Securities Registration: Employee Benefit Plan (s-8)

August 24 2015 - 1:44PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on August 21, 2015

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

THE KROGER CO.

(Exact name of registrant as specified in its charter)

|

Ohio |

|

31-0345740 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer |

|

incorporation or organization) |

|

Identification No.) |

|

|

|

|

|

1014 Vine Street, Cincinnati, Ohio |

|

45202 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

The Kroger Co. 401(k) Retirement Savings Account Plan

(Full title of Plan)

Christine S. Wheatley

Group Vice President, Secretary and General Counsel

The Kroger Co.

1014 Vine Street

Cincinnati, Ohio 45202

(Name and address of agent for service)

(513) 762-4000

(Telephone number, including area code, of agent for service)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer x |

Accelerated filer o |

|

Non-accelerated filer o (Do not check if smaller reporting company) |

Smaller reporting company o |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Proposed |

|

Proposed |

|

|

|

|

|

|

|

|

Maximum |

|

Maximum |

|

|

|

|

Title of |

|

Amount |

|

Offering |

|

Aggregate |

|

Amount of |

|

|

Securities to |

|

to be |

|

Price |

|

Offering |

|

Registration |

|

|

be Registered |

|

Registered |

|

Per Share(1) |

|

Price(1) |

|

Fee |

|

|

Common Shares $1 Par Value |

|

20,000,000 shares |

(2) |

$ |

34.93 |

|

$ |

698,600,000 |

|

$ |

81,177.32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Estimated solely for the purpose of calculating the registration fee pursuant to Securities Act Rule 457(c), on the basis of the average of the high and low sale prices of the Registrant’s Common Shares on the New York Stock Exchange on August 21, 2015, which date is within 5 business days prior to the date of the filing of this Registration Statement.

(2) In addition, pursuant to Rule 416(c) under the Securities Act of 1933, this Registration Statement also covers an indeterminate amount of interests to be offered or sold pursuant to the employee benefit plan described herein.

EXPLANATORY NOTE

The Registrant is registering additional securities under The Kroger Co. 401(k) Retirement Savings Account Plan (the “Plan”) covered hereby for which a Registration Statement on Form S-8, bearing Registration No. 333-180404, currently is effective. Pursuant to General Instruction E of Form S-8, the Registrant elects to incorporate by reference into this Registration Statement the contents of such earlier registration statement that constitute information required in this Registration Statement.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 5. Interests of Named Experts and Counsel.

A legal opinion to the effect that the Registrant’s common shares offered hereby have been duly authorized and that, when they are issued in accordance with the terms of the Plan, they will be validly issued and outstanding, fully paid and nonassessable, has been rendered by Christine S. Wheatley, Esquire, Group Vice President, Secretary and General Counsel of the Registrant. As of July 15, 2015, Ms. Wheatley owned approximately 47,619 common shares of the Registrant and held options to acquire 19,980 common shares of the Registrant.

Item 8. Exhibits.

The following exhibits are filed as part of this Registration Statement:

|

Exhibit No. |

|

Description |

|

|

|

|

|

Exhibit 5.1* |

|

Opinion of Christine S. Wheatley, Esquire. |

|

|

|

|

|

Exhibit 5.2* |

|

IRS Determination Letter for The Kroger Co. 401(k) Retirement Savings Account Plan. |

|

|

|

|

|

Exhibit 23.1* |

|

Consent of PricewaterhouseCoopers LLP. |

|

|

|

|

|

Exhibit 23.2* |

|

Consent of Christine S. Wheatley, Esquire (included as part of Exhibit 5.1). |

|

|

|

|

|

Exhibit 24.1* |

|

Power of Attorney of Directors of the Registrant. |

* Filed herewith.

2

SIGNATURES

The Registrant. Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cincinnati, State of Ohio, on August 24, 2015.

|

|

THE KROGER CO. |

|

|

|

|

|

By: |

/s/ W. Rodney McMullen |

|

|

|

W. Rodney McMullen |

|

|

|

Chairman of the Board and Chief Executive Officer |

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on August 24, 2015.

|

Signature |

|

Title |

|

|

|

|

|

/s/ W. Rodney McMullen |

|

Chairman of the Board, Chief Executive Officer and Director |

|

W. Rodney McMullen |

|

(principal executive officer) |

|

|

|

|

|

/s/ J. Michael Schlotman |

|

Chief Financial Officer |

|

J. Michael Schlotman |

|

(principal financial officer) |

|

|

|

|

|

/s/ M. Elizabeth Van Oflen |

|

Vice President and Corporate Controller |

|

M. Elizabeth Van Oflen |

|

(principal accounting officer) |

|

|

|

|

|

* /s/ Nora A. Aufreiter |

|

Director |

|

Nora A. Aufreiter |

|

|

|

|

|

|

|

* /s/ Robert D. Beyer |

|

Director |

|

Robert D. Beyer |

|

|

|

|

|

|

|

* /s/ Susan J. Kropf |

|

Director |

|

Susan J. Kropf |

|

|

|

|

|

|

|

* /s/ David B. Lewis |

|

Director |

|

David B. Lewis |

|

|

|

|

|

|

|

* /s/ Jorge P. Montoya |

|

Director |

|

Jorge P. Montoya |

|

|

|

|

|

|

|

* /s/ Clyde R. Moore |

|

Director |

|

Clyde R. Moore |

|

|

|

|

|

|

|

* /s/ Susan M. Phillips |

|

Director |

|

Susan M. Phillips |

|

|

|

|

|

|

|

* /s/ James A. Runde |

|

Director |

|

James A. Runde |

|

|

|

|

|

|

|

* /s/ Ronald L. Sargent |

|

Director |

|

Ronald L. Sargent |

|

|

|

|

|

|

|

* /s/ Bobby S. Shackouls |

|

Director |

|

Bobby S. Shackouls |

|

|

|

|

|

|

|

|

|

|

|

By: |

* /s/ Stacey M. Heiser |

|

|

|

Stacey M. Heiser |

|

|

|

Attorney-in-fact |

|

|

|

|

|

|

3

The Plan. Pursuant to the requirements of the Securities Act of 1933, the trustees (or other persons who administer the employee benefit plan) have duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Cincinnati, Ohio, on August 24, 2015.

|

|

THE KROGER CO. 401(K) RETIREMENT SAVINGS ACCOUNT PLAN |

|

|

|

|

|

By: |

/s/ Theresa Monti |

|

|

|

Name: Theresa Monti |

|

|

Title: Chairman of the Administrative Committee |

4

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

Exhibit 5.1* |

|

Opinion of Christine S. Wheatley, Esquire. |

|

|

|

|

|

Exhibit 5.2* |

|

IRS Determination Letter for The Kroger Co. 401(k) Retirement Savings Account Plan. |

|

|

|

|

|

Exhibit 23.1* |

|

Consent of PricewaterhouseCoopers LLP. |

|

|

|

|

|

Exhibit 23.2* |

|

Consent of Christine S. Wheatley, Esquire (included as part of Exhibit 5.1). |

|

|

|

|

|

Exhibit 24.1* |

|

Power of Attorney of Directors of the Registrant. |

* Filed herewith.

5

Exhibit 5.1

THE KROGER CO.

1014 Vine Street

Cincinnati, OH 45202

Christine S. Wheatley

Group Vice President, Secretary

and General Counsel

August 24, 2015

Board of Directors

The Kroger Co.

1014 Vine Street

Cincinnati, OH 45202

Ladies and Gentlemen:

I am familiar with the proceedings taken and proposed to be taken by The Kroger Co., an Ohio corporation (the “Company”), in connection with the issuance of 20,000,000 of its Common Shares (the “Securities”) along with an indeterminate number of interests of participation pursuant to The Kroger Co. 401(k) Retirement Savings Account Plan (the “Plan”). I have acted as counsel to the Company in connection with its preparation of a Registration Statement relating to such issuance on Form S-8 to be filed by the Company with the Securities and Exchange Commission for the registration of the Securities and interests of participation under the Securities Act of 1933, as amended. I have examined the above-mentioned documents, the Amended Articles of Incorporation and Regulations of the Company, the corporate minutes of the proceedings of the directors and shareholders of the Company, and such other records and documents of the Company as I have deemed necessary in order to express the opinions hereinafter set forth.

Based upon the foregoing, and assuming compliance with applicable federal and state securities laws, I am of the opinion that:

(i) when the Securities are issued pursuant to the Plan, they will be duly authorized, validly issued and outstanding, fully paid and non-assessable;

(ii) when issued pursuant to the Plan, the interests of participation will be validly issued; and

(iii) certain plan amendments since February 27, 2014, as of which date a Determination Letter was issued by the Internal Revenue Service regarding the Plan, comply with the technical provisions of the Employee Retirement Income Security Act of 1974, as amended (hereinafter “ERISA”) and the Internal Revenue Code of 1986, as amended (hereinafter the “Code”) pertaining to the Plan, although it should be noted that whether any plan qualifies under the Code is a question based upon factual considerations prevailing at any given time. While this opinion is not binding upon any governmental agency, I believe the Internal Revenue Service would act favorably upon submission of the Plan with a request for a determination letter to the same effect as this opinion. I note that the Internal Revenue Service may require that modifications be made to the Plan. The Company, however, has expressly reserved the right in the Plan to make such modifications to the Plan as are required to obtain receipt of a favorable determination letter from the Internal Revenue Service.

This opinion is based upon the Plan as it is now designed and drafted and upon the provisions of ERISA, the Code, governmental regulations and judicial authorities in effect as at the date of this opinion letter, any of which may change in the future with retroactive effect.

I consent to the filing of this opinion as an exhibit to the Registration Statement and to the reference to me in the Registration Statement as having passed upon the legality of the Securities and interests of participation offered thereby on behalf of the Company.

|

|

Very truly yours, |

|

|

|

|

|

/s/ Christine S. Wheatley |

Exhibit 5.2

|

INTERNAL REVENUE SERVICE

P. O. BOX 2508

CINCINNATI, OH 45201

Date: FEB 27 2014

THE KROGER CO

C/O THE KROGER CO

KELLY L REBLIN

1014 VINE ST

CINCINNATI, OH 45202 |

|

DEPARTMENT OF THE TREASURY

Employer Identification Number:

31-0345740

DLN:

17007038080021

Person to Contact:

MELINDA LINDERMAN ID# 95036

Contact Telephone Number:

(949) 389-4418

Plan Name:

TEH KROGER CO 401 K RETIREMENT

SAVINGS ACCOUNT PLAN

Plan Number: 010 |

Dear Applicant:

We have made a favorable determination on the plan identified above based on the information you have supplied. Please keep this letter, the application forms submitted to request this letter and all correspondence with the Internal Revenue Service regarding your application for a determination letter in your permanent records. You must retain this information to preserve your reliance on this letter.

Continued qualification of the plan under its present form will depend on its effect in operation. See section 1.401-1(b) (3) of the Income Tax Regulations. We will review the status of the plan in operation periodically.

The enclosed Publication 794 explains the significance and the scope of this favorable determination letter based on the determination requests selected on your application forms. Publication 794 describes the information that must be retained to have reliance on this favorable determination letter. The publication also provides examples of the effect of a plan’s operation on its qualified status and discusses the reporting requirements for qualified plans. Please read Publication 794.

This letter relates only to the status of your plan under the Internal Revenue Code. It is not a determination regarding the effect of other federal or local statutes.

This determination letter gives no reliance for any qualification change that becomes effective, any guidance published, or any statutes enacted, after the issuance of the Cumulative List (unless the item has been identified in the cumulative List) for the cycle under which this application was submitted.

This letter may not be relied on after the end of the plan’s first five-year remedial amendment cycle that ends more than 12 months after the application was received. This letter expires on January 31, 2016. This letter considered the 2009 Cumulative List of Changes in Plan Qualification Requirements.

This determination letter is applicable for the plan adopted on

Letter 2002 (DO/CG)

-2-

THE KROGER CO

12/29/06.

This determination letter is applicable for the amendment(s) executed on 12/28/07 & 6/27/08.

This determination letter is also applicable for the amendment(s) dated on 4/30/09 & 9/01/09.

This determination letter is also applicable for the amendment(s) dated on 12/31/10 & 1/28/11.

This determination is subject to your adoption of the proposed amendments submitted in your letter dated 10/21/13. The proposed amendments should be adopted on or before the date prescribed by the regulations under Code section 401(b).

This is not a determination with respect to any language in the plan or any amendment to the plan that reflects Section 3 of the Defense of Marriage Act, Pub. L. 104-199, 110 Stat. 2419 (DOMA) or U.S. v. Windsor, 133 S. Ct. 2675 (2013), which invalidated that section.

We have sent a copy of this letter to your representative as indicated in the Form 2848 Power of Attorney or appointee as indicated by the Form 8821 Tax Information Authorization.

If you have questions concerning this matter, please contact the person whose name and telephone number are shown above.

|

|

Sincerely, |

|

|

|

|

|

/s/ Andrew E. Zuckerman |

|

|

Andrew E. Zuckerman |

|

|

Director, EP Rulings & Agreements |

|

|

|

|

Enclosures: |

|

|

Publication 794 |

|

Letter 2002 (DO/CG)

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of our report dated March 31, 2015 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in The Kroger Co.’s Annual Report on Form 10-K for the year ended January 31, 2015.

/s/ PricewaterhouseCoopers LLP

Cincinnati, Ohio

August 21, 2015

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that the undersigned directors of The Kroger Co. (the “Company”) hereby constitute and appoint Christine S. Wheatley and Stacey M. Heiser and each of them (with full power to each of them to act alone) his or her true and lawful attorneys-in-fact to sign and agent for him or her and on his or her behalf and in his or her name, place and stead, to sign, execute and affix his or her seal thereto and file with the Securities and Exchange Commission (or any other governmental or regulatory authority) any of the documents referred to below relating to the registration under the Securities Act of 1933, as amended, on Form S-8 or other appropriate form of such number of Common Shares of the Company as the Company may determine to include in the registration statement or any amendment thereto, and an indeterminate number of plan interests associated therewith, with respect to the selling of any such shares to employees of the Company or its subsidiaries pursuant to The Kroger Co. 401(k) Retirement Savings Account Plan: (a) a registration statement under the Securities Act of 1933, as amended, with all exhibits and any and all documents required to be filed with respect thereto; and (b) any and all amendments thereto that may be filed from time to time by the Company with all exhibits and any and all documents required to be filed with respect thereto; granting unto said attorneys, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises in order to effectuate the same as fully to all intents and purposes as he or she might or could do if personally present, hereby ratifying and confirming all that said attorneys-in-fact and agents, or any of them may lawfully do or cause to be done by virtue hereof.

IN WITNESS WHEREOF, the undersigned directors have hereunto set their hands as of the 25th day of June 2015.

|

/s/ Nora A. Aufreiter |

|

/s/ Clyde R. Moore |

|

Nora A. Aufreiter |

|

Clyde R. Moore |

|

|

|

|

|

|

|

|

|

/s/ Robert D. Beyer |

|

/s/ Susan M. Phillips |

|

Robert D. Beyer |

|

Susan M. Phillips |

|

|

|

|

|

|

|

|

|

/s/ Susan J. Kropf |

|

/s/ James A. Runde |

|

Susan J. Kropf |

|

James A. Runde |

|

|

|

|

|

|

|

|

|

/s/ David B. Lewis |

|

/s/ Ronald L. Sargent |

|

David B. Lewis |

|

Ronald L. Sargent |

|

|

|

|

|

|

|

|

|

/s/ W. Rodney McMullen |

|

/s/ Bobby S. Shackouls |

|

W. Rodney McMullen |

|

Bobby S. Shackouls |

|

|

|

|

|

|

|

|

|

/s/ Jorge P. Montoya |

|

|

|

Jorge P. Montoya |

|

|

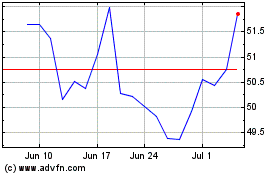

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024