafter created specifically ranking by its terms junior to the Series A Preference Shares; |

| |

• |

|

on parity with our Series A Preference Shares and any class or series of our capital stock hereafter created specifically ranking by its terms on parity with the Series A Preference Shares; and |

| |

• |

|

junior to any class or series of our capital stock hereafter created specifically ranking by its terms senior to the Series A Preference Shares, |

in each case, as to dividends or distributions of assets upon our liquidation, dissolution or winding up whether voluntarily or involuntarily.

Consolidation and Redesignation

Each ten (10) Series A Preference Shares may be consolidated and redesignated into one ordinary share (subject to adjustment as

provided in the Series A Preference Share Terms) at any time at the option of the holder, except that the securities subscription agreement pursuant to which the Preference ADSs were initially issued provides that a holder will be prohibited from

consolidating and redesignating Series A Preference Shares into ordinary shares if, as a result of such consolidation, such holder, together with its affiliates, would beneficially own more than 4.99% of the total number of our ordinary shares then

issued and outstanding, which limitation we refer to as the Beneficial Ownership Limitation. By written notice to the Company, a holder may from time to time increase or decrease the Beneficial Ownership Limitation to any other percentage not in

excess of 19.9% specified in such notice; provided that any such increase will not be effective until the sixty-first (61st) day after such notice is delivered to the Company.

Liquidation Preference

In the event of our liquidation, dissolution or winding up, holders of Series A Preference Shares will receive a payment equal to $0.001 per

Series A Preference Share before any proceeds are distributed to the holders of our ordinary shares. After the payment of this preferential amount, and subject to the rights of holders of any class or series of our capital stock hereafter created

specifically ranking by its terms senior to the Series A Preference Shares, holders of Series A Preference Shares will participate ratably in the distribution of any remaining assets with the ordinary shares and any other class or series of our

capital stock hereafter created that participates with the ordinary shares in such distributions.

Voting Rights

Series A Preference Shares will generally have no voting rights, except as required by law and except that the consent of holders of

seventy-five percent (75%) of the outstanding Series A Preference Shares will be required to amend the terms of the Series A Preference Shares or the Series A Preference Share Terms.

Dividends

Holders

of Series A Preference Shares are entitled to receive, and we are required to pay, dividends on the Series A Preference Shares equal (on an as-if-consolidated-and-redesignated-to-ordinary shares basis) to and in the same form as dividends (other

than dividends in the form of ordinary shares) actually paid on the ordinary shares when, as and if such dividends (other than dividends in the form of ordinary shares) are paid on the ordinary shares.

9

Redemption

We are not obligated to redeem or repurchase any Series A Preference Shares. Series A Preference Shares are not otherwise entitled to any

redemption rights, or mandatory sinking fund or analogous fund provisions.

Listing

There is no established public trading market for the Series A Preference Shares, and we do not expect such a market to develop. In addition,

we do not intend to apply for listing of the Series A Preference Shares on any national securities exchange or trading system.

Fundamental Transactions

If, at any time that Series A Preference Shares are outstanding, we effect a merger or other change of control transaction, as described in the

certificate of designation and referred to as a fundamental transaction, then a holder will have the right to receive, upon any subsequent consolidation and redesignation of Series A Preference Shares (in lieu of ordinary shares) for each issuable

ordinary share, the same kind and amount of securities, cash or property as such holder would have been entitled to receive upon the occurrence of such fundamental transaction if such holder had been, immediately prior to such fundamental

transaction, the holder of one (1) ordinary shares for each ten (10) Series A Preference Shares held by such holder at such time.

Description of American Depositary Shares

The Depositary is the depositary bank for our currently registered Ordinary ADSs and has agreed to act as the depositary bank for Preference

ADSs, under the Preference Deposit Agreement. The Depositary’s offices are located at 388 Greenwich Street, New York, New York 10013. Ordinary ADSs and Preference ADSs are American Depositary Shares and represent ownership interests in

securities that are on deposit with the Depositary. American Depositary Shares may be represented by certificates that are commonly known as “American Depositary Receipts” or “ADRs.” The Depositary typically appoints a custodian

to safekeep the securities on deposit. In this case, the custodian is Citibank, N.A., London Branch, having its principal office at Citigroup Centre, Canada Square, Canary Wharf, London E14 5LB, England.

We have appointed Citibank as the Depositary for the Ordinary ADSs pursuant to an amended and restated deposit agreement dated as of

November 4, 2011 and for the Preference ADSs pursuant to the Preference Deposit Agreement. A copy of the deposit agreement governing the Ordinary ADSs is on file with the SEC under cover of a Registration Statement on Form F-6 filed on

September 16, 2011 and the Preference Deposit Agreement is on file with the SEC as an exhibit to our Current Report on Form 8-K filed on March 30, 2015. You may obtain a copy of the deposit agreement and/or Preference Deposit Agreement

from the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 and from the SEC’s website (www.sec.gov).

We

are providing you with a summary description of the material terms of the Ordinary ADSs and the Preference ADSs, which we will collectively refer to as ADSs herein when no distinction between the two is required, and of your material rights as an

owner of ADSs. Please remember that summaries by their nature lack the precision of the information summarized and that the rights and obligations of an owner of ADSs will be determined by reference to the terms of the deposit agreement or the

Preference Deposit Agreement, as applicable, and not by this summary. We urge you to review both the deposit agreement and the Preference Deposit Agreement in their entirety.

Each Ordinary ADS represents the right to receive one ordinary share on deposit with the custodian and each Preference ADS represents the

right to receive one Series A Preference Share on deposit with the custodian. An ADS also represents the right to receive any other property received by the Depositary or the custodian on behalf of the owner of the ADS but that has not been

distributed to the owners of ADSs because of legal restrictions or practical considerations. The custodian, the Depositary and their respective nominees will hold all deposited property for the benefit of the holders and beneficial owners of ADSs.

The deposited property does not constitute the proprietary assets of the Depositary, the custodian or their nominees. Beneficial ownership in the deposited property will under the terms of the deposit agreement and the Preference Deposit Agreement

be vested in the beneficial owners of the ADSs. The Depositary, the custodian and their respective nominees will be the record holders of the deposited property represented by the ADSs for the benefit of the holders and beneficial owners of the

corresponding ADSs. Owners of ADSs will be able to exercise beneficial ownership interests in the deposited property only through the registered holders of the ADSs, by the registered holders of the ADSs (on behalf of the applicable ADS owners) only

through the Depositary, and by the Depositary (on behalf of the owners of the corresponding ADSs) directly, or indirectly through the custodian or their respective nominees, in each case upon the terms of the deposit agreement or the Preference

Deposit Agreement, as applicable.

10

If you become an owner of ADSs, you will become a party to the deposit agreement and/or the

Preference Deposit Agreement, as applicable, and therefore will be bound to their respective terms and to the terms of any ADR that represents your ADSs. The deposit agreement and/or the Preference Deposit Agreement and the ADR specify our rights

and obligations as well as your rights and obligations as owner of ADSs and those of the Depositary. As an ADS holder you appoint the Depositary to act on your behalf in certain circumstances. The deposit agreement, the Preference Deposit Agreement

and the ADRs are governed by New York law. However, our obligations to the holders of ordinary shares and the Series A Preference Shares will continue to be governed by the laws of England and Wales, which may be different from the laws in the

United States.

As an owner of Ordinary ADSs, you may hold your Ordinary ADSs either by means of an ADR registered in your name, through a

brokerage or safekeeping account, or through an account established by the Depositary in your name reflecting the registration of uncertificated ADSs directly on the books of the Depositary (commonly referred to as the “direct registration

system” or “DRS”). Preference ADSs can only be held by means of an ADR registered in your name. The direct registration system reflects the uncertificated (book-entry) registration of ownership of Ordinary ADSs by the Depositary.

Under the direct registration system, ownership of Ordinary ADSs is evidenced by periodic statements issued by the Depositary to the holders of the Ordinary ADSs. The direct registration system includes automated transfers between the Depositary and

The Depository Trust Company (“DTC”), the central book-entry clearing and settlement system for equity securities in the United States. If you decide to hold your Ordinary ADSs through your brokerage or safekeeping account,

you must rely on the procedures of your broker or bank to assert your rights as an Ordinary ADS owner. Banks and brokers typically hold securities such as the Ordinary ADSs through clearing and settlement systems such as DTC. The procedures of such

clearing and settlement systems may limit your ability to exercise your rights as an owner of Ordinary ADSs. Please consult with your broker or bank if you have any questions concerning these limitations and procedures. All Ordinary ADSs held

through DTC will be registered in the name of a nominee of DTC. This summary description assumes you have opted to own the Ordinary ADSs directly by means of an Ordinary ADS registered in your name and, as such, we will refer to you as the

“holder.” When we refer to “you,” we assume the reader owns ADSs and will own ADSs at the relevant time.

Dividends and Distributions

As a holder of ADSs, you generally have the right to receive the distributions we make on the securities deposited with the custodian. Your

receipt of these distributions may be limited, however, by practical considerations and legal limitations. Holders of ADSs will receive such distributions under the terms of the deposit agreement or Preference Deposit Agreement, as applicable, in

proportion to the number of ADSs held as of a specified record date, after deduction of applicable fees, taxes and expenses.

Distributions of Cash

Whenever we make a cash distribution for the securities on deposit with the custodian, we will deposit the funds with the custodian. Upon

receipt of confirmation of the deposit of the requisite funds, the Depositary will arrange for the funds to be converted into U.S. dollars and for the distribution of the U.S. dollars to the holders, subject to English laws and regulations.

The conversion into U.S. dollars will take place only if practicable and if the U.S. dollars are transferable to the United States. The

Depositary will apply the same method for distributing the proceeds of the sale of any property (such as undistributed rights) held by the custodian in respect of securities on deposit.

The distribution of cash will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the

deposit agreement or the Preference Deposit Agreement, as applicable. The Depositary will hold any cash amounts it is unable to distribute in a non-interest bearing account for the benefit of the applicable holders and beneficial owners of ADSs

until the distribution can be effected or the funds that the Depositary holds must be escheated as unclaimed property in accordance with the laws of the relevant states of the United States.

11

Distributions of Shares

Whenever we make a free distribution of shares for the securities on deposit with the custodian, we will deposit the applicable number of

shares with the custodian. Upon receipt of confirmation of such deposit, the Depositary will either distribute to holders new ADSs representing the ordinary shares deposited or modify the ADS-to-shares ratio, in which case each ADS you

hold will represent rights and interests in the additional ordinary shares so deposited. Only whole new ADSs will be distributed. Fractional entitlements will be sold and the proceeds of such sale will be distributed as in the case of a cash

distribution.

The distribution of new ADSs or the modification of the ADS-to-ordinary shares ratio upon a distribution of ordinary shares

will be made net of the fees, expenses, taxes and governmental charges payable by holders under the terms of the deposit agreement or the Preference Deposit Agreement, as applicable. In order to pay such taxes or governmental charges, the Depositary

may sell all or a portion of the new ordinary shares so distributed.

No such distribution of new ADSs will be made if it would violate a

law (i.e., the U.S. securities laws) or if it is not operationally practicable. If the Depositary does not distribute new ADSs as described above, it may sell the shares received upon the terms described in the deposit agreement or the

Preference Deposit Agreement, as applicable and will distribute the proceeds of the sale as in the case of a distribution of cash.

Distributions of Rights

Whenever we intend to distribute rights to purchase additional ordinary shares, we will give prior notice to the Depositary and we will assist

the Depositary in determining whether it is lawful and reasonably practicable to distribute rights to purchase additional ADSs to holders.

The Depositary will establish procedures to distribute rights to purchase additional ADSs to holders and to enable such holders to exercise

such rights if it is lawful and reasonably practicable to make the rights available to holders of ADSs, and if we provide all of the documentation contemplated in the deposit agreement or the Preference Deposit Agreement, as applicable (such as

opinions to address the lawfulness of the transaction). You may have to pay fees, expenses, taxes and other governmental charges to subscribe for the new ADSs upon the exercise of your rights. The Depositary is not obligated to establish procedures

to facilitate the distribution and exercise by holders of rights to purchase new ordinary shares other than in the form of ADSs.

The

Depositary will not distribute the rights to you if:

| |

• |

|

We do not timely request that the rights be distributed to you or we request that the rights not be distributed to you; or |

| |

• |

|

We fail to deliver satisfactory documents to the Depositary; or |

| |

• |

|

It is not reasonably practicable to distribute the rights. |

The Depositary will sell the

rights that are not exercised or not distributed if such sale is lawful and reasonably practicable. The proceeds of such sale will be distributed to holders as in the case of a cash distribution. If the Depositary is unable to sell the rights, it

will allow the rights to lapse.

Elective Distributions

Whenever we intend to distribute a dividend payable at the election of shareholders either in cash or in additional shares, we will give prior

notice thereof to the Depositary and will indicate whether we wish the elective distribution to be made available to you. In such case, we will assist the Depositary in determining whether such distribution is lawful and reasonably practicable.

The Depositary will make the election available to you only if it is reasonably practicable and if we have provided all of the documentation

contemplated in the deposit agreement or the Preference Deposit Agreement, as applicable. In such case, the Depositary will establish procedures to enable you to elect to receive either cash or additional ADSs, in each case as described in the

deposit agreement or the Preference Deposit Agreement, as applicable.

If the election is not made available to you, you will receive

either cash or additional ADSs, depending on what a shareholder under English law would receive upon failing to make an election, as more fully described in the deposit agreement or the Preference Deposit Agreement, as applicable.

12

Other Distributions

Whenever we intend to distribute property other than cash, ordinary shares or rights to purchase additional ordinary shares, we will notify the

Depositary in advance and will indicate whether we wish such distribution to be made to you. If so, we will assist the Depositary in determining whether such distribution to holders is lawful and reasonably practicable.

If it is reasonably practicable to distribute such property to you and if we provide all of the documentation contemplated in the deposit

agreement or the Preference Deposit Agreement, as applicable, the Depositary will distribute the property to the holders in a manner it deems practicable.

The distribution will be made net of fees, expenses, taxes and governmental charges payable by holders under the terms of the deposit

agreement or the Preference Deposit Agreement, as applicable. In order to pay such taxes and governmental charges, the Depositary may sell all or a portion of the property received.

The Depositary will not distribute the property to you and will sell the property if:

| |

• |

|

We do not request that the property be distributed to you or if we ask that the property not be distributed to you; or |

| |

• |

|

We do not deliver satisfactory documents to the Depositary; or |

| |

• |

|

The Depositary determines that all or a portion of the distribution to you is not reasonably practicable. |

The

proceeds of such a sale will be distributed to holders as in the case of a cash distribution.

Redemption

Whenever we decide to redeem any of the securities on deposit with the custodian, we will notify the Depositary in advance. If it is

practicable and if we provide all of the documentation contemplated in the deposit agreement or the Preference Deposit Agreement, as applicable, the Depositary will provide notice of the redemption to the holders.

The custodian will be instructed to surrender the shares being redeemed against payment of the applicable redemption price. The Depositary

will convert the redemption funds received into U.S. dollars upon the terms of the deposit agreement or the Preference Deposit Agreement, as applicable and will establish procedures to enable holders to receive the net proceeds from the redemption

upon surrender of their ADSs to the Depositary. You may have to pay fees, expenses, taxes and other governmental charges upon the redemption of your ADSs. If less than all ADSs are being redeemed, the ADSs to be retired will be selected by lot or on

a pro rata basis, as the Depositary may determine.

Changes Affecting Shares

The shares held on deposit for your ADSs may change from time to time. For example, there may be a change in nominal or par value, a split-up,

cancellation, consolidation or reclassification of such shares or a recapitalization, reorganization, merger, consolidation or sale of assets.

If any such change were to occur, your ADSs would, to the extent permitted by law, represent the right to receive the property received or

exchanged in respect of the new shares held on deposit. The Depositary may in such circumstances deliver new ADSs to you, amend the deposit agreement or Preference Deposit Agreement, the ADRs and the applicable Registration Statement(s) on Form F-6,

call for the exchange of your existing ADSs for new ADSs and take any other actions that are appropriate to reflect as to the ADSs the change affecting the shares. If the Depositary may not lawfully distribute such property to you, the Depositary

may sell such property and distribute the net proceeds to you as in the case of a cash distribution.

Issuance of ADSs upon Issuance

or Deposit of Securities

After the closing of this offer, the Depositary may create ADSs on your behalf if you or your broker

either deposit ordinary shares or Series A Preference Shares with the custodian or request that your Series A Preference Shares represented by Preference ADSs be consolidated and redesigned as ordinary shares to be represented by Ordinary ADSs. The

Depositary will deliver these ADSs only after you pay any applicable issuance fees and any charges and taxes payable to the custodian. Your ability to receive ADSs may be limited by U.S. and U.K. legal considerations applicable at the time of

deposit.

The issuance of ADSs may be delayed until the Depositary or the custodian receives confirmation that all required approvals have

been given and that the ordinary shares or Series A Preference Shares, as applicable, have been duly credited to the custodian. The Depositary will only issue ADSs in whole numbers.

13

When you make a deposit of ordinary shares or Series A Preference Shares or request consolidation

and redesignation of Series A Preference Shares into ordinary shares you will be responsible for transferring good and valid title to the Depositary. As such, you will be deemed to represent and warrant that:

| |

• |

|

The securities are duly authorized, validly issued, fully paid, non-assessable and legally obtained. |

| |

• |

|

All preemptive (and similar) rights, if any, with respect to such securities have been validly waived or exercised. |

| |

• |

|

You are duly authorized to request consolidation and redesignation of Series A Preference Shares into ordinary shares or deposit the ordinary shares, as applicable. |

| |

• |

|

The securities are free and clear of any lien, encumbrance, security interest, charge, mortgage or adverse claim, and the ADSs issuable upon such consolidation and redesignation or deposit will not be, “restricted

securities” (as defined in the deposit agreement and Preference Deposit Agreement, as applicable). |

| |

• |

|

The securities presented for deposit have not been stripped of any rights or entitlements. |

If any of the

representations or warranties are incorrect in any way, we and the Depositary may, at your cost and expense, take any and all actions necessary to correct the consequences of the misrepresentations.

Transfer, Combination and Split Up of ADRs

As an ADR holder, you will be entitled to transfer, combine or split up your ADRs and the ADSs evidenced thereby. For transfers of ADRs, you

will have to surrender the ADRs to be transferred to the Depositary and also must:

| |

• |

|

ensure that the surrendered ADR is properly endorsed or otherwise in proper form for transfer; |

| |

• |

|

provide such proof of identity and genuineness of signatures as the Depositary deems appropriate; |

| |

• |

|

provide any transfer stamps required by the State of New York or the United States; and |

| |

• |

|

pay all applicable fees, charges, expenses, taxes and other government charges payable by ADR holders pursuant to the terms of the deposit agreement, upon the transfer of ADRs. |

To have your ADRs either combined or split up, you must surrender the ADRs in question to the Depositary with your request to have them combined or split up,

and you must pay all applicable fees, charges and expenses payable by ADR holders, pursuant to the terms of the deposit agreement, upon a combination or split up of ADRs.

Withdrawal of Shares Upon Cancellation of ADSs

As an ADS holder, you will be entitled to present your ADSs to the Depositary for cancellation and then receive the corresponding number of

underlying ordinary shares or Series A Preference Shares at the custodian’s offices. Your ability to withdraw the ordinary shares or Series A Preference Shares may be limited by U.S. and U.K. legal considerations applicable at the time of

withdrawal. In order to withdraw the ordinary shares or Series A Preference Shares represented by your ADSs, you will be required to pay to the Depositary the fees for cancellation of ADSs and any charges and taxes payable upon the transfer of the

ordinary shares being withdrawn. You assume the risk for delivery of all funds and securities upon withdrawal. Once canceled, the ADSs will not have any rights under the deposit agreement or Preference Deposit Agreement, as applicable.

If you hold ADSs registered in your name, the Depositary may ask you to provide proof of identity and genuineness of any signature and such

other documents as the Depositary may deem appropriate before it will cancel your ADSs. The withdrawal of the shares represented by your ADSs may be delayed until the Depositary receives satisfactory evidence of compliance with all applicable laws

and regulations. Please keep in mind that the Depositary will only accept ADSs for cancellation that represent a whole number of securities on deposit.

You will have the right to withdraw the securities represented by your ADSs at any time except for:

| |

• |

|

Temporary delays that may arise because (i) the transfer books for the ordinary shares, Series A Preference Shares or ADSs are closed, or (ii) shares are immobilized on account of a shareholders’ meeting

or a payment of dividends. |

| |

• |

|

Obligations to pay fees, taxes and similar charges. |

14

| |

• |

|

Restrictions imposed because of laws or regulations applicable to ADSs or the withdrawal of securities on deposit. |

The deposit agreement or Preference Deposit Agreement, as applicable, may not be modified to impair your right to withdraw the securities

represented by your ADSs except to comply with mandatory provisions of law.

Voting Rights

As a holder of ADSs, you generally have the right under the deposit agreement or Preference Deposit Agreement to instruct the Depositary to

exercise the voting rights for the ordinary shares or Series A Preference Shares represented by your ADSs. The voting rights of holders of ordinary shares are described under the heading “Description of Securities–Description of Ordinary

Shares” in this prospectus and the voting rights of holders of Series A Preference Shares are described under the heading “Description of Securities–Description of Series A Preference Shares”.

At our request, the Depositary will distribute to you any notice of shareholders’ meeting received from us together with information

explaining how to instruct the Depositary to exercise the voting rights of the securities represented by ADSs.

If the Depositary timely

receives voting instructions from a holder of ADSs, it will endeavor to vote the securities (in person or by proxy) represented by the holder’s ADSs in accordance with such voting instructions.

Please note that the ability of the Depositary to carry out voting instructions may be limited by practical and legal limitations and the

terms of the securities on deposit. We cannot assure you that you will receive voting materials in time to enable you to return voting instructions to the Depositary in a timely manner. Securities for which no voting instructions have been received

will not be voted.

Fees and Charges

As an ADS holder, you will be required to pay the following service fees to the Depositary:

|

|

|

| Service |

|

Fees |

| • Issuance of ADSs upon deposit of Shares (excluding issuances as a result of distributions described in

the fourth paragraph below). |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) issued. |

|

|

| • Delivery of Deposited Securities against surrender of ADSs. |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) surrendered. |

|

|

| • Distribution of cash dividends or other cash distributions (i.e., sale of rights and other

entitlements). |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. |

|

|

| • Distribution of ADSs pursuant to (i) stock dividends or other free stock distributions, or

(ii) exercise of rights to purchase additional ADSs. |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. |

|

|

| • Distribution of securities other than ADSs or rights to purchase additional ADSs (i.e., spin-off

shares). |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held. |

|

|

| • Depositary Services. |

|

Up to U.S. $5.00 per 100 ADSs (or fraction thereof) held on the applicable record date(s) established by the Depositary. |

As an ADS holder you will also be responsible to pay certain fees and expenses incurred by the Depositary and

certain taxes and governmental charges such as:

| |

• |

|

Fees for the transfer and registration of shares charged by the registrar and transfer agent for the shares in England (i.e., upon deposit and withdrawal of ordinary shares). |

| |

• |

|

Expenses incurred for converting foreign currency into U.S. dollars. |

| |

• |

|

Expenses for cable, telex and fax transmissions and for delivery of securities. |

15

| |

• |

|

Taxes and duties upon the transfer of securities (i.e., when ordinary shares are deposited or withdrawn from deposit). |

| |

• |

|

Fees and expenses incurred in connection with the delivery or servicing of ordinary shares on deposit. |

Depositary fees payable upon the issuance and cancellation of ADSs are typically paid to the Depositary by the brokers (on behalf of their

clients) receiving the newly issued ADSs from the Depositary and by the brokers (on behalf of their clients) delivering the ADSs to the Depositary for cancellation. The brokers in turn charge these fees to their clients. Depositary fees payable in

connection with distributions of cash or securities to ADS holders and the depositary services fee are charged by the Depositary to the holders of record of ADSs as of the applicable ADS record date.

The Depositary fees payable for cash distributions are generally deducted from the cash being distributed. In the case of distributions other

than cash (i.e., stock dividend, rights), the Depositary charges the applicable fee to the ADS record date holders concurrent with the distribution. In the case of ADSs registered in the name of the investor (whether certificated or

uncertificated in direct registration), the Depositary sends invoices to the applicable record date ADS holders. In the case of Ordinary ADSs held in brokerage and custodian accounts (via DTC), the Depositary generally collects its fees through the

systems provided by DTC (whose nominee is the registered holder of the Ordinary ADSs held in DTC) from the brokers and custodians holding Ordinary ADSs in their DTC accounts. The brokers and custodians who hold their clients’ Ordinary ADSs in

DTC accounts in turn charge their clients’ accounts the amount of the fees paid to the Depositary.

In the event of refusal to pay

the depositary fees, the Depositary may, under the terms of the deposit agreement and/or the Preference Deposit Agreement, refuse the requested service until payment is received or may set off the amount of the depositary fees from any distribution

to be made to the ADS holder.