- Completed sale of Diversey to Bain

Capital Private Equity on September 6, 2017 for $3.2 Billion

- Third Quarter 2017 Sales from

Continuing Operations of $1.1 Billion, an increase of 6% As

Reported

- Net Earnings from Continuing Operations

of $62 Million and Reported Net Earnings Per Share from Continuing

Operations of $0.33

- Adjusted Net Income from Continuing

Operations of $87 Million, Adjusted EPS from Continuing Operations

of $0.46 per share and Adjusted EBITDA of $217 Million, or 19.2% of

Net Sales

- Outlook for Full Year 2017 includes Net

Sales of approximately $4.4 Billion, Adjusted EBITDA of

approximately $830 Million, Adjusted EPS of $1.75 to $1.80 from

Continuing Operations and Free Cash Flow of $400 Million

Sealed Air Corporation (NYSE:SEE) today announced financial

results for the third quarter 2017. Commenting on these results,

Jerome A. Peribere, President and Chief Executive Officer, said,

“For the third consecutive quarter, we are delivering on our

accelerated growth strategy, led by favorable volume trends across

all regions. North America was once again our fastest growing

region with an increase in volumes of 7%. Our top-line performance

continues to be driven by the adoption of our innovative solutions

coupled with strong end market demand across all proteins and

within the e-commerce and fulfillment sectors. We expect top-line

growth to continue into year-end and sequential profitability

improvements through operational disciplines and increased sales of

value-added solutions."

Peribere continued, “Our journey as a knowledge-based company

continues with many exciting opportunities ahead. We are pleased to

have Ted Doheny join Sealed Air as our Chief Operating Officer and

CEO-Designate, and will assume the role of President and CEO

effective January 1, 2018. Furthermore, we recently announced that

our current Chief Accounting Officer and Controller, Bill Stiehl,

has assumed the additional position of Acting Chief Financial

Officer. Under both Ted and Bill’s leadership, the organization

will continue to thrive and generate significant value for our

global customers, shareholders and employees."

Unless otherwise stated, all results compare third quarter 2017

results to third quarter 2016 results from continuing operations.

As a result of the sale of Diversey, which refers to Diversey Care

and the food hygiene and cleaning business, we have changed our

segment reporting structure effective as of January 1, 2017. Food

Care now includes the Medical Applications business, which was

previously reported under 'Other.' Additionally, Food Care now

excludes the food hygiene and cleaning business, which is a

component of Diversey and classified as discontinued operations.

Year-over-year financial discussions present operating results from

continuing operations as reported, and on a constant dollar basis.

Constant dollar refers to unit volume and price/mix performance and

excludes the impact of currency translation from all periods

referenced. Additionally, non-U.S. GAAP adjusted financial

measures, such as Adjusted Earnings Before Interest Expense, Taxes,

Depreciation and Amortization (“Adjusted EBITDA”), Adjusted Net

Earnings, Adjusted Diluted Earnings Per Share (“Adjusted EPS”) and

Adjusted Tax Rate, exclude the impact of special items, such as

restructuring charges, charges related to the sale of Diversey,

charges related to ceasing operations in Venezuela, cash-settled

stock appreciation rights (“SARs”) granted as part of the original

Diversey acquisition and certain other infrequent or one-time

items. Please refer to the supplemental information included with

this press release for a reconciliation of Non-U.S. GAAP to U.S.

GAAP financial measures.

Business Highlights

- In the third quarter, Food Care net

sales of $716 million increased 6% as reported. Currency had a

positive impact on Food Care net sales of 2%, or $10 million. On a

constant dollar basis, net sales increased 4% almost entirely due

to positive volume growth. Volume trends were led by 9% growth in

North America, 3% in Latin America and 1% in EMEA. This was offset

by a decline in Asia Pacific. Adjusted EBITDA of $158 million or

22.1% of net sales was primarily attributable to positive volume

trends and favorable foreign currency, which were offset by higher

raw material costs and non-material costs including salary and wage

increases.

- Product Care net sales of $415 million

in the third quarter were up 7% as reported. Currency had a

positive impact on Product Care net sales of 1%, or $3 million. On

a constant dollar basis, net sales and volumes increased 6% due to

continued strength in e-commerce and fulfillment. Volume increased

4% in North America, over 7% in EMEA and Latin America, and 17% in

Asia Pacific. Adjusted EBITDA of $87 million or 20.8% of net sales

was attributable to volume growth, which was offset by unfavorable

price/cost spread primarily due to higher raw material and freight

costs as well as unfavorable product mix.

- On September 6, 2017, Sealed Air

completed the sale of Diversey to Bain Capital for $3.2 billion.

The sale provided the Company the financial flexibility to

accelerate share repurchases, pay down approximately $1.1 billion

in debt and target selective acquisitions. Most recently, on

October 2, 2017, Sealed Air acquired Fagerdala Singapore Pte Ltd.,

a manufacturer and fabricator of polyethylene foam, for $100

million in cash. Fagerdala generated approximately $80 million in

sales in 2016.

- From January 1, 2017 through September

30, 2017, Sealed Air repurchased approximately $677 million or 15.5

million shares through a combination of open market repurchases and

Accelerated Share Repurchase (ASR) programs. The Company

repurchased approximately $426 million or 9.7 million shares during

the third quarter.

Third Quarter 2017 U.S. GAAP Summary,

Continuing Operations

Net sales of $1.1 billion increased 6% on an as reported basis.

Currency had a positive impact on total net sales of 1%, or $13

million. As reported, net sales increased across all regions.

Net income from continuing operations on a reported basis was

$62 million, or $0.33 per diluted share, as compared to net income

from continuing operations of $64 million, or $0.32 per diluted

share, in the third quarter 2016. Net income in the third quarter

2017 was unfavorably impacted by $24 million of special items,

including $9 million of restructuring and other restructuring

associated costs, $7 million related to acquisition and divestiture

activity and $5 million of tax special items. Net income in the

third quarter 2016 included $17 million of special items, including

$7 million of charges related to restructuring and other costs

associated with our restructuring programs and $9 million related

to tax special items.

The effective tax rate in the third quarter of 2017 was 41.2%,

compared to the effective tax rate of 45.9% in the third quarter of

2016. The effective tax rate in the third quarter of 2017

was negatively affected by additional tax expenses related to

the sale of Diversey. The effective tax rate in the third

quarter of 2016 was negatively impacted by an increase in

unrecognized tax benefits.

Third Quarter 2017 Non-U.S. GAAP

Summary, Continuing Operations

Net sales on a constant dollar increased 5% primarily on volume

growth. On constant dollar basis, North America sales increased 7%,

Asia Pacific was up 3%, and EMEA and Latin America were up 2%.

Adjusted EBITDA for the third quarter 2017 was $217 million, or

19.2% of net sales, compared to $213 million, or 20.0% of net sales

for the third quarter of 2016. Adjusted EBITDA included $28 million

of Corporate expenses in the third quarter of 2017, of which $3

million reflected costs that were previously allocated to Diversey

but not included in net income from discontinued operations.

Corporate expenses were $31 million in the third quarter of 2016,

and included $4 million of costs that were previously allocated to

Diversey, but which were not included in net income from

discontinued operations.

Adjusted EPS was $0.46 for the third quarter 2017. This compares

to Adjusted EPS of $0.41 in the third quarter 2016. The Adjusted

Tax Rate was 30.7% in the third quarter 2017, compared to 35.6% in

the third quarter 2016. The Adjusted Tax Rate in the third quarter

of 2016 was negatively impacted by an increase in unrecognized

tax benefits.

Third Quarter 2017 U.S. GAAP Summary,

Discontinued Operations

The sale of Diversey was completed during the quarter on

September 6, 2017. The Company recognized a net gain on the sale of

$699.3 million. The calculation of net earnings from discontinued

operations included third quarter net sales of $435 million. Net

income from discontinued operations on a reported basis was $26

million, or $0.14 per diluted share.

Cash Flow and Net Debt

Cash flow provided by operating activities in the nine months

ended September 30, 2017 was $333 million, which is net of $49

million of restructuring payments and $61 million of payments

related to the sale of Diversey, which included $33 million of tax

payments made in the second quarter and the remainder primarily

attributable to professional fees required to facilitate the

separation.

Capital expenditures were $127 million in the nine months ended

September 30, 2017. Free Cash Flow, defined as net cash

provided by operating activities less capital expenditures and

payments related to the sale of Diversey, was an inflow of $267

million in the nine months ended September 30, 2017.

The Company repurchased 15.5 million shares for approximately

$677 million, and paid cash dividends of $92 million during the

nine months ended September 30, 2017.

Net Debt, defined as total debt less cash and cash equivalents,

decreased to $2.0 billion as of September 30, 2017 from $3.8

billion as of December 31, 2016. This decrease in net debt

primarily resulted from payments of debt and net cash received as

part of the sale of Diversey.

Outlook for Full Year 2017, Continuing

Operations

For the full year 2017, the Company increased its outlook for

Net Sales to approximately $4.4 billion from approximately $4.3

billion. Adjusted EBITDA from continuing operations is expected to

be approximately $830 million as compared to previously provided

guidance of $825 million to $835 million. Currency is expected to

have a favorable impact of approximately $40 million on Net Sales

and $7 million on Adjusted EBITDA. The Company continues to

forecast Adjusted EPS to be in the range of $1.75 to $1.80, which

is based on 190 million shares outstanding and an Adjusted Tax Rate

of 30%.

The outlook for Free Cash Flow remains unchanged at

approximately $400 million. Free Cash Flow guidance is based on

consolidated results, including continuing and discontinuing

operations, and assumes capital expenditures of approximately

$175 million and cash restructuring payments of approximately $55

million. Free Cash Flow outlook excludes cash flow generation from

working capital related to Diversey

post-separation, restructuring charges to address stranded

costs, and any payments made in relation to the sale of

Diversey.

Conference Call

Information

Date:

Wednesday, November 8, 2017

Time:

10:00 a.m. (ET)

Webcast:

www.sealedair.com/investors

Conference Dial

In:

(855) 472-5411 (domestic) (330) 863-3389 (international)

Participant

Code:

96077061

A supplemental presentation accompanying the conference call

will be available on the Company’s website at

www.sealedair.com/investors.

Conference Call

Replay Information

Dates:

Wednesday, November 8, 2017 at 1:00 p.m. (ET)

through Friday, December 8, 2017 at 12:59 p.m. (ET)

Webcast:

www.sealedair.com/investors

Conference Dial

In:

(855) 859-2056 (domestic) (404) 537-3406 (international)

Participant

Code:

96077061

Business

Sealed Air Corporation is a knowledge-based company focused on

packaging solutions that help our customers achieve their

sustainability goals in the face of today’s biggest social and

environmental challenges. Our portfolio of widely recognized

brands, including Cryovac® brand food packaging solutions and

Bubble Wrap® brand cushioning, enable a safer and less

wasteful food supply chain and protect valuable goods shipped

around the world. Sealed Air generated $4.2 billion in sales in

2016 and has approximately 14,000 employees who serve customers in

117 countries. To learn more, visit www.sealedair.com.

Website Information

We routinely post important information for investors on our

website, www.sealedair.com, in the "Investor Relations" section. We

use this website as a means of disclosing material, non-public

information and for complying with our disclosure obligations under

Regulation FD. Accordingly, investors should monitor the Investor

Relations section of our website, in addition to following our

press releases, SEC filings, public conference calls, presentations

and webcasts. The information contained on, or that may be accessed

through, our website is not incorporated by reference into, and is

not a part of, this document.

Non-U.S. GAAP

Information

In this press release and supplement, we have included several

non-U.S. GAAP financial measures, including Net Debt, Adjusted Net

Earnings and Adjusted EPS, net sales on a “constant dollar” or

“organic” basis, Free Cash Flow, Adjusted EBITDA and Adjusted Tax

Rate, as our management believes these measures are useful to

investors. We present results and guidance, adjusted to exclude the

effects of Special Items and their related tax impact that would

otherwise be included under U.S. GAAP, to aid in comparisons with

other periods or prior guidance. In addition, non-U.S. GAAP

measures are used by management to review and analyze our operating

performance and, along with other data, as internal measures for

setting annual budgets and forecasts, assessing financial

performance, providing guidance and comparing our financial

performance with our peers and may also be used for purposes of

determining incentive compensation. The non-U.S. GAAP information

has limitations as an analytical tool and should not be considered

in isolation from or as a substitute for U.S. GAAP information. It

does not purport to represent any similarly titled U.S. GAAP

information and is not an indicator of our performance under U.S.

GAAP. Non-U.S. GAAP financial measures that we present may not be

comparable with similarly titled measures used by others. Investors

are cautioned against placing undue reliance on these non-U.S. GAAP

measures. For a reconciliation of these U.S. GAAP measures to

non-U.S. GAAP measures and other important information on our use

of non-U.S. GAAP financial measures, see the attached

supplementary information entitled “Condensed Consolidated

Statements of Cash Flows” (under the section entitled “Non-U.S.

GAAP Free Cash Flow”), “Reconciliation of U.S. GAAP Net Earnings

and U.S. GAAP Net Earnings Per Share to Non-U.S. GAAP Adjusted Net

Earnings and Non-U.S. GAAP Adjusted Net Earnings Per Share”

“Segment Information,” “Reconciliation of U.S. GAAP Net Earnings to

Non-U.S. GAAP Total Company Adjusted EBITDA,” “Components of Change

in Net Sales by Segment,” “Components of Changes in Net Sales by

Region,” “Components of Organic Change in Net Sales by Segment,”

and “Components of Organic Changes in Net Sales by Region.”

Information reconciling forward-looking U.S. GAAP measures to

non-U.S. GAAP measures is not available without unreasonable

effort.

*We have not provided guidance for the most directly comparable

U.S. GAAP financial measures, as they are not available without

unreasonable effort due to the high variability, complexity, and

low visibility with respect to certain Special Items, including

gains and losses on the disposition of businesses, the ultimate

outcome of certain legal or tax proceedings, foreign currency gains

or losses resulting from the volatile currency market in Venezuela,

and other unusual gains and losses. These items are uncertain,

depend on various factors, and could be material to our results

computed in accordance with U.S. GAAP.

Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 concerning our business, consolidated

financial condition and results of operations. Forward-looking

statements are subject to risks and uncertainties, many of which

are outside our control, which could cause actual results to differ

materially from these statements. Therefore, you should not rely on

any of these forward-looking statements. Forward-looking statements

can be identified by such words as “anticipates,” “believes,”

“plan,” “assumes,” “could,” “should,” “estimates,” “expects,”

“intends,” “potential,” “seek,” “predict,” “may,” “will” and

similar references to future periods. All statements other than

statements of historical facts included in this press release

regarding our strategies, prospects, financial condition,

operations, costs, plans and objectives are forward-looking

statements. Examples of forward-looking statements include, among

others, statements we make regarding expected future operating

results, expectations regarding the results of restructuring and

other programs, anticipated levels of capital expenditures and

expectations of the effect on our financial condition of claims,

litigation, environmental costs, contingent liabilities and

governmental and regulatory investigations and proceedings. The

following are important factors that we believe could cause actual

results to differ materially from those in our forward-looking

statements: the tax benefits associated with the Settlement

agreement (as defined in our 2016 Annual Report on Form 10-K),

global economic and political conditions, changes in our credit

ratings, changes in raw material pricing and availability, changes

in energy costs, competitive conditions, the success of our

restructuring activities, currency translation and devaluation

effects, the success of our financial growth, profitability, cash

generation and manufacturing strategies and our cost reduction and

productivity efforts, the success of new product offerings, the

effects of animal and food-related health issues, pandemics,

consumer preferences, environmental matters, regulatory actions and

legal matters, and the other information referenced in the “Risk

Factors” section appearing in our most recent Annual Report on Form

10-K, as filed with the Securities and Exchange Commission, and as

revised and updated by our Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K. Any forward-looking statement made by

us is based only on information currently available to us and

speaks only as of the date on which it is made. We undertake no

obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

SEALED AIR CORPORATION

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(1)

(Unaudited)

(In millions, except per share

data)

Three Months EndedSeptember 30,

(unaudited)

Nine Months EndedSeptember 30,

(unaudited)

(In millions, except share data) 2017 2016

2017 2016 Net sales $ 1,131.3 $ 1,065.1 $ 3,233.8 $

3,109.9 Cost of sales(2) 769.2 708.4 2,191.0

2,068.0 Gross profit 362.1 356.7 1,042.8 1,041.9 Selling,

general and administrative expenses(2) 192.7 184.2 590.2 566.7

Amortization expense of intangible assets acquired 3.1 4.1 9.2 10.4

Restructuring and other charges(2) 6.2 1.3 9.2

1.4 Operating profit 160.1 167.1 434.2 463.4 Interest

expense (54.0 ) (49.6 ) (153.7 ) (151.4 ) Foreign currency exchange

loss related to Venezuelan subsidiaries — — — (1.6 ) Charge related

to Venezuelan subsidiaries(2) — — — (46.0 ) Other (expense) income,

net — 0.4 (6.2 ) 1.4 Earnings before income

tax provision 106.1 117.9 274.3 265.8 Income tax provision 43.7

54.1 236.5 124.7 Net earnings from

continuing operations 62.4 63.8 37.8 141.1 Gain on sale of

discontinued operations, net of tax 699.3 — 699.3 — Net earnings

from discontinued operations, net of tax(3) 25.7 99.5

111.3 174.2

Net earnings available to common

stockholders

$ 787.4 $ 163.3 $ 848.4 $ 315.3

Basic: Continuing operations $ 0.33 $ 0.33 $ 0.20 $ 0.71

Discontinued operations(3) 3.86 0.51 4.22 0.89

Net earnings per common share - basic $ 4.19 $ 0.84

$ 4.42 $ 1.60

Diluted: Continuing

operations $ 0.33 $ 0.32 $ 0.19 $ 0.71 Discontinued operations(3)

3.82 0.51 4.18 0.88 Net earnings per

common share - diluted $ 4.15 $ 0.83 $ 4.37 $

1.59 Dividends per common share $ 0.16 $ 0.16

$ 0.48 $ 0.45 Weighted average number of common

shares outstanding: Basic 186.9 194.1 190.9

195.0 Diluted 188.9 196.7 192.9 197.5

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) Due to the ongoing

challenging economic situation in Venezuela, the Company approved a

program in the second quarter of 2016 to cease operations in the

country. This resulted in total costs of $47.3 million being

incurred which included a voluntary reduction in headcount

including severance and termination benefits for employees of

approximately $0.3 million recorded in restructuring and other

charges, depreciation and amortization expense related to fixed

assets and intangibles of approximately $0.6 million recorded in

selling, general and administrative expenses, inventory reserves of

$0.4 million recorded in costs of sales and the reclassification of

cumulative translation adjustment of approximately $46.0 million

recorded in charges related to Venezuelan subsidiaries. (3) For the

nine months ended September 30, 2017, there was a revision to net

earnings from discontinued operations, net of tax, on the Condensed

Consolidated Statement of Operations related to depreciation and

amortization on Diversey assets held for sale. As a result, net

earnings from discontinued operations, net of tax, increased $16.4

million and increased basic and diluted shares by $0.09 per share.

SEALED AIR CORPORATION

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATED BALANCE

SHEETS(1)

(Unaudited)

(In millions)

(In millions, except share data)

September 30,2017

(unaudited)

December 31,2016

ASSETS Current assets: Cash and cash equivalents $ 1,304.7 $

333.7 Trade receivables, net 540.5 460.5 Income tax receivables

16.7 11.5 Other receivables 81.7 72.7 Inventories, net 547.7 456.7

Current assets held for sale 20.8 825.7 Prepaid expenses and other

current assets 63.6 54.5 Total current assets 2,575.7

2,215.3 Property and equipment, net 951.0 889.6 Goodwill 1,898.3

1,882.9 Intangible assets, net 44.8 40.1 Deferred taxes 275.7 169.9

Non-current assets held for sale — 2,026.0 Other non-current assets

193.9 175.4 Total assets $ 5,939.4 $ 7,399.2

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

liabilities: Short-term borrowings $ 84.0 $ 83.0 Current portion of

long-term debt 2.0 297.0 Accounts payable 778.2 539.2 Current

liabilities held for sale 1.8 683.3 Accrued restructuring costs

16.1 44.8 Income tax payable 183.6 48.3 Other current liabilities

451.2 423.4 Total current liabilities 1,516.9 2,119.0

Long-term debt, less current portion 3,219.4 3,762.6 Deferred taxes

4.7 4.9 Non-current liabilities held for sale — 501.0 Other

non-current liabilities 437.8 402.0 Total liabilities

5,178.8 6,789.5 Stockholders’ equity: Preferred stock — — Common

stock 23.0 22.8 Additional paid-in capital 1,933.3 1,974.1 Retained

earnings 1,796.0 1,040.0 Common stock in treasury (2,155.8 )

(1,478.1 ) Accumulated other comprehensive loss, net of taxes

(835.9 ) (949.1 ) Total stockholders’ equity 760.6 609.7

Total liabilities and stockholders’ equity $ 5,939.4

$ 7,399.2

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission.

CALCULATION OF NET

DEBT(1)

September 30,2017

(unaudited)

December 31,2016

Short-term borrowings $ 84.0 $ 83.0 Current portion of long-term

debt 2.0 297.0 Long-term debt, less current portion 3,219.4

3,762.6 Total debt 3,305.4 4,142.6 Less: cash and

cash equivalents (1,304.7 ) (333.7 )

Net debt

$ 2,000.7 $ 3,808.9

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission.

SEALED AIR CORPORATION

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS(1)

(Unaudited)

(In millions)

Nine Months Ended September

30,(unaudited)

(In millions) 2017 2016(2) Net earnings

available to common stockholders $ 848.4 $ 315.3 Adjustments to

reconcile net earnings to net cash provided by operating

activities(3) (332.7 ) 309.6 Changes in operating assets and

liabilities: Trade receivables, net (87.5 ) (58.5 ) Inventories

(100.5 ) (100.5 ) Accounts payable 135.2 140.5 Other assets and

liabilities (130.4 ) (138.0 )

Net cash provided by operating

activities 332.5 468.4 Cash flows

from investing activities: Capital expenditures (126.5 ) (190.2 )

Proceeds, net from sale of business and property and equipment 4.4

8.4 Business acquired in purchase transactions, net of cash

acquired (25.4 ) (5.8 ) Impact of sale of Diversey(4) 2,053.0 —

Settlement of foreign currency forward contracts (1.1 ) (43.1 )

Net cash provided by (used in) investing activities

1,904.4 (230.7 ) Cash flows from

financing activities: Changes in short term borrowings (21.5 ) 85.5

Payments of borrowings(4) (369.5 ) (12.8 ) Change in cash used as

collateral on borrowing arrangements (1.8 ) 1.5 Proceeds from cross

currency swap 17.4 6.2 Dividends paid on common stock (92.4 ) (90.1

) Acquisition of common stock for tax withholding (21.9 ) (22.7 )

Repurchases of common stock(5) (757.3 ) (217.0 ) Other financing

activities — (0.1 )

Net cash used in financing

activities (1,247.0 ) (249.5 )

Effect of foreign currency exchange rate changes on cash and

cash equivalents (18.9 ) (15.9 )

Balance, beginning of period 333.7 321.7 Net change during the

period 971.0 (27.7 )

Balance, end of period $ 1,304.7

$ 294.0

Non-U.S. GAAP Free Cash Flow:

Cash flow from operating activities $ 332.5 $ 468.4 Capital

expenditures for property and equipment (126.5 ) (190.2 )

Free

Cash Flow(6) $ 206.0 $

278.2 Supplemental Cash Flow Information:

Interest payments, net of amounts capitalized $ 156.5 $

157.4 Income tax payments $ 126.6 $ 93.5

Payments related to the sale of Diversey(4) $ 61.2 $ —

Stock appreciation rights payments (less amounts included in

restructuring payments) $ — $ 1.9 Restructuring

payments including associated costs $ 48.7 $ 51.0

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2)

Due to changes in the accounting treatment

of a factoring agreement the Company reclassified amounts from cash

and cash equivalents to other receivables of $9 million as of

September 30, 2016. This reclassification resulted in an increase

in cash provided by operating activities of $2 million for the nine

months ended September 30, 2016.

(3) 2017 primarily consists of $699 million related to the gain on

sale from Diversey partially offset by $161 million of deferred

taxes, depreciation and amortization $114 million, share based

compensation expense of $39 million and profit sharing expense of

$19 million. 2016 primarily consists of depreciation and

amortization of $161 million, share based compensation expense of

$45 million, profit sharing expense of $30 million, charges related

to ceasing operations in Venezuela of $46 million, a remeasurement

loss of $3 million and loss on sale of business of $2 million. (4)

Payments of borrowings included in financing activities excludes

amounts which were paid using cash proceeds from the sale of

Diversey. As a result, $755 million of payments of borrowings is

included within investing activities for a total payment of

borrowings of $1.1 billion through the nine months ended September

30, 2017. (5) The Company entered into an accelerated share

repurchase agreement with a third-party financial institution to

repurchase $400 million of the Company’s common stock. The full

amount was paid as of September 30, 2017 however, only $320 million

was used to repurchase shares at that point in time. The ASR

program is expected to conclude in the fourth quarter of 2017. (6)

Free cash flow was $267 million in 2017 excluding the payment of

charges related to the sale of Diversey of $61 million. These

payments include $33 million related to tax payments and the

remainder primarily attributable to professional fees. Free cash

flow does not represent residual cash available for discretionary

expenditures, including mandatory debt servicing requirements or

non-discretionary expenditures that are not deducted from this

measure.

SEALED AIR CORPORATION

SUPPLEMENTARY INFORMATION

RECONCILIATION OF U.S. GAAP NET

EARNINGS AND U.S. GAAP NET EARNINGS PER COMMON SHARE TO

NON-U.S. GAAP ADJUSTED NET EARNINGS AND

NON-U.S. GAAP ADJUSTED NET EARNINGS PER COMMON

SHARE(1)

(Unaudited)

(In millions, except per share

data)

Three Months Ended September 30, Nine Months Ended

September 30, 2017 2016 2017 2016

(In millions, except per share data)

NetEarnings

EPS

NetEarnings

EPS NetEarnings EPS

NetEarnings EPS

U.S. GAAP net earnings and EPS

available

to common stockholders from

continuing operations(2)

$ 62.4 $ 0.33 $ 63.8 $ 0.32 $ 37.8 $ 0.19 $ 141.1 $ 0.71 Special

items(3) 24.2 0.13 17.0 0.09 201.7

1.05 95.6 0.48

Non-U.S. GAAP adjusted net earnings

and

adjusted EPS available to

common

stockholders from continuing

operations

$ 86.6 $ 0.46 $ 80.8 $ 0.41 $ 239.5

$ 1.24 $ 236.7 $ 1.19

Weighted average number of common

sharesoutstanding - Diluted

188.9 196.7 192.9 197.5

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) Net earnings per common

share is calculated under the two-class method. (3) Special Items

include the following:

Three Months EndedSeptember

30,

Nine Months EndedSeptember

30,

(In millions, except per share data) 2017 2016

2017

2016(1)

Special Items: Restructuring and other charges $ (6.2 ) $ (1.3 ) $

(9.2 ) $ (1.1 )

Other restructuring associated costs

included in cost of sales

and selling, general and administrative

expenses

(2.9 ) (5.2 ) (12.7 ) (13.2 ) SARs — 0.3 — (0.7 )

Foreign currency exchange loss related to

Venezuelan

subsidiaries

— — — (1.6 ) Charges related to ceasing operations in Venezuela(1)

— — — (47.3 )

Gain (loss) on sale of North American foam

trays and

absorbent pads business and European food

trays

business

0.2 — 2.3 (1.6 )

(Loss) gain related to the sale of other

businesses,

investments and property, plant and

equipment

(6.9 ) 2.1 (7.1 ) — Charges related to the sale of Diversey (13.7 )

— (47.6 ) —

Settlement/curtailment benefits related to

retained Diversey

retirement plans

13.5 — 13.5 — Other special items(2) (2.9 ) (3.5 ) (0.2 ) (3.2 )

Pre-tax impact of special items (18.9 ) (7.6 ) (61.0 ) (68.7

) Tax impact of special items and tax special items(3) (5.3 ) (9.4

) (140.7 ) (26.9 ) Net impact of special items $ (24.2 ) $

(17.0 ) $ (201.7 ) $ (95.6 )

Weighted average number of common shares

outstanding -

Diluted

188.9 196.7 192.9 197.5 Earnings

per share impact from special items $ (0.13 ) $ (0.09 ) $ (1.05 ) $

(0.48 )

_______________

(1) Due to the ongoing challenging economic situation in

Venezuela, the Company approved a program in the second quarter of

2016 to cease operations in the country. This resulted in total

costs of $47.3 million being incurred which included a voluntary

reduction in headcount including severance and termination benefits

for employees of approximately $0.3 million recorded in

restructuring and other charges, depreciation and amortization

expense related to fixed assets and intangibles of approximately

$0.6 million recorded in selling, general and administrative

expenses, inventory reserves of $0.4 million recorded in costs of

sales and the release of cumulative translation adjustment of

approximately $46.0 million recorded in charges related to

Venezuelan subsidiaries. (2) Other special items for the three and

nine months ended September 30, 2017 primarily included transaction

fees related to various divestitures and acquisitions. Other

special items for the three and nine months ended September 30,

2016 primarily included a reduction in a non-income tax reserve

following the completion of a governmental audit partially offset

by legal fees associated with restructuring and acquisitions. (3)

Refer to Note 1 to the table below for a description of Special

Items related to tax.

The calculation of the non-U.S. GAAP Adjusted income tax rate is

as follows:

Three months ended

September30,

Nine months ended

September30,

(In millions) 2017 2016 2017

2016

U.S. GAAP Earnings before income tax

provision from

continuing operations

$ 106.1 $ 117.9 $ 274.3 $ 265.8 Pre-tax impact of special items

(18.9 ) (7.6 ) (61.0 ) (68.7 )

Non-U.S. GAAP Adjusted Earnings before

income tax

provision from continuing operations

$ 125.0 $ 125.5 $ 335.3 $ 334.5

U.S. GAAP Income tax provision from continuing operations $ 43.7 $

54.1 $ 236.5 $ 124.7 Tax Special Items(1) (0.4 ) (5.6 ) (150.3 )

(26.8 ) Tax impact of Special Items (4.9 ) (3.8 ) 9.6 (0.1 )

Non-U.S. GAAP Adjusted Income tax

provision from

continuing operations

$ 38.4 $ 44.7 $ 95.8 $ 97.8 U.S.

GAAP Effective income tax rate 41.2 % 45.9 % 86.2 % 46.9 % Non-U.S.

GAAP Adjusted income tax rate 30.7 % 35.6 % 28.6 % 29.2 %

_______________

(1) For the nine months ended September 30, 2017, the

special tax items included $145 million of tax expense recorded in

accordance with the pending sale of Diversey.

SEALED AIR CORPORATION

SUPPLEMENTARY INFORMATION

SEGMENT INFORMATION(1)

(Unaudited)

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, (In millions) 2017

2016 2017 2016 Net Sales: Food Care $

716.0 $ 676.2 $ 2,051.1 $ 1,979.2 As a % of Total Company net sales

63.3 % 63.5 % 63.4 % 63.6 % Product Care 415.3 388.9 1,182.7

1,130.7 As a % of Total Company net sales 36.7 % 36.5 % 36.6 % 36.4

%

Total Company Net Sales $ 1,131.3

$ 1,065.1 $ 3,233.8

$ 3,109.9 Three Months

EndedSeptember 30, Nine Months EndedSeptember

30, (In millions) 2017 2016 2017

2016 Adjusted EBITDA from continuing

operations(2): Food Care $ 158.3 $ 155.6 $ 446.0

$ 440.7 Adjusted EBITDA Margin 22.1 % 23.0 % 21.7 % 22.3 % Product

Care 86.5 88.0 237.7 243.8 Adjusted EBITDA Margin 20.8 % 22.6 %

20.1 % 21.6 % Corporate(3) (28.0

)

(30.7

)

(88.7

)

(91.7

)

Non-U.S. GAAP Total Company Adjusted

EBITDA from

continuing operations

$ 216.8 $ 212.9 $

595.0 $ 592.8 Adjusted EBITDA

Margin 19.2 % 20.0 % 18.4 % 19.1 %

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) As of January 1, 2017 we

modified our calculation of Adjusted EBITDA to exclude interest

income. The impact in this modification was $1.6 million and $5.3

million for the three and nine months ended September 30, 2016,

respectively. (3) Unallocated costs related to Diversey that have

been included in adjusted EBITDA for Corporate were as follows:

Three Months

EndedSeptember 30, Nine Months EndedSeptember

30, (In millions) 2017 2016 2017

2016 Unallocated costs $ 2.8 $ 3.5 $ 13.7 $ 10.4

SEALED AIR CORPORATION

SEGMENT INFORMATION – CONTINUED

SUPPLEMENTARY

INFORMATION(1)

RECONCILIATION OF U.S. GAAP NET

EARNINGS TO

NON-U.S. GAAP TOTAL COMPANY ADJUSTED

EBITDA

(Unaudited)

Three Months EndedSeptember 30, Nine Months

EndedSeptember 30, (In millions) 2017

2016 2017 2016(2) U.S. GAAP Net

earnings from continuing operations $ 62.4 $ 63.8 $ 37.8 $

141.1 Interest expense (54.0 ) (49.6 ) (153.7 ) (151.4 ) Interest

income 4.9 1.7 10.3 5.3 Income tax provision 43.7 54.1 236.5 124.7

Depreciation and amortization(4) (42.7 ) (39.6 ) (116.3 ) (113.0 )

Accelerated depreciation and amortization

of fixed assets

and intangible assets for Venezuelan

subsidiaries

— 0.1 — 0.8 Special Items: Restructuring and other charges(5) (6.2

) (1.3 ) (9.2 ) (1.1 )

Other restructuring associated costs

included in cost of

sales and selling, general and

administrative expenses

(2.9 ) (5.2 ) (12.7 ) (13.2 ) SARs — 0.3 — (0.7 )

Foreign currency exchange loss related to

Venezuelan

subsidiaries

— — — (1.6 ) Charges related to ceasing operations in Venezuela — —

(47.3 )

Gain (loss) on sale of North American foam

trays and

absorbent pads business and European food

business

0.2 — 2.3 (1.6 )

(Loss) gain related to the sale of other

businesses,

investments and property, plant and

equipment

(6.9 ) 2.1 (7.1 ) — Charges incurred related to the sale of

Diversey (13.7 ) — (47.6 ) —

Settlement/curtailment benefits related to

retained

Diversey retirement plans

13.5 — 13.5 — Other special items(3) (2.9 ) (3.5 ) (0.2 ) (3.2 )

Pre-tax impact of Special items (18.9 ) (7.6 ) (61.0 ) (68.7 )

Non-U.S. GAAP Total Company Adjusted

EBITDA from

continuing operations

$ 216.8 $ 212.9 $

595.0 $ 592.8

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) Due to the ongoing

challenging economic situation in Venezuela, the Company approved a

program in the second quarter of 2016 to cease operations in the

country. This resulted in total costs of $47.3 million being

incurred which included a voluntary reduction in headcount

including severance and termination benefits for employees of

approximately $0.3 million recorded in restructuring and other

charges, depreciation and amortization expense related to fixed

assets and intangibles of approximately $0.6 million recorded in

selling, general and administrative expenses, inventory reserves of

$0.4 million recorded in costs of sales and the release of

cumulative translation adjustment of approximately $46.0 million

recorded in charges related to Venezuelan subsidiaries. (3) For the

three and nine months ended September 30, 2017, primarily included

transaction fees related to various divestitures and acquisitions.

Other special items for the three and nine months ended September

30, 2016 primarily included a reduction in a non-income tax reserve

following the completion of a governmental audit partially offset

by legal fees associated with restructuring and acquisitions. (4)

Depreciation and amortization by segment are as follows:

Three Months

EndedSeptember 30, Nine Months EndedSeptember

30, (In millions) 2017 2016 2017

2016 Food Care $ 26.4 $ 23.1 $ 75.8 $ 68.3 Product Care 11.7

9.6 34.2 28.6 Corporate 4.6 6.9 6.3 16.1

Total Company depreciation and amortization(1)

$ 42.7 $ 39.6 $

116.3 $ 113.0

_______________

(1) Includes share-based incentive compensation of $12.3

million and $31.2 million for the three and nine months ended

September 30, 2017, respectively, and $12.2 million and $37.6

million for the three and nine months ended September 30, 2016,

respectively.

(5)

Restructuring and other charges by segment

is as follows:

Three Months

EndedSeptember 30, Nine Months EndedSeptember

30, (In millions) 2017 2016 2017

2016 Food Care $ 3.9 $ 0.8 $ 5.8 $ 0.7 Product Care 2.3

0.5 3.4 0.4

Total Company restructuring and

other charges(1) $ 6.2 $

1.3 $ 9.2 $ 1.1

_______________

(1) For the nine months ended September 30, 2016

restructuring and other charges excludes $0.3 million related to

severance and termination benefits for employees in our Venezuelan

subsidiaries.

SEALED AIR

CORPORATION SUPPLEMENTARY INFORMATION COMPONENTS OF

CHANGE IN NET SALES BY SEGMENT(1) Three Months

Ended September 30, (Unaudited) (In millions) Food

Care Product Care Total Company 2016 Net Sales $

676.2

$

388.9 $

1,065.1

Volume - Units 31.1 4.6 % 23.9 6.1 % 55 5.2 % Price/mix(2) (1.1 )

(0.2 )% (0.9 ) (0.2 )% (2.0 ) (0.2 )%

Total constant dollar change (Non-U.S.

GAAP)(3)

30.0

4.4 %

23.0

5.9 %

53.0

5.0

%

Foreign currency translation

9.8 1.5 % 3.4 0.9 % 13.2 1.2 %

Total change (U.S. GAAP)

39.8 5.9 % 26.4 6.8 %

66.2 6.2 %

2017 Net Sales $

716.0

$ 415.3 $

1,131.3

Nine Months Ended September 30,

(Unaudited) (In millions) Food Care Product

Care Total Company 2016 Net Sales $

1,979.2

$ 1,130.70 $

3,109.9

Volume - Units 68.8 3.5 % 65.2 5.8 %

134.0

4.4 % Price/mix(2) (7.7 ) (0.4 )% (7.7 ) (0.7 )% (15.4 ) (0.5 )%

Total constant dollar change (Non-

U.S. GAAP)(3)

61.1 3.1 % 57.5 5.1 % 118.6 3.9 % Foreign currency translation 10.8

0.5 % (5.5 ) (0.5 )% 5.3 0.1 %

Total change (U.S. GAAP)

71.9 3.6 %

52.0

4.6 % 123.9

4.0

%

2017 Net Sales $

2,051.1

$

1,182.7

$

3,233.8

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly report on Form 10-Q with the

Securities and Exchange Commission. (2) Our price/mix reported

above includes the net impact of our pricing actions and rebates as

well as the period-to-period change in the mix of products sold.

Also included in our reported price/mix is the net effect of some

of our customers purchasing our products in non-U.S. dollar or

euro-denominated countries at selling prices denominated in U.S.

dollars or euros. This primarily arises when we export products

from the U.S. and euro-zone countries. (3) Total constant dollar

change is a non-U.S. GAAP financial measure which excludes the

impact of foreign currency translation. Since we are a U.S.

domiciled company, we translate our foreign currency denominated

financial results into U.S. dollars. Due to changes in the value of

foreign currencies relative to the U.S. dollar, translating our

financial results from foreign currencies to U.S. dollars may

result in a favorable or unfavorable impact. It is important that

we take into account the effects of foreign currency translation

when we view our results and plan our strategies. Nonetheless, we

cannot control changes in foreign currency exchange rates.

Consequently, when our management looks at our financial results to

measure the core performance of our business, we exclude the impact

of foreign currency translation by translating our current period

results at prior period foreign currency exchange rates. We also

may exclude the impact of foreign currency translation when making

incentive compensation determinations. As a result, our management

believes that these presentations are useful internally and may be

useful to our investors.

SEALED AIR

CORPORATION SUPPLEMENTARY INFORMATION COMPONENTS OF

CHANGE IN NET SALES BY REGION(1) Three Months

Ended September 30, (Unaudited) (In millions) North

America EMEA(2) Latin America

APAC(3) Total 2016 net sales $ 581.4 $ 232.3 $

98.8 $ 152.6 $

1,065.1

Volume - Units 38.6 6.6 % 6.6 2.8 % 3.2 3.2 % 6.6 4.3 %

55.0

5.2 % Price/mix(4) 1.8 0.3 % (1.3 ) (0.6 )% (0.9 ) (0.9 )%

(1.6 ) (1.0 )% (2.0 ) (0.2 )% Total constant dollar change

(Non-U.S. GAAP)(5) 40.4 6.9 % 5.3 2.2 % 2.3 2.3 %

5.0

3.3 %

53.0

5.0

% Foreign currency translation 1.4 0.2 % 10.2 4.4 %

0.4 0.4 % 1.2 0.8 % 13.2 1.2 %

Total change

(U.S. GAAP) 41.8 7.2 % 15.5

6.7 % 2.7 2.7 % 6.2

4.1 % 66.2 6.2 %

2017 net sales $

623.2 $ 247.8 $

101.5 $ 158.8 $

1,131.3

Nine Months Ended September 30,

(Unaudited) (In millions) North America

EMEA(2) Latin America APAC(3)

Total 2016 net sales $

1,657.8

$ 716.5 $ 289.1 $ 446.5 $

3,109.9

Volume - Units 127.7 7.7 % 1.1 0.2 % (1.4 ) (0.5 )% 6.6 1.4 %

134.0

4.4 % Price/mix(4) (8.7 ) (0.5 )% (7.4 ) (1.0 )% 4.4 1.5 %

(3.7 ) (0.8 )% (15.4 ) (0.5 )% Total constant dollar change

(Non-U.S. GAAP)(5)

119.0

7.2 % (6.3 ) (0.8 )%

3.0

1.0

% 2.9 0.6 % 118.6 3.9 % Foreign currency translation 1.1 — %

(3.5 ) (0.6 )% 2.1 0.7 % 5.6 1.3 % 5.3 0.1 %

Total change (U.S. GAAP) 120.1 7.2 %

(9.8 ) (1.4 )% 5.1 1.7

% 8.5 1.9 % 123.9

4.0

%

2017 net

sales $

1,777.9

$ 706.7 $ 294.2

$

455.0

$

3,233.8

_______________

(1) The supplementary information included in this press

release for 2017 is preliminary and subject to change prior to the

filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) EMEA consists of Europe,

Middle East, Africa and Turkey. (3) APAC refers collectively to our

Asia Pacific region. This region consists of i) Greater China, ii)

India/Southeast Asia and iii) Australia, New Zealand, Japan and

Korea. (4) Our price/mix reported above includes the net impact of

our pricing actions and rebates as well as the period-to-period

change in the mix of products sold. Also included in our reported

price/mix is the net effect of some of our customers purchasing our

products in non-U.S. dollar or euro-denominated countries at

selling prices denominated in U.S. dollars or euros. This primarily

arises when we export products from the U.S. and euro-zone

countries. (5) Total constant dollar change is a non-U.S. GAAP

financial measure which excludes the impact of foreign currency

translation. Since we are a U.S. domiciled company, we translate

our foreign currency denominated financial results into U.S.

dollars. Due to changes in the value of foreign currencies relative

to the U.S. dollar, translating our financial results from foreign

currencies to U.S. dollars may result in a favorable or unfavorable

impact. It is important that we take into account the effects of

foreign currency translation when we view our results and plan our

strategies. Nonetheless, we cannot control changes in foreign

currency exchange rates. Consequently, when our management looks at

our financial results to measure the core performance of our

business, we exclude the impact of foreign currency translation by

translating our current period results at prior period foreign

currency exchange rates. We also may exclude the impact of foreign

currency translation when making incentive compensation

determinations. As a result, our management believes that these

presentations are useful internally and may be useful to our

investors.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171108005472/en/

For Sealed Air CorporationInvestor RelationsLori Chaitman,

704-503-8841

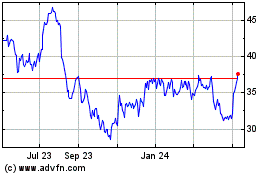

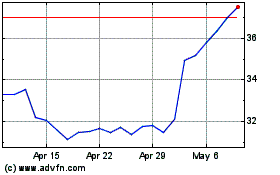

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sealed Air (NYSE:SEE)

Historical Stock Chart

From Apr 2023 to Apr 2024