Sanofi Lifts Profit Outlook -- Update

October 28 2016 - 4:10AM

Dow Jones News

By Noemie Bisserbe

PARIS--French drugmaker Sanofi on Friday lifted its profit

outlook for the year after posting better-than-expected

third-quarter earnings, and said it planned to complete a EUR3.5

billion ($3.82 billion) share buyback by the end of 2017.

Shares were trading 5.5% higher at EUR72.63 in early trading in

Paris.

Sanofi said it now expected earnings per share--excluding the

impact of acquisitions and divestments--to grow between 3% and 5%

in 2016 at constant exchange rates. Sanofi previously said earnings

per share would remain "broadly stable" this year. Weakening

currencies could, however, have a 4% negative impact on revenues in

2016, the company warned.

The Paris-based drugmaker said net profit rose by 3% to EUR1.67

billion for the three months through September, buoyed by higher

biotech drug and vaccine sales and lower costs.

Business net income, the company's term for adjusted income

excluding the impact of acquisitions and divestments, increased 10%

to EUR2.3 billion, above analysts' expectations of EUR1.93 billion,

according to a Dow Jones Newswires poll. Sanofi's total sales

increased 2% to EUR9.03 billion.

Sanofi's results this quarter show how the French drugmaker's

long-drawn-out efforts to cut costs to boost its profitability are

finally paying off. However, the dwindling revenue of its

all-important diabetes division reflect continuing pricing pressure

in the U.S. market.

Diabetes drug sales, which account for about 20% of the

company's revenue, fell 2% to EUR1.81 billion in the third-quarter,

hurt by a 10% drop in Lantus insulin sales. Sanofi's vaccine

division and its biotech unit Genzyme, which respectively posted a

14% and 17% jump in the third-quarter, helped offset lower diabetes

sales this quarter.

To boost growth, Sanofi has pledged to refocus the company on

fewer businesses, and replenish its new drugs pipeline.

In August, however, Sanofi was defeated by pharmaceutical giant

Pfizer Inc. in the race to acquire U.S. innovative cancer drugmaker

Medivation Inc.

One of the company's promising new drugs, rheumatoid arthritis

treatment Sarilumab, also suffered a setback, after regulators

found manufacturing deficiencies at a French plant, Sanofi said

Friday.

"These deficiencies may potentially impact the timing of the

approval," Chief Executive Olivier Brandicourt told reporters in a

conference call.

The company previously said it expected to receive approval for

Sarimulab from the U.S. Food and Drug Administration, or FDA, in

the fourth quarter of 2016.

"We are working with the U.S. FDA to resolve these issues as

quickly as possible," Mr. Brandicourt added.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

October 28, 2016 03:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

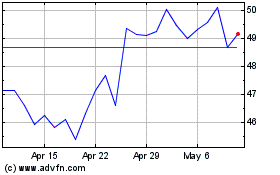

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

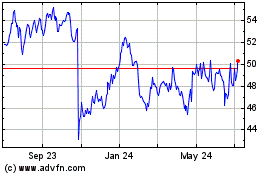

Sanofi (NASDAQ:SNY)

Historical Stock Chart

From Apr 2023 to Apr 2024