As filed with the Securities and Exchange Commission on January 6, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM S‑8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________

NIKE, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Oregon | | 93-0584541 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

One Bowerman Drive

Beaverton, Oregon 97005-6453

(503) 671-6453

(Address of principal executive offices, including zip code)

___________________

NIKE, INC. STOCK INCENTIVE PLAN

(Full title of the plan)

John F. Coburn III

Vice President and Corporate Secretary

NIKE, Inc.

One Bowerman Drive

Beaverton, Oregon 97005-6453

(503) 671-6453

(Name, address and telephone number, including area code, of agent for service)

____________________

Copy to:

J. Sue Morgan

Perkins Coie LLP

1201 Third Avenue, Suite 4900

Seattle, Washington 98101

(206) 359-8000

_____________________

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | | | | |

Large accelerated filer | n | | | | Accelerated filer | o |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | | Smaller reporting company | o |

______________________

CALCULATION OF REGISTRATION FEE

|

| | | | | | | | |

Title of Securities to Be Registered | | Amount to Be Registered | | Proposed Maximum

Offering Price Per Share | | Proposed Maximum Aggregate Offering Price(1) | | Amount of Registration Fee |

Class B Common Stock, no par value | | 66,000,000 | | $61.39 | | $4,051,740,000.00 | | $408,010.22 |

| |

(1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(h) under the Securities Act of 1933. The calculation of the registration fee for the shares is based on $61.39 which was the average of the high and low prices of the Class B Common Stock on January 4, 2016, as reported in The Wall Street Journal for New York Stock Exchange issues. |

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by NIKE, Inc. (the “Company”) with the Securities and Exchange Commission (the “SEC” or the “Commission”) are incorporated by reference in this registration statement, other than information in a report or document that is "furnished" and not "filed" pursuant to the applicable rules and regulations of the SEC:

(a) The Company’s latest annual report filed pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or the latest prospectus filed pursuant to Rule 424(b) under the Securities Act of 1933, as amended (the “Securities Act”) that contains audited consolidated financial statements for the Company’s latest fiscal year for which such statements have been filed.

(b) All other reports filed pursuant to Section 13(a) or 15(d) of the Exchange Act since the end of the fiscal year covered by the annual report or prospectus referred to in (a) above.

(c) The description of the authorized capital stock of the Company contained in the Company’s registration statement filed under Section 12 of the Exchange Act, including any amendment or report filed for the purpose of updating the description.

All reports and other documents subsequently filed by the Company pursuant to Sections 13(a) and (c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of the filing of such reports and documents.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Under the Oregon Business Corporation Act (the “Oregon Act”), the Company’s Restated Articles of Incorporation as amended September 25, 2015 (the “Articles”) and the Company’s Third Restated Bylaws as amended June 20, 2013 (the “Bylaws”), the Company has broad powers to indemnify directors and officers against liabilities that they may incur in such capacities.

The Oregon Act authorizes the indemnification of an individual made a party to a proceeding because the individual is or was an officer or director against certain liability incurred in the proceeding if:

(a) the conduct of the individual was in good faith;

(b) the individual reasonably believed that his or her conduct was in the best interests of the corporation or at least not opposed to its best interests;

(c) in the case of any criminal proceeding, the individual had no reasonable cause to believe his or her conduct was unlawful;

(d) in the case of any proceeding by or in the right of the corporation, the individual was not adjudged liable to the corporation; and

(e) in connection with any proceeding (other than a proceeding by or in the right of the corporation) charging improper personal benefit to the individual, the individual was not adjudged liable on the basis that he or she improperly received personal benefit.

The Oregon Act also authorizes a court to order indemnification, whether or not the above standards of conduct have been met, if the court determines that the officer or director is fairly and reasonably entitled to indemnification in view of all the relevant circumstances. In addition, the Oregon Act provides that the indemnification described above is not exclusive of any other rights to which officers or directors may be entitled under the corporation's

articles of incorporation or bylaws, or under any agreement, action of its board of directors, vote of shareholders or otherwise.

Paragraph A of Article VIII of the Articles authorizes, but does not require, the Company to indemnify its officers and directors to the fullest extent not prohibited by law against liability incurred in serving the Company. Article 9 of the Bylaws requires the Company to indemnify its directors and officers to the fullest extent not prohibited by law against liability incurred in serving the Company.

The Oregon Act also authorizes a corporation to include in its articles of incorporation a provision eliminating or limiting the personal liability of a director to the corporation or its shareholders for monetary damages for conduct as a director, except that such a provision cannot affect the liability of a director (i) for any breach of the director's duty of loyalty to the corporation or its shareholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) for any unlawful corporate distribution as defined in the Oregon Act or (iv) for any transaction from which the director derived an improper personal benefit.

Paragraph B of Article VIII of the Articles and Article X of the Bylaws provide that the liability of the Company's directors to the Company or its shareholders for monetary damages for conduct as a director is limited to the fullest extent not prohibited by law.

In addition to the indemnification and exculpation provided by the Articles and Bylaws, the Company has entered into an indemnity agreement with each of its directors and officers. The indemnity agreements require the Company to provide indemnification, to the fullest extend not prohibited by law, for all liability (including attorney fees, judgments, fines and amounts paid in settlement) actually and reasonably incurred by the director or officer in connection with any actual or threatened proceeding (including, to the extent not prohibited by law, any derivative action) by reason of the fact that the person is or was serving as a director or officer of the Company, or is or was serving at the request of the Company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, including an employee benefit plan.

The Company maintains directors’ and officers’ liability insurance under which the Company’s directors and officers are insured against loss (as defined) as a result of claims brought against them alleging breach of duty, neglect, error or misstatement while acting in such capacities.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

| | |

Exhibit Number | | Description of Document |

| | |

4.1 | | Restated Articles of Incorporation, as amended. Incorporated by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2015. |

4.2 | | Third Restated Bylaws, as amended. Incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed June 21, 2013. |

5.1 | | Opinion of Counsel. |

23.1 | | Consent of PricewaterhouseCoopers LLP. |

23.2 | | Consent of Counsel (included in Exhibit 5.1). |

24.1 | | Power of Attorney (included on the signature page of this registration statement). |

99.1 | | NIKE, Inc. Stock Incentive Plan. |

Item 9. Undertakings.

A. The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(a) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(b) To reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this registration statement; and

(c) To include any material information with respect to the plan of distribution not previously disclosed in this registration statement or any material change to such information in this registration statement;

provided, however, that paragraphs (A)(1)(a) and (A)(1)(b) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act are incorporated by reference in this registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

B. The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

C. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Company certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Beaverton, State of Oregon, on January 6, 2016.

|

| | |

| | NIKE, INC.

By: /s/ John F. Coburn III Name: John F. Coburn III Title: Vice President and Corporate Secretary |

| | |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints MARK G. PARKER, ANDREW CAMPION and JOHN F. COBURN III, or any of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her in any and all capacities, to sign any amendments (including any post-effective amendments) to this registration statement and to file the same, with all exhibits thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, or any of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them, or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities indicated on January 6, 2016.

|

| | |

Signature | | Title |

/s/ Mark G. Parker ___________________________________ Mark G. Parker | |

Chief Executive Officer and Director

(Principal Executive Officer) |

| | |

/s/ Andrew Campion ___________________________________ Andrew Campion | |

Chief Financial Officer

(Principal Financial Officer) |

| | |

/s/ Chris Abston ___________________________________ Chris Abston | |

Corporate Controller

(Principal Accounting Officer) |

| | |

/s/ Philip H. Knight ___________________________________ Philip H. Knight | |

Director, Chairman of the Board |

| | |

|

| | |

Signature | | Title |

/s/ Elizabeth J. Comstock ___________________________________ Elizabeth J. Comstock | |

Director |

| | |

/s/ John G. Connors ___________________________________ John G. Connors | |

Director |

| | |

/s/ Timothy D. Cook ___________________________________ Timothy D. Cook | |

Director |

| | |

/s/ John J. Donahoe ___________________________________ John J. Donahoe | |

Director |

| | |

/s/ Alan B. Graf, Jr. ___________________________________ Alan B. Graf, Jr. | |

Director |

| | |

/s/ Travis A. Knight ___________________________________ Travis A. Knight | |

Director |

| | |

/s/ John C. Lechleiter ___________________________________ John C. Lechleiter | |

Director |

| | |

/s/ Michelle A. Peluso ___________________________________ Michelle A. Peluso | |

Director |

| | |

/s/ Jonathan A. Rodgers ___________________________________ Jonathan A. Rodgers | |

Director

|

| | |

/s/ John R. Thompson, Jr. ___________________________________ John R. Thompson, Jr. | |

Director |

| | |

/s/ Phyllis M. Wise ___________________________________ Phyllis M. Wise | |

Director |

| | |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description of Document |

| | |

4.1 | | Restated Articles of Incorporation, as amended. Incorporated by reference to Exhibit 3.1 to the Company’s Quarterly Report on Form 10-Q for the fiscal quarter ended November 30, 2015. |

4.2 | | Third Restated Bylaws, as amended. Incorporated by reference to Exhibit 3.2 to the Company’s Current Report on Form 8-K filed June 21, 2013. |

5.1 | | Opinion of Counsel. |

23.1 | | Consent of PricewaterhouseCoopers LLP. |

23.2 | | Consent of Counsel (included in Exhibit 5.1). |

24.1 | | Power of Attorney (included on the signature page of this registration statement). |

99.1 | | NIKE, Inc. Stock Incentive Plan. |

Exhibit 5.1

Opinion of Perkins Coie LLP

Perkins Coie LLP

1201 Third Avenue, Suite 4900

Seattle, WA 98101-3099

Phone: 206.359.8000

Fax: 206.359.9000

www.perkinscoie.com

January 6, 2016

NIKE, Inc.

One Bowerman Drive

Beaverton, Oregon 97005-6453

| |

Re: | Registration Statement on Form S-8 of Shares of Class B Common Stock, no par value (“Class B Common Stock”), of NIKE, Inc. |

Ladies and Gentlemen:

We have acted as counsel to you in connection with the preparation of a Registration Statement on Form S-8 (the “Registration Statement”) under the Securities Act of 1933, as amended (the “Act”), which you are filing with the Securities and Exchange Commission with respect to up to 66,000,000 additional shares (the “Shares”) of Class B Common Stock that may be issued pursuant to the NIKE, Inc. Stock Incentive Plan (the “Plan”).

We have examined the Registration Statement and such documents and records of NIKE, Inc. as we have deemed necessary for the purpose of this opinion. In giving this opinion, we are assuming the authenticity of all instruments presented to us as originals, the conformity with originals of all instruments presented to us as copies and the genuineness of all signatures.

Based upon and subject to the foregoing, we are of the opinion that any original issuance Shares that may be issued pursuant to the Plan have been duly authorized and that, upon the registration by its registrar of the Shares and the issuance thereof by NIKE, Inc. in accordance with the terms of the Plan, and the receipt of consideration therefor in accordance with the terms of the Plan, such Shares will be legally issued, fully paid and nonassessable.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Act.

Very truly yours,

/s/ Perkins Coie LLP

Perkins Coie LLP

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated July 23, 2015 relating to the financial statements, the financial statement schedule and the effectiveness of internal control over financial reporting, which appears in NIKE, Inc.’s Annual Report on Form 10-K for the year ended May 31, 2015.

/s/ PRICEWATERHOUSECOOPERS LLP

Portland, Oregon

January 6, 2016

Exhibit 99.1

NIKE, INC. STOCK INCENTIVE PLAN As amended and restated as of June 18, 2015

1. Purpose. The purpose of this Stock Incentive Plan (the “Plan”) is to enable NIKE, Inc. (the “Company”) to attract and retain as directors, officers, employees, consultants, advisors and independent contractors people of initiative and ability and to provide additional incentives to such persons.

2. Shares Subject to the Plan.

(a) Shares Authorized. Subject to adjustment as provided below and in paragraph 10, the shares to be offered under the Plan shall consist of Class B Common Stock of the Company (“Shares”), and the total number of Shares that may be issued under the Plan shall not exceed seven hundred eighteen million (718,000,000) Shares (the “Plan Limit”).

(b) Share Usage. If an option or stock appreciation right granted under the Plan expires, terminates or is canceled, the unissued Shares subject to such option or stock appreciation right shall again be available under the Plan. If any Shares issued pursuant to a Stock Award (as defined in paragraph 7) or a Performance-Based Award (as defined in paragraph 8) are forfeited to the Company, or the award expires, terminates or is canceled, the number of Shares forfeited or unissued shall again be available under the Plan. Upon the exercise of an option, the number of Shares reserved for issuance under the Plan shall be reduced by the number of Shares issued upon exercise of the options, plus the number of Shares, if any, withheld upon exercise as full or partial payment of the exercise price or to satisfy the tax withholding amount. Upon the exercise of a stock appreciation right for Shares, the number of Shares reserved for issuance under the Plan shall be reduced by the number of Shares covered by the stock appreciation right. Cash payments of stock appreciation rights shall not reduce the number of Shares reserved for issuance under the Plan. Upon the issuance of Shares under a Stock Award or a Performance-Based Award, the number of Shares reserved for issuance under the Plan shall be reduced by the number of Shares issued. For all purposes of this paragraph 2(b), the number of Shares “issued” pursuant to a Stock Award or a Performance-Based Award shall be net of any Shares withheld to satisfy tax withholding obligations with respect to the award. The number of Shares available for issuance under the Plan shall not be reduced to reflect any dividends or dividend equivalents that are reinvested into additional Shares or credited as additional Shares subject or paid with respect to an award.

(c) Fungible Share Provision. Any Shares subject to an option or stock appreciation right granted under the Plan shall be counted against the Plan Limit as one Share for every one Share subject to such option or stock appreciation right, except that a stock appreciation right payable solely in cash shall not be counted against the Plan Limit. Any Shares issued pursuant to a Stock Award or a Performance-Based Award shall be counted against the Plan Limit as one Share for every one Share so issued; provided, however, that if the aggregate number of Shares issued pursuant to Stock Awards and Performance-Based Awards granted after July 16, 2010 exceeds the Full Value Limit (as defined below), any excess Shares issued under those awards shall be counted against the Plan Limit as two and eight-tenths (2.8) Shares for every one Share so issued. If any Shares issued pursuant to a Stock Award or a Performance-Based Award are counted against the Plan Limit as two and eight-tenths (2.8) Shares as provided above, and any Shares issued pursuant to a Stock Award or a Performance-Based Award are subsequently forfeited to the Company, the number of Shares that again become available under the Plan shall be equal to the number of Shares forfeited (up to the aggregate number of Shares previously counted against the Plan Limit as two and eight-tenths (2.8) Shares) multiplied by two and eight-tenths (2.8). Subject to adjustment as provided in paragraph 10, the “Full Value Limit” shall equal fourteen million (14,000,000) Shares plus the number of Shares issued pursuant to Stock Awards granted on or before July 16, 2010 that are forfeited to the Company or withheld to satisfy tax withholding obligations after July 16, 2010.

(d) Award Limits.

(i) Incentive Stock Options. Subject to adjustment under paragraph 10, a maximum of seven hundred eighteen million (718,000,000) Shares shall be available for issuance under Incentive Stock Options.

(ii) Individual Award Limits for Section 162(m). Subject to adjustment under paragraph 10, the maximum number of each type of award intended to constitute “performance-based compensation” under Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”), granted to any individual in any fiscal year shall not exceed the following: (A) options and stock appreciation rights: an aggregate of two million (2,000,000) Shares, plus an additional aggregate of two million (2,000,000) Shares for one-time awards to newly hired or newly promoted individuals, and (B) Stock Awards (including restricted stock and restricted stock units) that are Performance-Based Awards: two million (2,000,000) Shares, plus an additional aggregate of two million (2,000,000) Shares for one-time awards to newly hired or newly promoted individuals.

(iii) Limits on Awards to Non-Employee Directors. No Non-Employee Director may be granted any award or awards denominated in Shares that exceed in the aggregate $500,000 in value (such value computed as of the date of grant in accordance with applicable financial accounting rules) in any fiscal year, plus an additional $500,000 in value for one-time awards to a newly appointed or elected Non-Employee Director. A “Non-Employee Director” is any member of the Board of Directors who is not an employee of the Company.

(e) Dividends. Participants in the Plan may, if the Committee (as defined in paragraph 4) so determines, be credited with dividends or dividend equivalents for dividends paid with respect to Shares underlying an award in a manner determined by the Committee in its sole discretion, provided that with respect to awards that are subject to achievement of performance goals, any such credited dividends or dividend equivalents may only be paid with respect to the portion of such awards that is actually earned. The Committee may apply any restrictions to the dividends or dividend equivalents that the Committee deems appropriate. The Committee, in its sole discretion, may determine the form of payment of dividends or dividend equivalents, including cash, shares of the Class B Common Stock, restricted stock or restricted stock units.

3. Duration of Plan. The Plan shall continue in effect until all Shares available for issuance under the Plan have been issued and all restrictions on such Shares have lapsed; provided, however, that no awards shall be made under the Plan on or after the 10th anniversary of the last action by the shareholders approving any amendment to the Plan or amendment and restatement of the Plan to increase the number of Shares available for issuance under the Plan. The Board of Directors may suspend or terminate the Plan at any time except with respect to awards and Shares subject to restrictions then outstanding under the Plan. Termination shall not affect any outstanding awards or the forfeitability of Shares issued under the Plan.

4. Administration. The Plan shall be administered by a committee appointed by the Board of Directors of the Company consisting of not less than two directors (the “Committee”), which shall determine and designate from time to time the individuals to whom awards shall be made, the amount of the awards and the other terms and conditions of the awards, except that only the Board of Directors may amend or terminate the Plan as provided in paragraphs 3 and 14. Subject to the provisions of the Plan, the Committee may from time to time adopt and amend rules and regulations relating to administration of the Plan, adopt forms of award agreements setting out the terms and conditions of the awards, advance the lapse of any waiting period, accelerate any exercise date, waive or modify any restriction applicable to Shares (except those restrictions imposed by law) and make all other determinations in the judgment of the Committee necessary or desirable for the administration of the Plan. The interpretation and construction of the provisions of the Plan and related agreements by the Committee shall be final and conclusive. The Committee may correct any defect or supply any omission or reconcile any inconsistency in the Plan or in any related agreement in the manner and to the extent it shall deem expedient to carry the Plan into effect, and it shall be the sole and final judge of such expediency.

Notwithstanding anything to the contrary contained in this paragraph 4, the Board of Directors may delegate to the Chief Executive Officer of the Company, as a one-member committee of the Board of Directors, the authority to grant awards with respect to a maximum of 100,000 Shares to any eligible individual who is not, at the time of such grant, subject to the reporting requirements and liability provisions contained in Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”) and the regulations thereunder, provided that such committee may not grant awards pursuant to paragraph 8, and provided that any award so granted is made pursuant to the form of agreement approved by the Committee for such award. Notwithstanding anything to the contrary contained in this paragraph 4, the Board of Directors may delegate to the Chief Executive Officer of the Company, as a one-member

committee of the Board of Directors, the authority to approve award terms for recipients of awards residing outside of the United States to the extent such terms are necessary or desirable to ensure compliance with applicable laws.

5. Types of Awards; Eligibility; General Terms of Awards.

(a) Awards. The Committee may, from time to time, take the following actions, separately or in combination, under the Plan: (i) grant Incentive Stock Options, as defined in Section 422 of the Code as provided in paragraph 6(b); (ii) grant options other than Incentive Stock Options (“Non-Statutory Stock Options”) as provided in paragraph 6(c); (iii) grant Stock Awards, including restricted stock and restricted stock units, as provided in paragraph 7; (iv) grant Performance-Based Awards as provided in paragraph 8; and (v) grant stock appreciation rights as provided in paragraph 9.

(b) Eligibility. Any such awards may be made to employees, including employees who are officers or directors, of the Company or any parent or subsidiary corporation of the Company and to other individuals described in paragraph 1 who the Committee believes have made or will make an important contribution to the Company or its subsidiaries; provided, however, that only employees of the Company shall be eligible to receive Incentive Stock Options under the Plan. The Committee shall select the individuals to whom awards shall be made. The Committee shall specify the action taken with respect to each individual to whom an award is made under the Plan.

(c) Termination of Service. For purposes of the Plan, service means service as a Non-Employee Director, consultant, advisor or independent contractor of the Company or a parent or subsidiary corporation of the Company and termination of service means termination of employment or service.

(d) Vesting Limitations. Notwithstanding any other provision of the Plan to the contrary, and subject to adjustment as provided in paragraph 10, the aggregate number of Shares that may be issued pursuant to awards granted under the Plan that either contain no restrictions or contain restrictions based solely on continuous employment or service over less than one year shall not exceed five million two hundred eighty thousand (5,280,000) Shares. The above limitation will not, however, apply in the following situations: (1) a Change in Control (as defined in paragraph 11(b); (2) termination of service due to death or disability; and (3) a substitute award granted pursuant to paragraph 12.

6. Option Grants.

(a) Grant. The Committee may grant options under the Plan. With respect to each option grant, the Committee shall determine the number of Shares subject to the option, the option price, the period of the option, the time or times at which the option may be exercised and whether the option is an Incentive Stock Option or a Non-Statutory Stock Option.

(b) Incentive Stock Options. Incentive Stock Options shall be subject to the following terms and conditions:

(i) An Incentive Stock Option may be granted under the Plan to an employee possessing more than 10 percent of the total combined voting power of all classes of stock of the Company or of any parent or subsidiary of the Company only if the option price is at least 110 percent of the fair market value of the Shares subject to the option on the date it is granted, as described in paragraph 6(b)(iii), and the option by its terms is not exercisable after the expiration of five years from the date it is granted.

(ii) Subject to paragraphs 6(b)(i) and 6(d), Incentive Stock Options granted under the Plan shall continue in effect for the period fixed by the Committee, except that no Incentive Stock Option shall be exercisable after the expiration of 10 years from the date it is granted.

(iii) The option price per share shall be determined by the Committee at the time of grant. Subject to paragraph 6(b)(i), the option price shall not be less than 100 percent of the fair market value of the Shares covered by the Incentive Stock Option at the date the option is granted. The fair market value shall be deemed to be the closing price of the Class B Common Stock of the Company as reported in the New York Stock Exchange Composite Transactions in the Wall Street Journal on the date the option is granted, or if there has been no sale on that date, on the last preceding date on which a sale occurred, or such other reported value of the Class B Common Stock of the Company as shall be specified by the Committee.

(iv) No Incentive Stock Option shall be granted on or after the tenth anniversary of the last action by the Board of Directors approving an increase in the number of Shares available for issuance under the Plan, which action was subsequently approved within 12 months by the shareholders.

(c) Non-Statutory Stock Options. The option price for Non-Statutory Stock Options shall be determined by the Committee at the time of grant. The option price may not be less than 100 percent of the fair market value of the Shares covered by the Non-Statutory Stock Option on the date the option is granted. The fair market value of Shares covered by a Non-Statutory Stock Option shall be determined pursuant to paragraph 6(b)(iii). No Non-Statutory Stock Option shall be exercisable after the expiration of 10 years from the date it is granted.

(d) Exercise of Options. Except as provided in paragraph 6(f), no option granted under the Plan may be exercised unless at the time of such exercise the optionee is employed by or providing services to the Company or any parent or subsidiary corporation of the Company and shall have been so employed or providing services continuously since the date such option was granted. Absence on leave or on account of illness or disability under rules established by the Committee shall not, however, be deemed an interruption of employment or service for this purpose. Except as provided in paragraphs 6(f), 10 and 11, options granted under the Plan may be exercised from time to time over the period stated in each option in such amounts and at such times as shall be prescribed by the Committee, provided that options shall not be exercised for fractional Shares. Unless otherwise determined by the Committee, if the optionee does not exercise an option in any one year with respect to the full number of Shares to which the optionee is entitled in that year, the optionee’s rights shall be cumulative and the optionee may purchase those Shares in any subsequent year during the term of the option.

(e) Nontransferability. Except as provided below, each stock option granted under the Plan by its terms shall be nonassignable and nontransferable by the optionee, either voluntarily or by operation of law, and each option by its terms shall be exercisable during the optionee’s lifetime only by the optionee. A stock option may be transferred by will or by the laws of descent and distribution of the state or country of the optionee’s domicile at the time of death. A Non-Statutory Stock Option shall also be transferable pursuant to a qualified domestic relations order as defined under the Code or Title I of the Employee Retirement Income Security Act. The Committee may, in its discretion, authorize all or a portion of a Non-Statutory Stock Option granted to an optionee to be on terms which permit transfer by the optionee to (i) the spouse, children or grandchildren of the optionee (“Immediate Family Members”), (ii) a trust or trusts for the exclusive benefit of Immediate Family Members, or (iii) a partnership in which Immediate Family Members are the only partners, provided that (x) there may be no consideration for any transfer, (y) the option agreement pursuant to which the options are granted must expressly provide for transferability in a manner consistent with this paragraph, and (z) subsequent transfers of transferred options shall be prohibited except by will or by the laws of descent and distribution. Following any transfer, options shall continue to be subject to the same terms and conditions as were applicable immediately prior to transfer, provided that for purposes of paragraphs 6(d), 6(g), 10 and 11 the term “optionee” shall be deemed to refer to the transferee. The events of termination of service of paragraph 6(f), shall continue to be applied with respect to the original optionee, following which the options shall be exercisable by the transferee only to the extent, and for the periods specified, and all other references to employment or service, termination of service, life or death of the optionee, shall continue to be applied with respect to the original optionee.

(f) Termination of Service or Death.

(i) Unless otherwise provided at the time of grant, in the event of termination of the optionee’s service with the Company or a parent or subsidiary corporation of the Company for any reason other than because of normal retirement, early retirement, physical disability or death, the option may be exercised at any time prior to the expiration date of the option or the expiration of three months after the date of such termination of service, whichever is the shorter period, but only if and to the extent the optionee was entitled to exercise the option at the date of such termination.

(ii) Unless otherwise provided at the time of grant, in the event of termination of the optionee’s service with the Company or a parent or subsidiary corporation of the Company as a result of the optionee’s normal retirement, any option granted to the optionee less than one year prior to the date of such termination of service shall immediately terminate, and any option granted to the optionee at least one year prior to the date of such termination

of service may be exercised by the optionee free of the limitations on the amount that may be purchased in any one year specified in the option agreement at any time prior to the expiration date of the option or the expiration of four years after the date of such termination of service, whichever is the shorter period. For purposes of this paragraph 6(f), “normal retirement” means a termination of service that occurs at a time when (A) the optionee’s age is at least 60 years, and (B) the optionee has at least five full years of employment or service with the Company or a parent or subsidiary corporation of the Company.

(iii) Unless otherwise provided at the time of grant, in the event of termination of the optionee’s service with the Company or a parent or subsidiary corporation of the Company terminates as a result of the optionee’s early retirement, any option granted to the optionee less than one year prior to the date of such termination of service shall immediately terminate, and any option granted to the optionee at least one year prior to the date of such termination of service may be exercised by the optionee in the amounts and according to the schedule specified in the option agreement with no forfeiture of any portion of the option resulting from such termination of service, except that the option may not be exercised after the earlier of the expiration date of the option or the expiration of four years after the date of such termination of service. For purposes of this paragraph 6(f), “early retirement” means a termination of service that occurs at a time when (A) the optionee’s age is at least 55 years and less than 60 years, and (B) the optionee has at least five full years of employment or service with the Company or a parent or subsidiary corporation of the Company.

(iv) Unless otherwise provided at the time of grant, in the event of termination of the optionee’s service with the Company or a parent or subsidiary corporation of the Company because the optionee becomes disabled (within the meaning of Section 22(e)(3) of the Code), the option may be exercised by the optionee free of the limitations on the amount that may be purchased in any one year specified in the option agreement at any time prior to the expiration date of the option or the expiration of four years after the date of such termination, whichever is the shorter period.

(v) Unless otherwise provided at the time of grant, in the event of the death of the optionee while in the employ or service of the Company or a parent or subsidiary corporation of the Company, the option may be exercised free of the limitations on the amount that may be purchased in any one year specified in the option agreement at any time prior to the expiration date of the option or the expiration of four years after the date of such death, whichever is the shorter period, but only by the person or persons to whom such optionee’s rights under the option shall pass by the optionee’s will or by the laws of descent and distribution of the state or country of domicile at the time of death.

(vi) The Committee, at the time of grant or at any time thereafter, may extend the three-month and four-year expiration periods any length of time not later than the original expiration date of the option, and may increase the portion of an option that is exercisable, subject to such terms and conditions as the Committee may determine.

(vii) To the extent that the option of any deceased optionee or of any optionee whose service terminates is not exercised within the applicable period, all further rights to purchase Shares pursuant to such option shall cease and terminate.

(g) Purchase of Shares. Unless the Committee determines otherwise, Shares may be acquired pursuant to an option granted under the Plan only upon receipt by the Company of notice from the optionee of the optionee’s intention to exercise, specifying the number of Shares as to which the optionee desires to exercise the option and the date on which the optionee desires to complete the transaction, and if required in order to comply with the Securities Act of 1933, as amended, containing a representation that it is the optionee’s present intention to acquire the Shares for investment and not with a view to distribution. Unless the Committee determines otherwise, on or before the date specified for completion of the purchase of Shares pursuant to an option, the optionee must have paid the Company the full purchase price of such Shares in cash or with the consent of the Committee, in whole or in part, in Class B Common Stock of the Company valued at fair market value, or by having the Company withhold shares of Class B Common Stock of the Company that would otherwise be issued on exercise of the option that have an aggregate fair market value equal to the aggregate purchase price of the Shares being purchased under the option. The fair market value of Class B Common Stock of the Company provided in payment of the purchase price shall be the closing price of the Class B Common Stock of the Company as reported in the New York Stock Exchange

Composite Transactions in the Wall Street Journal or such other reported value of the Class B Common Stock of the Company as shall be specified by the Committee, on the date the option is exercised, or if such date is not a trading day, then on the immediately preceding trading day. No Shares shall be issued until full payment therefor has been made. With the consent of the Committee, an optionee may request the Company to apply automatically the Shares to be received upon the exercise of a portion of a stock option (even though stock certificates have not yet been issued) to satisfy the purchase price for additional portions of the option. Each optionee who has exercised an option shall immediately upon notification of the amount due, if any, pay to the Company in cash amounts necessary to satisfy any applicable federal, state and local tax withholding requirements. If additional withholding is or becomes required beyond any amount deposited before delivery of the certificates, the optionee shall pay such amount to the Company on demand. If the optionee fails to pay the amount demanded, the Company may withhold that amount from other amounts payable by the Company to the optionee, including salary, subject to applicable law. With the consent of the Committee, an optionee may satisfy the minimum statutory withholding obligation, in whole or in part, by having the Company withhold from the Shares to be issued upon the exercise that number of Shares that would satisfy the withholding amount due or by delivering Class B Common Stock of the Company to the Company to satisfy the withholding amount.

(h) No Repricing. Except for actions approved by the shareholders of the Company or adjustments made pursuant to paragraph 10, the option price for an outstanding option granted under the Plan may not be decreased after the date of grant nor may the Company grant a new option or pay any cash or other consideration (including another award under the Plan) in exchange for any outstanding option granted under the Plan at a time when the option price of the outstanding option exceeds the fair market value of the Shares covered by the option.

7. Stock Awards, Including Restricted Stock and Restricted Stock Units. The Committee may grant Shares as stock awards under the Plan (“Stock Awards”). Stock Awards shall be subject to the terms, conditions, and restrictions determined by the Committee. The restrictions may include restrictions concerning transferability and forfeiture of the Shares awarded, together with such other restrictions as may be determined by the Committee. Stock Awards subject to restrictions may be either restricted stock awards under which Shares are issued immediately upon grant subject to forfeiture if vesting conditions are not satisfied, or restricted stock unit awards under which Shares are not issued until after vesting conditions are satisfied. The Committee may require the recipient to sign an agreement as a condition of the award, but may not require the recipient to pay any monetary consideration other than amounts necessary to satisfy tax withholding requirements. The agreement may contain any terms, conditions, restrictions, representations and warranties required by the Committee. The certificates representing the Shares awarded shall bear any legends required by the Committee. The Company may require any recipient of a Stock Award to pay to the Company in cash upon demand amounts necessary to satisfy any applicable federal, state or local tax withholding requirements. If the recipient fails to pay the amount demanded, the Company may withhold that amount from other amounts payable by the Company to the recipient, including salary, subject to applicable law. With the consent of the Committee, a recipient may satisfy the minimum statutory withholding obligation, in whole or in part, by having the Company withhold from the awarded Shares that number of Shares that would satisfy the withholding amount due or by delivering Class B Common Stock of the Company to the Company to satisfy the withholding amount.

8. Performance-Based Awards. The Committee may grant awards denominated in Shares intended to qualify as qualified performance-based compensation under Section 162(m) of the Code and the regulations thereunder (“Performance-Based Awards”). Performance-Based Awards shall be subject to the following terms and conditions:

(a) Award Period. The Committee shall determine the period of time for which a Performance-Based Award is made (the “Award Period”).

(b) Performance Targets and Payment. The Committee shall establish in writing objectives (“Performance Targets”) that must be met by the Company or any subsidiary, division or other unit of the Company (“Business Unit”) during the Award Period as a condition to payment being made under the Performance-Based Award. The Performance Targets for each award shall be one or more targeted levels of performance with respect to one or more of the following objective measures with respect to the Company or any Business Unit: net income, net income before taxes, operating income, earnings before interest and taxes, revenues, return on sales, return on equity, earnings per share, total shareholder return, or any of the foregoing before the effect of acquisitions, divestitures,

accounting changes, restructuring or other special charges, as determined by the Committee at the time of establishing a Performance Target. The Committee shall also establish the number of Shares to be issued under a Performance-Based Award if the Performance Targets are met or exceeded, including the fixing of a maximum number of Shares (subject to paragraph 2(d)(ii)). The Committee may establish other restrictions to payment under a Performance-Based Award, such as a continued employment requirement, in addition to satisfaction of the Performance Targets. Some or all of the Shares subject to a Performance-Based Award may be issued at the time of the award as restricted Shares subject to forfeiture in whole or in part if Performance Targets or, if applicable, other restrictions are not satisfied.

(c) Computation of Payment. During or after an Award Period, the performance of the Company or Business Unit, as applicable, during the period shall be measured against the Performance Targets. If the Performance Targets are not met, no payment shall be made under a Performance-Based Award. If the Performance Targets are met or exceeded, the Committee shall certify that fact in writing and certify the number of Shares earned under the terms of the Performance-Based Award.

(d) Tax Withholding. The Company may require any recipient of a Performance-Based Award to pay to the Company in cash upon demand amounts necessary to satisfy any applicable federal, state or local tax withholding requirements. If the recipient fails to pay the amount demanded, the Company may withhold that amount from other amounts payable by the Company to the recipient, including salary, subject to applicable law. With the consent of the Committee, a recipient may satisfy the minimum statutory withholding obligation, in whole or in part, by having the Company withhold from the awarded Shares that number of Shares that would satisfy the withholding amount due or by delivering Class B Common Stock of the Company to the Company to satisfy the withholding amount.

9. Stock Appreciation Rights.

(a) Grant. Stock appreciation rights may be granted under the Plan by the Committee, subject to such rules, terms, and conditions as the Committee prescribes.

(b) Exercise.

(i) A stock appreciation right shall be exercisable only at the time or times established by the Committee, except that no stock appreciation right shall be exercisable after the expiration of 10 years from the date it is granted. If a stock appreciation right is granted in connection with an option, the stock appreciation right shall be exercisable only to the extent and on the same conditions that the related option could be exercised. Upon exercise of a stock appreciation right, any option or portion thereof to which the stock appreciation right relates terminates. If a stock appreciation right is granted in connection with an option, upon exercise of the option, the stock appreciation right or portion thereof to which the option relates terminates.

(ii) The Committee may withdraw any stock appreciation right granted under the Plan at any time and may impose any conditions upon the exercise of a stock appreciation right or adopt rules and regulations from time to time affecting the rights of holders of stock appreciation rights. Such rules and regulations may govern the right to exercise stock appreciation rights granted before adoption or amendment of such rules and regulations as well as stock appreciation rights granted thereafter.

(iii) Each stock appreciation right shall entitle the holder, upon exercise, to receive from the Company in exchange therefor an amount equal in value to the excess of the fair market value on the date of exercise of one share of Class B Common Stock of the Company over its fair market value on the date of grant or such higher amount as the Committee may determine (or, in the case of a stock appreciation right granted in connection with an option, the option price per Share under the option to which the stock appreciation right relates), multiplied by the number of Shares covered by the stock appreciation right or the option, or portion thereof, that is surrendered. Payment by the Company upon exercise of a stock appreciation right may be made in Shares valued at fair market value, in cash, or partly in Shares and partly in cash, all as determined by the Committee.

(iv) For purposes of this paragraph 9, the fair market value of the Class B Common Stock of the Company on the date a stock appreciation right is exercised shall be the closing price of the Class B Common Stock of the Company as reported in the New York Stock Exchange Composite Transactions in the Wall Street Journal, or

such other reported value of the Class B Common Stock of the Company as shall be specified by the Committee, on the date the stock appreciation right is exercised, or if such date is not a trading day, then on the immediately preceding trading day.

(v) No fractional Shares shall be issued upon exercise of a stock appreciation right. In lieu thereof, cash shall be paid in an amount equal to the value of the fractional share.

(vi) Each stock appreciation right granted under the Plan by its terms shall be nonassignable and nontransferable by the holder, either voluntarily or by operation of law, except by will or by the laws of descent and distribution of the state or county of the holder’s domicile at the time of death, and each stock appreciation right by its terms shall be exercisable during the holder’s lifetime only by the holder; provided, however, that a stock appreciation right not granted in connection with an Incentive Stock Option shall also be transferable pursuant to a qualified domestic relations order as defined under the Code or Title I of the Employee Retirement Income Security Act.

(vii) Each participant who has exercised a stock appreciation right shall, upon notification of the amount due, pay to the Company in cash amounts necessary to satisfy any applicable federal, state or local tax withholding requirements. If the participant fails to pay the amount demanded, the Company may withhold that amount from other amounts payable by the Company to the participant including salary, subject to applicable law. With the consent of the Committee a participant may satisfy the minimum statutory obligation, in whole or in part, by having the Company withhold from any Shares to be issued upon the exercise that number of Shares that would satisfy the withholding amount due or by delivering Class B Common Stock of the Company to the Company to satisfy the withholding amount.

(c) No Repricing. Except for actions approved by the shareholders of the Company or adjustments made pursuant to paragraph 10, the grant price for an outstanding stock appreciation right granted under the Plan may not be decreased after the date of grant nor may the Company grant a new stock appreciation right or pay any cash or other consideration (including another award under the Plan) in exchange for any outstanding stock appreciation right granted under the Plan at a time when the grant price of the outstanding stock appreciation right exceeds the fair market value of the Shares covered by the stock appreciation right.

10. Changes in Capital Structure. If the outstanding shares of Class B Common Stock of the Company are hereafter increased or decreased or changed into or exchanged for a different number or kind of shares or other securities of the Company by reason of any recapitalization, reclassification, stock split, combination of shares, dividend payable in shares, or large nonrecurring cash dividend, the authorization limits under paragraphs 2(a), 2(c), 2(d)(i), 2(d)(ii) and 5(d) shall be adjusted proportionately. In addition, the number and kind of shares subject to outstanding awards, and the exercise price of outstanding options and stock appreciation rights shall be adjusted, to the end that the recipient’s proportionate interest is maintained as before the occurrence of such event. The Committee may also require that any securities issued in respect of or exchanged for Shares issued hereunder that are subject to restrictions be subject to similar restrictions. Notwithstanding the foregoing, the Committee shall have no obligation to effect any adjustment that would or might result in the issuance of fractional shares, and any fractional shares resulting from any adjustment may be disregarded or provided for in any manner determined by the Committee. Any adjustments made pursuant to this paragraph 10 shall be conclusive.

11. Sale of the Company; Change in Control.

(a) Sale of the Company. Unless otherwise provided at the time of grant, if during the term of an option, stock appreciation right or restricted stock unit award, there shall occur a merger, consolidation or plan of exchange involving the Company pursuant to which outstanding Shares are converted into cash or other stock, securities or property, or a sale, lease, exchange or other transfer (in one transaction or a series of related transactions) of all, or substantially all, the assets of the Company, then either:

(i) the option, stock appreciation right or restricted stock unit award shall be converted into an option, stock appreciation right or restricted stock unit award to acquire stock of the surviving or acquiring corporation in the applicable transaction for a total purchase price equal to the total price applicable to the unexercised portion of the option, stock appreciation right or restricted stock unit award, and with the amount and type of shares subject

thereto and exercise price per share thereof to be conclusively determined by the Committee, taking into account the relative values of the companies involved in the applicable transaction and the exchange rate, if any, used in determining shares of the surviving corporation to be held by holders of Shares following the applicable transaction, and disregarding fractional shares; or

(ii) all unissued Shares subject to restricted stock unit awards shall be issued immediately prior to the consummation of such transaction, all options and stock appreciation rights will become exercisable for 100 percent of the Shares subject to the option or stock appreciation right effective as of the consummation of such transaction, and the Committee shall approve some arrangement by which holders of options and stock appreciation rights shall have a reasonable opportunity to exercise all such options and stock appreciation rights effective as of the consummation of such transaction or otherwise realize the value of these awards, as determined by the Committee. Any option or stock appreciation right that is not exercised in accordance with procedures approved by the Committee shall terminate.

(b) Change in Control. Unless otherwise provided at the time of grant, if paragraph 11(a)(ii) does not apply, all options and stock appreciation rights granted under the Plan shall become exercisable in full for a remaining term extending until the earlier of the expiration date of the applicable option or stock appreciation right or the expiration of four years after the date of termination of service, and all Stock Awards shall become fully vested, if a Change in Control occurs and at any time after the earlier of Shareholder Approval (as defined below), if any, or the Change in Control and on or before the second anniversary of the Change in Control, (i) the award holder’s service is terminated by the Company (or its successor) without Cause (as defined below), or (ii) the award holder’s service is terminated by the award holder for Good Reason (as defined below).

(i) For purposes of the Plan, a “Change in Control” of the Company shall mean the occurrence of any of the following events:

(A) At any time during a period of two consecutive years, individuals who at the beginning of such period constituted the Board of Directors of the Company (“Incumbent Directors”) shall cease for any reason to constitute at least a majority thereof; provided, however, that the term “Incumbent Director” shall also include each new director elected during such two-year period whose nomination or election was approved by two-thirds of the Incumbent Directors then in office;

(B) At any time that the holders of the Class A Common Stock of the Company have the right to elect (voting as a separate class) a majority of the members of the Board of Directors, any “person” or “group” (within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act) shall, as a result of a tender or exchange offer, open market purchases or privately negotiated purchases from anyone other than the Company, have become the beneficial owner (within the meaning of Rule 13d-3 under the Exchange Act), directly or indirectly, of more than 50 percent of the then outstanding Class A Common Stock of the Company;

(C) At any time after such time as the holders of the Class A Common Stock of the Company cease to have the right to elect (voting as a separate class) a majority of the members of the Board of Directors, any “person” or “group” (within the meaning of Sections 13(d) and 14(d)(2) of the Exchange Act) shall, as a result of a tender or exchange offer, open market purchases or privately negotiated purchases from anyone other than the Company, have become the beneficial owner (within the meaning of Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company ordinarily having the right to vote for the election of directors (“Voting Securities”) representing 30 percent or more of the combined voting power of the then outstanding Voting Securities;

(D) A consolidation, merger or plan of exchange involving the Company (“Merger”) as a result of which the holders of outstanding Voting Securities immediately prior to the Merger do not continue to hold at least 50 percent of the combined voting power of the outstanding Voting Securities of the surviving corporation or a parent corporation of the surviving corporation immediately after the Merger, disregarding any Voting Securities issued to or retained by such holders in respect of securities of any other party to the Merger; or

(E) A sale, lease, exchange, or other transfer (in one transaction or a series of related transactions) of all or substantially all of the assets of the Company.

(ii) For purposes of the Plan, “Shareholder Approval” shall mean approval by the shareholders of the Company of a transaction, the consummation of which would be a Change in Control.

(iii) For purposes of this Plan, “Cause” shall mean (A) the willful and continued failure to perform substantially the award holder’s reasonably assigned duties with the Company (other than any such failure resulting from incapacity due to physical or mental illness) after a demand for substantial performance is delivered to the award holder by the Company which specifically identifies the manner in which the Company believes that the award holder has not substantially performed the award holder’s duties, or (B) the willful engagement in illegal conduct which is materially and demonstrably injurious to the Company. No act, or failure to act, shall be considered “willful” if the award holder reasonably believed that the action or omission was in, or not opposed to, the best interests of the Company.

(iv) For purposes of the Plan, “Good Reason” shall mean (A) the assignment of a different title, job or responsibilities that results in a decrease in the level of responsibility of the award holder after Shareholder Approval, if applicable, or the Change in Control when compared to the award holder’s level of responsibility for the Company’s operations prior to Shareholder Approval, if applicable, or the Change in Control; provided that Good Reason shall not exist if the award holder continues to have the same or a greater general level of responsibility for Company operations after the Change in Control as the award holder had prior to the Change in Control even if the Company operations are a subsidiary or division of the surviving company, (B) a reduction in the award holder’s base pay as in effect immediately prior to Shareholder Approval, if applicable, or the Change in Control, (C) a material reduction in the total package of benefits available to the award holder under cash incentive, stock incentive and other employee benefit plans after Shareholder Approval, if applicable, or the Change in Control compared to the total package of such benefits as in effect prior to Shareholder Approval, if applicable, or the Change in Control, or (D) the award holder is required to be based more than 50 miles from where the award holder’s office is located immediately prior to Shareholder Approval, if applicable, or the Change in Control except for required travel on company business to an extent substantially consistent with the business travel obligations which the award holder undertook on behalf of the Company prior to Shareholder Approval, if applicable, or the Change in Control.

12. Corporate Mergers, Acquisitions, etc. The Committee may also grant options, stock appreciation rights and Stock Awards under the Plan having terms, conditions and provisions that vary from those specified in the Plan, provided that any such awards are granted in substitution for, or in connection with the assumption of, existing options, stock appreciation rights or Stock Awards issued by another corporation and assumed or otherwise agreed to be provided for by the Company pursuant to or by reason of a transaction involving a corporate merger, consolidation, plan of exchange, acquisition of property or stock, separation, reorganization or liquidation to which the Company or a parent or subsidiary corporation of the Company is a party.

13. Clawback Policy. Unless otherwise provided at the time of grant, all awards under the Plan shall be subject to (a) any applicable securities, tax and stock exchange laws, rules and regulations relating to the recoupment or clawback of incentive compensation, (b) the NIKE, Inc. Policy for Recoupment of Incentive Compensation as approved by the Committee and in effect at the time of grant, (c) such other policy for clawback or recoupment of incentive compensation as may subsequently be approved from time to time by the Committee, and (d) any clawback or recoupment provisions set forth in the agreement evidencing the award.

14. Amendment of Plan. The Board of Directors may at any time, and from time to time, modify or amend the Plan in such respects as it shall deem advisable because of changes in the law while the Plan is in effect or for any other reason. Except as provided in paragraphs 6(f), 9, 10 and 11, however, no change in an award already granted shall be made without the written consent of the holder of such award.

15. Approvals. The obligations of the Company under the Plan are subject to the approval of state and federal authorities or agencies with jurisdiction in the matter. The Company will use its best efforts to take steps required by state or federal law or applicable regulations, including rules and regulations of the Securities and Exchange Commission and any stock exchange or trading system on which the Company’s shares may then be listed or admitted for trading, in connection with the grants under the Plan. The foregoing notwithstanding, the Company

shall not be obligated to issue or deliver Class B Common Stock under the Plan if such issuance or delivery would violate applicable state or federal securities laws.

16. Employment and Service Rights. Nothing in the Plan or any award pursuant to the Plan shall (a) confer upon any participant any right to be continued in the employment of or service with the Company or any parent or subsidiary corporation of the Company or interfere in any way with the right of the Company or any parent or subsidiary corporation of the Company by whom such participant is employed or to whom such participant is providing services to terminate such participant’s employment or service at any time, for any reason, with or without cause, or to increase or decrease such participant’s compensation or benefits, or (b) confer upon any person engaged by the Company any right to be employed or retained by the Company or to the continuation, extension, renewal, or modification of any compensation, contract, or arrangement with or by the Company.

17. Rights as a Shareholder. The recipient of any award under the Plan shall have no rights as a shareholder with respect to any Shares until the date of issue to the recipient of a stock certificate for such Shares. Except as otherwise expressly provided in the Plan, no adjustment shall be made for dividends or other rights for which the record date is prior to the date such stock certificate is issued.

18. Choice of Law and Venue. The Plan, all awards granted thereunder and all determinations made and actions taken pursuant thereto, to the extent not otherwise governed by the laws of the United States, shall be governed by the laws of the State of Oregon. For purposes of litigating any dispute that arises under the Plan, all awards granted thereunder and all determinations made and actions taken pursuant thereto, the parties hereby submit to and consent to the jurisdiction of, and agree that such litigation shall be conducted in, the courts of Washington County, Oregon or the United States District Court for the District of Oregon, where this Agreement is made and/or to be performed.

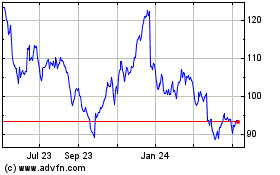

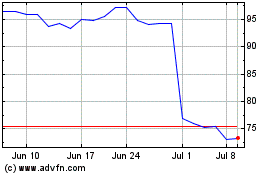

Nike (NYSE:NKE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Nike (NYSE:NKE)

Historical Stock Chart

From Apr 2023 to Apr 2024