UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ALAMO GROUP INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

74-1621248

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification Number)

|

| |

|

|

1627 East Walnut

|

|

|

Seguin, Texas

|

78155

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Alamo Group Inc. 2015 Incentive Stock Option Plan

(Full Title of the Plan)

Ronald A. Robinson, President

Alamo Group Inc.

1627 East Walnut

Seguin, Texas 78155

(Name and Address of Agent for Service)

(830) 379-1480

(Telephone Number, Including Area Code, of Agent for Service)

Indicate by check mark whether registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

T

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

o

|

CALCULATION OF REGISTRATION FEE

|

Title of Securities

To Be Registered

|

Amount to be Registered1

|

Proposed Maximum Offering Price Per Share2

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Common Stock, par value $0.10 per share

|

400,000

|

$52.485

|

$20,994,000

|

$2,439.51

|

___________________________________

1 In accordance with Rule 416 under the Securities Act of 1933, as amended, this registration statement shall be deemed to cover any additional securities that may from time to time be offered or issued to prevent dilution resulting from stock splits, stock dividends or similar transactions.

2 Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(c) and Rule 457(h) under the Securities Act, the price per share and aggregate offering price are calculated on the basis of the average of the high and low prices of the common stock as reported on the New York Stock Exchange on May 13, 2015.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information. The information required in Item 1 is included in documents sent or given to participants in the plan covered by this registration statement pursuant to Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”).

Item 2. Registration Information and Employee Plan Annual Information. The written statement required by Item 2 is included in documents sent or given to participants in the plan covered by this registration statement pursuant to Rule 428(b)(1) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

Alamo Group Inc. is subject to the informational and reporting requirements of Sections 13(a), 14, and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith files reports, proxy statements and other information with the Securities and Exchange Commission (the “Commission”). The following documents, which are on file with the Commission, are incorporated in this registration statement by reference:

(a) the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014;

(b) the Registrant’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2015;

(c) the Registrant’s Current Reports on Form 8-K filed on March 3, 2015 and May 12, 2015; and

(d) the description of Alamo Group Inc.’s common stock contained or incorporated by reference in its registration statement on Form 8-A, filed with the Commission on July 10, 1995.

All documents subsequently filed by Alamo Group Inc. pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by reference in this registration statement and to be part hereof from the date of the filing of such documents. Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of this registration statement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this registration statement.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Under Article Eight of its Certificate of Incorporation, Alamo Group Inc. is required to indemnify any person who at any time is, or shall have been, a director or officer of Alamo Group Inc. to the full extent permitted by Section 145 of the Delaware General Corporation Law, as such Section may be amended from time to time. Section 145 of the General Corporation Law of the State of Delaware empowers Alamo Group Inc. to indemnify, subject to the standards and limitations set forth therein, any person in connection with any action, suit or proceeding brought or threatened by reason of the fact that such person is or was a Director, officer, employee or agent of Alamo Group Inc. or is or was serving in such capacity with respect to another corporation or other enterprise at the request of Alamo Group Inc.

Under Section 1 of Article Six of the Bylaws of Alamo Group Inc., Alamo Group Inc. is required to indemnify any person who was or is a party, or is threatened to be made a party, to any threatened, pending, or contemplated action, suit or proceeding, whether civil, criminal, administrative or investigative (other than an action by or in the right of Alamo Group Inc.), by reason of the fact that such person is or was a director, officer, employee or agent of Alamo Group Inc., or is or was serving at the request of Alamo Group Inc. as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust or other enterprise, if such person acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of Alamo Group Inc. and, with respect to any criminal action or proceeding, that he had no reasonable cause to believe his conduct was unlawful.

Under Section 2 of Article Six of the Bylaws of Alamo Group Inc., Alamo Group Inc. also is required to indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending, or contemplated action or suit by or in the right of Alamo Group Inc. to procure a judgment in its favor by reason of the fact that he is or was a director, officer, employee or agent of Alamo Group Inc., or is or was serving at the request of Alamo Group Inc. as a director, officer, employee, or agent of another corporation, partnership, joint venture, trust, or other enterprise if he acted in good faith and in a manner he reasonably believed to be in the best interests of Alamo Group Inc., except that no indemnification shall be made in respect of any claim, issue or matter as to which such person shall have been adjudged to be liable for negligence or misconduct in the performance of his duty to Alamo Group Inc., unless and only to the extent that the court in which such action or suit was brought shall determine upon application that, despite the adjudication of liability but in view of all the circumstances of the case, such person is fairly and reasonably entitled to indemnity for such expenses which such court shall deem proper.

Any indemnification under Section 1 or 2 of Article Six of the Bylaws of Alamo Group Inc. shall be made by Alamo Group Inc. only as authorized in the specific case upon a determination that indemnification of the director, officer, employee, or agent is proper in the circumstances because he has met the applicable standard of conduct described in such sections. Such determination shall be made (i) by the Board of Directors by a majority vote of a quorum consisting of directors who were not parties to such action, suit, or proceeding, or (ii) if such quorum is not obtainable, or, even if obtainable, if a quorum of disinterested directors so directs, by independent legal counsel in a written opinion, or (iii) by the stockholders.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

|

Exhibit 3.1(1)

|

Certificate of Incorporation, as amended, of Alamo Group Inc.

|

|

Exhibit 3.2(2)

|

By-Laws of Alamo Group Inc. as amended

|

|

Exhibit 4.1

|

Alamo Group Inc. 2015 Incentive Stock Option Plan

|

|

Exhibit 5.1

|

Opinion of Sidley Austin llp

|

|

Exhibit 23.1

|

Consent of KPMG LLP

|

|

Exhibit 23.2

|

Consent of Sidley Austin llp (included as part of Exhibit 5.1)

|

_____________

|

(1)

|

Incorporated by reference to the Form S-1 of Alamo Group Inc. filed February 5, 1993.

|

|

(2)

|

Incorporated by reference to the Form 10-K of Alamo Group Inc. filed March 11, 2014.

|

Item 9. Undertakings.

1. Item 512(a) of Regulation S-K. The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table above; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement; provided, however, that paragraphs (i) and (ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

2. Item 512(b) of Regulation S-K. The undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. Item 512(h) of Regulation S-K. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Seguin, Texas, on this 14th day of May, 2015.

| |

ALAMO GROUP INC.

|

|

| |

|

|

|

| |

By:

|

/s/ Ronald A. Robinson

|

|

| |

|

Ronald A. Robinson, President and

|

|

| |

|

Chief Executive Officer

|

|

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ James B. Skaggs

|

|

|

|

|

|

James B. Skaggs

|

|

Chairman of the Board and Director

|

|

May 14, 2015

|

| |

|

|

|

|

|

/s/ Ronald A. Robinson

|

|

President, Chief Executive Officer and Director

(Principal Executive Officer)

|

|

May 14, 2015

|

|

Ronald A. Robinson

|

|

|

|

|

| |

|

|

|

|

|

/s/ Dan E. Malone

|

|

Executive Vice President, Chief Financial Officer

(Principal Financial Officer)

|

|

May 14, 2015

|

|

Dan E. Malone

|

|

|

|

|

| |

|

|

|

|

|

/s/ Richard J. Wehrle

|

|

Vice President and Controller

(Principal Accounting Officer)

|

|

May 14, 2015

|

|

Richard J. Wehrle

|

|

|

|

|

| |

|

|

|

|

|

/s/ Roderick R. Baty

|

|

Director

|

|

May 14, 2015

|

|

Roderick R. Baty

|

|

|

|

|

| |

|

|

|

|

|

/s/ Helen W. Cornell

|

|

Director

|

|

May 14, 2015

|

|

Helen W. Cornell

|

|

|

|

|

| |

|

|

|

|

|

/s/ Jerry E. Goldress

|

|

Director

|

|

May 14, 2015

|

|

Jerry E. Goldress

|

|

|

|

|

| |

|

|

|

|

|

/s/ David W. Grzelak

|

|

Director

|

|

May 14, 2015

|

|

David W. Grzelak

|

|

|

|

|

| |

|

|

|

|

|

/s/ Gary L. Martin

|

|

Director

|

|

May 14, 2015

|

|

Gary L. Martin

|

|

|

|

|

INDEX TO EXHIBITS

|

Number

|

Description

|

| |

|

|

3.1(1)

|

Certificate of Incorporation, as amended, of Alamo Group Inc.

|

| |

|

|

3.2(2)

|

By-Laws of Alamo Group Inc. as amended

|

| |

|

|

4.1

|

Alamo Group Inc. 2015 Incentive Stock Option Plan

|

| |

|

|

5.1

|

Opinion of Sidley Austin llp, counsel to Alamo Group Inc.

|

| |

|

|

23.1

|

Consent of KPMG LLP

|

| |

|

|

23.2

|

Consent of Sidley Austin llp (included as part of Exhibit 5.1)

|

_____________

|

(1)

|

Incorporated by reference to the Form S-1 of Alamo Group Inc. filed February 5, 1993.

|

|

(2)

|

Incorporated by reference to the Form 10-K of Alamo Group Inc. filed March 11, 2014.

|

6

Exhibit 4.1

Alamo Group Inc.

2015 Incentive Stock Option Plan

1. Purpose

The purpose of the Alamo Group Inc. 2015 Incentive Stock Option Plan (the "2015 Plan" or the "Plan") is to advance the interests of Alamo Group Inc. (the "Company") and to increase shareholder value by providing officers and employees of the Company and its Subsidiaries (as hereinafter defined) with a proprietary interest in the growth and performance of the Company and with incentives for current or future service with the Company and its Subsidiaries. The Plan shall be administered so as to qualify the options as "incentive stock options" under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"). The Plan is a successor plan to the 2005 Incentive Stock Option Plan, which may be referred to as the "Predecessor Plan."

2. Effective Date and Term

The Plan shall be effective as of May 7, 2015, the date of its adoption by the Company's Board of Directors (the "Board"), subject to the approval of Plan by the Company’s shareholders. If the shareholders fail to approve the Plan within 12 months after its adoption by the Board, then any grants, exercises or sales that have already occurred under the Plan shall be rescinded and no additional grants, exercises or sales shall thereafter be made under the Plan. No award shall be granted pursuant to this Plan on or after the tenth anniversary of the date on which this Plan was adopted by the Board (unless terminated sooner pursuant to Section 11 by the Board), but outstanding awards shall remain outstanding in accordance with their applicable terms and conditions except as provided by the immediately preceding sentence. Effective May 7, 2015, no further awards shall be made under the Predecessor Plan, but outstanding awards under the Predecessor Plan or any other Company employee benefit plan shall remain outstanding in accordance with their applicable terms and conditions.

3. Plan Administration

The independent Compensation Committee of the Board, or such other independent committee as the Board shall determine, comprised of not less than three members shall be responsible for administering the Plan (the "Compensation Committee"). To the extent specified by the Compensation Committee it may delegate its administrative responsibilities to a subcommittee of the Compensation Committee comprised of not less than two members (the Compensation Committee and such subcommittee being hereinafter referred to as the "Committee"). The Compensation Committee or such subcommittee members, as appropriate, shall be qualified to administer the Plan as contemplated by (a) Rule 16b-3 under the Securities Exchange Act of 1934 (the "1934 Act") or any successor rule, (b) Section 162(m) of the Code, and (c) any rules and regulations of a stock exchange on which Common Stock (as defined in Section 5) of the Company is listed. The Committee, and such subcommittee to the extent provided by the Committee, shall have full and exclusive power to interpret, construe and implement the Plan and any rules, regulations, guidelines or agreements adopted hereunder and to adopt such rules, regulations and guidelines for carrying out the Plan as it may deem necessary or proper. These powers shall include, but not be limited to, (i) determination of the type or types of awards to be granted under the Plan; (ii) determination of the terms and conditions of any awards under the Plan; (iii) determination of whether, to what extent and under what circumstances awards may be settled, paid or exercised in cash, shares, other securities, or other awards, or other property, or cancelled, forfeited or suspended; (iv) adoption of such modifications, amendments, procedures, subplans and the like as are necessary to enable participants employed in other countries in which the Company may operate to receive advantages and benefits under the Plan consistent with the laws of such countries, and consistent with the rules of the Plan; (v) subject to the rights of participants, modification, change, amendment or cancellation of any award to correct an administrative error, and (vi) taking any other action the Committee deems necessary or desirable for the administration of the Plan. All determinations, interpretations, and other decisions under or with respect to the Plan or any award by the Committee shall be final, conclusive and binding upon the Company, any participant, any holder or beneficiary of any award under the Plan and any employee of the Company. Except for (A) the power to amend the Plan as provided in Section 11, (B) determinations regarding employees who are subject to Section 16 of the 1934 Act, (C) as may otherwise be required under Section 162(m) of the Code, and (D) as may otherwise be required under applicable New York Stock Exchange rules, the Committee may delegate any or all of its duties, powers and authority under the Plan pursuant to such conditions or limitations as the Committee may establish to any officer or officers of the Company.

4. Eligibility

Any employee of the Company shall be eligible to receive an award under the Plan. For purposes of this Section 4, "Company" shall include any entity that is considered a Subsidiary of the Company. For this purpose, a "Subsidiary" means any corporation (other than the Company) in an unbroken chain of corporations beginning with the Company, if each of the corporations other than the last corporation in the unbroken chain owns stock possessing 50% or more of the total combined voting power of all classes of shares in one of the other corporations in such chain. A corporation that attains the status of a Subsidiary on a date after the effective date of the Plan shall be considered a Subsidiary commencing as of such date.

5. Shares of Stock Subject to the Plan

A total number of four hundred thousand (400,000) shares of common stock, par value $0.10 per share, of the Company ("Common Stock" or "Stock") shall become available for issuance under the Plan.

Any shares that are issued by the Company, and any awards that are granted by, or become obligations of, the Company, through the assumption by the Company or an affiliate of, or in substitution for, outstanding awards previously granted by an acquired company shall not be counted against the shares available for issuance under the Plan.

In determining shares available for issuance under the Plan, any shares underlying awards granted under the Plan that are cancelled, are forfeited or lapse shall become eligible again for issuance under the Plan.

Any shares issued under the Plan may consist in whole or in part, of authorized and unissued shares or of treasury shares, and no fractional shares shall be issued under the Plan. Cash may be paid in lieu of any fractional shares in settlements of awards under the Plan.

6. Adjustments and Reorganizations

The Committee may make such adjustments as it deems appropriate to meet the intent of the Plan in the event of changes that impact the Company's share price or share status, provided that any such actions are consistently and equitably applicable to all affected participants.

In the event of any stock dividend, stock split, combination or exchange of shares, merger, consolidation, spin-off or other distribution (other than normal cash dividends) of Company assets to shareholders, or any other change affecting shares, such adjustments, if any, as the Committee in its discretion may deem appropriate to reflect such change shall be made with respect to (i) the aggregate number of shares that may be issued under the Plan; (ii) the number of shares subject to awards of a specified type or to any individual under the Plan; and/or (iii) the price per share for any outstanding stock options.

Notwithstanding anything to the contrary in this Section 6 or any other provision of the Plan, the Committee may increase the maximum aggregate number of shares that may be issued under the Plan only to the extent necessary to reflect a change in the number of outstanding shares of Common Stock, such as a stock dividend or stock split.

7. Awards

The Committee shall determine the award(s) to be made to each participant under the Plan and shall approve the terms and conditions governing such awards in accordance with Section 10. However, under no circumstances may stock option awards be made which provide by their terms for the automatic award of additional stock options upon the exercise of such awards, including, without limitation, "reload options."

A Stock Option represents the right to purchase a share of Stock at a predetermined exercise price. Options granted under this Plan shall be in the form of Incentive Stock Options. The terms of each Stock Option, including the date of its grant (the "Grant Date"), shall be set forth in the award agreement. Subject to the applicable award agreement, Stock Options may be exercised, in whole or in part, by giving written notice of exercise to the Company specifying the number of shares to be purchased. Such notice shall be accompanied by payment in full of the exercise price by certified or bank check or such other instrument as the Company may accept (including a copy of instructions to a broker or bank acceptable to the Company to deliver promptly to the Company an amount of sale or loan proceeds sufficient to pay the exercise price). As determined by the Committee, payment in full or in part may also be made in the form of Common Stock already owned by the optionee valued at the Fair Market Value on the date the Stock Option is exercised; provided, however, that to the extent required by the Committee such Common Stock shall not have been acquired within the preceding six months upon the exercise of a Stock Option Award granted under the Plan or any other plan maintained at any time by the Company or any subsidiary.

Stock Options shall be designed to comply with the provisions of Section 422 of the Code and will be subject to certain restrictions contained in the Code. Among such restrictions, Stock Options must have an exercise price not less than the Fair Market Value of a share of Common Stock on the Grant Date, must be exercised within ten years after the Grant Date, and must expire no later than three months after the optionee's termination of employment for any reason other than Disability or death (and no later than six months after a termination by reason of Disability or 12 months after a termination by reason of death), or such after such shorter period as the Committee may determine. In the case of a Stock Option granted to an individual who owns (or is deemed to own) at least 10% of the total combined voting power of all classes of stock of the Company, the exercise price must be at least 110% of the total combined Fair Market Value of a share of Common Stock on the Grant Date and the Stock Option must expire no later than the fifth anniversary of the Grant Date. The aggregate Fair Market Value (determined at the time the option was granted) of the Common Stock with respect to which Stock Options are exercisable for the first time by a participant during any calendar year shall not exceed $100,000 (or such other limit as may be required by the Code).

Notwithstanding any provision of the Plan, a repricing of a stock option shall be allowed by the Committee only with the approval of the Company's shareholders to the extent required under the rules of the New York Stock Exchange. For this purpose, a "repricing" shall be defined as described in the New York Stock Exchange rules.

The Committee shall have the discretion with respect to any award granted under the Plan to establish upon its grant conditions under which (i) the award may be later forfeited, cancelled, rescinded, suspended, withheld or otherwise limited or restricted; or (ii) gains realized by the grantee in connection with an award or an award's exercise may be recovered; provided that such conditions and their consequences are: (a) clearly set forth in the grant agreement or other grant document; and (b) fully comply with applicable laws. These conditions may include, without limitation, actions by the participant which constitute a conflict of interest with the Company, are prejudicial to the Company's interests, or are in violation of any non-competition agreement or obligation, any confidentiality agreement or obligation, the Company's applicable policies, or the participant's terms and conditions of employment.

8. Fair Market Value

Fair Market Value for all purposes under the Plan shall mean the closing price of the Common Stock as reported in The Wall Street Journal in the New York Stock Exchange Composite Transactions or similar successor consolidated transactions reports for the relevant date, or if no sales of Common Stock were made on said exchange on that date, the closing price of Common Stock as reported in said composite transaction report for the preceding day on which sales of Common Stock were made on said exchange. Under no circumstances shall Fair Market Value be less than the par value of the Common Stock.

9. Transferability and Exercisability

Except as otherwise provided in this Section 9, all awards under the Plan shall be nontransferable and shall not be assignable, alienable, saleable or otherwise transferable by the participant other than by will or the laws of descent and distribution except pursuant to a domestic relations order entered by a court of competent jurisdiction. Except as otherwise provided in this Section 9, during the life of the participant, awards under the Plan shall be exercisable only by him or her except as otherwise determined by the Committee. In addition, if so permitted by the Committee, a participant may designate a beneficiary or beneficiaries to exercise the rights of the participant and receive any distributions under the Plan upon the death of the participant.

10. Award Agreements; Notification of Award

Awards under the Plan shall be evidenced by one or more agreements approved by the Committee that set forth the terms and conditions of and limitations on an award, except that in no event shall the term of any Stock Option exceed a period of ten years from the Grant Date. The Committee need not require the execution of any such agreement by a participant in which case acceptance of the award by the respective participant will constitute agreement to the terms of the award.

11. Plan Amendment and Termination

The Compensation Committee may amend the Plan as it deems necessary or appropriate, except that no such amendment which would cause the Plan not to comply with the requirements of (i) the Code or (ii) the Delaware General Corporation Law as in effect at the time of such amendment shall be made without the approval of the Company's shareholders. No such amendment shall adversely affect any outstanding awards under the Plan without the consent of all of the holders thereof.

Notwithstanding the foregoing, an amendment that constitutes a "material revision," as defined under the rules of the New York Stock Exchange, or a "material modification," as defined under Section 162(m) of the Code, shall be submitted to the Company's shareholders for approval. In addition, any revision that deletes or limits the scope of the provision in Section 7 prohibiting repricing of options without shareholder approval will be considered a material revision.

The Board may terminate the Plan at any time. Upon termination of the Plan, no future awards may be granted, but previously-made awards shall remain outstanding in accordance with their applicable terms and conditions, and the terms of the Plan.

12. Other Company Benefit and Compensation Programs

Unless otherwise determined by the Committee, settlements of awards received by participants under the Plan shall not be deemed a part of a participant's regular, recurring compensation for purposes of calculating payments or benefits from any Company benefit plan, severance program or severance pay law of any country.

13. Unfunded Plan

Unless otherwise determined by the Committee, the Plan shall be unfunded and shall not create (or be construed to create) a trust or a separate fund or funds. The Plan shall not establish any fiduciary relationship between the Company and any participant or other person. To the extent any person holds any rights by virtue of a grant awarded under the Plan, such right (unless otherwise determined by the Committee) shall be no greater than the right of an unsecured general creditor of the Company.

14. Future Rights

No person shall have any claim or right to be granted an award under the Plan, and no participant shall have any right by reason of the grant of any award under the Plan to continued employment by the Company or any Subsidiary.

15. General Restriction

Each award shall be subject to the requirement that, if at any time the Committee shall determine, in its sole discretion, that the listing, registration or qualification of any award under the Plan upon any securities exchange or under any state or federal law, or the consent or approval of any government regulatory body, is necessary or desirable as a condition of, or in connection with, the granting of such award or the exercise settlement thereof, such award may not be granted, exercised or settled in whole or in part unless such listing, registration, qualification, consent or approval shall have been effected or obtained free of any conditions not acceptable to the Committee.

16. Governing Law

THE VALIDITY, CONSTRUCTION AND EFFECT OF THE PLAN AND ANY ACTIONS TAKEN OR RELATING TO THE PLAN SHALL BE DETERMINED IN ACCORDANCE WITH THE LAWS OF THE STATE OF DELAWARE AND APPLICABLE FEDERAL LAW.

17. Successors and Assigns

The Plan shall be binding on all successors and permitted assigns of a participant, including, without limitation, the estate of such participant and the executor, administrator or trustee of such estate, or any receiver or trustee in bankruptcy or representative of such participant's creditors.

18. Rights as a Shareholder

A participant shall have no rights as a shareholder until he or she becomes the holder of record of Common Stock.

19. Change in Control

Notwithstanding anything to the contrary in the Plan, the following shall apply to all awards granted and outstanding under the Plan:

The following definitions shall apply to this Section 19:

A "Change in Control," unless otherwise defined by the Compensation Committee, shall be deemed to have occurred if (a) any "person," as such term is used in Section 13(d) and 14(d) of the 1934 Act, other than (1) the Company, (2) any trustee or other fiduciary holding securities under an employee benefit plan of the Company, (3) any company owned, directly or indirectly, by the shareholders of the Company in substantially the same proportions as their ownership of stock of the Company, or (4) any person who becomes a "beneficial owner" (as defined below) in connection with a transaction described in clause (1) of subparagraph (c) below, is or becomes the "beneficial owner" (as defined in Rule 13d-3 under the 1934 Act), directly or indirectly, of securities of the Company (not including in the securities beneficially owned by such person any securities acquired directly from the Company or its affiliates) representing 20 percent or more of the combined voting power of the Company's then outstanding voting securities; (b) individuals who on the effective date of the Plan constitute the Board and any new director (other than a director whose initial assumption of office is in connection with an actual or threatened election contest, including but not limited to a consent solicitation, relating to the election of directors of the Company) whose appointment or election by the Board or nomination for election by the Company's shareholders was approved or recommended by a vote of at least two-thirds of the directors then still in office who were directors on the effective date of the Plan, or whose appointment, election or nomination for election was previously so approved or recommended; (c) there is consummated a merger or consolidation of the Company or any direct or indirect subsidiary of the Company with any other corporation, other than (1) a merger or consolidation which results in the directors of the Company immediately prior to such merger or consolidation continuing to constitute at least a majority of the board of directors of the Company, the surviving entity or any parent thereof or (2) a merger or consolidation effected to implement a recapitalization of the Company (or similar transaction) in which no person is or becomes the beneficial owner, directly or indirectly, of securities of the Company or its affiliates) representing 20% or more of the combined voting power of the Company's then outstanding securities; or (d) the shareholders of the Company approve a plan of complete liquidation or dissolution of the Company or there is consummated an agreement for the sale or disposition by the Company of all or substantially all of the Company's assets, other than a sale or disposition by the Company of all or substantially all of the Company's assets to an entity, at least 50% of the combined voting power of the voting securities of which are owned by stockholders of the Company in substantially the same proportions as their ownership of the Company immediately prior to the sale.

"CIC Price" shall meant the higher of (a) the highest price paid for a share of the Company's Common Stock in the transaction or series of transactions pursuant to which a Change in Control of the Company shall have occurred, or (b) the highest price paid for a share of the Company's Common Stock during the 60 day period immediately preceding the date upon which the event constituting a Change in Control shall have occurred as reported in The Wall Street Journal in the New York Stock Exchange Composite Transactions or similar successor consolidated transactions reports.

B. Acceleration of Vesting

Upon the occurrence of an event constituting a Change in Control, all Stock Options (to the extent the CIC Price exceeds the exercise price), outstanding on such date shall become 100% vested and shall be paid in cash as soon as may be practicable. Upon such payment, such awards and any related Stock Options shall be cancelled.

The amount of cash to be paid shall be determined by multiplying the number of such awards by: the difference between the exercise price per share of the related Stock Option and the CIC Price to the extent the CIC Price is greater than the exercise price.

C. Notwithstanding the foregoing, any stock-based award held by an officer or director subject to Section 16 of the 1934 Act which shall have been outstanding less than six months (or such other period as may be required by the 1934 Act) upon the occurrence of an event constituting a Change in Control shall not be paid in cash until the expiration of such period, if any, as shall be required pursuant to such Section, and the amount to be paid shall be determined by multiplying the number of unexercised shares under such stock options, as the case may be, by the difference between the exercise price per share of the related Stock Option and the CIC Price determined as though the event constituting the Change in Control had occurred on the first day following the end of such period.

7

Exhibit 5.1

|

NEW YORK, NY 10019

|

|

BEIJING

BOSTON

BRUSSELS

CHICAGO

DALLAS

GENEVA

|

|

HONG KONG

HOUSTON

LONDON

LOS ANGELES

NEW YORK

PALO ALTO

|

|

SAN FRANCISCO

SHANGHAI

SINGAPORE

SYDNEY

TOKYO

WASHINGTON, D.C.

|

| |

|

|

|

|

|

|

|

| |

|

|

FOUNDED 1866

|

|

|

|

|

May 14, 2015

Alamo Group Inc.

1627 East Walnut

Seguin, Texas 78155

Ladies and Gentlemen:

We are acting as counsel for Alamo Group Inc., a Delaware corporation (the “Company”), in connection with the registration statement on Form S-8 (the “Registration Statement”) that is being filed by the Company with the Securities and Exchange Commission (the “Commission”) on the date hereof under the Securities Act of 1933, as amended (the “Securities Act”), and relating to 400,000 shares (the “Registered Shares”) of the Company’s common stock, par value $0.10 per share, that will be available for future issuance under the Alamo Group Inc. 2015 Incentive Stock Option Plan effective May 7, 2015 (the “Plan”).

This opinion letter is being delivered in accordance with the requirements of Item 8(a) of Form S-8 and Item 601(b)(5)(i) of Regulation S-K under the Securities Act.

We have examined such documents and records as we deemed appropriate, including, but not limited to, the following:

|

|

(i)

|

a copy of the Plan, as certified by the Secretary of the Company on the date hereof;

|

|

|

(ii)

|

a copy of the Registration Statement;

|

| |

(iii)

|

a copy of the Certificate of Incorporation of the Company as amended to date, as certified by the Secretary of the Company on the date hereof;

|

| |

(iv)

|

a copy of the By-Laws of the Company, as certified by the Secretary of the Company on the date hereof; and

|

|

|

(v)

|

copies, certified by the Secretary of the Company to be true, correct and complete copies, of resolutions adopted by the Board of Directors of the Company relating to the Plan and the Registration Statement and by the shareholders of the Company relating to the Plan.

|

We have also examined originals, or copies of originals certified to our satisfaction, of such other agreements, documents, certificates and statements of government officials and other instruments, and have examined such questions of law and have satisfied ourselves to such matters of fact, as we have considered relevant and necessary as a basis for this opinion letter. As to facts relevant to the opinions expressed herein, we have relied without independent investigation or verification upon, and assumed the accuracy and completeness of, certificates, letters and oral and written statements and representations of public officials and officers and other representatives of the Company.

Sidley Austin (NY) LLP is a Delaware limited liability partnership doing business as Sidley Austin LLP and practicing in affiliation with other Sidley Austin partnerships.

We have assumed the authenticity of all documents submitted to us as originals, the genuineness of all signatures, the legal capacity of all persons and the conformity with the original documents of any copies thereof submitted to us for examination and the conformity with the original documents of all documents submitted to us as certified or photostatic copies or by facsimile or other means of electronic transmission and the authenticity of the originals thereof.

Based upon the foregoing and subject to the limitations and qualifications set forth below, we are of the opinion that the issuance of the Registered Shares was duly authorized and each Registered Share will be validly issued, fully paid and non-assessable when such Registered Share shall have been duly issued and delivered in accordance with the Plan to the person entitled thereto against payment of the agreed consideration therefor in an amount not less than the par value thereof.

This opinion is limited to the matters stated in this opinion letter, and no opinions may be implied or inferred beyond the matters expressly stated in this opinion letter. The opinions set forth herein are limited to matters of the General Corporation Law of the State of Delaware. We express no opinion as to the laws, rules or regulations of any other jurisdiction, including, without limitation, the federal laws of the United States of America or any state securities or blue sky laws. The opinions expressed herein are based on laws in effect at the time of delivery of this opinion letter, and we assume no obligation to advise you after such time of facts or circumstances that come to our attention or changes in law that occur which could affect the opinions contained herein.

We hereby consent to the filing of this opinion letter as an exhibit to the Registration Statement and to all references to our firm included in on made a part of the Registration Statement. In giving this consent, we do not hereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

| |

Very truly yours,

|

| |

|

| |

/s/ Sidley Austin LLP |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

The Board of Directors

Alamo Group Inc.:

We consent to the use of our reports dated March 6, 2015, with respect to the consolidated balance sheets of Alamo Group Inc. and subsidiaries as of December 31, 2014 and 2013, and the related consolidated statements of income, comprehensive income, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2014, and the effectiveness of internal control over financial reporting as of December 31, 2014 incorporated herein by reference.

Our report dated March 6, 2015, on the effectiveness of internal control over financial reporting as of December 31, 2014, contains an explanatory paragraph that states Alamo Group Inc. acquired all of the operating units of Specialized Industries LP (Specialized), Fieldquip Australia PTY, LTD (Fieldquip) and Kellands Agricultural Ltd. (Kellands) during 2014, and management excluded from its assessment of the effectiveness of Alamo Group Inc.’s internal control over financial reporting as of December 31, 2014, Specialized’s, Fieldquip’s and Kellands’ internal control over financial reporting associated with total assets of $222 million and total net sales of $118 million included in the consolidated financial statements of Alamo Group Inc. and subsidiaries as of and for the year ended December 31, 2014. Our audit of internal control over financial reporting of Alamo Group Inc. also excluded an evaluation of the internal control over financial reporting of Specialized, Fieldquip and Kellands.

Austin, Texas

May 14, 2015

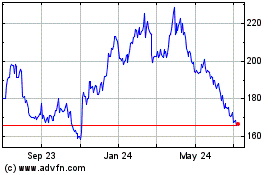

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

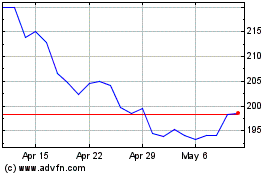

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024