Schneider Electric and AVEVA to Create a Global Leader in Industrial Software

July 20 2015 - 2:07AM

Business Wire

Regulatory News:

Schneider Electric SE (Paris:SU) announces today it has reached

a preliminary, non-binding agreement with AVEVA Group PLC (“AVEVA”)

on the key terms and conditions of a combination of selected

Schneider Electric industrial software assets and AVEVA (forming

the “Enlarged AVEVA Group”).

It is expected that the proposed transaction would:

1. create a global leader in industrial software, with a unique

portfolio of asset management solutions from design & build to

operations, with both scale and a distinct market position to

address critical customer requirements along the full asset life

cycle in key industrial and infrastructure markets;

2. unlock additional value at enlarged AVEVA and Schneider

Electric through the potential for material revenue and costs

synergies, leveraging on complementary end-markets exposures,

customer bases and product portfolios;

3. establish a ‘best in class’ management team and increased

brand profile for attracting further talent; and

4. realize the full value of the contributed industrial software

assets.

The enlarged AVEVA would have combined revenues and Adjusted

EBITA of c. £534 million and c. £130 million, respectively. It is

expected that the Enlarged AVEVA Group will continue to be admitted

to listing on the Official List of the UK Listing Authority and to

trade on the London Stock Exchange plc’s main market for listed

securities. Schneider Electric intends to comply with the Listing

Rules of the UKLA. As part of the transaction, Schneider Electric

would contribute a selection of its industrial software assets to

AVEVA and make a cash payment of £550m to AVEVA, (which would

subsequently be distributed to AVEVA shareholders excluding

Schneider Electric) in exchange for the issuance of new AVEVA

shares, giving Schneider Electric a majority stake of 53.5% in the

Enlarged AVEVA Group on a fully-diluted basis. Schneider Electric

would fully consolidate the business in its Group financials.

In addition to any consultation procedures involving the

personnel's representative bodies that may be required, the

transaction remains subject to, amongst other things, the

completion of mutual due diligence to the satisfaction of both

parties, agreement on the terms of legal documentation, the

approval of the respective Boards of Schneider Electric and AVEVA,

AVEVA shareholder approval and relevant anti-trust and regulatory

approvals (if required). In accordance with the applicable law and

regulation of the United Kingdom, a more detailed public

announcement has been released today and is available on the AVEVA

and Schneider Electric websites as well as on the AMF (French

regulatory authority) website.

A further announcement will be made as and when appropriate.

About Schneider Electric

As a global specialist in energy management with operations in

more than 100 countries, Schneider Electric offers integrated

solutions across multiple market segments, including leadership

positions in Utilities & Infrastructure, Industries &

Machines Manufacturers, Non-residential Building, Data Centers

& Networks and in Residential. Focused on making energy safe,

reliable, efficient, productive and green, the Group's 170,000

employees achieved revenues of 25 billion euros in 2014, through an

active commitment to help individuals and organizations make the

most of their energy.

www.schneider-electric.com

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150719005034/en/

Schneider ElectricInvestor Relations :Anthony

Song, +33 (0) 1 41 29 83 29Fax : +33 (0) 1 41 29 71

42orPress:Véronique Roquet-Montégon, +33 (0)1 41 29

70 76Fax : +33 (0)1 41 29 88 14orDGMPress

:Michel Calzaroni, +33 (0)1 40 70 11 89Fax : +33 (0)1 40

70 90 46orOlivier Labesse, +33 (0)1 40 70 11 89Fax : +33

(0)1 40 70 90 46

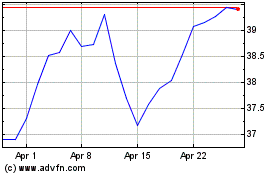

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Suncor Energy (NYSE:SU)

Historical Stock Chart

From Apr 2023 to Apr 2024