As filed with the Securities and Exchange Commission on November 10, 2014

Registration No. 333-199725

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 1

TO

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

CELLCEUTIX CORPORATION

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

30-0565645

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(IRS Employer Identification Number)

|

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 633-3623

(Address including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Leo Ehrlich, Chief Executive Officer

100 Cummings Center, Suite 151-B

Beverly, MA 01915

(978) 633-3623

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Clayton E. Parker, Esq.

Matthew L. Ogurick, Esq.

K&L Gates LLP

200 S. Biscayne Boulevard, Suite 3900

Miami, Florida 33131-2399

Telephone: (305) 539-3300

Facsimile: (305) 358-7095

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

¨ |

Accelerated filer

|

x |

|

Non-accelerated filer

|

¨ |

Smaller reporting company

|

¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

Cellceutix Corporation is filing this pre-effective Amendment No. 1 (this “Amendment”) to the Registration Statement on Form S-3 (Registration No. 333-199725) (the “Registration Statement”) as an exhibit-only filing to re-file Exhibit 5.1 previously filed with the Registration Statement. Accordingly, this Amendment consists only of the facing page, this explanatory note, Item 16 of Part II of the Registration Statement, the signature page to the Registration Statement, the exhibit index and the re-filed Exhibit 5.1. The remainder of the Registration Statement is unchanged and therefore has not been included in this Amendment.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

ITEM 16. EXHIBITS.

The exhibits to this registration statement are listed on the exhibit index, which appears elsewhere herein and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this pre-effective Amendment No. 1 to the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Beverly, State of Massachusetts, on November 10, 2014.

| |

CELLCEUTIX CORPORATION

|

|

| |

|

|

|

| |

By:

|

/s/ Leo Ehrlich

|

|

| |

Name:

|

Leo Ehrlich

|

|

| |

Title:

|

Chief Executive Officer, Chief Financial Officer,Chairman of the Board, Principal Executive Officer, and Principal Accounting Officer

|

|

Pursuant to the requirements of the Securities Act of 1933, this pre-effective Amendment No. 1 to the Registration Statement has been signed by the following persons in the capacities and on the dates indicated below:

|

Signatures

|

|

Title(s)

|

|

Date

|

| |

|

|

|

/s/ Leo Ehrlich

|

|

Chief Executive Officer, Chief Financial Officer, Chairman of the Board, Principal Executive Officer and Principal Financial and Accounting Officer

|

|

November 10, 2014

|

|

Leo Ehrlich

|

|

|

|

| |

|

|

|

/s/ Krishna Menon

|

|

President and Director

|

|

November 10, 2014

|

|

Krishna Menon

|

|

|

|

EXHIBIT INDEX

ITEM 16. EXHIBITS

(a) Exhibit index

(1) The documents set forth below are filed herewith or incorporated herein by reference to the location indicated.

|

Exhibit No.

|

|

Description

|

|

Location

|

| |

|

|

|

|

|

2.1

|

|

Agreement and Plan of Share Exchange, by and among EconoShare, Inc., Cellceutix Pharma, Inc., and the Shareholders of Cellceutix Pharma, Inc. dated as of December 6, 2007

|

|

Exhibit 2.1 to the Current Report on Form 8-K of the Company filed December 12, 2007

|

| |

|

|

|

|

|

4.1

|

|

Certificate Of Designations, Rights And Preferences Of The Series A Convertible Preferred Stock, May 9, 2012

|

|

Exhibit 3.4 to the Current Report on Form 8-K of the Company filed May 9, 2012

|

| |

|

|

|

|

|

5.1

|

|

Opinion of Burton Bartlett & Glogovac

|

|

Provided herewith

|

| |

|

|

|

|

|

10.1

|

|

Asset Purchase Agreement dated June 29, 2013 with Jeoffrey L. Burtch, Chapter 7 Trustee for the Estates of Polymedix

|

|

Incorporated by reference to the Company’s Current Report on Form 8-K as filed with the SEC on September 4, 2013

|

| |

|

|

|

|

|

10.2

|

|

First Amendment to Asset Purchase Agreement Dated August 30, 2013

|

|

Incorporated by reference to the Company’s Current Report on Form 8-K as filed with the SEC on September 4, 2013

|

| |

|

|

|

|

|

10.3

|

|

Bankruptcy Court Order Approving the Sale of substantially all the assets of the Estates of Polymedix, Inc. and Polymedix Pharmaceuticals, Inc.

|

|

Incorporated by reference to the Company’s Current Report on Form 8-K as filed with the SEC on September 4, 2013

|

| |

|

|

|

|

|

10.4

|

|

Purchase Agreement with Aspire Capital dated October 25, 2013

|

|

Incorporated by reference to the Company’s Current Report on Form 8-K as filed with the SEC on October 28, 2013

|

| |

|

|

|

|

|

10.5

|

|

Registration Rights Agreement, dated as of December 06, 2012 by and between the Company and Aspire Capital Fund, LLC.

|

|

Exhibit 4.1 to the Current Report on Form 8-K of the Company filed on December 10, 2012

|

| |

|

|

|

|

|

10.6

|

|

Registration Rights Agreement with Aspire Capital dated October 25, 2013

|

|

Incorporated by reference to the Company’s Current Report on Form 8-K as filed with the SEC on October 28, 2013

|

| |

|

|

|

|

|

10.7

|

|

Employment Agreement Dr. William James Alexander dated October 23, 2014

|

|

Exhibit 10.1 to the Current Report on Form 8-K of the Company filed on October 24, 2014

|

| |

|

|

|

|

|

23.1

|

|

Consent of Baker Tilly Virchow Krause, LLP, independent registered public accounting firm

|

|

Incorporated by reference to the Company's Registration Statement on Form S-3 filed on October 30, 2014

|

| |

|

|

|

|

|

23.2

|

|

Consent of Burton Bartlett & Glogovac (contained in Exhibit 5.1)

|

|

Included in the opinion filed as Exhibit 5.1 to this Registration Statement

|

4

EXHIBIT 5.1

Burton, Bartlett & Glogovac

427 West Plumb Lane

Reno, Nevada 89509-3766

Phone: (775) 333-0400

Fax: (775) 333-0412

November 10, 2014

Cellceutix Corporation

100 Cumming Center, Suite 151-B

Beverly, Massachusetts 01915

Re: Form S-3 Registration Statement

Ladies and Gentlemen:

We have acted as your special counsel in connection with the registration statement on Form S-3 (the “Registration Statement”) filed by Cellceutix Corporation, a Nevada corporation (the “Company”) with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement relates to the issuance by the Company of a presently indeterminate amount of the following up to a $75,000,000 aggregate offering price:

|

(i)

|

shares of the Company’s Class A common stock, $0.0001 par value per share (the “Class A Common Stock”);

|

|

|

|

|

(ii)

|

one or more classes or series of shares of the Company’s preferred stock, $0.001 par value per share (the “Preferred Stock”);

|

|

|

|

|

(iii)

|

warrants representing the rights to purchase shares of Common Stock or Preferred Stock (the “Warrants”);

|

|

|

|

|

(iv)

|

debt securities, including secured or unsecured debt securities, which may be senior, subordinated or junior subordinated, and which may be convertible and which may be issued in one or more series (the “Debt Securities”); and

|

|

|

|

|

(v)

|

units composed of one or more of the securities described in the Registration Statement in any combination (the “Units”). The Units, together with the Class A Common Stock, the Preferred Stock, the Warrants, and the Debt Securities, shall be collectively referred to as the “Securities”.

|

The Securities may be issued from time to time on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, and as set forth in the Registration Statement, any amendment thereto, the prospectus contained therein (the “Prospectus”) and any supplements to the Prospectus (each, a “Prospectus Supplement”), at an aggregated public offering price not to exceed $75,000,000.

You have requested our opinion as to the matters set forth below in connection with the Registration Statement. For purposes of rendering the opinions set forth below, we have examined (i) the Registration Statement, including the exhibits filed therewith, (ii) the Prospectus, (iii) the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”), (iv) the Company’s Bylaws (the “Bylaws”), and (v) the corporate resolutions and other actions of the Company that authorize and provide for the issuance of the Securities covered by this opinion letter, and we have made such other investigation as we have deemed appropriate. We have examined and relied upon certificates of public officials and, as to certain matters of fact that are material to our opinions, we have also relied on a certificate of an officer of the Company. We have not independently established any of the facts so relied on.

For the purposes of this opinion letter, we have made assumptions that are customary in opinions of this kind, including the assumptions of the accuracy and completeness of each document submitted to us, the genuineness of all signatures on original documents, the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as copies thereof, and the due execution and delivery of all documents where due execution and delivery are prerequisites to the effectiveness thereof. We have further assumed the legal capacity of natural persons, and we have assumed that each party to the documents we have examined or relied on (other than the Company) has the legal capacity and authority and has satisfied all legal requirements that are applicable to that party to the extent necessary to make such documents enforceable against that party. We have not verified any of those assumptions.

This opinion is rendered as of the date hereof and is limited to matters of Nevada corporate law, including applicable provisions of the Nevada Constitution and reported judicial decisions interpreting those laws. We are not opining on, and we assume no responsibility for, the applicability to or effect on any of the matters covered herein of (a) any other laws; (b) the laws of any other jurisdiction; or (c) the laws of any county, municipality or other political subdivision or local governmental agency or authority.

All references in our opinions to the board of directors of the Company are intended to include an authorized committee thereof empowered to act under Chapter 78 of the Nevada Revised Statutes in lieu of the full board of directors of the Company.

Based on the foregoing and in reliance thereon, and subject to the assumptions, qualifications, limitations and exceptions set forth below, we are of the opinion that:

1. With respect to shares of Class A Common Stock, when (a) the board of directors of the Company has taken all necessary corporate action to approve the issuance and terms of the offering thereof and related matters, including without limitation the due reservation of any Class A Common Stock for issuance, and (b) certificates representing the shares of Class A Common Stock have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the board of directors of the Company upon payment of the consideration therefor (which consideration shall not be less than the par value of the Class A Common Stock) provided for in such definitive purchase, underwriting or similar agreement, as applicable, or (ii) upon conversion, exchange or exercise of any other Security in accordance with the terms of such Security or the instrument governing such Security providing for the conversion, exchange or exercise as approved by the board of directors of the Company, for the consideration therefor set forth in the applicable agreement and approved by the board of directors of the Company, which consideration shall not be less than the par value of the Class A Common Stock, such shares of Class A Common Stock will be validly issued, fully paid, and non-assessable;

2. With respect to shares of any series of Preferred Stock, when (a) the board of directors of the Company has taken all necessary corporate action to approve the issuance and terms of the shares of such series, the terms of the offering thereof and related matters, including the adoption of a certificate of designation or amendment to the Company’s Articles of Incorporation fixing and determining the terms of such Preferred Stock conforming to Chapter 78 of the Nevada Revised Statutes, the filing of a certificate or amendment or certificate of designation, as applicable, with the Secretary of State of Nevada, the payment in full of any filing fees attendant thereto, and the due reservation of any Common Stock and Preferred Stock for issuance, and (b) certificates representing the shares of the series of Preferred Stock have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the board of directors of the Company, upon payment of the consideration therefor (which consideration shall not be less than the par value of the Preferred Stock) provided for in such definitive purchase, underwriting or similar agreement, as applicable, or (ii) upon conversion, exchange or exercise of any other Security in accordance with the terms of the Security or the instrument governing the Security providing for the conversion, exchange or exercise as approved by the board of directors of the Company, for the consideration approved by the board of directors of the Company, which consideration shall not be less than the par value of the Preferred Stock, the shares of such series of Preferred Stock will be validly issued, fully paid, and non-assessable;

3. With respect to any Debt Securities, when (a) the board of directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Debt Securities, the terms of the offering thereof and related matters, the payment in full of any filing fees attendant thereto, and the due reservation of any required Class A Common Stock and Preferred Stock for issuance, and (b) appropriate documentation representing the Debt Securities have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the board of directors of the Company, upon payment of the consideration therefor provided for in such definitive purchase, underwriting or similar agreement, as applicable, or (ii) upon conversion, exchange or exercise of any Debt Security in accordance with the terms of the Debt Securities or the instrument governing the Debt Securities providing for the conversion, exchange or exercise as approved by the board of directors of the Company, for the consideration approved by the board of directors of the Company, (y) the related Class A Common Stock and Preferred Stock will be validly issued, fully paid, and non-assessable and (z) the Debt Securities will be binding obligations of the Company;

4. With respect to any Units, when (a) the board of directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Units, the terms of the offering thereof and related matters, the payment in full of any filing fees attendant thereto, and the due reservation of any required Class A Common Stock and Preferred Stock for issuance, and (b) appropriate documentation representing the Units have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the board of directors of the Company, upon payment of the consideration therefor provided for in such definitive purchase, underwriting or similar agreement, as applicable, or (ii) upon conversion, exchange or exercise of any Unit in accordance with the terms of the Units or the instrument governing the Units providing for the conversion, exchange or exercise as approved by the board of directors of the Company, for the consideration approved by the board of directors of the Company, (y) the related Class A Common Stock and Preferred Stock will be validly issued, fully paid, and non-assessable and (z) the Units will be binding obligations of the Company; and

5. With respect to any Warrants, when (a) the board of directors of the Company has taken all necessary corporate action to approve the issuance and terms of the Warrants and the shares issuable thereunder, the terms of the offering thereof and related matters, the payment in full of any filing fees attendant thereto, and the due reservation of any required Class A Common Stock and Preferred Stock for issuance, and (b) appropriate documentation representing the Warrants have been duly executed, countersigned, registered and delivered either (i) in accordance with the applicable definitive purchase, underwriting or similar agreement approved by the board of directors of the Company, upon payment of the consideration therefor provided for in such definitive purchase, underwriting or similar agreement, as applicable, or (ii) upon conversion, exchange or exercise of any Warrant in accordance with the terms of the Warrants or the instrument governing the Warrants providing for the conversion, exchange or exercise as approved by the board of directors of the Company, for the consideration approved by the board of directors of the Company, (y) the related Class A Common Stock and Preferred Stock will be validly issued, fully paid, and non-assessable and (z) the Warrants will be binding obligations of the Company.

The opinions set forth above are subject to the following additional assumptions:

(a) the Registration Statement, any amendments thereto (including post effective amendments), will have been declared effective under the Securities Act and such effectiveness shall not have been terminated, suspended or rescinded;

(b) all Securities will be issued and sold in compliance with applicable federal and state securities laws, rules and regulations and solely in the manner provided in the Registration Statement and the appropriate Prospectus Supplement and there will not have occurred any change in law or fact affecting the validity of any of the opinions rendered herein;

(c) in the case of any agreement pursuant to which any Securities are to be issued or governed, there will have been no additions, deletions or modifications of the terms or provisions contained in the forms thereof included as exhibits to the Registration Statement that would affect the validity of any of the opinions rendered herein;

(d) a definitive purchase, underwriting or similar agreement and any other necessary agreements with respect to any Securities offered or issued will have been duly authorized and duly executed and delivered by the Company and the other parties thereto;

(e) in the case of any agreement or supplement or amendment thereto, underwriting or purchase agreement, certificate of designation, amendment to the Articles of Incorporation, or other agreement pursuant to which any Securities are to be issued or governed, there shall be no terms or provisions contained therein which would (i) contravene any applicable law, rule or regulation, (ii) render any material portion of such documents invalid or unenforceable, or (iii) otherwise affect the validity of any of the opinions rendered herein;

(f) the final terms of any of the Securities (including any Securities comprising the same or subject thereto), and when issued, the issuance, sale and delivery thereof by the Company, and the incurrence and performance of the Company’s obligations thereunder or respect thereof in accordance with the terms thereof, and any consideration received by the Company for any such issuance, sale and delivery, will comply with, and will not violate, the Company’s Articles of Incorporation, as amended or supplemented, or Bylaws, as amended, or any applicable law, rule or regulation, or result in a default under or breach of any agreement or instrument binding upon the Company and will comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company or to which the issuance, sale and delivery of such Securities or the incurrence and performance of such obligations may be subject or violate any applicable public policy, or be subject to any defense in law or equity;

(g) the Company shall have taken any action required to be taken by the Company, based on the type of Security being offered, to authorize the offer and issuance thereof, and such authorization shall remain in effect and unchanged at all times during which the Securities are offered and issued and shall not have been modified or rescinded (subject to the further assumption that the sale of any Security takes place in accordance with such authorization), the board of directors of the Company (or an authorized committee thereof) shall have duly established the terms of such Security and duly authorized and taken any other necessary corporate action to approve the issuance and sale of such Security in conformity with the Articles of Incorporation of the Company, as amended or supplemented, and its Bylaws, as amended (subject to the further assumption that the Articles of Incorporation, as amended or supplemented, and Bylaws have not been amended from the date hereof in a manner that would affect the validity of any of the opinions rendered herein), and such authorization shall remain in effect and unchanged at all times during which the Securities are offered and issued and shall not have been modified or rescinded (subject to the further assumption that the sale of any Security takes place in accordance with such authorization); and

(h) to the extent they purport to relate to liabilities resulting from or based upon gross negligence, recklessness or other conduct committed or omitted willfully or in bad faith or any violation of federal or state securities or blue sky laws, we express no opinions concerning the enforceability of indemnification provisions.

The opinions above are subject to the effects of (a) bankruptcy, insolvency, fraudulent conveyance, fraudulent transfer, reorganization, receivership, moratorium and other similar laws relating to or affecting enforcement of creditors’ rights or remedies generally; (b) general principles of equity, whether such principles are considered in a proceeding of law or at equity; and (c) an implied covenant of good faith, reasonableness and fair dealing and standards of materiality.

We express no opinion as to any provision in any Warrant Agreement, stock purchase contract, or other agreement pursuant to which any Securities are to be issued or governed, or the Company’s Articles of Incorporation, as amended or supplemented, or Bylaws, as amended (i) that purports to waive forum non conveniens or trial by jury; (ii) that relates to judgments in currencies other than U.S. dollars; (iii) that releases, exculpates or exempts a party from, or requires indemnification or contribution of a party for, liability for its own negligence or misconduct; (iv) that purports to allow any party to unreasonably interfere in the conduct of the business of another party; (v) that purports to require any party to pay any amounts due to another party without a reasonable accounting of the sums purported to be due; (vi) that purports to prohibit the assignment of rights that may be assigned pursuant to applicable law regardless of an agreement not to assign such rights; (vii) that purports to require that amendments to any agreement be in writing; (viii) relating to powers of attorney, severability or set-off; (ix) that purports to limit access exclusively to any particular courts; and (x) providing that decisions by a party are conclusive or may be made in its sole discretion. We express no opinion concerning whether any state or federal court would accept jurisdiction in any dispute, action, suit or proceeding arising out of or relating to any agreement or the transactions contemplated thereby.

We further note that, to the extent that any particular laws other than the laws of the State of Nevada are chosen as the governing law in the Warrants, any stock purchase agreement, or any other agreement pursuant to which any Securities are to be issued or governed, an opinion of counsel duly licensed to practice law in such other jurisdiction may be necessary as to the opinions expressed above.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement and to the use of our name under the caption “Legal Matters” in the Prospectus. In giving our consent, we do not thereby admit that we are experts with respect to any part of the Registration Statement, the Prospectus or any Prospectus Supplement within the meaning of the term “expert”, as used in Section 11 of the Securities Act or the rules and regulations promulgated thereunder by the Commission nor do we admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

Very truly yours,

/s/ Burton, Bartlett & Glogovac

Burton, Bartlett & Glogovac

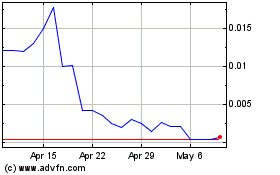

Innovation Pharmaceuticals (PK) (USOTC:IPIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Innovation Pharmaceuticals (PK) (USOTC:IPIX)

Historical Stock Chart

From Apr 2023 to Apr 2024