As filed with the Securities and Exchange

Commission on March 31,

2017

Registration No. 333-212384

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

Form S-1/A

Amendment No.

3

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

________________________

Guided Therapeutics, Inc.

(Exact name of registrant as specified in its

charter)

________________________

|

Delaware

|

|

3845

|

|

58-2029543

|

|

(State or other

jurisdiction of incorporation or organization)

|

|

(Primary Standard

Industrial Classification Code Number)

|

|

(I.R.S.

Employer

Identification Number)

|

5835 Peachtree Corners East, Suite

D

Norcross, Georgia

30092

(770) 242-8723

(Address, including zip code, and telephone

number, including area code, of registrant’s principal

executive offices)

________________________

Gene S. Cartwright, Ph.D

President and Chief Executive

Officer

Guided Therapeutics,

Inc.

5835 Peachtree Corners East, Suite

D

Norcross, Georgia

30092

(770) 242-8723

(Name, address, including zip code, and

telephone number, including area code, of agent for

service)

________________________

Copy

to:

Heith D. Rodman, Esq.

Jones Day

1420 Peachtree Street,

N.E.

Suite 800

Atlanta, Georgia

30309-3053

(404) 581-3939

________________________

Approximate date of commencement of proposed

sale to the public

: From time to time following the

effective date of this registration statement.

If any of the

securities being registered on this Form are to be offered on a

delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box.

☑

If this Form is

filed to register additional securities for an offering pursuant to

Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering.

◻

If this Form is a

post-effective amendment filed pursuant to Rule 462(c) under the

Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration

statement for the same offering. ◻

If this Form is a

post-effective amendment filed pursuant to Rule 462(d) under the

Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration

statement for the same offering. ◻

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated

filer,” “accelerated filer,” and “smaller

reporting company” in Rule 12b-2 of the Exchange

Act.

|

Large accelerated

filer

|

◻

|

Accelerated

filer

|

◻

|

Non-accelerated

filer

|

◻

|

Smaller reporting

company

|

☑

|

________________________

CALCULATION OF REGISTRATION

FEE

|

Title of Each Class of

Securities to be Registered

(1)

|

Amount to be Registered

|

Proposed Maximum Offering Price Per

Unit

|

Proposed Maximum Aggregate

Offering

Price

|

Amount of Registration

Fee

|

|

Series D preferred

stock, par value $0.001

|

5,000

|

$1,000

|

$5,000,000

|

(2)

|

|

Warrants to purchase

shares of common stock

|

5,000

|

--

|

--

|

(3)

|

|

Shares of common stock

issuable upon conversion of Series D preferred stock

|

20,000,000

|

--

|

--

|

-

|

|

Shares of common stock

issuable upon exercise of the Warrants

|

20,000,000

|

$0.33 (4)

|

$6,600,000

(4)

|

(2)

|

|

|

(1)

|

In the event of a stock split, stock dividend

or other similar transaction involving the registrant’s

common stock, the number of shares of common stock registered

hereby shall be automatically increased to cover the additional

common shares in accordance with Rule 416(a) under the Securities

Act of 1933.

|

|

|

(2)

|

The registration fee for these securities was

previously paid.

|

|

|

(3)

|

No separate registration fee is payable

pursuant to Rule 457(g) under the Securities Act.

|

|

|

(4)

|

Estimated solely for the purpose of

calculating the registration fee pursuant to Rules 457(g) and (c)

under the Securities Act.

|

The registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its

effective date until the registrant shall file a further amendment

which specifically states that this registration statement shall

thereafter become effective in accordance with Section 8(a) of the

Securities Act of 1933 or until this registration statement shall

become effective on such date as the Securities and Exchange

Commission, acting pursuant to said Section 8(a), may

determine.

The information in this prospectus is

not complete and may be changed. We may not sell or offer these

securities until the registration statement filed with the

Securities and Exchange Commission is declared effective. This

prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the

offer or sale is not permitted.

PRELIMINARY PROSPECTUS

Subject to completion, dated March

31, 2017

$5,000,000

5,000 Shares of Series D Convertible Preferred

Stock

Warrants to Purchase up to

16,670,000 Shares of Common Stock

Shares of

Common Stock Underlying the Series D Preferred

Stock

Shares of

Common Stock Underlying the Warrants

________________________

We are offering up

to 5,000 shares of our Series D convertible preferred stock,

together with warrants to purchase an aggregate of up to

16,670,000

shares of common stock (and the shares issuable from time to time

upon conversion of the Series D preferred stock and the exercise of

the warrants), at a purchase price of $1,000 per share of Series D

preferred stock and warrant, pursuant to this prospectus. The

shares of Series D preferred stock and warrants are immediately

separable and will be separately issued.

Subject

to certain ownership limitations, each shares of Series D preferred

stock will be convertible at any time at the holder’s option

into shares of our common stock at an initial conversion price of

$__ per share of common stock. Subject to similar ownership

limitations, each warrant will be immediately exercisable for

up to 3,334 shares of our common stock (based on

warrant coverage of 100% of the shares issued upon conversion

of a share of Series D preferred stock), have an exercise

price of $__ per share, and expire five years from the date of

issuance.

Our

common stock is quoted on the OTCQB marketplace under the symbol

“GTHP.” The last reported sale price of our common

stock on the OTCQB on March 27, 2017 was

$0.40 per share.

|

|

|

|

|

Offering

Price

|

$

1,000

|

$

5,000,000

|

|

Placement

Agent’s Fees (1)

|

$

100

|

$

500,000

|

|

Offering Proceeds,

Before Expenses

|

$

900

|

$

4,500,000

|

_____________________________

|

|

(1)

|

We have agreed to reimburse to the placement

agent for its reasonable, out-of-pocket expenses. See “Plan

of Distribution” on page 20 for more

information.

|

We have retained

Moody Capital Solutions, Inc. to act as our exclusive placement

agent in connection with this offering and to use its “best

efforts” to solicit offers to purchase the securities. The

placement agent is not required to sell any specific number or

dollar amount of securities but will use its best efforts to sell

the securities offered. This best-efforts offering does not have a

minimum purchase requirement and therefore is not certain to raise

any specific amount.

Investing in our common stock involves a high

degree of risk. These risks are described under the caption

“Risk Factors” that begins on page 7 of this

prospectus.

Neither the

Securities and Exchange Commission, or SEC, nor any state

securities commission has approved or disapproved of the securities

that may be offered under this prospectus, nor have any of these

organizations determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal

offense.

Moody Capital Solutions,

Inc.

The date of this prospectus is ,

2017.

TABLE OF CONTENTS

|

FORWARD-LOOKING STATEMENTS

|

ii

|

|

SUMMARY

|

1

|

|

RISK FACTORS

|

6

|

|

USE OF PROCEEDS

|

18

|

|

DILUTION

|

19

|

|

CAPITALIZATION

|

20

|

|

PLAN OF DISTRIBUTION

|

21

|

|

DESCRIPTION OF SECURITIES WE ARE

OFFERING

|

23

|

|

DESCRIPTION OF SECURITIES

|

26

|

|

OUR BUSINESS

|

30

|

|

PROPERTIES

|

39

|

|

LEGAL PROCEEDINGS

|

39

|

|

MARKET FOR OUR COMMON STOCK AND RELATED

STOCKHOLDER MATTERS

|

39

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

40

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

46

|

|

CORPORATE GOVERNANCE

|

47

|

|

EXECUTIVE COMPENSATION

|

49

|

|

SHARE OWNERSHIP OF DIRECTORS, OFFICERS AND

CERTAIN BENEFICIAL OWNERS

|

51

|

|

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

52

|

|

LEGAL MATTERS

|

53

|

|

EXPERTS

|

53

|

|

WHERE YOU CAN GET MORE INFORMATION

|

55

|

i

ABOUT THIS PROSPECTUS

You should rely

only on the information contained in this prospectus or a

prospectus supplement. We have not authorized any other person to

provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it.

This prospectus is an offer to sell only the common stock offered

hereby, but only under circumstances and in jurisdictions where it

is lawful to do so. You should assume that the information

appearing in this prospectus is accurate only as of the

date hereof. Our business, financial condition, results of

operations and prospects may have changed.

The terms

“Guided Therapeutics,” “Company,”

“our,” “we,” and “us,” as used

in this prospectus, refer to Guided Therapeutics, Inc. and its

wholly owned subsidiary.

FORWARD-LOOKING

STATEMENTS

Statements in this

prospectus, which express “belief,”

“anticipation” or “expectation,” as well as

other statements that are not historical facts, are forward-looking

statements. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ

materially from historical results or anticipated results,

including those identified in the foregoing “Risk

Factors” and elsewhere in this prospectus. Examples of these

uncertainties and risks include, but are not limited

to:

|

|

●

|

access to sufficient debt or equity capital to

meet our operating and financial needs;

|

|

|

●

|

the extent of dilution of the holdings of our

existing stockholders upon the issuance, conversion or exercise of

securities issued as part of our capital raising

efforts;

|

|

|

●

|

whether and when we or any potential strategic

partners will obtain required regulatory approvals in the markets

in which we plan to operate;

|

|

|

●

|

the effectiveness and ultimate market acceptance

of our products and our ability to generate sufficient sales

revenues to sustain our growth and strategy plans;

|

|

|

●

|

whether our products in development will prove

safe, feasible and effective;

|

|

|

●

|

our need to achieve manufacturing scale-up in a

timely manner, and our need to provide for the efficient

manufacturing of sufficient quantities of our

products;

|

|

|

●

|

the lack of immediate alternate sources of

supply for some critical components of our products;

|

|

|

●

|

our ability to establish and protect the

proprietary information on which we base our products, including

our patent and intellectual property position;

|

|

|

●

|

the need to fully develop the marketing,

distribution, customer service and technical support and other

functions critical to the success of our product

lines;

|

|

|

●

|

the dependence on potential strategic partners

or outside investors for funding, development assistance, clinical

trials, distribution and marketing of some of our products;

and

|

|

|

●

|

other risks and uncertainties described from

time to time in our reports filed with the SEC.

|

Forward-looking

statements should not be read as a guarantee of future performance

or results, and will not necessarily be accurate indications of the

times at, or by which, such performance or results will be

achieved. Forward-looking information is based on information

available at the time and/or management’s good faith belief

with respect to future events, and is subject to risks and

uncertainties that could cause actual performance or results to

differ materially from those expressed in the

statements.

Forward-looking

statements speak only as of the date the statements are made. We

assume no obligation to update forward-looking statements to

reflect actual results, changes in assumptions or changes in other

factors affecting forward-looking information except to the extent

required by applicable securities laws. If we update one or more

forward-looking statements, no inference should be drawn that we

will make additional updates with respect thereto or with respect

to other forward-looking statements.

ii

SUMMARY

This summary highlights information contained

elsewhere in this prospectus. This summary is not complete and may

not contain all of the information that may be important to you. We

urge you to read the entire prospectus carefully, including the

‘‘Risk Factors’’ section, before making an

investment decision. Except for the financial statements included

with this prospectus and unless otherwise noted, all share and per

share data in this prospectus give effect to the 1:800 reverse

stock split of our common stock that was implemented on November 7,

2016. For more information about our reverse stock split, see

“Recent Developments.”

Our Company

We are a medical

technology company focused on developing innovative medical devices

that have the potential to improve healthcare. Our primary focus is

the sales and marketing of our LuViva® Advanced Cervical Scan

non-invasive cervical cancer detection device. The underlying

technology of LuViva primarily relates to the use of biophotonics

for the non-invasive detection of cancers. LuViva is designed to

identify cervical cancers and precancers painlessly, non-invasively

and at the point of care by scanning the cervix with light, then

analyzing the reflected and fluorescent light.

LuViva provides a

less invasive and painless alternative to conventional tests for

cervical cancer screening and detection. Additionally, LuViva

improves patient well-being not only because it eliminates pain,

but also because it is convenient to use and provides rapid results

at the point of care. We focus on two primary applications for

LuViva: first, as a cancer screening tool in the developing world,

where infrastructure to support traditional cancer-screening

methods is limited or non-existent, and second, as a triage

following traditional screening in the developed world, where a

high number of false positive results cause a high rate of

unnecessary and ultimately costly follow-up tests.

Screening for

cervical cancer represents one of the most significant demands on

the practice of diagnostic medicine. As cervical cancer is linked

to a sexually transmitted disease—the human papillomavirus

(HPV)—every woman essentially becomes “at risk”

for cervical cancer simply after becoming sexually active. In the

developing world, there are approximately 2.0 billion women aged 15

and older who are potentially eligible for screening with LuViva.

Guidelines for screening intervals vary across the world, but U.S.

guidelines call for screening every three years. Traditionally, the

Pap smear screening test, or Pap test, is the primary cervical

cancer screening methodology in the developed world. However, in

developing countries, cancer screening using Pap tests is expensive

and requires infrastructure and skill not currently existing, and

not likely to be developed in the near future, in these

countries.

We

believe LuViva is the answer to the developing world’s

cervical cancer screening needs. Screening for cervical cancer in

the developing world often requires working directly with foreign

governments or non-governmental agencies (NGOs). By partnering with

governments or NGOs, we can provide immediate access

to cervical cancer detection to large segments of a nation’s

population as part of national or regional governmental healthcare

programs, eliminating the need to develop expensive and

resource-intensive infrastructures.

Manufacturing,

Sales Marketing and Distribution

We

manufacture LuViva at our Norcross, Georgia facility. Most of the

components of LuViva are custom made for us by third-party

manufacturers. We adhere to ISO 13485:2003 quality standards in our

manufacturing processes.

Research,

Development and Engineering

We have

been engaged primarily in the research, development and testing of

our LuViva non-invasive cervical cancer detection product and our

core biophotonic technology. Since 2013, we have incurred about

$7.2 million in research and development expenses, net

of about $927,000 reimbursed through collaborative arrangements and

government grants. Research and development costs were

approximately $0.7 million and $1.5 million in

2016 and 2015, respectively

Patents

We have

pursued a course of developing and acquiring patents and patent

rights and licensing technology. Our success depends in large part

on our ability to establish and maintain the proprietary nature of

our technology through the patent process and to license from

others patents and patent applications necessary to develop our

products. As of March 27, 2017, we have

25 granted U.S. patents relating to our biophotonic

cancer detection technology and 5 pending U.S. patent

applications. We also have three granted patents that apply to our

interstitial fluid analysis system.

We are a Delaware

corporation, originally incorporated in 1992 under the name

“SpectRx, Inc.,” and, on February 22, 2008, changed our

name to Guided Therapeutics, Inc. At the same time, we renamed our

wholly owned subsidiary, InterScan, which originally had been

incorporated as “Guided Therapeutics.”

Since our

inception, we have raised capital through the public and private

sale of debt and equity, funding from collaborative arrangements,

and grants.

Our

prospects must be considered in light of the substantial risks,

expenses and difficulties encountered by entrants into the medical

device industry. This industry is characterized by an increasing

number of participants, intense competition and a high failure

rate. We have experienced operating losses since our inception and,

as of December 31, 2016 we have an accumulated deficit

of approximately $127.6 million. To date, we have

engaged primarily in research and development efforts and the early

stages of marketing our products. We do not have significant

experience in manufacturing, marketing or selling our products. We

may not be successful in growing sales for our products. Moreover,

required regulatory clearances or approvals may not be obtained in

a timely manner, or at all. Our products may not ever gain market

acceptance and we may not ever generate significant revenues or

achieve profitability. The development and commercialization of our

products requires substantial development, regulatory, sales and

marketing, manufacturing and other expenditures. We expect our

operating losses to continue through at least the end of

2017 as we continue to expend substantial resources to

complete commercialization of our products, obtain regulatory

clearances or approvals, build our marketing, sales,

manufacturing and finance capabilities, and conduct further

research and development.

Our

product revenues to date have been limited. In 2016,

the majority of our revenues were from the sale of LuViva devices

and disposables, as well as some revenue from grants from the NIH

and licensing agreement fees received. We expect that the majority

of our revenue in 2017 will be derived from revenue

from the sale of LuViva devices and disposables.

Our principal

executive and operations facility is located at 5835 Peachtree

Corners East, Suite D, Norcross, Georgia 30092, and our telephone

number is (770) 242-8723.

Recent Developments

Convertible

Promissory Note.

On February 13, 2017, we entered into a

securities purchase agreement with Auctus Fund, LLC for the

issuance and sale to Auctus of $170,000 in aggregate principal

amount of a 12% convertible promissory note for an aggregate

purchase price of $156,400 (representing a $13,600 original issue

discount). On February 13, 2017, we issued the note to Auctus.

Pursuant to the purchase agreement, we also issued to Auctus a

warrant exercisable to purchase an aggregate of 200,000 shares of

our common stock. The warrant is exercisable at any time, at an

exercise price per share equal to $0.77 (110% of the closing price

of the common stock on the day prior to issuance), subject to

certain customary adjustments and price-protection provisions

contained in the warrant. The warrant has a five-year term. The

note matures nine months from the date of issuance and, in addition

to the original issue discount, accrues interest at a rate of 12%

per year. We may prepay the note, in whole or in part, for 115% of

outstanding principal and interest until 30 days from issuance, for

125% of outstanding principal and interest at any time from 31 to

60 days from issuance, and for 130% of outstanding principal and

interest at any time from 61 days from issuance to 180 days from

issuance. After six months from the date of issuance, Auctus may

convert the note, at any time, in whole or in part, into shares of

our common stock, at a conversion price equal to the lower of the

price offered in our next public offering or a 40% discount to the

average of the two lowest trading prices of the common stock during

the 20 trading days prior to the conversion, subject to certain

customary adjustments and price-protection provisions contained in

the note. The note includes customary events of default provisions

and a default interest rate of 24% per year. Upon the occurrence of

an event of default, Auctus may require us to redeem the note (or

convert it into shares of common stock) at 150% of the outstanding

principal balance plus accrued and unpaid interest. In connection

with the transaction, we agreed to reimburse Auctus for $30,000 in

legal and diligence fees, of which we paid $10,000 in cash and

$20,000 in restricted shares of common stock, valued at $0.40 per

share (a 42.86% discount to the closing price of the common stock

on the day prior to issuance).

SMI License

Agreement

. On January 22, 2017, we entered into a license

agreement with Shandong Yaohua Medical Instrument Corporation, or

SMI, pursuant to which we granted SMI an exclusive global license

to manufacture the LuViva device and related disposables (subject

to a carve-out for manufacture in Turkey) and exclusive

distributionrights in the Peoples Republic of China, Macau, Hong

Kong and Taiwan. In exchange for the license, SMI will pay a $1.0

million licensing fee, payable in five installments through October

2017, underwrite the cost of securing approval of LuViva with the

Chinese Food and Drug Administration, or CFDA, and, once it obtains

CFDA approval, pay $1.90 royalty on each disposable sold in the

territories by purchasing directly from us a Controlled

Programmable Chip (CPC), necessary for the operation of disposable

unit. Pursuant to the SMI agreement, SMI must become capable of

manufacturing LuViva in accordance with ISO 13485 for medical

devices by the second anniversary of the SMI agreement, and achieve

CFDA approval by July 22, 2019, or else forfeit the license. During

2017, SMI must purchase no fewer than ten devices at $13,000 each

(with up to four devices pushed to 2018 if there is a delay in

obtaining approval from the CFDA). In the three full calendar years

following CFDA approval, SMI must sell a minimum of 3,500 devices

(500 in the first year, 1,000 in the second, and 2,000 in the

third), and purchase a minimum of 25,200,000 CPCs from us. If SMI

is able to meet these minimums or otherwise agrees to make up the

difference between payments for CPC orders and the minimum payments

to GTI (i.e., “pay to play”), this would result in

revenues of $47,880,000 to us over the three-year period.

Otherwise, SMI would forfeit the license. In any event, we cannot

be assured that SMI will be able to secure CFDA approval or meet

its minimum sales targets, or agree to make up the difference to

preserve their license, and therefore we cannot be assured of any

such revenue. As manufacturer of the devices and disposables, SMI

will be obligated to sell each to us at costs no higher than our

current costs. As partial consideration for, and as a condition to,

the license, and to further align the strategic interests of the

parties, we agreed to issue $1.0 million in shares of our common

stock to SMI, in five installments through October 2017, at a price

per share equal to the lesser of the average closing price for the

five days prior to issuance and $1.25. On March 28, 2017, we

amended the license agreement via a letter agreement to limit

SMI’s beneficial ownership of our common stock on any given

date to no more than 4.99% of our then-outstanding common stock. In

connection with the letter agreement, we agreed to issue to SMI

three warrants, each exercisable for 15,000 shares of our common

stock, to be issued in conjunction with the next three cash

payments by SMI under the license agreement. Each warrant will be

immediately exercisable (subject to the beneficial ownership

limitation), have an exercise price equal to the lesser of the

closing price per share of our common stock for the average of five

consecutive days preceding the payment by SMI and $1.25 per share,

and have a term of five years.

In order to

facilitate the SMI agreement, immediately prior to its execution we

entered into an agreement with Shenghuo Medical, LLC, regarding our

previous license to Shenghuo (see “—Shenghuo

License”). Under the terms of the new agreement, Shenghuo

agreed to relinquish its manufacturing license and its distribution

rights in SMI’s territories, and to waive its rights under

the original Shenghuo agreement, all for as long as SMI performs

under the SMI agreement. As consideration, we have agreed to split

with Shenghuo the licensing fees and net royalties from SMI that we

will receive under the SMI agreement. Should the SMI agreement be

terminated, we have agreed to re-issue the original license to

Shenghuo under the original terms. Our COO and director, Mark

Faupel, is a shareholder of Shenghuo, and another director, Richard

Blumberg, is a managing member of Shenghuo.

OID

Note.

On December 28, 2016, we entered

into a securities purchase agreement with RedDiamond Partners LLC

for the issuance and sale to RedDiamond of up to $330,000 in

aggregate principal amount of 10% original issuance discount

convertible promissory notes, for an aggregate purchase price of

$300,000. On that date, we issued to RedDiamond a note in the

principal amount of $222,000, for a purchase price of $200,000. At

our option, at any time within 60 days from that issuance, we may

issue another note in the principal amount of $110,000, for a

purchase price of $100,000, subject to customary conditions

contained in the purchase agreement. The notes mature six months

from their date of issuance and, in addition to the 10% original

issue discount, accrue interest at a rate of 10% per year. We may

prepay the notes, in whole or in part, for 115% of outstanding

principal and interest until 30 days from issuance, for 125% of

outstanding principal and interest at any time from 31 to 60 days

from issuance, and for 130% of outstanding principal and interest

at any time from 61 days from issuance until immediately prior to

the maturity date. After six months from the date of issuance

(i.e., if we fail to repay all principal and interest due under the

notes at the maturity date), RedDiamond may convert the notes, at

any time, in whole or in part, into shares of our common stock, at

a conversion price equal to 60% of the lowest volume weighted

average price of our common stock during the 20 trading days prior

to conversion, subject to certain customary adjustments and

anti-dilution provisions contained in the notes.

New Directors

and Chief Operating Officer.

On November 10, 2016,

the board of directors increased its size from three members to

four and appointed Richard P. Blumberg to fill the newly created

vacancy. On December 8, 2016, the board of directors appointed Mark

Faupel, our co-founder and former President and CEO, as our new COO

and, after again increasing the size of the board to five,

appointed Dr. Faupel to fill the newly created vacancy. Dr. Faupel

and Mr. Blumberg serves as a Managing Member of

Shenghuo, holder of a license to manufacture our products in Asia.

See “—Shenghuo License Agreement.”

Debt

Restructuring.

On December 7, 2016, we entered into

an exchange agreement with GPB Debt Holdings II LLC with regard to

the $1,525,000 in outstanding principal amount of senior secured

convertible note originally issued to GPB on February 11, 2016 (see

“—Senior Secured Convertible Note”), and the

$306,863 in outstanding principal amount of our secured promissory

note that GPB holds (see “—Secured Promissory

Note”). Pursuant to the exchange agreement, upon completion

of the next financing resulting in at least $1 million in cash

proceeds, GPB will exchange both securities for a new convertible

note in principal amount of $1,831,863. The new convertible note

will mature on February 12, 2018 and will accrue

interest at a rate of 19% per year. We will pay monthly interest

coupons and, beginning one year after issuance, will pay amortized

quarterly principal payments. Subject to resale restrictions under

Federal securities laws and the availability of sufficient

authorized but unissued shares of our common stock, the new

convertible note will be convertible at any time, in whole or in

part, at the holder’s option, into shares of our common

stock, at a conversion price equal to the price offered in the

qualifying financing that triggers the exchange, subject to certain

customary adjustments and anti-dilution provisions contained in the

new convertible note. The new convertible note will include

customary event of default provisions and a default interest rate

of the lesser of 21% or the maximum amount permitted by law. Upon

the occurrence of an event of default, GPB will be entitled to

require us to redeem the new convertible note at 120% of the

outstanding principal balance. The new convertible note will be

secured by a lien on all of our assets, including our intellectual

property, pursuant to the security agreement entered into by us and

GPB in connection with the issuance of the original senior secured

convertible note. As an inducement to GPB to enter into these

transactions, we agreed to increase the royalty payable to GPB

pursuant to its consulting agreement with us from 3.5% to 3.85% of

revenues from the sales of our products. We expect this offering to

trigger GPB’s obligation to exchange.

Reverse Stock

Split.

A 1:800 reverse stock split of all of our

issued and outstanding common stock was implemented on November 7,

2016. As a result of the reverse stock split, every 800 shares of

issued and outstanding common stock was converted into 1 share of

common stock. All fractional shares created by the reverse stock

split were rounded to the nearest whole share. The number of

authorized shares of common stock did not change.

Lockup and

Exchange Agreement.

On November 2, 2016, we entered

into a lockup and exchange agreement with GHS Investments, LLC,

holder of approximately $221,000 in outstanding principal amount of

our secured promissory note and all of the outstanding shares of

our Series C preferred stock (see “—Series C

Exchanges”). Pursuant to the agreement, upon the

effectiveness of the 1:800 reverse stock split and continuing for

45 days after, GHS and its affiliates were prohibited from

converting any portion of the secured promissory note or any of the

shares of Series C preferred stock or selling any of our securities

that they beneficially owned. We agreed that, upon consummation of

our next financing, we would use $260,000 of net cash proceeds

first, to repay GHS’s portion of the secured promissory note

and second, with any remaining amount from the $260,000, to

repurchase a portion of GHS’s shares of Series C preferred

stock. In addition, GHS has agreed to exchange the stated value per

share (plus any accrued but unpaid dividends) of its remaining

shares of Series C preferred stock for new securities of the same

type that we separately issue in the next qualifying financing we

undertake, on a dollar-for-dollar basis in a private placement

exchange. We expect this offering will be a qualifying financing

and, therefore, GHS will be contractually obligated to exchange

those shares of Series C preferred stock for shares of Series D

preferred stock and warrants immediately after we consummate this

offering, in a private placement exchange.

Royalty

Agreement.

On September 6, 2016, we entered into a

royalty agreement with one of our directors, John Imhoff, and

another stockholder, Dolores Maloof, pursuant to which we sold to

them a royalty of future sales of single-use cervical guides for

LuViva. Under the terms of the royalty agreement, and for

consideration of $50,000, we will pay them an aggregate perpetual

royalty initially equal to $0.10, and from and after October 2,

2016, equal to $0.20, for each disposable that we sell (or that is

sold by a third party pursuant to a licensing arrangement with

us).

Warrant

Restructuring.

Between June 13, 2016 and June 14,

2016, we entered into various agreements with holders of certain

warrants (including John Imhoff, one of our directors) originally

issued in May 2013, and with GPB Debt Holdings II LLC, holder of a

warrant issued February 12, 2016, pursuant to which each holder

separately agreed to exchange warrants for either (1) shares of

common stock equal to 166% of the number of shares of common stock

underlying the surrendered warrants, or (2) new warrants

exercisable for 200% of the number of shares underlying the

surrendered warrants, but without certain anti-dilution protections

included with the surrendered warrants. As a result of the

exchanges, we effectively eliminate any potential exponential

increase in the number of underlying shares issuable upon exercise

of our outstanding warrants. In total, for surrendered warrants

then-exercisable for an aggregate of 1,814,598 shares of common

stock (but subject to exponential increase upon operation of

certain anti-dilution provisions), we issued or are obligated to

issue 16,898 shares of common stock and new warrants that, if

exercised as of June 14, 2016, would have been exercisable for an

aggregate of 3,608,835 shares of common stock. In certain

circumstances, in lieu of presently issuing all of the shares (for

each holder that opted for shares of common stock), we and the

holder further agreed that we will, subject to the terms and

conditions set forth in the applicable warrant exchange agreement,

from time to time, be obligated to issue the remaining shares to

the holder. No additional consideration will be payable in

connection with the issuance of the remaining shares. The holders

that elected to receive shares for their surrendered warrants have

agreed that they will not sell shares on any trading day in an

amount, in the aggregate, exceeding 20% of the composite aggregate

trading volume of the common stock for that trading day. The

holders that elected to receive new warrants will be required to

surrender their old warrants upon consummation of this offering.

The new warrants will have an initial exercise price equal to the

exercise price of the surrendered warrants as of immediately prior

to consummation of this offering, subject to customary

“downside price protection” for as long as our common

stock is not listed on a national securities exchange, and will

expire five years from the date of issuance.

Shenghuo

License Agreement.

On June 5, 2016, we entered into a license

agreement with Shenghuo Medical, LLC pursuant to which we granted

Shenghuo an exclusive license to manufacture, sell and distribute

LuViva in Taiwan, Brunei Darussalam, Cambodia, Laos, Myanmar,

Philippines, Singapore, Thailand, and Vietnam. Shenghuo was already

our exclusive distributor in China, Macau and Hong Kong, and the

license extended to manufacturing in those countries

as well. Under the terms of the license agreement, once Shenghuo

was capable of manufacturing LuViva in accordance with

ISO 13485 for medical devices, Shenghuo would pay us a

royalty equal to $2.00 or 20% of the distributor price (subject to

a discount under certain circumstances), whichever is higher, per

disposable distributed within Shenghuo’s exclusive

territories. In connection with the license grant, Shenghuo would

underwrite the cost of securing approval of LuViva with Chinese

Food and Drug Administration. At its option, Shenghuo also

would provide up to $1.0 million in furtherance of our

efforts to secure regulatory approval for LuViva from the U.S. Food

and Drug Administration, or U.S. FDA, in exchange for

the right to receive payments equal to 2% of our future sales in

the United States, up to an aggregate of $4.0 million. Pursuant to

the license agreement, Shenghuo had the option to have

a designee appointed to our board of directors (and Richard

Blumberg is that designee). As partial consideration for,

and as a condition to, the license, and to further align the

strategic interests of the parties, on March 24, 2017

we issued a $300,000 convertible note to Shenghuo, in

exchange for Shenghuo’s June 2016 aggregate cash

investment of $200,000. The unsecured note

accrues interest at 20% per year, compounded

annually, from January 1, 2017 until repayment, and is

convertible into shares of our common stock at a conversion price

per share of $13.92, subject to customary anti-dilution adjustment.

We also issued Shenghuo a five-year warrant

exercisable immediately for 17,239 shares of common stock at an

exercise price equal to theconversion price of the note, subject to

customary anti-dilution adjustment.

On January 22, 2017, we entered into a license agreement with SMI,

pursuant to which we granted SMI an exclusive global license to

manufacture the LuViva device and related disposables (subject to a

carve-out for manufacture in Turkey) and exclusive distribution

rights in the Peoples Republic of China, Macau, Hong Kong and

Taiwan. In order to facilitate the SMI agreement, immediately prior

to its execution we entered into an agreement with Shenghuo,

regarding the previous license to Shenghuo. Under the terms of the

new agreement, Shenghuo agreed to relinquish its manufacturing

license and its distribution rights in SMI’s territories, and

to waive its rights under the original Shenghuo agreement, all for

as long as SMI performs under the SMI agreement

(see

“–SMI License Agreement”).

Cash

Advances.

On May 4, 2016, May 26, 2016, and June 22,

2016 Aquarius Opportunity Fund advanced us a total of $107,500 for

2% simple interest notes due the earlier of December 31, 2016 or

consummation of this offering. Also on May 26, 2016, GPB Debt

Holdings II LLC, holder of our outstanding senior secured

convertible note, advanced as an additional $87,500, on the same

terms as its note. We intend to offer Aquarius the

opportunity to participate in the offering at least up to the

extent of the outstanding principal and interest on its cash

advance, by extinguishing all or a portion of the debt on a

dollar-for-dollar basis.

Series C

Exchanges.

Between April 27, 2016 and May 3, 2016, we

entered into various agreements with certain holders of our Series

C preferred stock, including John Imhoff and Mark Faupel, two of

our directors, pursuant to which those holders separately agreed to

exchange each share of Series C preferred stock held for 2.25

shares of our newly created Series C1 preferred stock and 12 shares

of our common stock. In connection with these exchanges, each

holder also agreed to exchange the $1,000 stated value per share of

the holder’s shares of Series C1 preferred stock for new

securities of the same type that we separately issue in the next

qualifying financing we undertake, on a dollar-for-dollar basis in

private placement exchanges. This obligation is contingent on all

holders of the then-outstanding Series C preferred stock exchanging

their shares of Series C preferred stock on the same terms. We do

not expect the remaining holder of our Series C preferred stock

to exchange its shares on the same terms, and

therefore the holders of our Series C1 preferred stock will not be

so obligated. Finally, each holder agreed, except in the event of

an additional $50,000 cash investment by the holder in our next

public financing of at least $1 million, to execute a customary

“lockup” agreement in connection with such financing.

In total, for 1,916 shares of Series C preferred stock surrendered,

we issued 4,311 shares of Series C1 preferred stock and 22,996

shares of common stock. The Series C1 preferred stock has terms

that are substantially the same as the Series C preferred stock,

except that the Series C1 preferred stock does not pay dividends

(unless and to the extent declared on the common stock) or

at-the-market “make-whole payments.” See

“Description of Securities” for a description of the

material terms of the Series C1 preferred stock. Separately, on

April 27, 2016, we entered into a similar agreement with a prior

holder of Series C preferred stock, Aquarius Opportunity Fund, but

Aquarius subsequently sold all of its shares of Series C preferred

stock (and its portion of our secured promissory note, also subject

to the agreement) to GHS. Pursuant to the agreement, Aquarius also

agreed to return to us for cancelation warrants exercisable for 903

shares of our common stock that it held. Finally, Aquarius, as the

holder of a majority of the outstanding Series C preferred stock,

agreed to amend the Series C stock purchase agreement to eliminate

any participation rights held by the Series C shareholders and to

waive operation of certain anti-dilution provisions of the Series C

that would otherwise be triggered by the transactions described in

“—Recent Developments.”

February 2016

Reverse Stock Split.

On February 24, 2016, we

implemented a 1:100 reverse stock split of all of our issued and

outstanding common stock. As a result of the reverse stock split,

every 100 shares of issued and outstanding common stock was

converted into 1 share of common stock. All fractional shares

created by the reverse stock split were rounded to the nearest

whole share. The number of authorized shares of common stock did

not change.

Secured

Promissory Note.

On February 11, 2016, we consented

to an assignment of our outstanding secured promissory note to two

accredited investors, Aquarius Opportunity Fund and GPB Debt

Holdings II LLC. In connection with the assignment, the holders

waived an ongoing event of default under the notes related to our

minimum market capitalization, and agreed to eliminate the

requirement going forward. On March 7, 2016, we further amended the

notes to eliminate the volume limitations on sales of common stock

issued or issuable upon conversion of the notes. GPB subsequently

sold the note to GHS.

Senior

Secured Convertible Note.

On

February 11, 2016, we entered into a securities purchase agreement

with GPB Debt Holdings II LLC for the issuance and sale on February

12, 2016 of $1.4375 million in aggregate principal amount of a

senior secured convertible note for an aggregate purchase price of

$1.15 million (a 20% original issue discount). The note matures on

the second anniversary of issuance and, in addition to the 20%

original issue discount, accrues interest at a rate of 17% per

year. Subject to certain restrictions, it is convertible at any

time, in whole or in part, at the holder’s option, into

shares of our common stock, at an initial conversion price equal to

$640.00 per share, subject to certain customary adjustments and

anti-dilution provisions. In addition, the investor received a

five-year warrant exercisable to purchase an aggregate of

approximately 2,247 shares of our common stock with an initial

exercise price of $640.00 per share, subject to certain customary

adjustments and anti-dilution provisions. As of March

27, 2017, as a result of the operation of the anti-dilution

provisions, the conversion price of the note and the exercise price

of the warrants are $.2639 per share and

5,447,817 shares were issuable upon exercise of

the warrant. On March 18, 2016, our placement agent received

a warrant with similar terms exercisable for 197,807

shares.

Increase in

Authorized Shares.

On September 15, 2015, we amended

our certificate of incorporation to increase the number of shares

of common stock authorized for issuance to 500.0 million, and on

November 12, 2015, we further amended our certificate of

incorporation to increase the number of shares of common stock

authorized for issuance to 1.0 billion.

Series C

Financing.

On June 29, 2015, we entered into

a securities purchase agreement with certain accredited investors

(including John Imhoff and Mark Faupel, two of our directors),

amended on September 3, 2015, for the issuance and sale of shares

of an aggregate of 7,903 shares of our Series C preferred stock, at

a purchase price of $750 per share and an initial conversion price

of $76.00 per share, and five-year warrants exercisable to purchase

an aggregate of approximately 156,000 shares of our common stock at

an initial exercise price of $76.00 per share, subject to certain

customary adjustments and anti-dilution provisions.

The Offering

|

Issuer

|

Guided Therapeutics, Inc.

|

|

Securities

offered

|

Up to 5,000 shares of Series D preferred

stock and warrants exercisable for an aggregate of up to

16,670,000 shares of our common stock. The shares of

Series D preferred stock and the warrants are immediately separable

and will be issued separately, but will be purchased together in

this offering. This prospectus also covers the shares of common

stock issuable upon conversion of the Series D preferred stock and

upon the exercise of the warrants.

|

|

Offering

price

|

$1,000 combined price for each share of Series D

preferred stock and accompanying warrant

|

|

Description of

Series D preferred stock

|

Series D preferred stock pays a two-year

cumulative dividend of 12% per year, has a liquidation

preference senior to our common stock but junior to our

Series C preferred stock, is convertible at the option of the

holder (subject to certain ownership limitations) into shares of

our common stock at a conversion price of $__ per share (and is

mandatorily convertible upon the election of two-thirds of the

then-outstanding holders), subject to anti-dilution adjustment, and

is redeemable under certain circumstances at our option or the

option of two-thirds of the then-outstanding holders. See

“Description of Securities We Are Offering” on page

22.

|

|

Shares of common

stock underlying the shares of Series D preferred

stock

|

Up to 16,670,000

shares, based on an assumed conversion price of $0.30. The actual

number of shares will depend on the actual conversion price, which

has not been determined, but is expected to be a discount to the

then-current market price of our common

stock

|

|

Description of

warrants

|

Each warrant will

be immediately exercisable for up to 3,334 shares of

our common stock (based on warrant coverage of 100% of the

shares issued upon conversion of a share of Series D

preferred stock), have an exercise price assumed to be

$0.36 per share, and expire five years after the date of

issuance. The actual exercise price has not been determined,

but is expected to be 120% of the conversion price of the Series D

preferred stock. See “Description of Securities We Are

Offering” on page

1.

|

|

Shares of common

stock underlying the warrants

|

Up to 16,670,000

shares (based on warrant coverage of 100% of the shares issued upon

conversion of all 5,000 shares of Series D preferred

stock).

|

|

Shares of common

stock outstanding before and after this

offering

|

1,494,741 shares before this

offering and 18,164,741 shares after this offering,

assuming all shares of Series D preferred stock are sold and

converted to common stock.* See “Dilution” on page

17.

|

|

Use of

proceeds

|

We intend to apply net cash proceeds received in

connection with the offering to increase inventory of LuViva to

meet current demand, repay our outstanding secured promissory note

and repurchase approximately $43,000 in shares of

Series C preferred stock, support our efforts to re-file for

U.S. FDA approval of LuViva, and support general working

capital and operations. However, we will retain broad discretion

over the use of proceeds and may use the money for other corporate

purposes. See “Use of Proceeds” on page

17.

|

|

Market for the

common stock

|

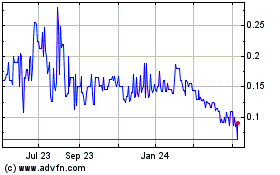

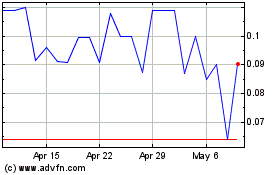

Our common stock is quoted on the OTCQB

marketplace under the symbol “GTHP.” See “Market

for Our Common Stock and Related Stockholder Matters” on page

37.

|

|

Risk

factors

|

You should read “Risk Factors” on

page 7 for an explanation of the risks of investing in this

offering.

|

|

|

*

|

Share numbers are

based on shares outstanding as of March 27, 2017 and

exclude:

|

|

|

●

|

125 shares

of common stock reserved for future issuance under our 1995 Stock

Plan;

|

|

|

●

|

16,864,630

shares of common stock reserved for issuance upon conversion of, or

as dividends on, our Series C and Series C1 convertible preferred

stock;

|

|

|

●

|

7,743,293

shares reserved for issuance upon conversion of our outstanding

convertible debt;

|

|

|

●

|

5,738,112

shares of common stock issuable upon the exercise of outstanding

warrants or warrants to be exchanged for outstanding

warrants;

|

|

|

●

|

up to 16,670,000

shares of common stock issuable upon exercise of warrants sold as

part of this offering.

|

RISK

FACTORS

Your investment in shares of our common stock

involves substantial risks. In consultation with your own advisers,

you should carefully consider, among other matters, the factors set

forth below before deciding whether an investment in shares of our

common stock is suitable for you. If any of the risks contained in

this prospectus develop into actual events, our business, financial

condition, liquidity, results of operations and prospects could be

materially and adversely affected, the market price of our common

stock could decline and you may lose all or part of your

investment. Some statements in this prospectus, including

statements in the following risk factors, constitute

forward-looking statements. See “Forward-Looking

Statements” in this prospectus.

Risks

Related to this Offering

As a new investor, you will incur substantial dilution as a result

of this offering and future equity issuances.

Our net tangible

book value deficiency as of December 31, 2016 was

approximately $10.6 million, or $15.79

per share of common stock. Net tangible book value per share

represents total tangible assets less total liabilities, divided by

the number of shares of common stock outstanding. On a pro forma

basis after giving effect to the assumed sale of 5,000 shares of

Series D preferred stock in this offering at a public offering

price of $1,000 per share, and assuming the conversion of all the

shares of Series D preferred stock sold in the offering at an

assumed conversion price of $0.30 per share, which

represents a 25% discount off the last reported sale price for our

common stock on March 27, 2017 (and excluding shares

of common stock issuable upon exercise of the warrants), and after

deducting estimated placement agent fees and estimated offering

expenses payable by us, if you purchase securities in this

offering, you will suffer immediate and substantial dilution of

approximately $0.53 per share in the net tangible book

value of the common stock underlying the Series D preferred stock

that you acquire. See “Dilution” for a more detailed

discussion of the dilution you will incur if you participate in

this offering. In addition to this offering, subject to market

conditions and other factors, it is likely that we will pursue

additional capital to finance our operations. Accordingly, we may

conduct substantial future offerings of equity securities. The

exercise of outstanding options and warrants and future equity

issuances, including future public offerings or future private

placements of equity securities, would result in further dilution

to investors.

The actual offering amount, the offering price and the net proceeds

to us, if any, in this offering may be substantially less than the

amounts set forth above.

Because there

is no minimum offering amount or offering price required as a

condition to closing in this offering, the actual public offering

amount, offering price and net proceeds to us, if any, in this

offering are not presently determinable and may be substantially

less than the amounts set forth above. We are not required to sell

any specific number or dollar amount of the securities offered in

this offering, but the placement agent will use its best efforts to

sell the securities offered.

Sales of a significant number of shares of our common stock in the

public markets, or the perception that such sales could occur,

could depress the market price of our common stock.

If our

stockholders (including those persons who may become stockholders

upon conversion of outstanding convertible securities or exercise

of outstanding warrants or options) sell substantial amounts of our

common stock, or the public market perceives that stockholders

might sell substantial amounts of our common stock, the market

price of our common stock could decline significantly. Such sales

also might make it more difficult for us to sell equity or

equity-related securities in the future at a time and price that

our management deems appropriate.

We will have broad discretion over the use of the proceeds of this

offering and may not realize a return.

We will have

considerable discretion in the application of the net cash proceeds

of this offering. We intend to use the net cash proceeds to

increase inventory of LuViva to meet current demand for the

product, and to support general working capital and operations.

However, we will retain broad discretion over the use of the net

proceeds and may use the money for other corporate purposes. We may

use the net cash proceeds for purposes that do not yield a

significant return, if any, for our stockholders.

There is no public market for the Series D preferred stock or

warrants being offered in this offering.

There is no

established public trading market for the Series D preferred stock

or warrants being offered in this offering and we do

not expect a market to develop for the securities. In

addition, we do not intend to apply for listing of the

securities on any securities exchange or expect the

securities to trade on the OTCQB marketplace. Without

an active market, the liquidity of the securities will

be limited.

The Series D preferred stock provides for the payment of dividends

in cash, but we are not currently permitted to pay such

dividends.

Each share of

Series D preferred stock will be entitled to receive cumulative

dividends until the second anniversary of the date of issuance. The

dividends are payable in cash, out of any funds legally available

for such purpose. We will not be permitted to pay the dividend in

cash unless we are legally permitted to do so under Delaware law,

which requires cash to be available from surplus or net profits,

neither of which we currently have available. Additionally, we are

also subject to certain restrictions pursuant to the terms of our

outstanding indebtedness, which prohibit us from paying cash

dividends or distributions on our capital stock. As such, we do not

expect to have cash available to pay the dividends on the Series D

preferred stock or to be permitted to make such payments under the

terms of our indebtedness. In such a case, the only way you will

realize the benefits of accrued but unpaid dividends will be upon

conversion, liquidation, or redemption of your shares of Series D

preferred stock.

Risks Related to Our

Business

Although we

are required to raise funds in this offering in order to continue

as a going concern, there is no assurance that such funds can be

raised on terms that we would find acceptable, on a timely basis,

or at all.

Additional debt or

equity financing is required for us to continue as a going concern.

If this offering is unsuccessful or insufficient, we may seek to

obtain additional funds for the financing of our cervical cancer

detection business through additional debt or equity financings

and/or new collaborative arrangements. Any required additional

funding may not be available on terms attractive to us, on a timely

basis, or at all.

If we cannot

obtain additional funds or achieve profitability, we may not be

able to continue as a going concern.

Because we must

obtain additional funds through financing transactions or through

new collaborative arrangements in order to grow the revenues of our

cervical cancer detection product line, there exists substantial

doubt about our ability to continue as a going concern. Therefore,

it will be necessary to raise additional funds. There can be no

assurance that we will be able to raise these additional funds. If

we do not secure additional funding when needed, we will be unable

to conduct all of our product development efforts as planned, which

may cause us to alter our business plan in relation to the

development of our products. Even if we obtain additional funding,

we will need to achieve profitability thereafter.

Our independent

registered public accountants’ report on our consolidated

financial statements as of and for the year ended December 31,

2016, indicated that there was substantial doubt about

our ability to continue as a going concern because we had suffered

recurring losses from operations and had an accumulated deficit of

$127.6 million at December 31, 2016

summarized as follows:

|

Accumulated deficit,

from inception to 12/31/2014

|

$

|

113.1 million

|

|

Preferred dividends and deemed

dividends

|

$

|

2.6 million

|

|

Net Loss for fiscal year 2015, ended

12/31/2015

|

$

|

6.9 million

|

|

Accumulated deficit, from inception to

12/31/2015

|

$

|

122.6 million

|

|

Preferred

dividends

|

$

|

1.0 million

|

|

Net Loss for year to date ended

12/31/2016

|

$

|

4.0 million

|

|

Accumulated deficit, from inception to

12/31/2016

|

$

|

127.6

million

|

Our management has

implemented reductions in operating expenditures and reductions in

some development activities. We have determined to make cervical

cancer detection the focus of our business. We are managing the

development of our other programs only when funds are made

available to us via grants or contracts with government entities or

strategic partners. However, there can be no assurance that we will

be able to successfully implement or continue these

plans.

If we cannot

obtain additional funds when needed, we will not be able to

implement our business plan.

We require

substantial additional capital to develop our products, including

completing product testing and clinical trials, obtaining all

required regulatory approvals and clearances, beginning and scaling

up manufacturing, and marketing our products. We have historically

financed our operations though the public and private sale of debt

and equity, funding from collaborative arrangements, and grants.

Any failure to achieve adequate funding in a timely fashion would

delay our development programs and could lead to abandonment of our

business plan. To the extent we cannot obtain additional funding,

our ability to continue to manufacture and sell our current

products, or develop and introduce new products to market, will be

limited. Further, financing our operations through the public or

private sale of debt or equity may involve restrictive covenants or

other provisions that could limit how we conduct our business or

finance our operations. Financing our operations through

collaborative arrangements generally means that the obligations of

the collaborative partner to fund our expenditures are largely

discretionary and depend on a number of factors, including our

ability to meet specified milestones in the development and testing

of the relevant product. We may not be able to obtain an acceptable

collaboration partner, and even if we do, we may not be able to

meet these milestones, or the collaborative partner may not

continue to fund our expenditures.

We do not have

a long operating history, especially in the cancer detection field,

which makes it difficult to evaluate our

business.

Although we have

been in existence since 1992, we have only recently begun to

commercialize our cervical cancer detection technology. Because

limited historical information is available on our revenue trends

and manufacturing costs, it is difficult to evaluate our

business. Our prospects must be considered in light of the

substantial risks, expenses, uncertainties and difficulties

encountered by entrants into the medical device industry, which is

characterized by increasing intense competition and a high failure

rate.

We have a

history of losses, and we expect losses to

continue.

We have never been

profitable and we have had operating losses since our inception. We

expect our operating losses to continue as we continue to expend

substantial resources to complete commercialization of our

products, obtain regulatory clearances or approvals; build our

marketing, sales, manufacturing and finance capabilities, and

conduct further research and development. The further development

and commercialization of our products will require substantial

development, regulatory, sales and marketing, manufacturing and

other expenditures. We have only generated limited revenues from

product sales. Our accumulated deficit was approximately

$127.6 million at December 31,

2016.

Our ability to

sell our products is controlled by government regulations, and we

may not be able to obtain any necessary clearances or

approvals.

The design,

manufacturing, labeling, distribution and marketing of medical

device products are subject to extensive and rigorous government

regulation in most of the markets in which we sell, or plan to

sell, our products, which can be expensive and uncertain and can

cause lengthy delays before we can begin selling our products in

those markets.

In foreign

countries, including European countries, we are subject to

government regulation, which could delay or prevent our ability to

sell our products in those

jurisdictions.

In order for us to

market our products in Europe and some other international

jurisdictions, we and our distributors and agents must obtain

required regulatory registrations or approvals. We must also comply

with extensive regulations regarding safety, efficacy and quality

in those jurisdictions. We may not be able to obtain the required

regulatory registrations or approvals, or we may be required to

incur significant costs in obtaining or maintaining any regulatory

registrations or approvals we receive. Delays in obtaining any

registrations or approvals required for marketing our products,

failure to receive these registrations or approvals, or future loss

of previously obtained registrations or approvals would limit our

ability to sell our products internationally. For example,

international regulatory bodies have adopted various regulations

governing product standards, packaging requirements, labeling

requirements, import restrictions, tariff regulations, duties and

tax requirements. These regulations vary from country to country.

In order to sell our products in Europe, in 2017 we

must undergo an inspection and re-file for ISO

13485:2003 and the CE MARK, which is an

international symbol of quality and compliance with applicable

European medical device directives. Failure to maintain ISO

13485:2003 certification or CE mark certification or other

international regulatory approvals would prevent us from selling in

some countries in the European Union.

As part of our

agreement with SMI, SMI will underwrite the cost of securing

approval of LuViva with the CFDA and is responsible for securing

CFDA approval by July 2019, although we cannot be assured that SMI

will successfully secure such approval without delays or conditions

unacceptable to us, or at all.

In the United

States, we are subject to regulation by the U.S. FDA,

which could prevent us from selling our products

domestically.

In order for us to

market our products in the United States, we must obtain clearance

or approval from the U.S. FDA. We cannot be sure

that:

|

|

●

|

we, or any collaborative partner, will make

timely filings with the

U.S.

FDA;

|

|

|

●

|

the

U.S.

FDA will act favorably or quickly on these

submissions;

|

|

|

●

|

we will not be required to submit additional

information or perform additional clinical studies; or

|

|

|

●

|

we will not face other significant difficulties

and costs necessary to obtain

U.S.

FDA clearance or approval.

|

It can take several

years from initial filing of a PMA application and require the

submission of extensive supporting data and clinical

information. The

U.S.

FDA may impose strict labeling or other requirements as a condition

of its clearance or approval, any of which could limit our ability

to market our products domestically. Further, if we wish to modify

a product after

U.S.

FDA approval of a PMA application, including changes in indications

or other modifications that could affect safety and efficacy,

additional clearances or approvals will be required from

the

U.S.

FDA. Any request by the

U.S.

FDA for additional data, or any requirement by

the

U.S.

FDA that we conduct additional clinical studies, could result in a

significant delay in bringing our products to market domestically

and require substantial additional research and other expenditures.

Similarly, any labeling or other conditions or restrictions imposed

by the

U.S.

FDA could hinder our ability to effectively market our products

domestically. Further, there may be new

U.S.

FDA policies or changes in

U.S.

FDA policies that could be adverse to us.

Even if we

obtain clearance or approval to sell our products, we are subject

to ongoing requirements and inspections that could lead to the

restriction, suspension or revocation of our

clearance.

We, as well as any

potential collaborative partners, will be required to adhere to

applicable regulations in the markets in which we operate and sell

our products, regarding good manufacturing practice, which include

testing, control, and documentation requirements. Ongoing

compliance with good manufacturing practice and other applicable

regulatory requirements will be strictly enforced applicable

regulatory agencies. Failure to comply with these regulatory

requirements could result in, among other things, warning letters,

fines, injunctions, civil penalties, recall or seizure of products,

total or partial suspension of production, failure to obtain

premarket clearance or premarket approval for devices, withdrawal

of approvals previously obtained, and criminal prosecution. The

restriction, suspension or revocation of regulatory approvals or

any other failure to comply with regulatory requirements would

limit our ability to operate and could increase our

costs.

We depend on a

limited number of customers and any reduction, delay or

cancellation of an order from these customers or the loss of any of

these customers could cause our revenue to

decline.

Each year we have

had one or a few customers that have accounted for substantially

all of our limited revenues. As a result, the termination of a

purchase order with any one of these customers may result in the

loss of substantially all of our revenues. We are constantly

working to develop new relationships with existing or new

customers, but despite these efforts we may not be successful at

generating new orders to maintain similar revenues as current

purchase orders are filled. In addition, since a significant

portion of our revenues is derived from a relatively few customers,

any financial difficulties experienced by any one of these

customers, or any delay in receiving payments from any one of these