Samsung BioLogics Aims to Raise Up to $2.5 Billion From IPO

August 10 2016 - 4:10AM

Dow Jones News

Samsung BioLogics Co., the contract drug manufacturing unit of

South Korean conglomerate Samsung Group, is planning to raise as

much as $2.5 billion from an initial public offering that would

value it at roughly $10 billion, according to people familiar with

the matter.

The company, which manufactures complex biologic drugs on behalf

of clients like Bristol-Myers Squibb Co. and Roche Holding AG,

expects to file this week for approval to list shares in South

Korea, one of the people said. It expects to complete the share

offering in the fourth quarter of this year, the person said.

Samsung BioLogics is expected to offer between 10% and 25% of

its shares to the public based on South Korean listing requirements

and investor demand, meaning the company could end up raising

between $1 billion and $2.5 billion, one of the people said.

The biggest IPO globally this year was in May, when Danish

utility Dong Energy AS raised $2.61 billion.

Samsung announced plans to list the unit in April, without

giving details on the exact timing or size of the IPO.

While Samsung is best known for its crown jewel, smartphone and

semiconductor maker Samsung Electronics Co., the vice chairman and

heir apparent of the conglomerate, Lee Jae-yong, has poured

billions of dollars into the emerging field of biologic drugs. Such

drugs are complex to make because they are based on living cells

used to treat a variety of illnesses, including cancer and

arthritis, differentiating them from simpler, chemically

synthesized drugs like aspirin.

Mr. Lee is betting that biologic drugs can become a new growth

engine for Samsung as the long-term outlook for smartphones and

semiconductors grows more uncertain.

In addition to manufacturing biologic drugs on behalf of other

companies, Samsung has another affiliate, Samsung Bioepis Co.,

which develops near-replicas of existing biologic drugs that are

soon to lose patent protection, called biosimilars. Samsung Bioepis

was on track for an initial public offering on the Nasdaq Stock

Market earlier this year, but the IPO was shelved amid market

volatility at the beginning of the year.

Samsung BioLogics is 51% owned by the Samsung Group's de facto

holding company, Samsung C&T Corp. Samsung Electronics owns

about 47%. Samsung BioLogics owns 91.2% of Samsung Bioepis.

Samsung BioLogics said in May that Korea Investment Holdings Co.

Ltd. and NH Investment & Securities Co. Ltd. will lead the

share sale domestically, while overseas duties will be handled by

Citigroup Inc., J.P. Morgan Chase & Co. and Credit Suisse Group

AG.

Samsung BioLogics is one of the world's largest manufacturers of

biologic drugs by capacity. Late last year, the company broke

ground on a third plant, the world's largest with 180,000 liters of

capacity, and is already considering additional plants.

When the third plant begins operations, expected in late 2018,

Samsung BioLogics will have a drug-manufacturing capacity of

360,000 liters, putting it ahead of rivals Lonza Group of

Switzerland and Germany's Boehringer Ingelheim GmbH.

Write to Alec Macfarlane at Alec.Macfarlane@wsj.com and Jonathan

Cheng at jonathan.cheng@wsj.com

(END) Dow Jones Newswires

August 10, 2016 03:55 ET (07:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

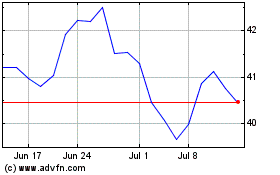

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

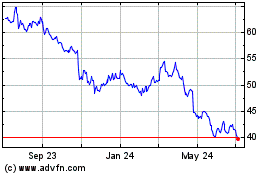

Bristol Myers Squibb (NYSE:BMY)

Historical Stock Chart

From Apr 2023 to Apr 2024