AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON AUGUST 11, 2015

Registration No. 333-

___________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Live Nation Entertainment, Inc.

(Exact name of registrant as specified in its charter)

|

| |

Delaware | 20-3247759 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

|

|

9348 Civic Center Drive Beverly Hills, California 90210 (310) 867-7000 |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) |

|

|

Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 |

(Full title of the plan) |

Michael G. Rowles General Counsel Live Nation Entertainment, Inc. 9348 Civic Center Drive Beverly Hills, California 90210 (310) 867-7000 |

(Name, address, including zip code, and telephone number, including area code, of agent for service) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| | | | | | |

Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨

(Do not check if a smaller reporting company) | | Smaller reporting company ¨ |

CALCULATION OF REGISTRATION FEE |

| | | | |

Title of securities to be registered | Amount to be registered(1) | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount of registration fee |

Common Stock, $.01 par value per share (“common stock”)(2) | 10,000,000 | $25.13 (3) | $251,300,000 (3) | $29,201.06 |

| |

(1) | Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement (this “Registration Statement”) also covers an indeterminate number of additional shares that may be necessary to adjust the number of shares being issued pursuant to the plan as a result of stock splits, stock dividends or similar transactions. |

| |

(2) | Each share of common stock includes one Series A Junior Participating Preferred Stock Purchase Right (the “Rights”), which initially attach to and trade with the shares of common stock being registered hereby. The terms of the Rights are described in the Rights Agreement filed as Exhibit 4.1 to the registrant’s Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC” or “Commission”) on December 23, 2005, as amended by (i) the First Amendment to Rights Agreement filed as Exhibit 4.1 to the registrant’s Current Report on Form 8-K with the SEC on March 3, 2009, (ii) the Second Amendment to Rights Agreement filed as Exhibit 4.1 to the registrant’s Current Report on Form 8-K with the SEC on September 28, 2011 and (iii) the Third Amendment to Rights Agreement filed as Exhibit 4.1 to the registrant’s Current Report on Form 8-K with the SEC on January 17, 2013. |

| |

(3) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) under the Securities Act. The price per share and aggregate offering price are based on the average of the high and low price of the registrant’s common stock on August 6, 2015, as reported on the New York Stock Exchange. |

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by Live Nation Entertainment, Inc. (“Live Nation” or the “registrant”) relating to 10,000,000 additional shares of the registrant’s common stock issuable to the registrant’s eligible directors, officers, employees, consultants and advisers under the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 (the “Plan”). The registrant previously registered shares of common stock issuable under the Plan by (i) Registration Statement No. 333-132949 on Form S-8 filed with the Commission on April 3, 2006, (ii) Registration Statement No. 333-164302 on Form S-8 filed with the Commission on January 12, 2010 and (iii) Registration Statement No. 333-175139 on Form S-8 filed with the Commission on June 24, 2011. In accordance with General Instruction E to Form S-8, the contents of these previously filed Registration Statements are incorporated by reference herein to the extent not modified or superseded hereby or thereby or by a subsequently filed document that is incorporated by reference herein or therein.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I will be sent or given to employees as specified by Rule 428(b)(1) of the Securities Act. Such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. Such documents and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II hereof, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by us with the Commission pursuant to the Securities Act and the Securities Exchange Act of 1934, as amended (the “Exchange Act”) are incorporated by reference in this Registration Statement:

|

| | |

| (i) | the registrant’s annual report on Form 10-K for the year ended December 31, 2014 filed with the Commission on February 26, 2015, as amended by Form 10-K/A filed with the Commission on June 30, 2015; |

|

| | |

| (ii) | the registrant’s quarterly reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015; |

|

| | |

| (iii) | the registrant’s current report on Form 8-K filed with the Commission on June 11, 2015 (other than the portions of such document not deemed to be filed pursuant to the rules promulgated under the Exchange Act); and |

|

| | |

| (iv) | a description of the registrant’s common stock and preferred share purchase rights included under the caption “Description of Our Capital Stock” in the Information Statement filed as Exhibit 99.1 to the registrant’s Registration Statement on Form 10, as amended (File No. 001-32601), as filed with the Commission on December 8, 2005, including any amendment or report filed for the purpose of updating such description. |

In addition to the foregoing, all documents subsequently filed by us with the Commission pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered under this Registration Statement have been sold or which deregisters all securities remaining unsold, shall be deemed to be incorporated by reference into this Registration Statement and to be a part of this Registration Statement from the date of filing of such documents. Any statement contained in a document incorporated by reference in this Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any subsequently filed document that is also incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 5. Interests of Named Experts and Counsel.

The opinion of counsel regarding the validity of the securities that may be issued under the Plan is provided by Eric Lassen, Deputy General Counsel of the registrant. Mr. Lassen is regularly employed by Live Nation, participates in various Live Nation employee benefit plans under which he may receive shares of common stock and currently beneficially owns less than 1 percent of the outstanding shares of common stock of Live Nation.

Item 8. Exhibits.

See the attached Exhibit Index, which is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Beverly Hills, California, on this 11th day of August, 2015.

LIVE NATION ENTERTAINMENT, INC.

By: /s/ Michael Rapino

Michael Rapino

President and Chief Executive Officer

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each of the undersigned officers and directors of the registrant hereby constitutes and appoints Michael Rapino and Kathy Willard, and each of them, acting individually and without the other, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments, exhibits thereto and other documents in connection therewith) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the SEC, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them individually, or their or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

| | |

Name | Title | Date |

/s/ Michael Rapino | President, Chief Executive Officer and Director | August 11, 2015 |

Michael Rapino | | |

/s/ Kathy Willard | Chief Financial Officer | August 11, 2015 |

Kathy Willard | | |

/s/ Brian Capo | Chief Accounting Officer | August 11, 2015 |

Brian Capo | | |

/s/ Mark Carleton | Director | August 11, 2015 |

Mark Carleton | | |

/s/ Jonathan L. Dolgen | Director | August 11, 2015 |

Jonathan L. Dolgen | | |

/s/ Ariel Emanuel | Director | August 11, 2015 |

Ariel Emanuel | | |

/s/ Robert Ted Enloe, III | Director | August 11, 2015 |

Robert Ted Enloe, III | | |

/s/ Jeffrey T. Hinson | Director | August 11, 2015 |

Jeffrey T. Hinson | | |

/s/ James Iovine | Director | August 11, 2015 |

James Iovine | | |

/s/ Margaret Johnson | Director | August 11, 2015 |

Margaret Johnson | | |

|

| | |

Name | Title | Date |

/s/ James S. Kahan | Director | August 11, 2015 |

James S. Kahan | | |

/s/ Gregory B. Maffei | Chairman of the Board of Directors | August 11, 2015 |

Gregory B. Maffei | | |

/s/ Randall T. Mays | Director | August 11, 2015 |

Randall T. Mays | | |

/s/ Mark S. Shapiro | Director | August 11, 2015 |

Mark S. Shapiro | | |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Exhibit Description |

4.1 | | Amended and Restated Certificate of Incorporation of Live Nation Entertainment, Inc., as amended (incorporated by reference to Exhibit 3.1 of the registrant’s Annual Report on Form 10-K filed February 25, 2010). |

4.2 | | Certificate of Amendment to the Amended and Restated Certificate of Incorporation of Live Nation Entertainment, Inc. (incorporated by reference to Exhibit 3.1 of the registrant’s Current Report on Form 8-K filed June 7, 2013). |

4.3 | | Fifth Amended and Restated Bylaws of Live Nation Entertainment, Inc. (incorporated by reference to Exhibit 3.2 of the registrant’s Current Report on Form 8-K filed June 7, 2013). |

4.4 | | Rights Agreement, dated December 21, 2005, between CCE Spinco, Inc. and The Bank of New York, as rights agent (incorporated by reference to Exhibit 4.1 of the registrant’s Current Report on Form 8-K filed December 23, 2005). |

4.5 | | First Amendment to Rights Agreement, effective as of February 25, 2009, between Live Nation Entertainment, Inc. and The Bank of New York Mellon (incorporated by reference to Exhibit 4.1 of the registrant’s Current Report on Form 8-K filed March 3, 2009). |

4.6 | | Second Amendment to Rights Agreement, effective as of September 23, 2011, entered into by and between Live Nation Entertainment, Inc. and The Bank of New York Mellon, as Rights Agent (incorporated by reference to Exhibit 4.1 of the registrant’s Current Report on Form 8-K filed September 28, 2011). |

4.7 | | Third Amendment to Rights Agreement, effective as of January 11, 2013, entered into by and between Live Nation Entertainment, Inc. and Computershare Shareowner Services, LLC, as Rights Agent (incorporated by reference to Exhibit 4.1 of the registrant’s Current Report on Form 8-K filed January 17, 2013). |

4.8 | | Form of Certificate of Designation of Series A Junior Participating Preferred Stock (incorporated by reference to Exhibit 4.2 of the registrant’s Current Report on Form 8-K filed December 23, 2005). |

4.9 | | Form of Right Certificate (incorporated by reference to Exhibit 4.3 of the registrant’s Current Report on Form 8-K filed December 23, 2005). |

5.1 | | Opinion of Eric Lassen, Senior Vice President and Deputy General Counsel of the registrant. |

10.1 | | Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 (incorporated by reference to Exhibit 10.2 of the registrant’s Current Report on Form 8-K filed June 10, 2015). |

10.2 | | Form of Stock Option Agreement under the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015. |

10.3 | | Form of Restricted Stock Award Agreement under the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015. |

23.1 | | Consent of Eric Lassen, Senior Vice President and Deputy General Counsel of the registrant (contained in Exhibit 5.1). |

23.2 | | Consent of Ernst & Young LLP. |

23.3 | | Consent of PricewaterhouseCoopers S.C. |

24.1 | | Power of Attorney (included in this Registration Statement under “Signatures”). |

August 11, 2015

Live Nation Entertainment, Inc.

9348 Civic Center Drive

Beverly Hills, CA 90210

|

| | |

| Re: | Live Nation Entertainment, Inc. Registration Statement on Form S-8 |

Ladies and Gentlemen:

In my capacity as Deputy General Counsel of Live Nation Entertainment, Inc. (the “Company”), I have acted as counsel to the Company in connection with the filing of a Registration Statement on Form S-8 (the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Act”), for the purpose of registering 10,000,000 additional shares of common stock, $0.01 par value per share, of the Company (the “Shares”) issuable pursuant to the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 (the “Plan”), and associated Series A Junior Participating Preferred Stock purchase rights (the “Rights”) to be issued pursuant to the Rights Agreement, dated as of December 21, 2005, between the Company and The Bank of New York, as rights agent, as amended by (i) the First Amendment to Rights Agreement, effective as of February 25, 2009, (ii) the Second Amendment to Rights Agreement, effective as of September 23, 2011 and (iii) the Third Amendment to Rights Agreement, effective as of January 11, 2013.

I have examined the Registration Statement and copies or originals of such other instruments, documents and records of the Company, have examined such questions of law and have satisfied myself as to such matters of fact as I have deemed relevant and necessary for the purpose of expressing the opinions herein. I have assumed the authenticity of all documents submitted to me as originals, the genuineness of all signatures, the legal capacity of all natural persons and the conformity with originals of all documents presented to me as copies.

Based upon the foregoing, I am of the opinion that:

|

| | |

| 1. | The Company is a corporation duly organized and validly existing under the laws of the State of Delaware. |

| 2. | The Shares and the associated Rights issuable pursuant to the Plan have been duly and validly authorized and, subject to the issuance of the Shares and payment thereof in accordance with the Plan, the Shares will be validly issued, fully paid and non-assessable. |

The above opinions are limited to the General Corporation Law of the State of Delaware.

I hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement. In giving such consent, I do not thereby admit that I am within the category of persons from whom consent is required by Section 7 of the Act or the related rules promulgated by the Commission.

|

| | |

Very truly yours, |

|

/s/ Eric Lassen |

Eric Lassen Senior Vice President and Deputy General Counsel |

LIVE NATION ENTERTAINMENT, INC.

2005 STOCK INCENTIVE PLAN,

AS AMENDED AND RESTATED AS OF MARCH 19, 2015

STOCK OPTION AGREEMENT

THIS STOCK OPTION AGREEMENT (the “Agreement”), made as of the __ day of _____, 20__ (the “Grant Date”) by and between Live Nation Entertainment, Inc., a Delaware corporation (the “Company”), and _________________ (the “Optionee”), evidences the grant by the Company of an option to purchase shares of the Company’s common stock, $.01 par value (the “Common Stock”), to the Optionee on such date and the Optionee’s acceptance of this option in accordance with the provisions of the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 (the “Plan”). The Company and the Optionee agree as follows:

1.Grant of Option. Subject to the terms and conditions set forth herein and in the Plan, the Company hereby grants to the Optionee an option (the “Option”) to purchase _____ shares of Common Stock (the “Option Shares”) from the Company at the price per share of $______ (the “Option Price”).

2. Limitations on Exercise of Option. Except as otherwise provided in this Agreement, this Option will vest and become exercisable at such times and on such dates (each, a “Vesting Date”) as are prescribed by the terms of the grant; provided, that, the Optionee is still employed or performing services for the Company on each such Vesting Date.

3. Term of Option. Unless sooner terminated in accordance herewith or in the Plan, this Option shall expire on the date set forth in the grant notification provided to the Optionee.

4. Method of Exercise.

(a) The Optionee may exercise this Option, from time to time, to the extent then exercisable, by contacting the Company’s outside Plan administrator (the “Administrator”) and following the procedures established by the Administrator. The Option Price of this Option may be paid in cash or by certified or bank check or in any other manner the Compensation Committee of the Company’s Board of Directors (the “Committee”), in its discretion, may permit, including, without limitation, (i) the delivery of previously-owned shares, (ii) by a combination of a cash payment and delivery of previously-owned shares, or (iii) pursuant to a cashless exercise program established and made available through a registered broker-dealer in accordance with applicable law.

(b) At the time of exercise, the Optionee shall pay to the Administrator (or at the option of the Company, to the Company) such amount as the Company deems necessary to satisfy its obligation to withhold federal, state or local income or other taxes incurred by reason of the exercise of this Option. The Optionee may elect to pay to the Administrator (or at the

option of the Company, to the Company) an amount equal to the amount of the taxes which the Company shall be required to withhold by delivering to the Administrator (or at the option of the Company, to the Company), cash, a check or, at the sole discretion of the Company, shares of Common Stock having a fair market value equal to the amount of the withholding tax obligation as determined by the Company.

5. Issuance of Shares. Except as otherwise provided in the Plan, as promptly as practical after receipt of notification of exercise and full payment of the Option Price and any required income tax withholding, the Company shall issue or transfer to the Optionee the number of Option Shares with respect to which this Option has been so exercised, and shall deliver to the Optionee or have deposited in the Optionee’s brokerage account with the Administrator a certificate or certificates therefor, registered in the Optionee’s name.

6. Termination of Employment.

(a) If the Optionee’s termination of employment or service is due to death, this Option shall automatically vest and become immediately exercisable in full and shall be exercisable by the Optionee’s designated beneficiary, or, if none, the person(s) to whom the Optionee’s rights under this Option are transferred by will or the laws of descent and distribution for one year following such termination of employment or service (but in no event beyond the term of the Option), and shall thereafter terminate.

(b) If the Optionee’s termination of employment or service is due to Disability (as defined herein), the Optionee shall be treated, for purposes of this Agreement only, as if his/her employment or service continued with the Company for the lesser of (i) five years or (ii) the remaining term of this Option and this Option will continue to vest and remain exercisable during such period (the “Disability Vesting Period”). Upon expiration of the Disability Vesting Period, this Option shall automatically terminate; provided, that, if the Optionee should die during such period, this Option shall automatically vest and become immediately exercisable in full and shall be exercisable by the Optionee’s designated beneficiary, or, if none, the person(s) to whom the Optionee’s rights under this Option are transferred by will or the laws of descent and distribution for one year following such death (but in no event beyond the term of the Option), and shall thereafter terminate. For purposes of this section, “Disability” shall mean (i) if the Optionee’s employment with the Company is subject to the terms of an employment or other service agreement between such Optionee and the Company, which agreement includes a definition of “Disability”, the term “Disability” shall have the meaning set forth in such agreement during the period that such agreement remains in effect; and (ii) in all other cases, the term “Disability” shall mean a physical or mental infirmity which impairs the Optionee’s ability to perform substantially his or her duties for a period of one hundred eighty (180) consecutive days.

(c) If the Optionee’s termination of employment or service is due to Retirement (as defined herein), the Optionee shall be treated, for purposes of this Agreement only, as if his/her employment or service continued with the Company for the lesser of (i) five years or (ii) the remaining term of this Option and this Option will continue to vest and remain exercisable during such period (the “Retirement Vesting Period”). Upon expiration of the Retirement Vesting Period, this Option shall automatically terminate; provided, that, if the Optionee should die during such period, this Option shall automatically vest and become

immediately exercisable in full and shall be exercisable by the Optionee’s designated beneficiary, or, if none, the person(s) to whom such Optionee’s rights under this Option are transferred by will or the laws of descent and distribution for one year following such death (but in no event beyond the term of the Option), and shall thereafter terminate. For purposes of this section, “Retirement” shall mean the Optionee’s resignation from the Company on or after the date on which the sum of his/her (i) full years of age (measured as of his/her last birthday preceding the date of termination of employment or service) and (ii) full years of service with the Company measured from his/her date of hire (or re-hire, if later), is equal at least seventy (70); provided, that, the Optionee must have attained at least the age of sixty (60) and completed at least five (5) full years of service with the Company prior to the date of his/her resignation. Any disputes relating to whether the Optionee is eligible for Retirement under this Agreement, including, without limitation, his years’ of service, shall be settled by the Committee in its sole discretion.

(d) If the termination of the Optionee’s employment or service is for Cause (as defined herein), this Option shall terminate upon such termination of employment or service, regardless of whether this Option was then exercisable. For purposes of this section, “Cause” shall mean the Optionee’s (i) intentional failure to perform reasonably assigned duties, (ii) dishonesty or willful misconduct in the performance of duties, (iii) involvement in a transaction in connection with the performance of duties to the Company which transaction is adverse to the interests of the Company and which is engaged in for personal profit or (iv) willful violation of any law, rule or regulation in connection with the performance of duties (other than traffic violations or similar offenses).

(e) If the termination of the Optionee’s of employment or service is for any other reason, the unvested portion of this Option, any, shall terminate on the date of termination and the vested portion of this Option shall be exercisable for a period of three-months following such termination of employment or service (but in no event beyond the term of the Option), and shall thereafter terminate. The Optionee’s status as an employee shall not be considered terminated in the case of a leave of absence agreed to in writing by the Company (including, but not limited to, military and sick leave); provided, that, such leave is for a period of not more than three-months or re-employment upon expiration of such leave is guaranteed by contract or statute.

(f) Notwithstanding any other provision of this Agreement or the Plan to the contrary, including, without limitation, Sections 7(b) and 7(c) of this Agreement:

(i) If it is determined by the Committee that prior to the date that this Option is fully vested (whether or not during the Disability Vesting Period or the Retirement Vesting Period), the Optionee engaged (or is engaging in) any activity that is harmful to the business or reputation of the Company (or any parent or subsidiary), including, without limitation, any “Competitive Activity” (as defined below) or conduct prejudicial to or in conflict with the Company (or any parent or subsidiary) or any material breach of a contractual obligation to the Company (or any parent or subsidiary) (collectively, “Prohibited Acts”), then, upon such determination by the Committee, this Option shall be cancelled and cease to be exercisable (whether or not then vested).

(ii) If it is determined by the Committee that the Optionee engaged (or is engaging in) any Prohibited Act where such Prohibited Act occurred or is occurring within the

one (1) year period immediately following the exercise of any Option granted under this Agreement, the Optionee agrees that he/she will repay to the Company any gain realized on the exercise of such Option (such gain to be valued as of the relevant exercise date(s)). Such repayment obligation will be effective as of the date specified by the Committee. Any repayment obligation must be satisfied in cash or, if permitted in the sole discretion of the Committee, in shares of Common Stock having a fair market value equal the gain realized upon exercise of the Option. The Company is specifically authorized to off-set and deduct from any other payments, if any, including, without limitation, wages, salary or bonus, that it may own the Optionee to secure the repayment obligations herein contained.

The determination of whether the Optionee has engaged in a Prohibited Act shall be determined by the Committee in good faith and in its sole discretion. The provisions of this Section shall have no effect following a Change in Control. For purposes of this Agreement, the term “Competitive Activity” shall mean the Optionee, without the prior written permission of the Committee, any where in the world where the Company (or any parent or subsidiary) engages in business, directly or indirectly, (i) entering into the employ of or rendering any services to any person, entity or organization engaged in a business which is directly or indirectly related to the businesses of the Company or any parent or subsidiary (“Competitive Business”) or (ii) becoming associated with or interested in any Competitive Business as an individual, partner, shareholder, creditor, director, officer, principal, agent, employee, trustee, consultant, advisor or in any other relationship or capacity other than ownership of passive investments not exceeding 1% of the vote or value of such Competitive Business.

(g) The term “Company” as used in this Agreement with reference to the employment or service of the Optionee shall include the Company and its subsidiaries, as appropriate.

7. Change in Control. Upon the occurrence of a Change in Control (as defined herein), this Option shall become immediately vested and exercisable in full. For the purposes hereof, the term “Change in Control” shall mean a transaction or series of transactions which constitutes an “exchange transaction” within the meaning of the Plan or such other event involving a change in ownership or control of the business or assets of the Company as the Board, acting in its discretion, may determine.

8. Rights as a Stockholder. No shares of Common Stock shall be issued in respect of the exercise of this Option until payment of the exercise price and the applicable tax withholding obligations have been satisfied or provided for to the satisfaction of the Company, and the Optionee shall have no rights as a stockholder with respect to any shares covered by this Option until such shares are duly and validly issued by the Company to or on behalf of the Optionee.

9. Non-Transferability. This Option is not assignable or transferable except upon the Optionee’s death to a beneficiary designated by the Optionee in a manner prescribed or approved for this purpose by the Committee or, if no designated beneficiary shall survive the Optionee, pursuant to the Optionee’s will or by the laws of descent and distribution. During an Optionee’s lifetime, this Option may be exercised only by the Optionee or the Optionee’s guardian or legal representative.

10. Limitation of Rights. Nothing contained in this Agreement shall confer upon the Optionee any right with respect to the continuation of his employment or service with the Company, or interfere in any way with the right of the Company at any time to terminate such employment or other service or to increase or decrease, or otherwise adjust, the compensation and/or other terms and conditions of the Optionee’s employment or other service.

11. Restrictions on Transfer. The Optionee agrees, by acceptance of this Option, that, upon issuance of any shares hereunder, that, unless such shares are then registered under applicable federal and state securities laws, (i) acquisition of such shares will be for investment and not with a view to the distribution thereof, and (ii) the Company may require an investment letter from the Optionee in such form as may be recommended by Company counsel. The Company shall in no event be obliged to register any securities pursuant to the Securities Act of 1933 (as now in effect or as hereafter amended) or to take any other affirmative action in order to cause the exercise of this Option or the issuance or transfer of shares pursuant thereto to comply with any law or regulation of any governmental authority.

12. Notice. Any notice to the Company provided for in this Agreement shall be addressed to it in care of its Secretary at the Company’s executive offices, and any notice to the Optionee shall be addressed to the Optionee at the current address shown on the payroll records of the Company. Any notice shall be deemed to be duly given if and when properly addressed and posted by registered or certified mail, postage prepaid.

13. Incorporation of Plan by Reference. This Option is granted pursuant to the terms of the Plan, the terms of which are incorporated herein by reference, and this Option shall in all respects be interpreted in accordance with the Plan. The Committee shall interpret and construe the Plan and this Agreement and its interpretations and determinations shall be conclusive and binding on the parties hereto and any other person claiming an interest hereunder, with respect to any issue arising hereunder or thereunder. In the event of a conflict or inconsistency between the terms and provisions of the Plan and the provisions of this Agreement, the Plan shall govern and control. All capitalized terms not defined herein shall have the meaning ascribed to them as set forth in the Plan.

14. Governing Law. This Agreement and the rights of all persons claiming under this Agreement shall be governed by the laws of the State of Delaware, without giving effect to conflicts of laws principles thereof.

15. Tax Status of Option. This Option is not intended to be an incentive stock option within the meaning of Section 422 of the Code.

16. Miscellaneous. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and may not be modified other than by written instrument executed by the parties.

IN WITNESS WHEREOF, the parties hereto have signed this Agreement as of the date first above written.

LIVE NATION ENTERTAINMENT, INC.

Optionee: By:

Name:

Title:

LIVE NATION ENTERTAINMENT, INC.

2005 STOCK INCENTIVE PLAN,

AS AMENDED AND RESTATED AS OF MARCH 19, 2015

RESTRICTED STOCK AWARD AGREEMENT

THIS RESTRICTED STOCK AWARD AGREEMENT (the “Agreement”), made as of the __ day of _____, 20__ (the “Grant Date”) by and between Live Nation Entertainment, Inc., a Delaware corporation (the “Company”), and ______________ (the “Grantee”), evidences the grant by the Company of an award of restricted stock (the “Award”) to the Grantee on such date and the Grantee’s acceptance of the Award in accordance with the provisions of the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015 (the “Plan”). The Company and the Grantee agree as follows:

1.Basis for Award. This Award is made under the Plan pursuant to Section 8 thereof for service rendered or to be rendered to the Company by the Grantee, subject to all of the terms and conditions of this Agreement, including, without limitation, Section 4(b) hereof.

2. Stock Awarded.

(a) The Company hereby awards to the Grantee, in the aggregate, _____________ shares of Restricted Stock (the “Restricted Stock”) which shall be subject to the restrictions and conditions set forth in the Plan and in this Agreement.

(b) Shares of Restricted Stock shall be evidenced by book-entry registration with the Company’s transfer agent, subject to such stop-transfer orders and other terms deemed appropriate by the Compensation Committee of the Company’s Board of Directors (the “Committee”) to reflect the restrictions applicable to such Award. Notwithstanding the foregoing, if any certificate is issued in respect of shares of Restricted Stock at the sole discretion of the Committee, such certificate shall be registered in the name of Grantee and shall bear an appropriate legend referring to the terms, conditions, and restrictions applicable to such award, substantially in the following form:

“THE TRANSFERABILITY OF THIS CERTIFICATE AND THE COMMON STOCK REPRESENTED HEREBY ARE SUBJECT TO THE TERMS AND CONDITIONS (INCLUDING FORFEITURE) CONTAINED IN THE RESTRICTED STOCK AWARD AGREEMENT DATED AS OF ________, 20__, ENTERED INTO BETWEEN THE REGISTERED OWNER AND LIVE NATION ENTERTAINMENT, INC.”

If a certificate is issued with respect to the Restricted Stock, the Committee may require that the certificate evidencing such shares be held in custody by the Company until the restrictions thereon shall have lapsed and that the Grantee deliver a stock power, endorsed in blank, relating to the shares covered by such Award. At the expiration of the restrictions, the Company shall instruct the transfer agent to release the shares from the restrictions applicable to such Award, subject to the terms of the Plan and applicable law or, in the event that a certificate has been

issued, redeliver to the Grantee (or his legal representative, beneficiary or heir) share certificates for the shares deposited with it without any legend except as otherwise provided by the Plan, this Agreement or applicable law. During the period that the Grantee holds the shares of Restricted Stock, the Grantee shall have the right to vote the Restricted Stock while it is subject to restriction, but, notwithstanding any provisions of the Plan to the contrary, shall have no right to receive dividends prior to the vesting of such shares, and shall have no right to payment, accrual, crediting or otherwise with regard to dividends declared or paid by the Company prior to the vesting of the applicable shares. If the Award is forfeited in whole or in part, the Grantee will assign, transfer, and deliver any evidence of the shares of Restricted Stock to the Company and cooperate with the Company to reflect such forfeiture.

(c) In addition to the forfeiture restrictions set forth herein, prior to vesting as provided in Sections 3 and 4(a) of this Agreement, the shares of Restricted Stock may not be sold, assigned, transferred, hypothecated, pledged or otherwise alienated (collectively a “Transfer”) by the Grantee and any such Transfer or attempted Transfer, whether voluntary or involuntary, and if involuntary whether by process of law in any civil or criminal suit, action or proceeding, whether in the nature of an insolvency or bankruptcy proceeding or otherwise, shall be void and of no effect.

3. Vesting. Except as otherwise provided in this Agreement, the restrictions described in Section 2 of this Agreement will lapse at such times and on such dates (each, a “Vesting Date”) as are prescribed by the terms of the grant; provided, that, the Grantee is still employed or performing services for the Company on each such Vesting Date. In the event of the Grantee’s termination of employment or service prior to the date that all of the Restricted Stock is vested, except as otherwise provided in this Agreement, all Restricted Stock still subject to restriction shall be forfeited.

(a) If the Grantee’s termination of employment or service is due to death and such death occurs prior to the date that all of the Restricted Stock is vested, all restrictions will lapse with respect to 100% of the Restricted Stock still subject to restriction on the date of death.

(b) If the Grantee’s termination of employment or service is due to Disability (as defined herein) or Retirement (as defined herein) and such Disability or Retirement, as the case may be, occurs prior to the date that all of the Restricted Stock is vested, the Grantee shall be treated, for purposes of this Agreement only, as if his/her employment or service continued with the Company until the date that all restrictions on the Restricted Stock have lapsed (the “Extension Period”) and such Restricted Stock will vest in accordance with the schedule set forth herein; provided, that, if the Grantee dies during the Extension Period and the Restricted Stock has not been forfeited in accordance with Section 4(b), all restrictions will lapse with respect to 100% of the Restricted Stock still subject to restriction on the date of death. “Disability” shall mean (i) if the Grantee’s employment with the Company is subject to the terms of an employment or other service agreement between such Grantee and the Company, which agreement includes a definition of “Disability”, the term “Disability” shall have the meaning set forth in such agreement during the period that such agreement remains in effect; and (ii) in all other cases, the term “Disability” shall mean a physical or mental infirmity which impairs the Grantee’s ability to perform substantially his or her duties for a period of one hundred eighty (180) consecutive days. “Retirement” shall mean the Grantee’s resignation from the Company on or after the date on which the sum of his/her (i) full years of age (measured as of his/her last

birthday preceding the date of termination of employment or service) and (ii) full years of service with the Company (or any parent or subsidiary) measured from his date of hire (or re-hire, if later), is equal at least seventy (70); provided, that, the Grantee must have attained at least the age of sixty (60) and completed at least five (5) full years of service with the Company (or any parent or subsidiary) prior to the date of his/her resignation. Any disputes relating to whether the Grantee is eligible for Retirement under this Agreement, including, without limitation, his years’ of service, shall be settled by the Committee in its sole discretion.

(c) If the Grantee’s termination of employment or service is for any other reason and such termination occurs prior to the date that all of the Restricted Stock is vested, the Restricted Stock still subject to restriction shall automatically be forfeited upon such cessation of employment or services.

(d) The term “Company” as used in this Agreement with reference to employment or service of the Grantee shall include the Company and its parent and subsidiaries, as appropriate.

4. Special Rules.

(a) Change in Control. In the event of a Change in Control, the restrictions described in Sections 2 and 3 of this Agreement will lapse with respect to 100% of the Restricted Stock still subject to restriction. For the purposes hereof, the term “Change in Control” shall mean a transaction or series of transactions which constitutes an “exchange transaction” within the meaning of the Plan or such other event involving a change in ownership or control of the business or assets of the Company as the Board, acting in its discretion, may determine.

(b) Forfeiture.

(i) Notwithstanding the provisions of Section 3 of this Agreement and any other provision of this Agreement or the Plan to the contrary, if it is determined by the Committee that prior to the date that all of the Restricted Stock is vested (whether or not during the Extension Period), the Grantee engaged (or is engaging in) any activity that is harmful to the business or reputation of the Company (or any parent or subsidiary), including, without limitation, any “Competitive Activity” (as defined below) or conduct prejudicial to or in conflict with the Company (or any parent or subsidiary) or any material breach of a contractual obligation to the Company (or any parent or subsidiary) (collectively, “Prohibited Acts”), then, upon such determination by the Committee, all Restricted Stock granted to the Grantee under this Agreement which is still subject to restriction shall be cancelled and forfeited.

(ii) Notwithstanding any other provision of this Agreement or the Plan to the contrary, if it is determined by the Committee that the Grantee engaged (or is engaging in) any Prohibited Act where such Prohibited Act occurred or is occurring within the one (1) year period immediately following the vesting of any Restricted Stock under this Agreement (including, without limitation, vesting that occurs by application of Section 3(b) of this Agreement), the Grantee agrees that he/she will repay to the Company any gain realized on the vesting of such Restricted Stock (such gain to be valued as of the relevant Vesting Date(s) based on the fair market value of the Restricted Stock on the relevant Vesting Date(s) over the purchase price paid, if any, of such stock). Such repayment obligation will be effective as of the date

specified by the Committee. Any repayment obligation must be satisfied in cash or, if permitted in the sole discretion of the Committee, in shares of Common Stock having a fair market value equal the value of the Restricted Stock on the relevant Vesting Date(s). The Company is specifically authorized to off-set and deduct from any other payments, if any, including, without limitation, wages, salary or bonus, that it may own the Grantee to secure the repayment obligations herein contained.

(iii) The determination of whether the Grantee has engaged in a Prohibited Act shall be determined by the Committee in good faith and in its sole discretion.

(iv) The provisions of this Section 4(b) shall have no effect following a Change in Control.

(v) For purposes of this Agreement, the term “Competitive Activity” shall mean the Grantee, without the prior written permission of the Committee, any where in the world where the Company (or any parent or subsidiary) engages in business, directly or indirectly, (A) entering into the employ of or rendering any services to any person, entity or organization engaged in a business which is directly or indirectly related to the businesses of the Company or any parent or subsidiary (“Competitive Business”) or (B) becoming associated with or interested in any Competitive Business as an individual, partner, shareholder, creditor, director, officer, principal, agent, employee, trustee, consultant, advisor or in any other relationship or capacity other than ownership of passive investments not exceeding 1% of the vote or value of such Competitive Business.

5. Compliance with Laws and Exchange Requirements. The issuance and transfer of any shares of Common Stock shall be subject to compliance by the Company and the Grantee with all applicable requirements of securities laws and with all applicable requirements of any stock exchange on which the shares may be listed at the time of such issuance or transfer. The Grantee understands that the Company is under no obligation to register or qualify the shares of Common Stock with the Securities and Exchange Commission, any state securities commission or any stock exchange to effect such compliance.

6. Tax Withholding.

(a) The Grantee agrees that, subject to clause 6(b) below, no later than the date as of which the restrictions on the Restricted Stock shall lapse with respect to all or any of the Restricted Stock covered by this Agreement, the Grantee shall pay to the Company (in cash or to the extent permitted by the Committee in its sole discretion, shares of Common Stock held by the Grantee whose fair market value is equal to the amount of the Grantee’s tax withholding liability) any federal, state or local taxes of any kind required by law to be withheld, if any, with respect to the Restricted Stock for which the restrictions shall lapse. The Company or its subsidiaries shall, to the extent permitted by law, have the right to deduct from any payment of any kind otherwise due to the Grantee any federal, state or local taxes of any kind required by law to be withheld with respect to the shares of Restricted Stock. The Company may refuse to instruct the transfer agent to release the shares of Common Stock or redeliver share certificates if the Grantee fails to comply with any withholding obligation.

(b) If the Grantee properly elects, within thirty (30) days of the Grant Date, to include in gross income for federal income tax purposes an amount equal to the fair market value as of the Grant Date of the Restricted Stock granted hereunder pursuant to Section 83(b) of the Internal Revenue Code of 1986, as amended, the Grantee shall pay to the Company, or make other arrangements satisfactory to the Committee to pay to the Company, any federal, state or local taxes required to be withheld with respect to such shares. If the Grantee fails to make such payments, the Company or its affiliates shall, to the extent permitted by law, have the right to deduct from any payment of any kind otherwise due to the Grantee any federal, state or local taxes of any kind required by law to be withheld with respect to such shares. The Company may refuse to instruct the transfer agent to release the shares or redeliver share certificates if Grantee fails to comply with any withholding obligation.

7. Limitation of Rights. Nothing contained in this Agreement shall confer upon the Grantee any right with respect to the continuation of his employment or service with the Company, or interfere in any way with the right of the Company at any time to terminate such employment or other service or to increase or decrease, or otherwise adjust, the compensation and/or other terms and conditions of the Grantee’s employment or other service.

8. Representations and Warranties of Grantee. The Grantee represents and warrants to the Company that:

(a) Agrees to Terms of the Plan. The Grantee has received a copy of the Plan and the Prospectus prepared pursuant to the Form S-8 Registration Statement relating to the Plan and has read and understands the terms of the Plan, this Agreement and the Prospectus, and agrees to be bound by their terms and conditions. The Grantee acknowledges that there may be adverse tax consequences upon the vesting of Restricted Stock or disposition of the shares once vested, and that the Grantee should consult a tax adviser prior to such time.

(b) Cooperation. The Grantee agrees to sign such additional documentation as may reasonably be required from time to time by the Company.

9. Incorporation of Plan by Reference. The Award is granted pursuant to the terms of the Plan, the terms of which are incorporated herein by reference, and the Award shall in all respects be interpreted in accordance with the Plan. The Committee shall interpret and construe the Plan and this Agreement and its interpretations and determinations shall be conclusive and binding on the parties hereto and any other person claiming an interest hereunder, with respect to any issue arising hereunder or thereunder. In the event of a conflict or inconsistency between the terms and provisions of the Plan and the provisions of this Agreement, the Plan shall govern and control. All capitalized terms not defined herein shall have the meaning ascribed to them as set forth in the Plan.

10. Governing Law. This Agreement and the rights of all persons claiming under this Agreement shall be governed by the laws of the State of Delaware, without giving effect to conflicts of laws principles thereof.

11. Miscellaneous. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. This

Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and may not be modified other than by written instrument executed by the parties.

IN WITNESS WHEREOF, the parties hereto have signed this Agreement as of the date first above written.

LIVE NATION ENTERTAINMENT, INC.

|

| | | | |

Grantee: | | | By: | |

| | | | Name: |

| | | | Title: |

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement (Form S-8) pertaining to the 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015, of Live Nation Entertainment, Inc. of our reports dated February 26, 2015 with respect to the consolidated financial statements and schedule of Live Nation Entertainment, Inc. and the effectiveness of internal control over financial reporting of Live Nation Entertainment, Inc. included in its Annual Report (Form 10-K) for the year ended December 31, 2014, filed with the Securities and Exchange Commission.

/s/ Ernst & Young LLP

Los Angeles, California

August 10, 2015

CONSENT OF INDEPENDENT AUDITORS

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 pertaining to the Live Nation Entertainment, Inc. 2005 Stock Incentive Plan, as amended and restated as of March 19, 2015, the Registration Statement on Form S-3 (No 333-190459), S-8 (No 333-175139), Registration Statement (Form S-8 No. 333-164507) pertaining to the Amended and Restated Ticketmaster Entertainment, Inc. 2008 Stock and Annual Incentive Plan; , Registration Statement (Form S-8 No. 333-164494) pertaining to the Amended and Restated Live Nation, Inc. Stock Bonus Plan; , Registration Statement (Form S-8 No. 333-164302) pertaining to the 2005 Stock Incentive Plan, as Amended and Restated of Live Nation, Inc.; , Registration Statement (Form S-8 No. 333-157664) pertaining to the Employee Stock Bonus Plan of Live Nation, Inc.; , Registration Statement (Form S-8 No. 333-149901) pertaining to the Employee Stock Bonus Plan of Live Nation, Inc.;, and Registration Statement (Form S-8 No. 333-132949) pertaining to the 2005 Stock Incentive Plan of Live Nation, Inc.of Live Nation Entertainment, Inc. of our report dated June 27, 2014 relating to the financial statements of Venta de Boletos por Computadora, S.A. de C.V., which was is incorporated by reference in this the Annual Report on Form 10-K of Live Nation Entertainment, Inc. for the year ended December 31, 2014.

PricewaterhouseCoopers S.C.

/s/ Maximino Manuel Sañudo Bolaños

Maximino Manuel Sañudo Bolaños

Mexico City, Mexico

August, 5 2015

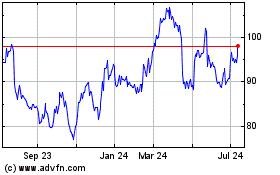

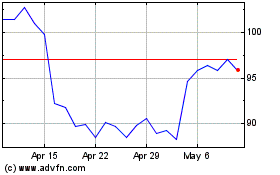

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Live Nation Entertainment (NYSE:LYV)

Historical Stock Chart

From Apr 2023 to Apr 2024