As filed with the Securities and Exchange Commission on November 10, 2015

Registration No. 333-__________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

(Exact name of Registrant as specified in its charter)

|

| | |

Ohio (State or other jurisdiction of incorporation or organization) | | 34-0117420 (I.R.S. Employer Identification No.) |

|

| | |

One Applied Plaza, Cleveland, Ohio (Address of Principal Executive Offices) | | 44115 (Zip Code) |

Applied Industrial Technologies, Inc.

2015 Long-Term Performance Plan

(Full title of the plan)

Fred D. Bauer

Vice President-General Counsel and Secretary

Applied Industrial Technologies, Inc.

One Applied Plaza, Cleveland, Ohio 44115

(Name and address of agent for service)

(216) 426-4000

(Telephone number, including area code, of agent for service)

With copy to:

David A. Zagore

Squire Patton Boggs (US) LLP

4900 Key Tower, 127 Public Square

Cleveland, Ohio 44114-1304

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

| | | |

Large accelerated filer [x] | Accelerated filer [ ] | Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

CALCULATION OF REGISTRATION FEE

|

| | | | |

Title of Securities to be Registered | Amount to be Registered (1) | Proposed maximum Offering Price per Share (2) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee |

Common Stock, no par value(3) | 2,500,000 shares | $42.19 | $105,475,000 | $10,622 |

|

| | |

(1) | | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement includes an undetermined number of additional shares of common stock that may be issued if the anti-dilution provisions of the plan become operative. |

(2) | | Estimated solely for the purpose of calculating the amount of the registration fee. Pursuant to Securities Act Rule 457(c), the proposed maximum offering price per unit is calculated as the average of the high and low prices for the Common Stock as reported by the New York Stock Exchange consolidated reporting system as of November 6, 2015. |

(3) | | The securities to be registered include options and rights to acquire Common Stock. |

PART I

The documents containing the information specified in Part I of From S-8 will be sent or given to the participants as specified by Rule 428(b)(1) of the Securities Act. Such documents and the documents incorporated by reference herein pursuant to Item 3 of Part II of this Form, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Certain Documents by Reference.

Applied Industrial Technologies (“Registrant”) incorporates by reference and makes part of this Registration Statement the following documents:

|

| | |

(a) | | The Registrant’s Annual Report on Form 10-K for the fiscal year ended June 30, 2015, filed with the Securities and Exchange Commission (the “Commission”) on August 26, 2015, pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”); |

(b) | | The Registrant’s Quarterly Report on Form 10-Q filed with the Commission on November 4, 2015; |

(c) | | The Registrant’s Current Reports on Form 8-K filed with the Commission on September 1, 2015, and October 28, 2015 (as to voting at annual meeting of shareholders); and |

(d) | | The Appendix to the Registrant's Definitive Proxy material filed with the Commission on September 11, 2015, setting forth the Applied Industrial Technologies, Inc. 2015 Long-Term Performance Plan. |

(e) | | The description of the Common Stock, no par value, of the Registrant (“Common Stock”) contained in the Registrant’s Registration Statement on Form S-4 (Commission File No. 333-27801) filed with the Commission on May 23, 1997, and any amendments or reports filed for the purpose of updating such description. |

Until the Registrant files a post-effective amendment to this Registration Statement indicating that all securities offered have been sold, or deregistering all such securities which remain unsold, all documents subsequently filed by the Registrant or the Applied Industrial Technologies, Inc. 2015 Long-Term Performance Plan (the “Plan”) pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing such documents.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers.

Ohio law permits the Registrant to indemnify a director, officer, employee and certain other persons (“Covered Persons”) against expenses, judgments, fines, and settlements reasonably incurred in a nonderivative suit, and against expenses reasonably incurred in a derivative suit, if the Covered Person acted in good faith and in a manner reasonably believed to be in or not opposed to the best interests of the Registrant. In addition, Ohio law permits the Registrant to indemnify a Covered Person in a criminal action or proceeding, other than in a derivative suit, if the person had no reasonable cause to believe his or her conduct was unlawful.

Unless ordered by a court, no indemnification of expenses in a derivative suit is authorized by Ohio law if the Covered Person is finally adjudged to be liable for negligence or misconduct in the performance of his or her duty to the corporation. However, if a Covered Person is successful on the merits or in defense of any matter, indemnification of expenses is mandatory. In addition, under Ohio law, a director’s expenses shall be paid by the corporation as they are incurred, provided the director agrees to reasonably cooperate with the corporation and to repay the amounts advanced if it is proved by clear and convincing evidence that the director’s action or failure to act was done with deliberate intent to cause injury or with reckless disregard for the best interests of the corporation.

Under Ohio law, a director is generally not liable for monetary damages unless it is proved by clear and convincing evidence that the director’s action or failure to act was undertaken with deliberate intent to cause injury to the corporation or with reckless disregard for the best interests of the corporation. There is, however, no comparable provision limiting the liability of officers, employees, or agents of a corporation. The statutory right to indemnification is not exclusive and is in addition to any other rights granted to persons seeking indemnification.

The Registrant’s Regulations provide that the Registrant shall indemnify its directors and officers to the full extent permitted by Ohio law, including circumstances in which indemnification is otherwise discretionary under Ohio law.

The Registrant has entered into indemnification agreements with its officers and directors containing provisions that are in some respects broader than the specific indemnification provisions contained in the Ohio Law. The indemnification agreements may require the Registrant, among other things, to indemnify its directors against certain liabilities that may arise by reason of their status or service as directors (other than liabilities arising from willful misconduct or willful disregard of duties), to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified, and to obtain director’s insurance if available on reasonable terms.

The Registrant has also obtained directors and officers’ liability insurance covering, subject to certain exceptions, actions taken by the Registrant’s directors and officers in their capacities as such.

Item 7. Exemption From Registration Claimed.

Not applicable.

Item 8. Exhibits.

The Exhibits to this Registration Statement are listed in the Exhibit Index, which Exhibit Index is incorporated herein by this reference.

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

| |

(i) | to include any prospectus required by Section 10(a)(3) of the Securities Act; |

| |

(ii) | to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; |

| |

(iii) | to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however, that paragraphs (i) and (ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act of 1934 that are incorporated by reference in this registration statement. |

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question of whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cleveland, and the State of Ohio, on November 10, 2015.

APPLIED INDUSTRIAL TECHNOLOGIES, INC.

By: /s/ Neil A. Schrimsher

Neil A. Schrimsher, President and Chief

Executive Officer

Pursuant to the requirements of the Securities Exchange Act of 1933, this Registration Statement has been signed below by the following persons in their indicated capacities as of the 10th day of November 2015.

|

| | |

/s/ Neil A. Schrimsher | | /s/ Mark O. Eisele |

Neil A. Schrimsher, President, Chief Executive Officer and Director (Principal Executive Officer) | | Mark O. Eisele, Vice President, Chief Financial Officer and Treasurer (Principal Financial Officer) |

| | |

/s/ Christopher Macey | | |

Christopher Macey, Corporate Controller (Principal Accounting Officer) | | |

| | |

* | | * |

Peter A. Dorsman, Director | | L. Thomas Hiltz, Director |

| | |

* | | * |

Edith Kelly-Green, Director | | Dan P. Komnenovich, Director |

| | |

* | | * |

John F. Meier, Director | | Vincent K. Petrella, Director |

| | |

* | | * |

Dr. Jerry Sue Thornton, Director | | Peter C. Wallace, Director and Chairman |

| | |

|

|

/s/ Fred D. Bauer |

Fred D. Bauer, as attorney in fact |

for persons indicated by “*” |

Date: November 10, 2015

|

| | |

Exhibit | | |

No.* | | Description |

| | |

4(a) | | Amended and Restated Articles of Incorporation of Applied Industrial Technologies, Inc., as amended on October 25, 2005 (filed as Exhibit 3(a) to Applied’s Form 10-Q for the quarter ended December 31, 2005, SEC File No. 1-2299, and incorporated herein by reference). |

| | |

4(b) | | Code of Regulations of Applied Industrial Technologies, Inc., as amended on October 19, 1999 (filed as Exhibit 3(b) to Applied’s Form 10-Q for the quarter ended September 30, 1999, SEC File No. 1-2299, and incorporated herein by reference). |

| | |

4(c) | | Certificate of Merger of Bearings, Inc. (Ohio) and Bearings, Inc. (Delaware) filed with the Ohio Secretary of State on October 18, 1988, including an Agreement and Plan of Reorganization dated September 6, 1988 (filed as Exhibit 4(a) to Registrant’s Registration Statement on Form S-4 filed May 23, 1997, Registration No. 333-27801, and incorporated herein by reference). |

| | |

4(d) | | Private Shelf Agreement dated as of November 27, 1996, as amended through October 30, 2014, between Applied and Prudential Investment Management, Inc. (assignee of The Prudential Insurance Company of America), conformed to show all amendments (filed as Exhibit 4.2 to Applied's Form 10-Q for the quarter ended March 31, 2015, SEC File No. 1-2299, and incorporated here by reference). |

| | |

4(e) | | Request for Purchase dated May 30, 2014 and 3.19% Series C Notes dated July 1, 2014, under Private Shelf Agreement dated November 27, 1996, as most recently amended on February 4, 2013, between Applied Industrial Technologies, Inc. and Prudential Investment Management, Inc. (filed as Exhibit 10.1 to Applied’s Form 8-K dated July 1, 2014, SEC File No. 1-2299, and incorporated here by reference). |

| | |

4(f) | | Request for Purchase dated October 22, 2014 and 3.21% Series D Notes dated October 30, 2014, under Private Shelf Agreement dated November 27, 1996, as amended, between Applied Industrial Technologies, Inc. and Prudential Investment Management, Inc. (filed as Exhibit 4.5 to Applied's Form 10-Q dated November 4, 2014, SEC File No. 1-2299, and incorporated here by reference). |

| | |

4(g) | | Credit Agreement dated as of May 15, 2012, among Applied Industrial Technologies, Inc., KeyBank National Association as Agent, and various financial institutions (filed as Exhibit 4 to Applied's Form 8-K dated May 17, 2012, SEC File No. 1-2299, and incorporated here by reference).

|

| | |

4(h) | | Credit Agreement dated as of April 25, 2014, among Applied Industrial Technologies, Inc., Key Bank National Association, as Agent, and various financial institutions (filed as Exhibit 10.1 to Applied’s Form 8-K dated May 1, 2014, SEC File No. 1-2299, and incorporated here by reference).

|

| | |

5 | | Opinion of Squire Patton Boggs (US) LLP as to the legality of the securities registered (attached). |

| | |

15 | | Independent Registered Public Accounting Firm’s Letter of Awareness (attached). |

| | |

23(a) | | Consent of Independent Registered Public Accounting Firm (attached). |

| | |

23(b) | | Consent of Squire Patton Boggs (US) LLP (contained in Exhibit 5). |

| | |

24 | | Powers of Attorney (attached). |

|

| | |

* | | All exhibits hereto are being filed through incorporation by reference, unless otherwise indicated. |

EXHIBIT 5

[Letterhead of Squire Patton Boggs (US) LLP]

November 10, 2015

Applied Industrial Technologies, Inc.

One Applied Plaza

Cleveland, Ohio 44115

Ladies and Gentlemen:

We have acted as counsel to Applied Industrial Technologies, Inc., an Ohio corporation (the “Company”), in connection with a Registration Statement on Form S-8 (the “Registration Statement”) that is being filed today with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”). The Registration Statement relates to the registration of 2,500,000 shares (the “Shares”) of Common Stock, no par value (“Common Stock”) and options and rights to acquire Common Stock (together with the Common Stock, the “Securities”) that may be issued under the Applied Industrial Technologies, Inc. 2015 Long-Term Performance Plan (the “Plan”).

This opinion letter is being delivered at your request in accordance with the requirements of Item 601(b)(5)(i) of Regulation S-K under the Securities Act.

For purposes of this opinion letter, we have examined originals or copies, certified or otherwise identified to our satisfaction, of:

(i) the Registration Statement relating to the Securities;

(ii) the Company’s Articles of Incorporation, as currently in effect;

(iii) the Company’s Regulations, as currently in effect;

(iv) the Resolutions of the Executive Organization & Compensation Committee of the Board of Directors of the Company (the “Board”) dated June 18, 2015 and of the Board dated October 26, 2015, respectively; and

(v) the Plan.

We also have examined and relied on certificates of public officials and, as to certain matters of fact that are material to our opinion, we have also relied on certifications by an officer of the Company. We have not independently established any of the facts on which we have so relied.

For purposes of this opinion letter, we have assumed the accuracy and completeness of each document submitted to us, the genuineness of all signatures on original documents, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as facsimile, electronic, certified, conformed or photostatic copies thereof, and the due execution and delivery of all documents where due execution and delivery are prerequisites to the effectiveness thereof. We also have assumed that the Company will not in the future issue or otherwise make unavailable shares of its Common Stock so that there are insufficient authorized and unissued shares of Common Stock, as the case may be, for issuance pursuant to the Plan or on exercise of options or other rights awarded under the Plan. We have not independently verified any of these assumptions.

The opinion expressed in this opinion letter is limited to the General Corporation Law of the State of Ohio. The opinion set forth below is rendered as of the date of this opinion letter. We assume no obligation to update or supplement such opinion to reflect any changes of law or fact that may occur.

Based upon and subject to the foregoing, it is our opinion that upon issuance pursuant to and in accordance with the Plan or on exercise of options or other rights awarded under the Plan, the Shares will be validly issued, fully paid and non-assessable.

We consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving this consent, we do not thereby admit that we are experts with respect to any part of the Registration Statement or Prospectus within the meaning of the term “expert” as used in Section 11 of the Securities Act or the rules and regulations promulgated thereunder by the Commission, nor do we admit that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of the Commission promulgated thereunder.

|

|

|

Respectfully submitted, |

|

/s/ Squire Patton Boggs (US) LLP |

EXHIBIT 15

November 10, 2015

Applied Industrial Technologies, Inc.

One Applied Plaza

Euclid Avenue at East 36th Street

Cleveland, Ohio 44115

We have reviewed, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the unaudited interim financial information of Applied Industrial Technologies, Inc. and subsidiaries for the three-month periods ended September 30, 2015 and 2014, and have issued our report dated November 4, 2015. As indicated in such report, because we did not perform an audit, we expressed no opinion on that information.

We are aware that our report referred to above, which was included in your Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, is being incorporated by reference in this Registration Statement.

We also are aware that the aforementioned report, pursuant to Rule 436(c) under the Securities Act of 1933, is not considered a part of the Registration Statement prepared or certified by an accountant or a report prepared or certified by an accountant within the meaning of Sections 7 and 11 of that Act.

/s/ DELOITTE & TOUCHE LLP

Cleveland, Ohio

EXHIBIT 23

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement on Form S-8 of our reports dated August 26, 2015, relating to the consolidated financial statements of Applied Industrial Technologies, Inc. and subsidiaries (the “Company”), and the effectiveness of the Company’s internal control over financial reporting, appearing in the Annual Report on Form 10-K of Applied Industrial Technologies, Inc. for the year ended June 30, 2015.

/s/ DELOITTE & TOUCHE LLP

Cleveland, Ohio

November 10, 2015

EXHIBIT 24

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/15 /s/ Peter A. Dorsman

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: October 26, 2015 /s/ L. Thomas Hiltz

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/15 /s/ D. P. Komnenovich

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/2015 /s/ Edith Kelly-Green

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/15 /s/ J. F. Meier

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: October 27, 2015 /s/ Vincent K. Petrella

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/15 /s/ Jerry Sue Thornton

POWER OF ATTORNEY

The undersigned director of Applied Industrial Technologies, Inc., an Ohio corporation, hereby constitutes and appoints Fred D. Bauer and Mark O. Eisele, and each of them, the true and lawful agents and attorneys-in-fact of the undersigned with full power and authority, and in either or both of them, to sign for the undersigned and in his or her respective name as director of the Corporation, the Corporation’s Form S-8 for the 2015 Long-Term Performance Plan, to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934, and the rules and regulations issued thereunder, hereby ratifying and confirming all acts taken by such agents and attorneys-in-fact, or any one of them, as herein authorized.

Date: 10/26/2015 /s/ Peter C. Wallace

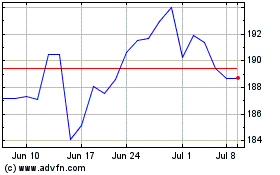

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

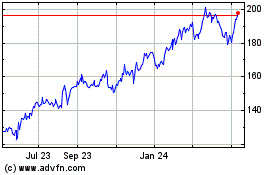

Applied Industrial Techn... (NYSE:AIT)

Historical Stock Chart

From Apr 2023 to Apr 2024