As submitted to the Securities and Exchange

Commission on December 31, 2014.

Registration No. 333-

UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANGAEA LOGISTICS SOLUTIONS LTD.

(Exact name of registrant as specified in

its charter)

Bermuda

(State or other jurisdiction of

incorporation or organization) |

|

4412

(Primary Standard Industrial

Classification Code Number) |

|

Not Applicable

(I.R.S. Employer

Identification Number) |

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

(Address, including Zip Code, and Telephone

Number, including Area Code, of Registrant’s Principal Executive Offices)

Pangaea Logistics Solutions Ltd. 2014 Share

Incentive Plan

(Full titles of the plans)

Trudy Coleman

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

(Name, Address, including

Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

Kirk A. Radke, Esq.

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, New York 10019

(212) 728-8000

Indicate by check mark

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer x |

Smaller reporting company o |

| |

|

(Do not check if a smaller reporting

company) |

|

CALCULATION OF REGISTRATION FEE

| Title of securities to be registered | |

Amount to be registered(1) | |

Proposed

maximum offering

price per share | |

Proposed

maximum

aggregate offering

price | |

Amount of

registration fee |

| Common Shares, par value $0.0001 per share | |

1,500,000 | |

4.81(2) | |

7,215,000(2) | |

$838.38(3) |

| |

(1) |

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common shares (“Common Share”) that become issuable under the plan set forth herein by reason of any stock dividend, stock split, recapitalization or other similar transaction. |

| |

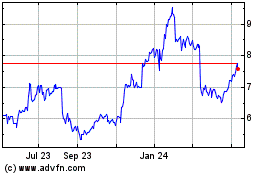

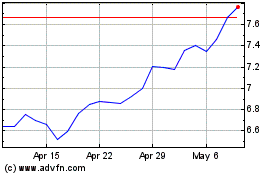

(2) |

Pursuant to Rule 457(c) and (h) under the Securities Act, the proposed maximum offering price per share was determined based on the high and low prices of Pangaea Logistics Solutions Ltd.’s Common Shares reported by the Nasdaq Capital Market on December 30, 2014. |

| |

(3) |

Calculated by multiplying the proposed maximum aggregate offering price by 0.0001162 |

EXPLANATORY NOTE

Pangaea Logistics Solutions Ltd. has prepared this Registration

Statement in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended, or the Securities

Act, to register 1,500,000 shares of its common shares, par value $0.0001 per share, which we refer to as the Common Shares, that

are reserved for issuance in respect of awards to be granted, under the Pangaea Logistics Solutions Ltd. 2014 Share Incentive Plan,

which we refer to as the Plan.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a)

PROSPECTUS

Item 1. Plan Information.

The

documents containing the information required by Part I of Form S-8 are omitted from this Registration Statement in accordance

with Rule 428 under the United States Securities Act of 1933, as amended (the “Securities Act”), and the instructions

to Form S-8. In accordance with the rules and regulations of the United States Securities and Exchange Commission (the “Commission”)

and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement

or as prospectuses or prospectus supplements pursuant to Rule 424 however such documents will be delivered to participants in

the Plan as specified by Rule 428(b)(1) under the Securities Act.

Item 2. Registrant Information and Employee Plan Annual

Information.

We

will furnish without charge to each person to whom the prospectus is delivered, upon the written or oral request of such person,

a copy of any and all of the documents incorporated by reference in Item 3 of Part II of this Registration Statement, other than

exhibits to such documents (unless such exhibits are specifically incorporated by reference to the information that is incorporated).

Those documents are incorporated by reference in the Section 10(a) prospectus. Requests should be directed to Pangaea Logistics

Solutions Ltd., 109 Long Wharf, Newport, Rhode Island 02840, Attention:

Chief Executive Officer; Telephone number (401) 846-7790.

PART II

INFORMATION REQUIRED IN THE REGISTRATION

STATEMENT

ITEM 3. INCORPORATION OF DOCUMETNS BY REFERENCE

We hereby incorporate by reference into

this Registration Statement the following documents previously filed by us with the Commission:

| (a) | Our

Registration

Statement

on

Form

S-4

(File

No.

333-195910)

under

the

Securities

Act

of

1933,

as

amended,

originally

filed

with

the

Securities

and

Exchange

Commission

on

May

13,

2014,

as

subsequently

amended;

and |

| (b) | The

description

of

the

Registrant’s

common

stock

contained

in

the

Registrant’s

registration

statement

on

Form

8-A

filed

on

December

30,

2014

(File

No.

001-36798)

under

the

Securities

Exchange

Act

of

1934,

as

amended

(the

“Exchange

Act”),

including

any

amendment

or

report

filed

for

the

purpose

of

updating

such

description. |

All documents, reports and definitive proxy

or information statements filed pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of this Registration

Statement and prior to the filing of a post-effective amendment to this Registration Statement which indicates that all securities

offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated by

reference into this Registration Statement and to be a part hereof from the date of filing of such documents with the Commission;

provided, however, that documents, reports and definitive proxy or information statements, or portions thereof, which are “furnished”

and not “filed” in accordance with the rules of the Commission shall not be deemed incorporated by reference into

this Registration Statement unless the Registrant expressly provides to the contrary that such document or information is incorporated

by reference into this Registration Statement.

Any statement contained in a document incorporated

or deemed to be incorporated herein by reference shall be deemed to be modified or superseded for purposes of this Registration

Statement to the extent that a statement herein or in any other subsequently filed document which also is or is deemed to be incorporated

by reference herein modifies or supersedes that statement. Any such statement so modified or superseded shall not constitute a

part of this Registration Statement, except as so modified or superseded.

ITEM 4. DESCRIPTION OF SECURITIES.

Not applicable.

ITEM 5. INTEREST OF NAMED EXPERTS AND COUNSEL.

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND

OFFICERS.

Exculpation and Indemnification

The

Bermuda Companies Act permits the Registrant to indemnify its directors, officers, employees and agents, subject to limitations

imposed by the Bermuda Companies Act. The Registrant’s Bye-laws require it to indemnify directors and officers to the full

extent permitted by the Bermuda Companies Act. The Registrant may enter into indemnification agreements with its officers and

directors that provide for indemnification to the maximum extent allowed under Bermuda law. Under Bermuda law, a company may indemnify

its directors and officers where the acts indemnified do not constitute fraud or dishonesty.

Indemnification Agreements

The Registrant may enter into indemnification

agreements with each of its directors and officers and may enter into indemnification agreements with certain of its employees.

With specified exceptions, these agreements provide for the indemnification of such persons for related expenses and liabilities

incurred in connection with any action or proceeding brought against them by reason of the fact that they are or were serving

in such capacity.

Merger Agreement Provisions

Under

the terms of the Agreement and Plan of Reorganization (the “Merger Agreement”), dated as of April 30, 2014, by and

among Quartet Merger Corp. (“Quartet”), the Registrant, Quartet Merger Sub, Ltd., the Registrant’s wholly-owned

subsidiary, Bulk Partners (Bermuda), LTD. (“Bulk Partners”) which was formerly known as Pangaea Logistics Solutions

Ltd., and the securityholders of Bulk Partners, the parties thereto agreed that the Registrant would

(i) indemnify and hold harmless, to the extent Quartet was

obligated to indemnify and hold harmless such persons as of the date of the Merger Agreement to the fullest extent permitted by

applicable law, each present and former director, officer and special advisor of Quartet and the Registrant against any costs

or expenses (including reasonable attorneys’ fees), judgments, fines, settlements, losses, claims, damages or liabilities

incurred in connection with any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative

or investigative, arising out of matters existing or occurring at or prior to the closing of the merger, whether asserted or claimed

prior to, at or after the closing of the merger and (ii) include and cause to be maintained in effect in the Registrant’s

(or any successor’s) constitutional documents after the closing of the mergers provisions regarding the elimination of liability

of directors and officers and the indemnification of the indemnified parties that are no less advantageous to the intended beneficiaries

than the corresponding provisions contained in the Quartet’s constitutive documents.

In addition, the Merger Agreement requires that the Registrant

obtain and fully pay for “tail” insurance policies with a claims period of six years from and after the closing of

the mergers from one or more insurance carriers with the same or better credit rating as Quartet’s insurance carriers with

respect to directors’ and officers’ liability insurance and fiduciary liability insurance to the fullest extent permitted

by applicable law with benefits and levels of coverage at least as favorable as Quartet’s policies prior to the closing

of the mergers with respect to matters existing or occurring at or prior to the closing of the mergers, and if the Registrant

failed to obtain such “tail” insurance policies as of the closing of the mergers, the Registrant shall continue to

maintain in effect for a period of six years from and after the closing of the mergers such insurance in place as of the date

of the Merger Agreement with benefits and levels of coverage at least as favorable as provided in Quartet’s then existing

policies, or the Registrant was entitled to purchase comparable insurance for such six-year period with benefits and levels of

coverage at least as favorable as provided in Quartet’s then existing policies; provided, however, that in no event shall

the Registrant be required to expend for such policies premium amounts in excess of 250% of the premiums paid by Quartet as of

the date of the Merger Agreement for such insurance; and, provided, further that if the annual premiums of such insurance coverage

exceed such amount, the Registrant shall obtain a policy with the greatest coverage available for a cost not exceeding such amount.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED.

Not applicable.

ITEM 8. EXHIBITS.

Reference is made to

the attached Exhibit Index, which is incorporated by reference herein.

ITEM 9. UNDERTAKINGS.

(a) The undersigned Registrant hereby undertakes:

| (1) | To

file,

during

any

period

in

which

offers

or

sales

are

being

made,

a

post-effective

amendment

to

this

Registration

Statement: |

| (i) | To

include

any

prospectus

required

by

section

10(a)(3)

of

the

Securities

Act; |

| (ii) | To

reflect

in

the

prospectus

any

facts

or

events

arising

after

the

effective

date

of

the

Registration

Statement

(or

the

most

recent

post-effective

amendment

thereof)

which,

individually

or

in

the

aggregate,

represent

a

fundamental

change

in

the

information

set

forth

in

the

Registration

Statement.

Notwithstanding

the

foregoing,

any

increase

or

decrease

in

volume

of

securities

offered

(if

the

total

dollar

value

of

securities

offered

would

not

exceed

that

which

was

registered)

and

any

deviation

from

the

low

or

high

end

of

the

estimated

maximum

offering

range

may

be

reflected

in

the

form

of

prospectus

filed

with

the

Commission

pursuant

to

Rule

424(b)

if,

in

the

aggregate,

the

changes

in

volume

and

price

represent

no

more

than

a

20%

change

in

the

maximum

aggregate

offering

price

set

forth

in

the

“Calculation

of

Registration

Fee”

table

in

the

effective

Registration

Statement; |

| (iii) | To

include

any

material

information

with

respect

to

the

plan

of

distribution

not

previously

disclosed

in

the

Registration

Statement

or

any

material

change

to

such

information

in

the

Registration

Statement; |

provided, however, that paragraphs (a)(1)(i)

and (a)(1)(ii) do not apply if the Registration Statement is on Form S-8, and the information required to be included in a post-effective

amendment by those paragraphs is contained in reports filed with or furnished to the Commission

by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the Registration

Statement.

| (2) | That,

for

the

purpose

of

determining

any

liability

under

the

Securities

Act,

each

such

post-effective

amendment

shall

be

deemed

to

be

a

new

registration

statement

relating

to

the

securities

offered

therein,

and

the

offering

of

such

securities

at

that

time

shall

be

deemed

to

be

the

initial

bona

fide

offering

thereof. |

| (3) | To

remove

from

registration

by

means

of

a

post-effective

amendment

any

of

the

securities

being

registered

which

remain

unsold

at

the

termination

of

the

offering. |

(b) The undersigned Registrant hereby undertakes that, for

purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to

Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual

report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be

deemed to be a new Registration Statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under

the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing

provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against

public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification

against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling

person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or

controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication

of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto

duly authorized, in the City of Newport, Rhode Island on December 31, 2014.

| Pangaea Logistics Solutions Ltd. |

|

| |

|

|

| By: |

/s/ Edward Coll |

|

| Name: |

|

Edward Coll |

|

| Title: |

|

Chairman of the Board and Chief Executive Officer |

|

POWER OF ATTORNEY

Each person whose signature appears below

constitutes and appoints Edward Coll and Anthony Laura and each of them, as attorney-in-fact with full power of substitution and

re-substitution, for him or her and in his or her name, place or stead, in any and all capacities, to sign any and all amendments

to this Registration Statement (including post-effective amendments), and to file the same, with exhibits thereto and other documents

in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each

of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about

the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all

that said attorneys-in-fact and agents, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue

hereof.

Pursuant to the requirements of the Securities

Act of 1933, as amended, this Registration Statement on Form S-8 has been signed by the following persons in the capacities and

on the dates indicated.

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

| /s/ Edward Coll |

|

Chairman

of the Board and Chief

Executive Officer |

|

|

| Edward Coll |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Carl Claus Boggild |

|

President

(Brazil) Director |

|

|

|

Carl Claus Boggild |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Anthony Laura |

|

Chief

Financial Officer |

|

|

| Anthony Laura |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Peter M. Yu |

|

Director |

|

|

| Peter M. Yu |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Paul Hong |

|

Director |

|

|

| Paul Hong |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Mark L. Filanowski |

|

Director |

|

|

| Mark L. Filanowski |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ Eric S. Rosenfeld |

|

Director |

|

|

| Eric S. Rosenfeld |

|

|

December 31,

2014 |

| |

|

|

|

|

| /s/ David D. Sgro |

|

Director |

|

|

| David D. Sgro |

|

|

December 31,

2014 |

EXHIBIT INDEX

| |

|

Incorporated by Reference |

|

Filed

Herewith |

Exhibit

No. |

|

Description |

|

Form |

|

File No. |

|

Exhibit |

|

Filing Date |

|

| 4.1 |

|

Bye-laws of Pangaea Logistics Solutions Ltd |

|

S-4 |

|

333-195910 |

|

3.2 |

|

May 13, 2014 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 4.2 |

|

Form of Common Stock Certificate. |

|

S-4/A |

|

333-195910 |

|

4.4 |

|

July 15, 2014 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 5.1 |

|

Opinion of Appleby (Bermuda) Limited |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 23.1 |

|

Consent of Grant Thornton LLP. |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 23.2 |

|

Consent of PricewaterhouseCoopers. |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 23.3 |

|

Consent of Appleby (Bermuda) Limited (included in Exhibit 5.1). |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 24.1 |

|

Power of Attorney (included on signature page of this Form S-8). |

|

|

|

|

|

|

|

|

|

X |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| 99.1 |

|

Pangaea Logistics Solutions Ltd. 2014 Equity Incentive Plan and Form of Award Agreement. |

|

|

|

|

|

|

|

|

|

X |

Exhibit 5.1

| |

Pangaea Logistics Solutions Ltd. |

Email jbodi@applebyglobal.com |

| |

Cumberland House

|

|

| |

9th Floor |

Direct Dial +1 441 298 3240 |

| |

1 Victoria Street |

|

| |

Hamilton HM11 |

Tel +1 441 295 2244 |

| |

|

Fax +1 441 292 8666 |

| |

|

|

| |

|

Your

Ref |

| |

|

|

| |

|

Appleby Ref 428932.0001/JB |

| |

|

|

| |

|

31 December 2014 |

| |

|

|

| |

Dear Sirs |

|

| |

|

|

Bermuda Office

Appleby (Bermuda)

Limited

Canon’s Court

22 Victoria Street

PO Box HM 1179

Hamilton HM EX

Bermuda

Tel +1 441 295 2244

applebyglobal.com

|

|

Pangaea Logistics Solutions Ltd. (Company)

We have acted as legal counsel in Bermuda to the Company and

this opinion as to Bermuda law is addressed to you in connection with the filing by the Company with the United States Securities

and Exchange Commission (SEC) under The Securities Act of 1933, as amended (Securities Act) of a Registration Statement

on Form S-8 (Registration Statement) in relation to the registration of 1,500,000 common shares, par value $0.0001 per share

(Common Shares) issuable in accordance with the Company’s 2014 share incentive plan (the 2014 Plan) as described

in the Registration Statement.

For the purposes of this opinion we have examined and relied

upon the documents listed, (which in some cases, are also defined) in the Schedule to this opinion (the Documents).

Assumptions

In stating our opinion we have assumed:

|

| |

|

(a) |

the authenticity, accuracy and completeness of all Documents and other documentation examined by us or submitted to us as originals and the conformity to authentic original documents of all Documents and such other documentation submitted to us as certified, conformed, notarised or photostatic copies; |

| |

|

|

|

Appleby (Bermuda)

Limited (the Legal

Practice) is a limited liability company

incorporated in Bermuda and

approved and recognised under the

Bermuda

Bar (Professional

Companies) Rules 2009. “Partner” is

a title referring to a director,

shareholder or an employee of

the

Legal Practice. A list of such persons

can be obtained from your

relationship partner.

|

|

(b) |

that each of the Documents and other such documentation which was received by electronic means is complete, intact and in conformity with the transmission as sent; |

Bermuda ¡

British Virgin Islands ¡ Cayman Islands ¡

Guernsey ¡ Hong Kong ¡ Isle of

Man ¡ Jersey ¡ London ¡

Mauritius ¡ Seychelles ¡ Shanghai

¡ Zurich

| | (c) | the genuineness of all signatures on the Documents; |

| (d) | the authority, capacity and power of each of the persons signing the Documents (other than the

Company, its directors and its officers); |

| (e) | that any representation, warranty or statement of fact or law, other than as to the laws of Bermuda,

made in any of the Documents is true, accurate and complete; |

| (f) | that the records which were the subject of the Company Search were complete and accurate at the

time of such search and disclosed all information which is material for the purposes of this opinion and such information has not

since the date of the Company Search been materially altered; |

| (g) | that the records which were the subject of the Litigation Search were complete and accurate at

the time of such search and disclosed all information which is material for the purposes of this opinion and such information has

not since the date of the Litigation Search been materially altered; |

| (h) | that there are no provisions of the laws or regulations of any jurisdiction, other than Bermuda,

which would be contravened by the execution or delivery of the 2014 Plan or which would have any implication in relation to the

opinion expressed herein and that, in so far as any obligation under, or action to be taken under, the 2014 Plan is required to

be performed or taken in any jurisdiction outside Bermuda, the performance of such obligation or the taking of such action will

constitute a valid and binding obligation of each of the parties thereto under the laws of that jurisdiction and will not be illegal

by virtue of the laws of that jurisdiction; |

| (i) | that the Resolutions are in full force and effect and have not been rescinded, either in whole

or in part, and accurately record the resolutions adopted by all of the Directors of the Company as unanimous written resolutions

of the Board and that there is no matter affecting the authority of the Directors to take the actions specified in the Resolutions,

not disclosed by the Constitutional Documents, the Company Search, the Litigation Search or the Resolutions, which would have any

adverse implication in relation to the opinions expressed herein; |

| (j) | that, when the Directors of the Company adopted the Resolutions, each of the Directors discharged

his fiduciary duties to the Company and acted honestly and in good faith with a view to the best interest of the Company; |

| (k) | that the Company has filed the Registration Statement in good faith for the purpose of carrying

on its business and that, at the time it did so, there were reasonable grounds for believing that the activities contemplated by

the Registration Statement and the 2014 Plan would benefit the Company; and |

| (l) | that the general permissions contained in the Notice remain in full force and effect on the date

on which either the Company issues or transfers any securities. |

| | Based upon and subject to the foregoing and subject to the reservations set out below and to

any matters not disclosed to us, we are of the opinion that the Common Shares, when issued in accordance with the 2014

Plan, will be duly authorised, validly issued, fully paid and non-assessable shares of the Company. |

| | We have the following reservations: |

| (a) | We express no opinion as to any law other than Bermuda law and none of the opinions expressed herein

relates to compliance with or matters governed by the laws of any jurisdiction except Bermuda. This opinion is limited to Bermuda

law as applied by the Courts of Bermuda at the date hereof. |

| (b) | Where an obligation is to be performed in a jurisdiction other than Bermuda, the courts of Bermuda

may refuse to enforce it to the extent that such performance would be illegal under the laws of, or contrary to public policy of,

such other jurisdiction. |

| (c) | Any reference in this opinion to shares being “non-assessable” shall mean, in relation

to fully-paid shares of the Company and subject to any contrary provision in any agreement in writing between the Company and the

holder of the shares, that: no shareholder shall be obliged to contribute further amounts to the capital of the Company, either

in order to complete payment for their shares, to satisfy claims of creditors of the Company, or otherwise; and no shareholder

shall be bound by an alteration of the Memorandum of Association or Bye-Laws of the Company after the date on which he became a

shareholder, if and so far as the alteration requires him to take, or subscribe for, additional shares, or in any way increases

his liability to contribute to the share capital of, or otherwise to pay money to, the Company. |

| (d) | Searches of the Register of Companies at the office of the Registrar of Companies and of the Supreme

Court Causes Book at the Registry of the Supreme Court are not conclusive and it should be noted that the Register of Companies

and the Supreme Court Causes Book do not reveal: |

| | | (i) details of matters which have been lodged for filing or registration which as a matter of

best practice of the Registrar of Companies or the Registry of the Supreme Court would have or should have been disclosed

on the public file, the Causes Book or the Judgment Book, as the case may be, but for whatever reason have not actually been

filed or registered or are not disclosed or which, notwithstanding filing or registration, at the date and time the search is

concluded are for whatever reason not disclosed or do not appear on the public file, the Causes Book or Judgment Book; |

| | | (ii) details of matters which should have been lodged for filing or registration at

the Registrar of Companies or the Registry of the Supreme Court but have not been lodged for filing or registration at the

date the search is concluded; |

| | | (iii) whether an application to the Supreme Court for a winding-up petition or for the

appointment of a receiver or manager has been prepared but not yet been presented or has been presented but does not appear

in the Causes Book at the date and time the search is concluded; |

| | | (iv) whether any arbitration or administrative proceedings are pending or whether any

proceedings are threatened, or whether any arbitrator has been appointed; or |

| | | (v) whether a receiver or manager has been appointed privately pursuant to the provisions of

a debenture or other security, unless notice of the fact has been entered in the Register of Charges in accordance with

the provisions of the Act. |

| | (e) | In order to issue this opinion we have carried out the Company Search as referred to in the Schedule

to this opinion and have not enquired as to whether there has been any change since the date of such search. |

| | (f) | In order to issue this opinion we have carried out the Litigation Search as referred to in the

Schedule to this opinion and have not enquired as to whether there has been any change since the date of such search. |

Disclosure

This opinion is addressed to you in connection

with the filing of this opinion as an exhibit to the Registration Statement. We consent to the inclusion of this opinion as Exhibit

5.1 to the Registration Statement but it is not to be made available, or relied on by any other person or entity, or for any other

purpose, nor quoted or referred to in any public document nor filed with any governmental agency or person (other than the SEC

in connection with the Registration Statement), without our prior written consent except as may be required by law or regulatory

authority. As Bermuda attorneys we are not qualified to opine on matters of law of any jurisdiction other than Bermuda and accordingly

we do not admit to being an expert within the meaning of the Securities Act.

Further, this opinion speaks as of its

date and is strictly limited to the matters stated herein and we assume no obligation to review or update this opinion if applicable

laws or the existing facts or circumstances should change.

This opinion is governed by and is to be

construed in accordance with Bermuda law. It is given on the basis that it will not give rise to any legal proceedings with respect

thereto in any jurisdiction other than Bermuda.

Yours faithfully

Appleby (Bermuda) Limited

SCHEDULE

| | 1. | The

entries and filings shown in respect of the Company on the file of the Company maintained

in the Register of Companies at the office of the Registrar of Companies in Hamilton,

Bermuda, as revealed by a search conducted on December 31, 2014 (Company Search). |

| | 2. | The

entries and filings shown in respect of the Company in the Supreme Court Causes Book

maintained at the Registry of the Supreme Court in Hamilton, Bermuda, as revealed by

a search conducted on December 31, 2014 (Litigation Search). |

| 3. | Copies

of the Certificate of Incorporation on Change of Name, Certificate of Incorporation,

Amended and Restated Memorandum of Association (Memorandum of Association) and

Bye-Laws adopted for the Company (collectively referred to as the Constitutional Documents). |

| 4. | Copy

of the unanimous written resolutions of the Directors effective April 29, 2014 (the “Resolutions”). |

| | 5. | A

copy of the notice to the public dated 1 June 2005 as issued by the Bermuda Monetary

Authority under the Exchange Control Act 1972 and the Exchange Control Regulations 1973

(the “Notice”). |

| 6. | A

certified copy of the Register of Directors and Officers. |

| 7. | A

PDF copy of the Registration Statement. |

| 8. | A

PDF copy of the 2014 Plan. |

Bermuda ¡ British

Virgin Islands ¡ Cayman

Islands ¡ Guernsey ¡ Hong

Kong ¡ Isle

of Man ¡ Jersey ¡

London ¡ Mauritius ¡ Seychelles ¡ Shanghai ¡ Zurich

6

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We have issued our report dated May 5, 2014, with respect to the

consolidated financial statements of Pangaea Logistics Solutions Ltd. (f/k/a Bulk Partners (Bermuda) Ltd.) contained in its Registration Statement on Form S-4,

filed on May 13, 2014 (File No. 333-195910) which is incorporated by reference in this Registration Statement on Form S-8. We consent to the incorporation by reference

of the aforementioned report in the Registration Statement on Form S-8.

/s/ GRANT THORNTON LLP

Boston, MA

December 31, 2014

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC

ACCOUNTING FIRM

We have issued our report dated April 18, 2014 relating to the financial

statements of Nordic Bulk Holding ApS, contained in the Registrant’s Registration Statement on Form S-4, filed on May 13,

2014 (File No. 333-195910), which is incorporated by reference in this Registration Statement on Form S-8. We consent to the incorporation

by reference of the aforementioned report in the Registration Statement on Form S-8.

/s/ PricewaterhouseCoopers

Copenhagen, Denmark

December 31, 2014

Exhibit 99.1

PANGAEA LOGISTICS SOLUTIONS LTD.

2014 SHARE INCENTIVE PLAN

1. Purpose.

The purpose of the Plan

is to assist the Company in attracting, retaining, motivating, and rewarding certain key employees, officers, directors, and consultants

of the Company and its Affiliates and promoting the creation of long-term value for shareholders of the Company by closely aligning

the interests of such individuals with those of such shareholders. The Plan authorizes the award of Share-based incentives to Eligible

Persons to encourage such persons to expend maximum effort in the creation of shareholder value.

2. Definitions.

For purposes of the

Plan, the following terms shall be defined as set forth below:

“Affiliate”

means, with respect to any Person, any other Person that, directly or indirectly through one or more intermediaries, controls,

is controlled by, or is under common control with, such Person.

“Award”

means any Option, Restricted Share, Restricted Share Unit, Share Appreciation Right, Performance Award, or other Share-based or

cash-based award granted under the Plan.

“Award Agreement”

means an Option Agreement, a Restricted Share Agreement, an RSU Agreement, an SAR Agreement, a Performance Award Agreement, or

an agreement governing the grant of any other Share-based or cash-based Award granted under the Plan.

“Board”

means the Board of Directors of the Company.

“Cause”

means, in the absence of an Award Agreement or Employment Agreement otherwise defining Cause, (1) the Participant’s plea

of nolo contendere, conviction of or indictment for any crime (whether or not involving the Company or its Affiliates) (i)

constituting a felony or (ii) that has, or could reasonably be expected to result in, an adverse impact on the performance of the

Participant’s duties to the Service Recipient, or otherwise has, or could reasonably be expected to result in, an adverse

impact on the business or reputation of the Company or its Affiliates, (2) conduct of the Participant, in connection with his employment

or service, that has resulted, or could reasonably be expected to result, in material injury to the business or reputation of the

Company or its Affiliates, (3) any material violation of the policies of the Company or its Affiliates, including but not limited

to those relating to sexual harassment or the disclosure or misuse of confidential information, or those set forth in the manuals

or statements of policy of the Company or its Affiliates, or (4) willful neglect in the performance of the Participant’s

duties for the Service Recipient or willful or repeated failure or refusal to perform such duties. In the event that there is an

Award Agreement or Employment Agreement defining Cause, “Cause” shall have the meaning provided in such agreement,

and a Termination by the Service Recipient for Cause hereunder shall not be deemed to have occurred unless all applicable notice

and cure periods in such Award Agreement or Employment Agreement are complied with.

“Change in

Control” means the first of the following to occur after the Effective Date:

(1) a

change in ownership or control of the Company effected through a transaction or series of transactions (other than an offering

of Shares to the general public through a registration statement filed with the Securities and Exchange Commission or pursuant

to a Non-Control Transaction) whereby any “person” (as defined in Section 3(a)(9) of the Exchange Act) or any two or

more persons deemed to be one “person” (as used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act), other than

the Company or any of its Affiliates, an employee benefit plan sponsored or maintained by the Company or any of its Affiliates

(or its related trust), or any underwriter temporarily holding securities pursuant to an offering of such securities, directly

or indirectly acquire “beneficial ownership” (within the meaning of Rule 13d-3 under the Exchange Act) of securities

of the Company possessing more than fifty percent (50%) of the total combined voting power of the Company’s securities eligible

to vote in the election of the Board (the “Company Voting Securities”);

(2) the

date, within any consecutive twenty-four (24) month period commencing on or after the Effective Date, upon which individuals who

constitute the Board as of the Effective Date (the “Incumbent Board”) cease for any reason to constitute at

least a majority of the Board; provided, however, that any individual who becomes a director subsequent to the Effective

Date whose election or nomination for election by the Company’s shareholders was approved by a vote of at least a majority

of the directors then constituting the Incumbent Board (either by a specific vote or by approval of the proxy statement of the

Company in which such individual is named as a nominee for director, without objection to such nomination) shall be considered

as though such individual were a member of the Incumbent Board, but excluding, for this purpose, any such individual whose initial

assumption of office occurs as a result of an actual or threatened election contest (including but not limited to a consent solicitation)

with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on

behalf of a person other than the Board; or

(3) the

consummation of a merger, consolidation, share exchange, or similar form of corporate transaction involving the Company or any

of its Affiliates that requires the approval of the Company’s shareholders (whether for such transaction or the issuance

of securities in the transaction or otherwise) (a “Reorganization”), unless immediately following such Reorganization

(i) more than fifty percent (50%) of the total voting power of (A) the corporation resulting from such Reorganization (the “Surviving

Company”) or (B) if applicable, the ultimate parent corporation that has, directly or indirectly, beneficial ownership

of one hundred percent (100%) of the voting securities of the Surviving Company (the “Parent Company”), is represented

by Company Voting Securities that were outstanding immediately prior to such Reorganization (or, if applicable, is represented

by shares into which such Company Voting Securities were converted pursuant to such Reorganization), and such voting power among

the holders thereof is in substantially the same proportion as the voting power of such Company Voting Securities among holders

thereof immediately prior to the Reorganization, (ii) no person, other than an employee benefit plan sponsored or maintained by

the Surviving

Company or the Parent

Company (or its related trust), is or becomes the beneficial owner, directly or indirectly, of fifty percent (50%) or more of the

total voting power of the outstanding voting securities eligible to elect directors of the Parent Company, or if there is no Parent

Company, the Surviving Company, and (iii) at least a majority of the members of the board of directors of the Parent Company, or

if there is no Parent Company, the Surviving Company, following the consummation of the Reorganization are members of the Incumbent

Board at the time of the Board’s approval of the execution of the initial agreement providing for such Reorganization (any

Reorganization which satisfies all of the criteria specified in (i), (ii), and (iii) above shall be a “Non-Control Transaction”);

(4) the

sale or disposition, in one or a series of related transactions, of all or substantially all of the assets of the Company to any

“person” (as defined in Section 3(a)(9) of the Exchange Act) or to any two or more persons deemed to be one “person”

(as used in Sections 13(d)(3) and 14(d)(2) of the Exchange Act) other than the Company’s Affiliates.

Notwithstanding the foregoing, (x) a Change

in Control shall not be deemed to occur solely because any person acquires beneficial ownership of fifty percent (50%) or more

of the Company Voting Securities as a result of an acquisition of Company Voting Securities by the Company that reduces the number

of Company Voting Securities outstanding; provided that if after such acquisition by the Company such person becomes the

beneficial owner of additional Company Voting Securities that increases the percentage of outstanding Company Voting Securities

beneficially owned by such person, a Change in Control shall then occur, and (y) with respect to the payment of any amount that

constitutes a deferral of compensation subject to Section 409A of the Code payable upon a Change in Control, a Change in Control

shall not be deemed to have occurred unless the Change in Control constitutes a change in the ownership or effective control of

the Company or in the ownership of a substantial portion of the assets of the Company under Section 409A(a)(2)(A)(v) of the Code.

“Code”

means the Internal Revenue Code of 1986, as amended from time to time, including regulations thereunder and successor provisions

and regulations thereto.

“Committee”

means the Board or such other committee consisting of two or more individuals appointed by the Board to administer the Plan and

each other individual or committee of individuals designated to exercise authority under the Plan.

“Company”

means Pangaea Logistics Solutions Ltd., a limited liability company organized under the laws of Bermuda, and its successors by

operation of law; provided that, prior to the Effective Date, “Company” means Quartet Holdco Ltd., a wholly-owned

subsidiary of Quartet Merger Corp.

“Company Voting

Securities” has the meaning set forth within the definition of “Change in Control.”

“Corporate

Event” has the meaning set forth in Section 11(b) below.

“Data”

has the meaning set forth in Section 21(c) below.

“Disability”

means, in the absence of an Award Agreement or Employment Agreement otherwise defining Disability, the permanent and total disability

of such Participant within the meaning of Section 22(e)(3) of the Code. In the event that there is an Award Agreement or Employment

Agreement defining Disability, “Disability” shall have the meaning provided in such Award Agreement or Employment

Agreement.

“Disqualifying

Disposition” means any disposition (including any sale) of Shares acquired upon the exercise of an Incentive Stock Option

made within the period that ends either (i) two years after the date on which the Participant was granted the Incentive Stock Option

or (ii) one year after the date upon which the Participant acquired the Shares.

“Effective

Date” means the effective date of the mergers contemplated by the Agreement and Plan of Reorganization, dated as of April

30, 2014, by and among Quartet Merger Corp., a Delaware corporation, Quartet Holdco Ltd., a wholly-owned subsidiary of Quartet

Merger Corp., Quartet Merger Sub, Ltd., a wholly-owned subsidiary of Quartet Holdco Ltd., and Pangaea Logistics Solutions Ltd.

(“Pangaea”) and the security holders of Pangaea.

“Eligible Person”

means (1) each employee and officer of the Company or of any of its Affiliates, including each such employee and officer who may

also be a director of the Company or any of its Affiliates, (2) each non-employee director of the Company or any of its Affiliates,

(3) each other natural person who provides substantial services to the Company or any of its Affiliates as a consultant or advisor

and who is designated as eligible by the Committee, and (4) each natural person who has been offered employment by the Company

or any of its Affiliates; provided that such prospective employee may not receive any payment or exercise any right relating

to an Award until such person has commenced employment or service with the Company or its Affiliates; provided further, however,

that (i) with respect to any Award that is intended to qualify as a “stock right” that does not provide for a “deferral

of compensation” within the meaning of Section 409A of the Code, the term Affiliate for this purpose shall include only those

corporations or other entities in the unbroken chain of corporations or other entities beginning with the Company where each of

the corporations in the unbroken chain other than the last corporation owns stock possessing at least fifty percent (50%) or more

of the total combined voting power of all classes of stock in one of the other corporations in the chain, and (ii) with respect

to any Award that is intended to qualify as an Incentive Stock Option, the term “Affiliate” as used for this purpose

shall include only those entities that qualify as a “subsidiary corporation” with respect to the Company within the

meaning of Code Section 424(f). An employee on an approved leave of absence may be considered as still in the employ of the Company

or any of its Affiliates for purposes of eligibility for participation in the Plan.

“Employment

Agreement” means an employment or other services agreement between a Participant and the Service Recipient that describes

the terms and conditions of such Participant’s employment or service with the Service Recipient and is effective as of the

date of determination.

“Exchange Act”

means the U.S. Securities Exchange Act of 1934, as amended from time to time, including rules and regulations thereunder and successor

provisions and rules and regulations thereto.

“Expiration

Date” means the date upon which the term of an Option or Share Appreciation Right expires, as determined under Section

5(b) or 8(b) hereof, as applicable.

“Fair Market

Value” means, as of any date when the Shares are listed on Nasdaq Capital Market or an other national securities exchange,

the closing price reported on the principal national securities exchange on which such Shares are listed and traded on the date

of determination, or if the closing price is not reported on such date of determination, the closing price on the most recent date

on which such closing price is reported. If the Shares are not listed on a national securities exchange, the Fair Market Value

shall mean the amount determined by the Board in good faith, and in a manner consistent with Section 409A of the Code, to be the

fair market value per Share.

“Incentive

Stock Option” means an Option intended to qualify as an incentive stock option within the meaning of Section 422 of the

Code.

“Incumbent

Board” shall have the meaning set forth within the definition of “Change in Control.”

“Non-Control

Transaction” has the meaning set forth within the definition of “Change in Control.”

“Nonqualified

Stock Option” means an Option not intended to qualify as an Incentive Stock Option.

“Option”

means a conditional right, granted to a Participant under Section 5 hereof, to purchase Shares at a specified price during a specified

time period.

“Option Agreement”

means a written agreement (including an electronic writing to the extent permitted by applicable law) between the Company and a

Participant evidencing the terms and conditions of an individual Option grant.

“Parent Company”

has the meaning set forth within the definition of “Change in Control.”

“Participant”

means an Eligible Person who has been granted an Award under the Plan, or if applicable, such other Person who holds an Award.

“Performance

Award” means an Award granted to a Participant under Section 9 hereof, which Award is subject to the achievement of Performance

Objectives during a Performance Period. A Performance Award shall be designated as a “Performance Share” or

a “Performance Unit” at the time of grant.

“Performance

Award Agreement” means a written agreement (including an electronic writing to the extent permitted by applicable law)

between the Company and a Participant evidencing the terms and conditions of an individual Performance Award grant.

“Performance

Objectives” means the performance objectives established pursuant to this Plan for Participants who have received Performance

Awards.

“Performance

Period” means the period designated for the achievement of Performance Objectives.

“Person”

means any individual, corporation, partnership, firm, joint venture, association, joint-stock company, trust, unincorporated organization,

or other entity.

“Plan”

means this Pangaea Logistics Solutions Ltd. 2014 Stock Incentive Plan, as amended from time to time.

“Qualified

Member” means a member of the Committee who is a “Non-Employee Director” within the meaning of Rule 16b-3

under the Exchange Act.

“Qualifying

Committee” has the meaning set forth in Section 3(b) hereof.

“Reorganization”

has the meaning set forth within the definition of “Change in Control.”

“Restricted

Share” means a Share granted to a Participant under Section 6 hereof that is subject to certain restrictions and to a

risk of forfeiture.

“Restricted

Share Agreement” means a written agreement (including an electronic writing to the extent permitted by applicable law)

between the Company and a Participant evidencing the terms and conditions of an individual Restricted Share grant.

“Restricted

Share Unit” means a notional unit representing the right to receive one Share (or the cash value of one Share, if so

determined by the Committee) on a specified settlement date.

“RSU Agreement”

means a written agreement (including an electronic writing to the extent permitted by applicable law) between the Company and a

Participant evidencing the terms and conditions of an individual grant of Restricted Share Units.

“SAR Agreement”

means a written agreement (including an electronic writing to the extent permitted by applicable law) between the Company and a

Participant evidencing the terms and conditions of an individual grant of Share Appreciation Rights.

“Securities

Act” means the U.S. Securities Act of 1933, as amended from time to time, including rules and regulations thereunder

and successor provisions and rules and regulations thereto.

“Service Recipient”

means, with respect to a Participant holding a given Award, either the Company or an Affiliate of the Company by which the original

recipient of such Award is, or following a Termination was most recently, principally employed or to which such original recipient

provides, or following a Termination was most recently providing, services, as applicable.

“Shares”

means the Company’s common shares, par value $.0001, and such other securities as may be substituted for such shares pursuant

to Section 11 hereof.

“Share Appreciation

Right” means a conditional right to receive an amount equal to the value of the appreciation in the Shares over a specified

period. Except in the event of extraordinary circumstances, as determined in the sole discretion of the Committee, or pursuant

to Section 11(b) below, Share Appreciation Rights shall be settled in Shares.

“Surviving

Company” has the meaning set forth within the definition of “Change in Control.”

“Termination”

means the termination of a Participant’s employment or service, as applicable, with the Service Recipient; provided, however,

that, if so determined by the Committee at the time of any change in status in relation to the Service Recipient (e.g., a Participant

ceases to be an employee and begins providing services as a consultant, or vice versa), such change in status will not be deemed

a Termination hereunder. Unless otherwise determined by the Committee, in the event that any Service Recipient ceases to be an

Affiliate of the Company (by reason of sale, divestiture, spin-off, or other similar transaction), unless a Participant’s

employment or service is transferred to another entity that would constitute a Service Recipient immediately following such transaction,

such Participant shall be deemed to have suffered a Termination hereunder as of the date of the consummation of such transaction.

Notwithstanding anything herein to the contrary, a Participant’s change in status in relation to the Service Recipient (for

example, a change from employee to consultant) shall not be deemed a Termination hereunder with respect to any Awards constituting

nonqualified deferred compensation subject to Section 409A of the Code that are payable upon a Termination unless such change in

status constitutes a “separation from service” within the meaning of Section 409A of the Code. Any payments in respect

of an Award constituting nonqualified deferred compensation subject to Section 409A of the Code that are payable upon a Termination

shall be delayed for such period as may be necessary to meet the requirements of Section 409A(a)(2)(B)(i) of the Code. On the first

business day following the expiration of such period, the Participant shall be paid, in a single lump sum without interest, an

amount equal to the aggregate amount of all payments delayed pursuant to the preceding sentence, and any remaining payments not

so delayed shall continue to be paid pursuant to the payment schedule applicable to such Award.

3. Administration.

(a) Authority

of the Committee. Except as otherwise provided below, the Plan shall be administered by the Committee. The Committee shall

have full and final authority, in each case subject to and consistent with the provisions of the Plan, to (1) select Eligible Persons

to become Participants, (2) grant Awards, (3) determine the type, number of Shares subject to,

other terms and conditions

of, and all other matters relating to, Awards, (4) prescribe Award Agreements (which need not be identical for each Participant)

and rules and regulations for the administration of the Plan, (5) construe and interpret the Plan and Award Agreements and correct

defects, supply omissions, and reconcile inconsistencies therein, (6) suspend the right to exercise Awards during any period that

the Committee deems appropriate to comply with applicable securities laws, and thereafter extend the exercise period of an Award

by an equivalent period of time, and (7) make all other decisions and determinations as the Committee may deem necessary or advisable

for the administration of the Plan. Any action of the Committee shall be final, conclusive, and binding on all persons, including,

without limitation, the Company, its Affiliates, Eligible Persons, Participants, and beneficiaries of Participants. For the avoidance

of doubt, the Board shall have the authority to take all actions under the Plan that the Committee is permitted to take.

(b) Manner

of Exercise of Committee Authority. At any time that a member of the Committee is not a Qualified Member, any action

of the Committee relating to an Award granted or to be granted to a Participant who is then subject to Section 16 of the Exchange

Act in respect of the Company must be taken by a subcommittee, designated by the Committee or the Board, composed solely of two

or more Qualified Members (a “Qualifying Committee”). Any action authorized by such a Qualifying Committee shall

be deemed the action of the Committee for purposes of the Plan. The express grant of any specific power to the Committee and the

taking of any action by the Committee shall not be construed as limiting any power or authority of the Committee.

(c) Delegation.

To the extent permitted by applicable law, the Committee may delegate to officers or employees of the Company or any of its Affiliates,

or committees thereof, the authority, subject to such terms as the Committee shall determine, to perform such functions under the

Plan, including, but not limited to, administrative functions, as the Committee may determine appropriate. The Committee may appoint

agents to assist it in administering the Plan. Notwithstanding the foregoing or any other provision of the Plan to the contrary,

any Award granted under the Plan to any Eligible Person who is not an employee of the Company or any of its Affiliates (including

any non-employee director of the Company or any Affiliate) or to any Eligible Person who is subject to Section 16 of the Exchange

Act must be expressly approved by the Committee or Qualifying Committee in accordance with subsection (b) above.

(d) Section

409A; Section 457A. All Awards made under the Plan that are intended to be “deferred compensation” subject to Section

409A or Section 457A of the Code shall be interpreted, administered and construed to comply with Section 409A or Section 457A,

as applicable, and all Awards made under the Plan that are intended to be exempt from Section 409A or Section 457A shall be interpreted,

administered and construed to comply with and preserve such exemption, as applicable. The Committee shall have full authority to

give effect to the intent of the foregoing sentence. To the extent necessary to give effect to this intent, in the case of any

conflict or potential inconsistency between the Plan and a provision of any Award or Award Agreement with respect to an Award,

the Plan shall govern. Notwithstanding the foregoing, neither the Company nor the Committee shall have any liability to any person

in the event Section 409A or Section 457A applies to any Award in a manner that results in adverse tax consequences for the Participant

or any of his beneficiaries or transferees.

4. Shares

Available Under the Plan.

(a) Number

of Shares Available for Delivery. Subject to adjustment as provided in Section 11 hereof, the total number of Shares reserved

and available for delivery in connection with Awards under the Plan shall equal 1,500,000. Notwithstanding the foregoing, the number

of Shares available for issuance hereunder shall not be reduced by Shares issued pursuant to Awards issued or assumed in connection

with a merger or acquisition as contemplated by, as applicable, NASDAQ Listing Rule 5635(c) and IM-5635-1, NYSE Listed Company

Manual Section 303A.08, AMEX Company Guide Section 711, or other applicable stock exchange rules, and their respective successor

rules and listing exchange promulgations.

(b) Share

Counting Rules. The Committee may adopt reasonable counting procedures to ensure appropriate counting, avoid double-counting

(as, for example, in the case of tandem or substitute awards) and make adjustments if the number of Shares actually delivered differs

from the number of Shares previously counted in connection with an Award. To the extent that an Award expires or is canceled, forfeited,

settled in cash, or otherwise terminated without a delivery to the Participant of the full number of Shares to which the Award

related, the undelivered Shares will again be available for grant. Shares withheld in payment of the exercise price or taxes relating

to an Award and Shares equal to the number surrendered in payment of any exercise price or taxes relating to an Award shall be

deemed to constitute shares not delivered to the Participant and shall be deemed to again be available for Awards under the Plan.

(c) Incentive

Stock Options. All Shares reserved for issuance hereunder may be issued or transferred upon exercise or settlement of Incentive

Stock Options.

(d) Limitation

on Awards to Non-Employee Directors. Notwithstanding anything to the contrary herein, the maximum number of Shares that may

be subject to Awards granted to any non-employee director of the Company in any one calendar year shall not exceed 10,000 Shares

(subject to adjustment as provided in Section 11 hereof).

5. Options.

(a) General.

Certain Options granted under the Plan are intended to qualify as Incentive Stock Options. Options may be granted to Eligible Persons

in such form and having such terms and conditions as the Committee shall deem appropriate; provided, however, that Incentive

Stock Options may be granted only to Eligible Persons who are employees of the Company or an Affiliate of the Company. The provisions

of separate Options shall be set forth in separate Option Agreements, which agreements need not be identical.

(b) Term.

The term of each Option shall be set by the Committee at the time of grant; provided, however, that no Option granted hereunder

shall be exercisable after the expiration of ten (10) years from the date it was granted.

(c) Exercise

Price. The exercise price per Share for each Option shall be set by the Committee at the time of grant; provided, however,

that if an Option is intended to qualify as either (1) a “stock right” that does not provide for a “deferral

of compensation” within the meaning of Section 409A of the Code, or (2) an Incentive Stock Option, then in each case the

applicable exercise price

shall not be less than the Fair Market Value on the date of grant, subject to subsection (g) below in the case of any Incentive

Stock Option.

(d) Payment

for Shares. Payment for Shares acquired pursuant to Options granted hereunder shall be made in full upon exercise of an Option

in immediately available funds in United States dollars or by certified or bank cashier’s check, or if approved by the Committee

(1) by delivery of Shares having a value equal to the exercise price, (2) by a broker-assisted cashless exercise in accordance

with procedures approved by the Committee, whereby payment of the Option exercise price or tax withholding obligations may be satisfied,

in whole or in part, with Shares subject to the Option by delivery of an irrevocable direction to a securities broker (on a form

prescribed by the Committee) to sell Shares and to deliver all or part of the sale proceeds to the Company in payment of the aggregate

exercise price and, if applicable, the amount necessary to satisfy the Company’s withholding obligations, or (3) by any other

means approved by the Committee (including,by delivery of a notice of “net exercise” to the Company, pursuant to which

the Participant shall receive the number of Shares underlying the Option so exercised reduced by the number of Shares equal to

the aggregate exercise price of the Option divided by the Fair Market Value on the date of exercise). Anything herein to the contrary

notwithstanding, if the Committee determines that any form of payment available hereunder would be in violation of Section 402

of the Sarbanes-Oxley Act of 2002, such form of payment shall not be available.

(e) Vesting.

Options shall vest and become exercisable in such manner, on such date or dates, or upon the achievement of performance or other

conditions, in each case as may be determined by the Committee and set forth in an Option Agreement; provided, however,

that notwithstanding any such vesting dates, but in all cases subject to Section 11 below, the Committee may in its sole discretion

accelerate the vesting of any Option at any time and for any reason. Unless otherwise specifically determined by the Committee,

the vesting of an Option shall occur only while the Participant is employed by or rendering services to the Service Recipient,

and all vesting shall cease upon a Participant’s Termination for any reason. If an Option is exercisable in installments,

such installments or portions thereof that become exercisable shall remain exercisable until the Option expires.

(f) Termination

of Employment or Service. Except as provided by the Committee in an Option Agreement or otherwise:

(1) In

the event of a Participant’s Termination for any reason other than (i) by the Service Recipient for Cause, or (ii) by reason

of the Participant’s death or Disability, (A) all vesting with respect to such Participant’s outstanding Options shall

cease, (B) each of such Participant’s outstanding unvested Options shall expire as of the date of such Termination, and (C)

each of such Participant’s outstanding vested Options shall remain exercisable until the earlier of the applicable Expiration

Date and the date that is ninety (90) days after the date of such Termination.

(2) In

the event of a Participant’s Termination by reason of such Participant’s death or Disability, (i) all vesting with

respect to such Participant’s outstanding Options shall cease, (ii) each of such Participant’s outstanding unvested

Options shall expire as of the date of such Termination, and (iii) each of such

Participant’s outstanding

vested Options shall remain exercisable until the earlier of the applicable Expiration Date and the date that is twelve (12) months

after the date of such Termination. In the event of a Participant’s death, such Participant’s Options shall remain

exercisable by the person or persons to whom a Participant’s rights under the Options pass by will or by the applicable laws

of descent and distribution until their expiration, but only to the extent that the Options were vested by such Participant at

the time of such Termination.

(3) In

the event of a Participant’s Termination by the Service Recipient for Cause, all of such Participant’s outstanding

Options (whether or not vested) shall immediately expire as of the date of such Termination.

(g) Special

Provisions Applicable to Incentive Stock Options.

(1) No

Incentive Stock Option may be granted to any Eligible Person who, at the time the Option is granted, owns directly, or indirectly

within the meaning of Section 424(d) of the Code, stock possessing more than ten percent (10%) of the total combined voting power

of all classes of stock of the Company or of any parent or subsidiary thereof, unless such Incentive Stock Option (i) has an exercise

price of at least one hundred ten percent (110%) of the Fair Market Value on the date of the grant of such Option and (ii) cannot

be exercised more than five (5) years after the date it is granted.

(2) To

the extent that the aggregate Fair Market Value (determined as of the date of grant) of Shares for which Incentive Stock Options

are exercisable for the first time by any Participant during any calendar year (under all plans of the Company and its Affiliates)

exceeds $100,000, such excess Incentive Stock Options shall be treated as Nonqualified Stock Options.

(3) Each

Participant who receives an Incentive Stock Option must agree to notify the Company in writing immediately after the Participant

makes a Disqualifying Disposition of any Shares acquired pursuant to the exercise of an Incentive Stock Option.

6. Restricted

Shares.

(a) General.

Restricted Shares may be granted to Eligible Persons in such form and having such terms and conditions as the Committee shall deem

appropriate. The provisions of separate Awards of Restricted Shares shall be set forth in separate Restricted Share Agreements,

which agreements need not be identical. Subject to the restrictions set forth in Section 6(b), and except as otherwise set forth

in the applicable Restricted Share Agreement, the Participant shall generally have the rights and privileges of a shareholder as

to such Restricted Shares, including the right to vote such Restricted Shares. Unless otherwise set forth in a Participant’s

Restricted Shares Agreement, cash dividends and stock dividends, if any, with respect to the Restricted Shares shall be withheld

by the Company for the Participant’s account, and shall be subject to forfeiture to the same degree as the Restricted Shares

to which such dividends relate. Except as otherwise determined by the Committee, no interest will accrue or be paid on the amount

of any cash dividends withheld.

(b) Vesting

and Restrictions on Transfer. Restricted Shares shall vest in such manner, on such date or dates, or upon the achievement of

performance or other conditions, in each case as may be determined by the Committee and set forth in a Restricted Share Agreement;

provided, however, that notwithstanding any such vesting dates, but in all cases subject to Section 11 below, the Committee

may in its sole discretion accelerate the vesting of any Award of Restricted Shares at any time and for any reason. Unless otherwise

specifically determined by the Committee, the vesting of an Award of Restricted Shares shall occur only while the Participant is

employed by or rendering services to the Service Recipient, and all vesting shall cease upon a Participant’s Termination

for any reason. In addition to any other restrictions set forth in a Participant’s Restricted Share Agreement, until such

time as the Restricted Shares has vested pursuant to the terms of the Restricted Share Agreement, the Participant shall not be

permitted to sell, transfer, pledge, or otherwise encumber the Restricted Shares.

(c) Termination

of Employment or Service. Except as provided by the Committee in a Restricted Share Agreement, Employment Agreement or otherwise,

in the event of a Participant’s Termination for any reason prior to the time that such Participant’s Restricted Shares

have vested, all vesting with respect to such Participant’s Restricted Shares shall cease and all of Participant’s

unvested Restricted Shares shall be immediately forfeited to the Company by the Participant for no consideration as of the date

of such Termination.

7. Restricted

Share Units.

(a) General.

Restricted Share Units may be granted to Eligible Persons in such form and having such terms and conditions as the Committee shall

deem appropriate. The provisions of separate Restricted Share Units shall be set forth in separate RSU Agreements, which agreements

need not be identical.

(b) Vesting.

Restricted Share Units shall vest in such manner, on such date or dates, or upon the achievement of performance or other conditions,