Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

As filed with the Securities and Exchange Commission on January 25, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CHS INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

Minnesota

(State or other jurisdiction of

incorporation or organization) |

|

41-0251095

(I.R.S. Employer

Identification Number) |

|

5150

(Primary Standard Industrial

Classification Code Number) |

|

|

|

5500 Cenex Drive

Inver Grove Heights, Minnesota 55077

(651) 355-6000

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices) |

|

James M. Zappa

Executive Vice President and General Counsel

CHS Inc.

5500 Cenex Drive

Inver Grove Heights, Minnesota 55077

Phone: (651) 355-6831

Fax: (651) 355-4554

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

|

Copies to:

David P. Swanson

Steven Khadavi

Brian R. Rosenau

Dorsey & Whitney LLP

50 South Sixth Street

Minneapolis, Minnesota 55402

Phone: (612) 340-2600

Fax: (952) 487-8509

Fax (612) 340-2868

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the

definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer ý

(Do not check if a

smaller reporting company) |

|

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

| |

Title of Each Class of Securities

to be Registered

|

|

Proposed Maximum

Aggregate Offering

Price(1)

|

|

Amount of

Registration Fee

|

| |

Class B Cumulative Redeemable Preferred Stock, Series 1 |

|

$75,000,000 |

|

$7,553 |

|

- (1)

- Estimated

solely for purposes of determining the registration fee pursuant to Rule 457(o) promulgated under the Securities

Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall

file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or

until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the

registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy

these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion dated January 25, 2016

PROSPECTUS

Shares

CHS Inc.

Class B Cumulative Redeemable Preferred Stock, Series 1

(Liquidation Preference Equivalent to $25.00 Per Share)

We are issuing shares of our Class B

Cumulative Redeemable Preferred Stock, Series 1 (the "Class B

Series 1 Preferred Stock") to redeem approximately $75,000,000 of our "patrons' equities" that are held in the form of qualified capital equity certificates. All of the Class B

Series 1 Preferred Stock being issued will be issued to non-individual "active patrons" who hold qualified capital equity certificates in an amount equal to or greater than $500. "Active

patrons" are non-individual patrons who have done business with us in the past five fiscal years. The amount of patrons' equities that will be redeemed with each share of Class B

Series 1 Preferred Stock issued will be $ which is the greater of $ (equal to the $25.00 liquidation

preference per share of Class B Series 1

Preferred Stock plus $ of accumulated dividends from and

including , 2016 to and

including , 2016) and the closing price for one share of the

Class B Series 1 Preferred Stock on , 2016. There will not be any cash proceeds from the issuance of the Class B

Series 1 Preferred Stock. However, by

issuing shares of Class B Series 1 Preferred Stock in redemption of patrons' equities we will make available for business purposes cash that otherwise may have been used to redeem those

patrons' equities.

Holders

of the Class B Series 1 Preferred Stock are entitled to receive cash dividends at the rate of $1.96875 per share per year. The Class B Series 1

Preferred Stock is subject to redemption and has the preferences described in this prospectus. The Class B Series 1 Preferred Stock is not convertible into any of our other securities

and is non-voting except in certain limited circumstances.

The

Class B Series 1 Preferred Stock is traded on the NASDAQ Stock Market under the trading symbol "CHSCO". On January 22, 2016, the closing price of the

Class B Series 1 Preferred Stock was $28.23 per share.

Ownership of our Class B Series 1 Preferred Stock involves risks. See "Risk Factors" beginning on

page 8.

We

expect to issue the Class B Series 1 Preferred Stock on or about , 2016.

Neither the Securities and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2016.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

IMPORTANT INFORMATION ABOUT THIS PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus. We have not authorized any other

person to provide you with different or additional information. You must not rely upon any information not contained or incorporated by reference in this prospectus. This prospectus does not

constitute an offer to sell or the solicitation of an offer to buy any securities other than the securities to which it relates. We are not making an offer of these securities in any state where the

offer is not permitted. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the date set forth on the front cover or that any information we

have incorporated by reference in this prospectus is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are

sold on a later date.

Unless

the context otherwise requires, references in this prospectus, and the documents incorporated by reference in this prospectus, to "CHS," the "Company," "we," "our" and "us" refer

to CHS Inc., a

Minnesota cooperative corporation, and its subsidiaries. We maintain a web site at http://www.chsinc.com. Information contained in our website does not constitute part of, and is not incorporated by

reference into, this prospectus.

ii

Table of Contents

PROSPECTUS SUMMARY

The following summary highlights information we present in greater detail elsewhere in this prospectus and in

the information incorporated by reference into this prospectus. This summary may not contain all of the information that is important to you and you should carefully consider all of the information

contained or incorporated by reference in this prospectus. This prospectus contains forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements. These factors include those listed under "Risk Factors" and elsewhere in this prospectus and the documents incorporated by reference into this

prospectus.

CHS Inc.

CHS Inc. is one of the nation's leading integrated agricultural companies, providing grain, foods and energy resources to

businesses and consumers on a global basis. As a cooperative, we are owned by farmers and ranchers and their member cooperatives (referred to herein as "members") across the United States. We also

have preferred stockholders that own shares of our 8% Cumulative Redeemable Preferred Stock, our Class B Series 1 Preferred Stock, our Class B Reset Rate Cumulative Redeemable

Preferred Stock, Series 2 (the "Class B Series 2 Preferred Stock"), our Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 3 (the "Class B

Series 3 Preferred Stock"), and our Class B Cumulative Redeemable Preferred Stock, Series 4 (the "Class B Series 4 Preferred Stock"), listed on the NASDAQ Stock

Market under the symbols "CHSCP", "CHSCO", "CHSCN", "CHSCM" and "CHSCL", respectively. On January 24, 2016, we had 12,272,003 shares of 8% Cumulative Redeemable Preferred Stock

outstanding, 18,071,363 shares of Class B Series 1 Preferred Stock outstanding, 16,800,000 shares of Class B Series 2 Preferred Stock outstanding, 19,700,00 shares of

Class B Series 3 Preferred Stock outstanding and 20,700,000 shares of Class B Series 4 Preferred Stock outstanding. We buy commodities from, and provide products and

services to, patrons (including our members and other non-member customers), both domestic and international. We provide a wide variety of products and services, from initial agricultural inputs such

as fuels, farm supplies, crop nutrients and crop protection products, to agricultural outputs that include grains and oilseeds, grain and oilseed processing, renewable fuels and food products. A

portion of our operations are conducted through equity investments and joint ventures whose operating results are not fully consolidated with our results; rather, a proportionate share of the income

or loss from those entities is included as a component in our net income under the equity method of accounting. For the year ended August 31, 2015, our total revenues were $34.6 billion

and net income attributable to CHS Inc. was approximately $781.0 million. For the three months ended November 30, 2015, our total revenues were $7.7 billion and net income

attributable to CHS Inc. was approximately $266.5 million.

We

have aligned our segments based on an assessment of how our businesses operate and the products and services they sell.

Our

Energy segment derives its revenues through refining, wholesaling and retailing of petroleum products. Our Ag segment derives its revenues through the origination and marketing of

grain, including service activities conducted at export terminals; through wholesale sales of crop nutrients; from sales of soybean meal, soybean refined oil and soyflour products; through the

production and marketing of renewable fuels; and through retail sales of petroleum and agronomy products, processed sunflowers, feed and farm supplies. Our Ag segment also records equity income from

investments in our grain export joint venture and other investments. We include other business operations in Corporate and Other because of the nature of their products and services, as well as the

relative revenues of those businesses. These businesses primarily include our financing, insurance, hedging and other service activities related to crop production. In addition, our wheat milling and

packaged food operations are included in Corporate and Other, as those businesses are conducted through non-consolidated joint ventures.

1

Table of Contents

Many

of our business activities are highly seasonal and operating results vary throughout the year. Our income is generally lowest during our second fiscal quarter and highest during our

third fiscal quarter. For example, in our Ag segment, our crop nutrients and country operations businesses generally experience higher volumes and income during the spring planting season and in the

fall, which corresponds to harvest. Our grain marketing operations are also subject to fluctuations in volume and earnings based on producer harvests, world grain prices and demand. Our Energy segment

generally experiences higher volumes and profitability in certain operating areas, such as refined products, in the summer and early fall when gasoline and diesel fuel usage is highest and is subject

to domestic supply and demand forces. Other energy products, such as propane, may experience higher volumes and profitability during the winter heating and crop drying seasons.

Our

earnings from cooperative business are allocated to members (and to a limited extent, to non-members with which we have agreed to do business on a patronage basis) based on the

volume of business they do with us. We allocate these earnings to our patrons in the form of patronage refunds (which are also called patronage dividends) in cash and patrons' equities (capital equity

certificates), which may be redeemed over time solely at the discretion of our Board of Directors. Earnings derived from non-members, which are not treated as patronage, are taxed at federal and state

statutory corporate rates and are retained by us as unallocated capital reserve. We also receive patronage refunds from the cooperatives in which we are a member, if those cooperatives have earnings

to distribute and if we qualify for patronage refunds from them.

Our

origins date back to the early 1930s with the founding of our predecessor companies, Cenex, Inc. and Harvest States Cooperatives. CHS Inc. emerged as the result of the

merger of those two entities in 1998, and is headquartered in Inver Grove Heights, Minnesota.

Energy

We are the nation's largest cooperative energy company based on revenues and identifiable assets, with operations that include

petroleum refining and pipelines; the supply, marketing and distribution of refined fuels (gasoline, diesel fuel and other energy products); the blending, sale and distribution of lubricants; and the

wholesale supply of propane and other natural gas liquids. Our Energy segment processes crude oil into refined petroleum products at refineries in Laurel, Montana (wholly-owned) and McPherson, Kansas

(an entity which became wholly owned as of September 1, 2015) and sells those products under the Cenex® brand to member cooperatives and other independent retailers through a

network of nearly 1,500 sites, a majority of which are convenience stores marketing Cenex® branded fuels. For fiscal 2015, our Energy revenues, after elimination of inter-segment revenues,

were $8.2 billion and were primarily from gasoline and diesel fuel. For the three months ended November 30, 2015, our Energy segment revenues, after elimination of intersegment revenues,

were $1.6 billion.

Ag

Our Ag segment includes our crop nutrients, country operations, grain marketing, renewable fuels and processing and food ingredients

businesses. In fiscal 2015, revenues in our Ag segment were $26.3 billion consisting principally of grain sales of $17.2 billion after elimination of inter-segment revenues. For the

three months ended November 30, 2015, our Ag segment revenues, after elimination of intersegment revenues, were $6.1 billion.

Grain Marketing. We are the nation's largest cooperative marketer of grain and oilseed based on grain storage capacity and grain sales,

handling over

2.0 billion bushels annually. During fiscal 2015, we purchased approximately half of our total grain volumes from individual and cooperative association members and our country operations

business, with the balance purchased from third parties. We arrange for the transportation of the grains either directly to customers or to our owned or leased grain terminals and elevators awaiting

delivery to domestic and foreign purchasers. We primarily conduct our grain marketing operations directly, but do conduct some of our business through TEMCO, LLC, a 50% joint venture with

Cargill, Incorporated.

2

Table of Contents

Country Operations. Our country operations business purchases a variety of grains from our producer members and other third parties,

and provides

producer members and other customers with access to a full range of products, programs and services for production agriculture. Country operations operates 475 agri-operations locations through 73

business units dispersed throughout Colorado, Idaho, Illinois, Iowa, Kansas, Michigan, Minnesota, Montana, Nebraska, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Washington ,Wisconsin and

Canada. Most of these locations purchase grain from farmers and sell agronomy, energy, feed and seed products to those same producers and others, although not all locations provide every product and

service.

Crop Nutrients. We believe our North America wholesale crop nutrients business is one of the largest wholesale fertilizer businesses in

the United

States based on tons sold. Tons sold include sales to our country operations retail business. There is significant seasonality in the sale of agronomy products and services, with peak activity

coinciding with the planting seasons. There is also significant volatility in the prices for the crop nutrient products we purchase and sell.

In

August 2015, we entered into an agreement with CF Industries Holdings, Inc. ("CF Industries") to invest $2.8 billion in cash in exchange for an 11.4% membership interest

(based on product tons) in CF Industries Nitrogen LLC ("CF Nitrogen") and a separate supply agreement to purchase nitrogen fertilizer products from that entity over an 80-year term. The closing

date for our investment in CF Nitrogen is anticipated to be February 1, 2016.

Processing and Food Ingredients. Our processing and food ingredients business operates globally and

converts oilseeds into meal, soyflour, edible oils, and associated by-products. We then further process soyflour for use in the food/snack industry. In July 2015, we purchased a canola processing

facility in Hallock, Minnesota that produces canola oil and canola meal.

Renewable Fuels. Our renewable fuels business produces ethanol and dried distillers grains with solubles. We also market and distribute

these

products throughout the United States and overseas for our plants and other production plants.

Corporate And Other

Corporate and Other primarily represents our non-consolidated wheat milling and packaged food joint ventures, as well as our business

solutions operations, which consists of commodities hedging, insurance and financial services related to crop production.

Issuance

We are issuing shares of our Class B Series 1 Preferred Stock to redeem

approximately $75,000,000 of our

"patrons' equities" that are held in the form of qualified capital equity certificates. All of the Class B Series 1 Preferred Stock being issued will be issued to non-individual "active

patrons" who hold qualified capital equity certificates in an amount equal to or greater than $500. "Active patrons" are non-individual patrons who have done business with us in the past five fiscal

years. The amount of patrons' equities that will be redeemed with each share of Class B Series 1 Preferred Stock issued will be $ which is the greater of

$

(equal to the $25.00 liquidation preference per share of Class B Series 1 Preferred Stock plus $ of accumulated dividends from and

including , 2016 to and

including , 2016) and the closing price for one share of the Class B Series 1 Preferred Stock

on , 2016. There will not be any cash proceeds from the

issuance of the Class B Series 1 Preferred Stock. However, by issuing shares of Class B Series 1 Preferred Stock in redemption of patrons' equities we will make available

for business purposes cash that otherwise may have been used to redeem those patrons' equities.

Principal Executive Offices

Our principal executive offices are located at 5500 Cenex Drive, Inver Grove Heights, Minnesota 55077, and our telephone number

at that address is (651) 355-6000.

3

Table of Contents

Terms of the Class B Series 1 Preferred Stock

|

|

|

Dividends |

|

Dividends on the Class B Series 1 Preferred Stock are cumulative and, if, when and as declared by our Board of Directors, are payable quarterly in arrears on March 31, June 30,

September 30 and December 31 of each year at the rate of $1.96875 per share per year. Dividends on the Class B Series 1 Preferred Stock accumulate whether or not we have earnings, whether or not there are funds legally available

for the payment of such dividends and whether or not such dividends are authorized or declared. See "Description of Class B Series 1 Preferred Stock—Dividends." |

Liquidation Preference |

|

In the event of our liquidation, holders of shares of Class B Series 1 Preferred Stock are entitled to receive

$25.00 per share plus all dividends accumulated and unpaid on the shares to, and including, the date of liquidation, subject, however, to the rights of any of our debt and any capital stock or equity capital that rank senior to or on parity with the

Class B Series 1 Preferred Stock. |

Rank |

|

With respect to the payment of dividends and amounts payable upon liquidation, the Class B Series 1 Preferred

Stock ranks (i) senior to any patronage refund, patrons' equities and any other class or series of our capital stock or equity capital designated by our Board of Directors as junior to the Class B Series 1 Preferred Stock,

(ii) junior to all shares of capital stock or equity capital of CHS which, by their terms, rank (with the approval of the holders of a majority of the outstanding shares of all series of our Class B Cumulative Redeemable Preferred Stock

(our "Class B Preferred Stock"), voting together as a class) senior to the Class B Series 1 Preferred Stock and (iii) on a parity with the 8% Cumulative Redeemable Preferred Stock, the Class B Series 2 Preferred Stock,

the Class B Series 3 Preferred Stock, the Class B Series 4 Preferred Stock and all other shares of capital stock or equity capital of CHS other than shares of capital stock or equity capital of CHS which, by their terms, rank

junior or (with the approval of the holders of a majority of the outstanding shares of all series of our Class B Preferred Stock, voting together as a class) senior to the Class B Series 1 Preferred Stock. See "Description of

Class B Series 1 Preferred Stock—Ranking." |

4

Table of Contents

|

|

|

Redemption at Our Option |

|

The Class B Series 1 Preferred Stock is not redeemable prior to September 26, 2023. On and after September 26, 2023, the

Class B Series 1 Preferred Stock is redeemable for cash at our option, in whole or in part, at a per share price equal to the per share liquidation preference of $25.00 per share, plus all dividends accumulated and unpaid on that share to,

and including, the date of redemption. Redemption of the Class B Series 1 Preferred Stock will be a taxable event for federal income tax purposes. See "Description of Class B Series 1 Preferred

Stock—Redemption—Redemption At Our Option." |

Redemption at the Holder's Option |

|

In the event a change in control (as defined herein) is approved by our Board of Directors, holders of the Class B

Series 1 Preferred Stock will have the right, for a period of 90 days from the date of the change in control, to require us to redeem their shares of Class B Series 1 Preferred Stock, for cash, at a per share price equal to the

per share liquidation preference of $25.00 per share, plus all dividends accumulated and unpaid on that share to, and including, the date of redemption. "Change in control" is defined in "Description of Class B Series 1 Preferred

Stock—Redemption At the Holder's Option." |

No Exchange or Conversion Rights; No Sinking Fund |

|

Shares of the Class B Series 1 Preferred Stock are not exchangeable for or convertible into any other shares of

our capital stock or any other securities or property. The Class B Series 1 Preferred Stock is not subject to the operation of any purchase, retirement or sinking fund. |

Voting Rights |

|

Holders of the Class B Series 1 Preferred Stock do not have voting rights, except as required by applicable law;

provided, that the affirmative vote of a majority of the outstanding shares of Class B Preferred Stock, voting as a class, is required to approve (i) any amendment to our articles of incorporation or the resolutions establishing the terms

of the Class B Preferred Stock if the amendment adversely affects the powers, rights or preferences of the holders of the Class B Preferred Stock; or (ii) the creation of any class or series of capital stock, equity capital or patrons'

equities having rights senior to the Class B Preferred Stock as to the payment of dividends or distribution of assets upon our liquidation, dissolution or winding up. |

Trading |

|

The Class B Series 1 Preferred Stock is listed on the NASDAQ Stock Market under the symbol "CHSCO". |

Comparison of Rights |

|

Holders of the Class B Series 1 Preferred Stock have different rights from those of holders of patrons' equities.

See "Comparison of Rights of Holders of Patrons' Equities and Rights of Holders of Class B Series 1 Preferred Stock" below. |

Risk Factors |

|

Ownership of our Class B Series 1 Preferred Stock involves risks. See "Risk Factors" beginning on page 8 of

this prospectus and in the documents we file with the Securities and Exchange Commission (the "SEC") that are incorporated herein by reference. |

5

Table of Contents

Selected Consolidated Financial Data

The selected consolidated financial information below has been derived from our consolidated financial statements for the periods

indicated below. The selected consolidated

financial information for the three months ended November 30, 2015 and 2014 and as of November 30, 2015, and the years ended August 31, 2015, 2014 and 2013 and as of

August 31, 2015 and 2014, should be read in conjunction with our consolidated financial statements and notes thereto included in our Quarterly Report on Form 10-Q for the quarterly

period ended November 30, 2015 and our Annual Report on Form 10-K for the year ended August 31, 2015, respectively, as well as the related management's discussion and analysis

thereof, incorporated by reference in this prospectus. The selected consolidated financial information as of November 30, 2014, and for the years ended August 31, 2012 and 2011 and as of

August 31, 2013, 2012 and 2011, should be read in conjunction with our audited consolidated financial statements and notes thereto, as well as the related management's discussion and analysis

thereof, not included or incorporated by reference in this prospectus. The selected consolidated financial information for the three months ended and as of November 30, 2015 and 2014 have been

derived from our unaudited consolidated financial statements. In the opinion of our management, the interim financial information for the periods ended and as of November 30, 2015 and 2014 were

prepared on the same basis as the annual historical financial information and include all adjustments, consisting of only normal recurring adjustments, necessary for a fair statement of this

information. Results for the three months ended November 30, 2015 are not necessarily indicative of the results that may be expected for the full fiscal year.

We

have revised certain prior period amounts in the selected consolidated financial information below to include activity and amounts related to capital leases that were previously

incorrectly accounted for as operating leases. See Note 18, Correction of Immaterial Errors, to our audited consolidated financial statements

included in our Annual Report on Form 10-K for the year ended

6

Table of Contents

August 31,

2015, incorporated by reference in this prospectus, for more information on the nature and amounts of these revisions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

November 30, |

|

Years Ended August 31, |

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

2013 |

|

2012 |

|

2011 |

|

|

|

(Dollars in thousands)

|

|

Income Statement Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

7,728,792 |

|

$ |

9,499,468 |

|

$ |

34,582,442 |

|

$ |

42,664,033 |

|

$ |

44,479,857 |

|

$ |

40,599,286 |

|

$ |

36,915,834 |

|

Cost of goods sold |

|

|

7,316,974 |

|

|

8,907,441 |

|

|

33,091,676 |

|

|

41,011,487 |

|

|

42,701,073 |

|

|

38,583,102 |

|

|

35,508,811 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

411,818 |

|

|

592,027 |

|

|

1,490,766 |

|

|

1,652,546 |

|

|

1,778,784 |

|

|

2,016,184 |

|

|

1,407,023 |

|

Marketing, general and administrative |

|

|

152,004 |

|

|

161,968 |

|

|

775,354 |

|

|

602,598 |

|

|

553,623 |

|

|

498,233 |

|

|

438,498 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating earnings |

|

|

259,814 |

|

|

430,059 |

|

|

715,412 |

|

|

1,049,948 |

|

|

1,225,161 |

|

|

1,517,951 |

|

|

968,525 |

|

(Gain) loss on investments |

|

|

(5,672 |

) |

|

(2,875 |

) |

|

(5,239 |

) |

|

(114,162 |

) |

|

(182 |

) |

|

5,465 |

|

|

(126,729 |

) |

Interest expense, net |

|

|

6,993 |

|

|

21,905 |

|

|

60,333 |

|

|

140,253 |

|

|

236,699 |

|

|

198,304 |

|

|

79,012 |

|

Equity (income) loss from investments |

|

|

(31,362 |

) |

|

(24,629 |

) |

|

(107,850 |

) |

|

(107,446 |

) |

|

(97,350 |

) |

|

(102,389 |

) |

|

(131,414 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

|

289,855 |

|

|

435,658 |

|

|

768,168 |

|

|

1,131,303 |

|

|

1,085,994 |

|

|

1,416,571 |

|

|

1,147,656 |

|

Income taxes |

|

|

23,681 |

|

|

57,327 |

|

|

(12,165 |

) |

|

48,296 |

|

|

89,666 |

|

|

80,852 |

|

|

86,628 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

|

266,174 |

|

|

378,331 |

|

|

780,333 |

|

|

1,083,007 |

|

|

996,328 |

|

|

1,335,719 |

|

|

1,061,028 |

|

Net income (loss) attributable to noncontrolling interests |

|

|

(301 |

) |

|

(372 |

) |

|

(712 |

) |

|

1,572 |

|

|

3,942 |

|

|

75,091 |

|

|

99,673 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to CHS Inc. |

|

$ |

266,475 |

|

$ |

378,703 |

|

$ |

781,045 |

|

$ |

1,081,435 |

|

$ |

992,386 |

|

$ |

1,260,628 |

|

$ |

961,355 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Data (at end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Working capital |

|

$ |

2,708,931 |

|

$ |

3,383,665 |

|

$ |

2,751,949 |

|

$ |

3,168,512 |

|

$ |

3,084,228 |

|

$ |

2,809,595 |

|

$ |

2,745,557 |

|

Net property, plant and equipment |

|

|

5,331,232 |

|

|

4,380,567 |

|

|

5,192,927 |

|

|

4,180,148 |

|

|

3,311,088 |

|

|

2,913,247 |

|

|

2,526,763 |

|

Total assets |

|

|

16,478,760 |

|

|

16,741,586 |

|

|

15,228,312 |

|

|

15,296,104 |

|

|

13,643,954 |

|

|

13,771,947 |

|

|

12,571,866 |

|

Long-term debt, including current maturities |

|

|

1,411,682 |

|

|

1,487,873 |

|

|

1,431,117 |

|

|

1,605,625 |

|

|

1,746,716 |

|

|

1,567,276 |

|

|

1,608,546 |

|

Total equities |

|

|

7,798,504 |

|

|

7,158,507 |

|

|

7,669,411 |

|

|

6,466,844 |

|

|

5,152,747 |

|

|

4,473,323 |

|

|

4,265,320 |

|

Ratio of earnings to fixed charges and preferred dividends(1) |

|

|

4.1x |

|

|

|

|

|

3.1x |

|

|

7.6x |

|

|

7.6x |

|

|

10.0x |

|

|

9.1x |

|

- (1)

- For

purposes of computing the ratio of earnings to fixed charges and preferred dividends, earnings consist of income from continuing operations before

income taxes on consolidated operations, distributed income from equity investees, amortization of capitalized interest, investments redeemed and fixed charges less deductions for equity holdings,

noncash patronage dividends received and capitalized interest. Fixed charges consist of interest expense, amortization of debt costs and one-third of rental expense, considered representative of that

portion of rental expense estimated to be attributable to interest. Interest costs of $34.8 million, $70.8 million, $149.1 million and $113.2 million for the years ended

August 31, 2015, 2014, 2013 and 2012, respectively, associated with our commitment to purchase the National Cooperative Refinery Association ("NCRA"), which is now known as CHS McPherson

Refinery Inc. ("CHS McPherson"), noncontrolling interests, were excluded from interest expense for purposes of computing the ratio of earnings to fixed charges and preferred dividends.

7

Table of Contents

RISK FACTORS

Any investment in the Class B Series 1 Preferred Stock involves a high degree of risk. You should

carefully consider all of the information contained or incorporated by reference in this prospectus, including the risk factors described under "Risk Factors" in Item 1A of our Annual Report on

Form 10-K for the year ended August 31, 2015. The risks and uncertainties described herein and therein are not the only risks and uncertainties that we face. Additional risks and

uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations or otherwise adversely affect us. If any of those risks actually occurs, our

business, financial condition, liquidity, results of operations and prospects could be materially and adversely affected and our ability to pay dividends on, or make other payments with respect to,

the Class B Series 1 Preferred Stock could be impaired, which we refer to collectively as a "material adverse effect on us," or comparable language, below. These risks also include

forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements. See "Special Note Regarding Forward-Looking

Statements."

The

information contained under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the year ended August 31, 2015 is incorporated herein by reference.

There have been no material changes to our risk factors disclosed in Item 1A of our Annual Report on Form 10-K for the year ended August 31, 2015. The following risk factors are

specific to the Class B Series 1 Preferred Stock offered hereby.

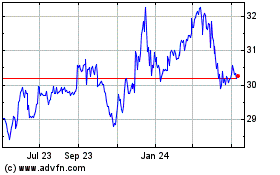

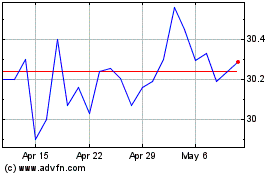

If you are able to resell your Class B Series 1 Preferred Stock, many factors may

affect the price you receive, which may be lower than you believe to be appropriate.

As with other publicly traded securities, many factors could affect the market price of your Class B Series 1 Preferred

Stock. In addition to those factors relating to CHS and the Class B Series 1 Preferred Stock described elsewhere in this "Risk Factors" section and elsewhere in this prospectus, or

incorporated by reference in this prospectus, the market price of our Class B Series 1 Preferred Stock could be affected by conditions in, and perceptions of, agricultural and energy

markets and companies and also by broader, general market, political and economic conditions.

Furthermore,

U.S. securities markets have experienced price and volume volatility that has affected many companies' securities prices, often for reasons unrelated to the operating

performance of those companies. Fluctuations such as these also may affect the market price of your Class B Series 1 Preferred Stock. As a result of these factors, you may only be able

to sell your Class B Series 1 Preferred Stock, if at all, at a price below the price you believe to be appropriate.

Issuances of substantial amounts of Class B Series 1 Preferred Stock or other

preferred stock could adversely affect the market price of your Class B Series 1 Preferred Stock.

From time to time in the future, we may sell additional shares of Class B Series 1 Preferred Stock or other preferred

equity securities to public or private investors, including future issuance of preferred stock to our members in redemption of patrons' equities. Future sales of Class B Series 1

Preferred Stock or other preferred equity securities or the availability of Class B Series 1 Preferred Stock or other preferred equity securities for sale may adversely affect the market

price for your Class B Series 1 Preferred Stock or our ability to raise additional equity capital.

Changes in market conditions, including market interest rates, may decrease the market price for the

Class B Series 1 Preferred Stock.

The terms of the Class B Series 1 Preferred Stock are fixed and will not change following issuance, even if market

conditions with respect to those terms fluctuate. This may mean that you could obtain a higher return from an investment in floating rate securities if market interest rates rise in the future. It

also means that an increase in market interest rates is likely to decrease the market price for the Class B Series 1 Preferred Stock.

8

Table of Contents

You will have limited voting rights.

As a holder of the Class B Series 1 Preferred Stock, you will be entitled to vote as a class with the holders of all

other outstanding Class B Preferred Stock only on actions that would amend, alter or repeal our articles of incorporation or the resolutions establishing the Class B Preferred Stock if

the amendment, alteration or repeal would adversely affect the powers, rights or preferences of the holders of Class B Preferred Stock or that would create a class or series of senior equity

securities. You will not have the right to vote on actions customarily subject to shareholder vote or approval, including the election of directors, the approval of significant transactions and other

amendments to our articles of incorporation that would not adversely affect the powers, rights and preferences of the Class B Preferred Stock and would not create a class or series of senior

equity securities.

Our equity is subject to a first lien in favor of CHS.

Under our articles of incorporation, all equity we issue (including the Class B Series 1 Preferred Stock) is subject to a

first lien in favor of us for any indebtedness we extend to the holders of such equity, if any. We have not taken any steps to date to perfect this lien against shares of the Class B

Series 1 Preferred Stock. If we perfect this interest in the future, your shares of the

Class B Series 1 Preferred Stock could be encumbered by our interest therein to the extent of any indebtedness you owe to CHS.

Payment of dividends on the Class B Series 1 Preferred Stock is not guaranteed.

Although dividends on the Class B Series 1 Preferred Stock are cumulative, our Board of Directors must approve the actual

payment of those dividends. Our Board of Directors can elect at any time or from time to time, and for an indefinite duration, not to pay any or all accumulated dividends. Our Board of Directors could

do so for any reason, including, without limitation, the following:

- •

- poor historical or projected cash flows;

- •

- the need to make payments on our indebtedness;

- •

- concluding that the payment of dividends would cause us to breach the terms of any indebtedness or other instrument or agreement, such

as financial ratio covenants; or

- •

- determining that the payment of dividends would violate applicable law regarding unlawful distributions to shareholders.

The amount of your liquidation preference is fixed and you will have no right to receive any greater

payment regardless of the circumstances.

The payment due upon a liquidation is fixed at the redemption preference of $25.00 per share plus accumulated and unpaid dividends to,

and including, the date of liquidation. If, in the case of our liquidation, there are remaining assets to be distributed after payment of this amount, you will have no right to receive or to

participate in these amounts. Furthermore, if the market price for your Class B Series 1 Preferred Stock is greater than the liquidation preference, you will have no right to receive the

market price from us upon our liquidation.

Your liquidation rights will be subordinate to those of holders of our indebtedness and of any

senior equity securities we may issue in the future and there is no limitation on our ability to issue additional preferred equity securities that rank equally with the Class B Series 1

Preferred Stock upon liquidation.

There are no restrictions in the terms of the Class B Series 1 Preferred Stock on our ability to incur indebtedness. As

of November 30, 2015, we had approximately $1.4 billion of outstanding long-term debt. In addition, in order to finance a portion of the $2.8 billion that we are required to pay

9

Table of Contents

at

the closing of our strategic venture with CF Industries, we have incurred, or will incur prior to closing, an aggregate of approximately $1.3 billion of new additional long-term debt. We can

also, with the consent of holders of a majority of the outstanding shares of our Class B Preferred Stock, voting together as a class, issue preferred equity securities that are senior as to

dividend and liquidation payments to the Class B Series 1 Preferred Stock. If we were to liquidate our business, we would be required to repay all of our outstanding indebtedness and to

satisfy the liquidation preferences of any senior equity securities that we may issue in the future before we could make any distributions to holders of our Class B Series 1 Preferred

Stock. We could have insufficient cash available to do so, in which case you would not receive any payment on the amounts due you. Moreover, there are no restrictions on our ability to issue preferred

equity securities that rank equally with the Class B Series 1 Preferred Stock as to dividend and liquidation payments and any amounts remaining after the payments to holders of senior

equity securities would be split among all holders of those securities, which might result in your receiving less than the full amount to which you would otherwise be entitled.

An active trading market for the Class B Series 1 Preferred Stock may not be

maintained, which may adversely affect the timing and price for any resales.

An active trading market for the Class B Series 1 Preferred Stock may not be maintained and there can be no assurance

that, in the future, any trading market for the Class B Series 1 Preferred Stock will be liquid. If you decide to sell your Class B Series 1 Preferred Stock, there may be

either no or only a limited number of potential buyers. This, in turn, may affect the price you receive for your Class B Series 1 Preferred Stock or your ability to sell your

Class B Series 1 Preferred Stock at all.

The Class B Series 1 Preferred Stock is redeemable at our option.

We may, at our option, redeem some or all of the Class B Series 1 Preferred Stock on and after September 26, 2023,

to the extent we have funds legally available for such purpose. If we redeem your Class B Series 1 Preferred Stock, you will be entitled to receive a redemption price equal to $25.00 per

share plus accumulated and unpaid dividends to, and including, the date of redemption. It is likely that we would choose to exercise our optional redemption right only when prevailing interest rates

have declined, which would adversely affect your ability to reinvest your proceeds from the redemption in a comparable investment with an equal or greater yield to the yield on the Class B

Series 1 Preferred Stock had the shares of the Class B Series 1 Preferred Stock not been redeemed.

To service and refinance our indebtedness, pay dividends on, or the redemption price of, our

preferred equity securities (including the Class B Series 1 Preferred Stock) and fund our capital and liquidity needs, we will require a significant amount of cash, and we cannot assure

you that we will generate sufficient cash, or have access to sufficient funding, for such purposes, and such failure would have a material adverse effect on us.

To service and refinance our indebtedness, pay dividends on, or the redemption price of, our preferred equity securities (including the

Class B Series 1 Preferred Stock) and fund our capital and liquidity needs, we will require a significant amount of cash. Our ability to raise capital is, to a certain extent, subject to

economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. In addition, we cannot assure you that our business will generate sufficient cash flows from

operations, or that future borrowings or alternative financing will be available to us on favorable terms, or at all, in an amount sufficient to enable us to service and refinance, at or before

maturity, our indebtedness, pay dividends on, or the redemption price of, our preferred equity securities (including the Class B Series 1 Preferred Stock) and fund our capital and

liquidity needs, which would have a material adverse effect on us.

10

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference in it contain "forward-looking statements" within the meaning of the safe

harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe,"

"project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor

assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our businesses, financial condition and results of

operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject

to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ

materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause our

actual results and financial condition to differ materially from

those indicated in the forward-looking statements include, but are not limited to, those listed below:

- •

- Our revenues, results of operations and cash flows could be materially and adversely affected by changes in commodity prices, as well

as global and domestic economic downturns and risks.

- •

- Our revenues, results of operations and cash flows could be materially and adversely affected if our members were to do business with

others rather than with us.

- •

- We participate in highly competitive business markets and we may not be able to continue to compete successfully, which would have a

material adverse effect on us.

- •

- Changes in federal income tax laws or in our tax status could increase our tax liability and reduce our net income significantly.

- •

- We incur significant costs in complying with applicable laws and regulations. Any failure to make the capital or other investments

necessary to comply with these laws and regulations could expose us to unanticipated expenditures and liabilities.

- •

- We are subject to the Foreign Corrupt Practices Act of 1977, as amended, and other similar anti-corruption, anti-bribery and

anti-kickback laws and regulations, and any noncompliance with those laws and regulations by us or others acting on our behalf could have a material adverse effect on our business, financial condition

and results of operations.

- •

- Changing environmental and energy laws and regulation, may result in increased operating costs and capital expenditures and may have a

material and adverse effect on us.

- •

- Governmental policies and regulation affecting the agricultural sector and related industries could have a material adverse effect on

us.

- •

- Environmental liabilities could have a material adverse effect on us.

- •

- Actual or perceived quality, safety or health risks associated with our products could subject us to significant liability and damage

our business and reputation.

- •

- Our financial results are susceptible to seasonality.

- •

- Our operations are subject to business interruptions and casualty losses; we do not insure against all potential losses and could be

seriously harmed by unanticipated liabilities.

- •

- Our cooperative structure limits our ability to access equity capital.

11

Table of Contents

- •

- Consolidation among the producers of products we purchase and customers for products we sell could materially and adversely affect our

revenues, results of operations and cash flows.

- •

- If our customers choose alternatives to our refined petroleum products, our revenues, results of operations and cash flows could be

materially and adversely affected.

- •

- The results of our agronomy business are highly dependent upon certain factors outside of our control.

- •

- Technological improvements in agriculture could decrease the demand for our agronomy and energy products.

- •

- We will require significant financing to consummate our strategic venture with CF Industries.

- •

- Acquisitions, strategic alliances, joint ventures, divestitures, and other non-ordinary course of business events resulting from

portfolio management actions and other evolving business strategies, including our strategic venture with CF Industries, could affect future results.

- •

- We utilize information technology systems to support our business. An ongoing multi-year implementation of an enterprise-wide resource

planning system, security breaches, or other disruptions to our information technology systems or assets could interfere with our operations, compromise security of our customers' or suppliers'

information, and expose us to liability which could adversely impact our business and reputation

These

risks and uncertainties are further described under "Risk Factors" and elsewhere in this prospectus and under "Risk Factors" in Item 1A of our Annual Report on

Form 10-K for the year ended August 31, 2015, which is incorporated herein by reference. Any forward-looking statements contained, or incorporated by reference, in this prospectus are

based only on information currently available to us and speak only as of the date on which the statement is made.

12

Table of Contents

USE OF PROCEEDS

The shares of Class B Series 1 Preferred Stock that are being issued pursuant to this prospectus and the registration

statement of which it is a part are being issued to redeem approximately $75,000,000 of our "patrons' equities" that are held in the form of qualified capital equity certificates. All of the

Class B Series 1 Preferred Stock being issued will be issued to non-individual "active patrons" who hold qualified capital equity certificates in an amount equal to or greater than $500.

"Active patrons" are non-individual patrons who have done business with us in the past five fiscal years. See "Membership in CHS and Authorized Capital—Patrons' Equities" for a discussion

of patrons' equities and our redemption of them. There will not be any cash proceeds from the issuance of the Class B Series 1 Preferred Stock. However, by issuing shares of

Class B Series 1 Preferred Stock in redemption of patrons' equities we will make available for business purposes cash that otherwise may have been used to redeem those patrons' equities.

13

Table of Contents

MEMBERSHIP IN CHS AND AUTHORIZED CAPITAL

Introduction

We are an agricultural membership cooperative organized under Minnesota cooperative law to do business with member and non-member

patrons. Our patrons, not us, are subject to income taxes on income from patronage sources, which is distributed to them as qualified patronage. We are subject to income taxes on undistributed

patronage income, non-qualified patronage distributions and non-patronage-sourced income. See "—Tax Treatment" below.

Distribution of Net Income; Patronage Dividends

We are required by our organizational documents annually to distribute net earnings derived from patronage business with members to

members on the basis of patronage, except that our Board of Directors may elect to retain and add to our unallocated capital reserve an amount not to exceed 10% of the distributable net income from

patronage business. We may also distribute net income derived from patronage business with a non-member if we have agreed to conduct business with the non-member on a patronage basis. Net income from

non-patronage business may be distributed to members or added to the unallocated capital reserve, in whatever proportions our Board of Directors deems appropriate. Our current policy is to allocate

non-patronage income to a capital reserve.

Accordingly,

patronage refunds are calculated based on amounts using financial statement earnings. The cash portion of the patronage distribution is determined annually by our Board of

Directors, with the balance issued in the form of qualified and non-qualified capital equity certificates. Consenting patrons have agreed to take both the cash and qualified capital equity certificate

portion allocated to them from our previous fiscal year's income into their taxable income, and as a result, we are allowed a deduction from our taxable income for both the cash distribution and the

allocated qualified capital equity certificates, as long as the cash distribution is at least 20% of the total patronage distribution. For the years ended August 31, 2014 and August 31,

2013, 10% of earnings from patronage business was added to our capital reserves and the remaining 90% was primarily distributed during the second fiscal quarters of the years ended August 31,

2015 and August 31, 2014, totaling $821.5 million and $841.1 million, respectively. The cash portion of the qualified distributions was deemed by the Board of Directors to be 40%

for fiscal 2014 and 2013. Cash related to these distributions was $271.2 million and $286.8 million and was paid during the years ended August 31, 2015 and August 31, 2014,

respectively. There were no patronage dividends distributed during the three months ended November 30, 2015. Patronage refunds distributed during the three months ended November 30, 2014

were $1.6 million ($0.6 million in cash).

8% Cumulative Redeemable Preferred Stock

On January 24, 2016, we had 12,272,003 shares of 8% Cumulative Redeemable Preferred Stock outstanding. The 8% Cumulative

Redeemable Preferred Stock is traded on the NASDAQ Stock Market under the symbol "CHSCP". Dividends paid on our 8% Cumulative Redeemable Preferred Stock were $6.1 million during the three

months ended November 30, 2015.

Holders

of our 8% Cumulative Redeemable Preferred Stock are entitled to receive cash dividends at the rate of $2.00 per share per year when, as and if declared by our Board of Directors.

Dividends are cumulative and are payable quarterly in arrears on March 31, June 30, September 30 and December 31 of each year, except that if a payment date is a Saturday,

Sunday or legal holiday, the dividend is paid without interest on the next day that is not a Saturday, Sunday or legal holiday. In the event of our liquidation, holders of our 8% Cumulative Redeemable

Preferred Stock are entitled to receive $25.00 per share plus all dividends accumulated and unpaid on the shares to and including the date of liquidation, subject, however, to the rights of any of our

securities that rank senior or on parity with the 8% Cumulative Redeemable Preferred Stock. As to payment of dividends and as to

14

Table of Contents

distributions

of assets upon the liquidation, dissolution or winding up of CHS, whether voluntary or involuntary, the 8% Cumulative Redeemable Preferred Stock ranks senior to: (i) any patronage

refund; and (ii) any other class or series of our capital stock designated by our Board of Directors as junior to the 8% Cumulative Redeemable Preferred Stock. Shares of any class or series of

our capital stock that are not junior to the 8% Cumulative Redeemable Preferred Stock, including our Class B Series 1 Preferred Stock, Class B Series 2 Preferred Stock,

Class B Series 3 Preferred Stock and Class B Series 4 Preferred Stock, rank equally with the 8% Cumulative Redeemable Preferred Stock as to the payment of dividends and the

distribution of assets.

We

may, at our option, at any time on or after July 18, 2023, redeem the 8% Cumulative Redeemable Preferred Stock, in whole or from time to time in part, for cash at a redemption

price of $25.00 per share plus all dividends accumulated and unpaid on that share to and including the date of redemption. We have no current plan or intention to redeem the 8% Cumulative Redeemable

Preferred Stock. In the event of a change in control initiated by our Board of Directors, holders of the 8% Cumulative Redeemable Preferred Stock will have the right, for a period of 90 days

from the date of the change in control, to require us to repurchase their shares of 8% Cumulative Redeemable Preferred Stock at a price of $25.00 per share plus all dividends accumulated and unpaid on

that share to and including the date of redemption. The 8% Cumulative Redeemable Preferred Stock is not exchangeable for or convertible into any other shares of our capital stock or any other

securities or property and is not subject to the operation of any purchase, retirement or sinking fund. Holders of the 8% Cumulative Redeemable Preferred Stock do not have voting rights, except as

required by applicable law; provided, that the affirmative vote of two-thirds of the outstanding 8% Cumulative Redeemable Preferred Stock will be required to approve (i) any amendment to our

articles of incorporation or the resolutions establishing the terms of the 8% Cumulative Redeemable Preferred Stock if the amendment adversely affects the rights or preferences of the 8% Cumulative

Redeemable Preferred Stock; or (ii) the creation of any class or series of equity securities having rights senior to the 8% Cumulative Redeemable Preferred Stock as to the payment of dividends

or distribution of assets upon the liquidation, dissolution or winding up of CHS. Holders of the 8% Cumulative Redeemable Preferred Stock have no preemptive right to acquire shares of any class or

series of our capital stock.

Class B Series 1 Preferred Stock

On January 24, 2016, we had 18,071,363 shares of Class B Series 1 Preferred Stock, outstanding. The Class B

Series 1 Preferred Stock is traded on the NASDAQ Stock Market under the symbol "CHSCO". Dividends paid on our Class B Series 1 Preferred Stock during the three months ended

November 30, 2015 were $8.9 million.

For

a description of our Class B Series 1 Preferred Stock, see "Description of Class B Series 1 Preferred Stock" below.

Class B Series 2 Preferred Stock

On January 24, 2016, we had 16,800,000 shares of Class B Series 2 Preferred Stock outstanding. The Class B

Series 2 Preferred Stock is traded on the NASDAQ Stock Market under the symbol "CHSCN". Dividends paid on our Class B Series 2 Preferred Stock during the three months ended

November 30, 2015 were $7.5 million.

Holders

of our Class B Series 2 Preferred Stock are entitled to receive cash dividends at the rate of $1.775 per share per year to but excluding March 31, 2024, and,

thereafter, at an annual rate equal to the three-month LIBOR, as determined for the applicable quarterly period, plus 4.298%, but in no event will the sum of such annual rate and spread be greater

than 8.00% per annum, when, as and if declared by our Board of Directors. Dividends are cumulative and are payable quarterly in arrears on March 31, June 30, September 30 and

December 31 of each year. In the event of our liquidation,

15

Table of Contents

holders

of our Class B Series 2 Preferred Stock are entitled to receive $25.00 per share plus all dividends accumulated and unpaid on such share to and including the date of liquidation,

subject, however, to the rights of any of our securities that rank senior or on parity with the Class B Series 2 Preferred Stock. As to payment of dividends and as to distributions of

assets upon the liquidation, dissolution or winding up of CHS, whether voluntary or involuntary, the Class B Series 2 Preferred Stock ranks senior to: (i) any patronage refund;

and (ii) any other class or series of our capital stock designated by our Board of

Directors as junior to the Class B Series 2 Preferred Stock. Shares of any class or series of our capital stock that are not junior to the Class B Series 2 Preferred Stock,

including our 8% Cumulative Redeemable Preferred Stock, Class B Series 1 Preferred Stock, Class B Series 3 Preferred Stock and Class B Series 4 Preferred

Stock, rank equally with the Class B Series 2 Preferred Stock as to the payment of dividends and the distribution of assets.

Our

Class B Series 2 Preferred Stock has the same voting rights, and is ranked equally with, the Class B Series 1 Preferred Stock, Class B

Series 3 Preferred Stock, Class B Series 4 Preferred Stock and any series of Class B Preferred Stock we issue in the future (except with respect to voting rights of the

Class B Series 2 Preferred Stock, the Class B Series 3 Preferred Stock and the Class B Series 4 Preferred Stock to each vote separately as a series in respect

of amendments solely relating to such series of Class B Preferred Stock and adversely affecting the holders thereof). We may, at our option, at any time on or after March 31, 2024,

redeem the Class B Series 2 Preferred Stock, in whole or from time to time in part, for cash at a redemption price of $25.00 per share plus all dividends accumulated and unpaid on that

share to and including the date of redemption. We have no current plan or intention to redeem the Class B Series 2 Preferred Stock. In the event of a change in control initiated by our

Board of Directors, holders of the Class B Series 2 Preferred Stock, will have the right, for a period of 90 days from the date of the change in control, to require us to

repurchase their shares of Class B Series 2 Preferred Stock, at a price of $25.00 per share plus all dividends accumulated and unpaid on that share to and including the date of

redemption. The Class B Series 2 Preferred Stock is not exchangeable for or convertible into any other shares of our capital stock or any other securities or property and is not subject

to the operation of any purchase, retirement or sinking fund. Holders of the Class B Series 2 Preferred Stock do not have voting rights, except as required by applicable law; provided,

that the affirmative vote of a majority of the outstanding Class B Preferred Stock, voting as a class, will be required to approve (i) any amendment to our articles of incorporation or

the resolutions establishing the terms of the Class B Preferred Stock, if the amendment adversely affects the powers, rights or preferences of the holders of the Class B Preferred Stock;

or (ii) the creation of any class or series of capital stock, equity capital or patrons' equities having rights senior to the Class B Preferred Stock, as to the payment of dividends or

distribution of assets upon our liquidation, dissolution or winding up. In addition, the affirmative vote of a majority of the outstanding Class B Series 2 Preferred Stock, voting as a

series, will be required to approve any amendment to our articles of incorporation that relates solely to the Class B Series 2 Preferred Stock or to the resolutions establishing the

specific economic terms of the Class B Series 2 Preferred Stock if such amendment adversely affects the powers, rights or preferences of the holders of the Class B Series 2

Preferred Stock. Holders of the Class B Series 2 Preferred Stock have no preemptive right to acquire shares of any class or series of our capital stock.

Class B Series 3 Preferred Stock

On January 24, 2016, we had 19,700,000 shares of Class B Series 3 Preferred Stock outstanding. The Class B

Series 3 Preferred Stock is traded on the NASDAQ Stock Market under the symbol "CHSCM". Dividends paid on our Class B Series 3 Preferred Stock during the three months ended

November 30, 2015 were $8.3 million.

Holders

of our Class B Series 3 Preferred Stock are entitled to receive cash dividends at the rate of $1.6875 per share per year to but excluding September 30, 2024,

and, thereafter, at an annual rate

16

Table of Contents

equal

to the three-month LIBOR, as determined for the applicable quarterly period, plus 4.155%, but in no event will the sum of such annual rate and spread be greater than 8.00% per annum, when, as

and if declared by our Board of Directors. Dividends are cumulative and are payable quarterly in arrears on March 31, June 30, September 30 and December 31 of each year. In

the event of our liquidation, holders of our Class B Series 3 Preferred Stock are entitled to receive $25.00 per share plus all dividends accumulated and unpaid on such share to and

including the date of liquidation, subject, however, to the rights of any of our securities that rank senior or on parity with the Class B Series 3 Preferred Stock. As to payment of

dividends and as to distributions of assets upon the liquidation, dissolution or winding up of CHS, whether voluntary or involuntary, the Class B Series 3 Preferred Stock ranks senior

to: (i) any patronage refund; and (ii) any other class or series of our capital stock designated by our Board of Directors as junior to the Class B Series 3 Preferred

Stock. Shares of any class or series of our capital stock that are not junior to the Class B Series 3 Preferred Stock, including our 8% Cumulative Redeemable Preferred Stock,

Class B Series 1 Preferred Stock, Class B Series 2 Preferred Stock and Class B Series 4 Preferred Stock, rank equally with the Class B Series 3

Preferred Stock as to the payment of dividends and the distribution of assets.

Our

Class B Series 3 Preferred Stock has the same voting rights, and is ranked equally with, the Class B Series 1 Preferred Stock, Class B

Series 2 Preferred Stock, Class B Series 4 Preferred Stock and any series of Class B Preferred Stock we issue in the future (except with respect to voting rights of the

Class B Series 2 Preferred Stock, the Class B Series 3 Preferred Stock and the Class B Series 4 Preferred Stock to each vote separately as a series in respect

of amendments solely relating to such series of Class B Preferred Stock and adversely affecting the holders thereof). We may, at our option, at any time on or after September 30, 2024,

redeem the Class B Series 3 Preferred Stock, in whole or from time to time in part, for cash at a redemption price of $25.00 per share plus all dividends accumulated and unpaid on that

share to and including the date of redemption. We have no current plan or intention to redeem the Class B Series 3 Preferred Stock. In the event of a change in control initiated by our

Board of Directors, holders of the Class B Series 3 Preferred Stock will have the right, for a period of 90 days from the date of the change in control, to require us to

repurchase their shares of Class B Series 3 Preferred Stock, at a price of $25.00 per share plus all dividends accumulated and unpaid on that share to and including the date of

redemption. The Class B Series 3 Preferred Stock is not exchangeable for or convertible into any other shares of our capital stock or any other securities or property and is not subject

to the operation of any purchase, retirement or sinking fund. Holders of the Class B Series 3 Preferred Stock do not have voting rights, except as required by applicable law; provided,

that the affirmative vote of a majority of the outstanding Class B Preferred Stock, voting as a class, will be required to approve (i) any amendment to our articles of incorporation or

the resolutions establishing the terms of the Class B Preferred Stock, if the amendment adversely affects the powers, rights or preferences of the holders of the Class B Preferred Stock;

or (ii) the creation of any class or series of capital stock, equity capital or patrons' equities having rights senior to the Class B Preferred Stock, as to the payment of dividends or

distribution of assets upon our liquidation, dissolution or winding up. In addition, the affirmative vote of a majority of the outstanding Class B Series 3 Preferred Stock, voting as a

series, will be required to approve any amendment to our articles of incorporation that relates solely

to the Class B Series 3 Preferred Stock or to the resolutions establishing the specific economic terms of the Class B Series 3 Preferred Stock if such amendment adversely

affects the powers, rights or preferences of the holders of the Class B Series 3 Preferred Stock. Holders of the Class B Series 3 Preferred Stock have no preemptive right

to acquire shares of any class or series of our capital stock.

Class B Series 4 Preferred Stock

On January 24, 2016, we had 20,700,000 shares of Class B Series 4 Preferred Stock outstanding. The Class B

Series 4 Preferred Stock is traded on the NASDAQ Stock Market under the symbol

17

Table of Contents

"CHSCL".

Dividends paid on our Class B Series 4 Preferred Stock during the three months ended November 30, 2015 were $9.7 million.

Holders

of our Class B Series 4 Preferred Stock are entitled to receive cash dividends at the rate of $1.875 per share per year when, as and if declared by our Board of

Directors. Dividends are cumulative and are payable quarterly in arrears on March 31, June 30, September 30 and December 31 of each year, except that if a payment date is a

Saturday, Sunday or legal holiday, the dividend is paid without interest on the next day that is not a Saturday, Sunday or legal holiday. In the event of our liquidation, holders of our Class B

Series 4 Preferred Stock are entitled to receive $25.00 per share plus all dividends accumulated and unpaid on such share to and including the date of liquidation, subject, however, to the

rights of any of our securities that rank senior or on parity with the Class B Series 4 Preferred Stock. As to payment of dividends and as to distributions of assets upon the

liquidation, dissolution or winding up of CHS, whether voluntary or involuntary, the Class B Series 4 Preferred Stock ranks senior to: (i) any patronage refund; and