Sally Beauty Holdings, Inc. (NYSE: SBH) (the “Company”) today

announced financial results for its fiscal 2017 third quarter ended

June 30, 2017. The Company will hold a conference call today at

7:30 a.m. (Central) to discuss these results and its business.

Fiscal 2017 Third Quarter Highlights

Reported diluted earnings per share in the third quarter were

$0.49, growth of 6.5% compared to the prior year’s third quarter.

Adjusted diluted earnings per share (excluding $5.1 million of

charges related to the Restructuring Plan announced in February

2017) were $0.52, growth of 10.6% compared to the prior year.

Consolidated net sales were $998.0 million in the third quarter,

essentially flat when compared to the prior year. Same store sales

growth of 0.3% and incremental sales from new stores were partially

offset by unfavorable foreign currency translation, the latter of

which negatively impacted revenue growth by $10.2 million, or

approximately 100 basis points. Additionally, the Company lost a

day of sales in the third quarter due to the shift of the Easter

holiday from March in the prior fiscal year to April this fiscal

year, which negatively impacted both sales growth and same store

sales growth in the quarter by approximately 60 basis points.

Gross margin for the third quarter increased 40 basis points to

50.4%, driven primarily by strategic pricing initiatives and

reduced reliance on promotional activity in the Sally Beauty

segment.

Selling, general and administrative (“SG&A”) expenses in the

third quarter, excluding depreciation and amortization expense,

were 33.9% of sales vs. 34.0% of sales in the prior year.

Reported operating earnings and operating margin in the third

quarter were $130.3 million and 13.1%, respectively, compared to

reported operating earnings and operating margin of $134.1 million

and 13.4%, respectively, in the prior year. Adjusted operating

earnings and operating margin were $135.4 million and 13.6%,

respectively, essentially flat when compared to the prior year’s

adjusted operating earnings and operating margin.

The Company repurchased (and subsequently retired) a total of

6.2 million shares of common stock during the quarter at an

aggregate cost of $117.6 million. Share repurchases through the

first three quarters of the fiscal year were approximately $286.5

million.

“We are pleased to report solid third quarter results, with

improved revenue performance, excellent gross margin expansion and

meaningful growth in adjusted earnings per share,” said Chris

Brickman, Sally Beauty Holding’s President and Chief Executive

Officer. “Our results reflect a balanced approach to managing our

business in a challenging retail environment, combining appropriate

long-term strategic investments with an unrelenting focus on

operating discipline and organizational efficiencies.

“Our effort to position the Company for better financial

performance extends to our capital structure. As we announced

shortly after quarter end, we refinanced $850 million of our

long-term debt in early July by redeeming higher cost senior notes

with funds generated from a new, lower cost institutional term

loan, a move that should generate a significant reduction in annual

cash interest expense.

“We intend to execute on our strategic priorities and strive for

additional gross margin improvement and cost savings in order to

achieve our financial goals for the year and deliver even better

results in fiscal 2018.”

Additional Fiscal 2017 Third Quarter Details

Reported net earnings in the quarter were $66.5 million, a

decrease of $1.4 million, or 2.0%, from the prior year. Adjusted

EBITDA in the quarter was $167.0 million, an increase of $3.3

million, or 2.0%, from the prior year. Adjusted EBITDA margin was

16.7% in the quarter compared to 16.4% in the prior year.

Inventory at quarter end was $947.6 million, up 4.2% from the

prior year. The increase was due primarily to new store growth and

the addition of new brands, partially offset by the impact of a

stronger U.S. dollar.

Capital expenditures in the quarter were $17.1 million, and

fiscal year to date capital expenditures were $64.0 million,

primarily for information technology projects, new stores openings

and distribution facility upgrades.

Fiscal 2017 Guidance

Based on fiscal year to date results and expectations for the

fiscal fourth quarter, the Company is maintaining its expectation

of approximately flat full year consolidated same store sales

growth, and now expects full year net new store growth of

approximately 1.5%. The Company expects full year gross margin

expansion of approximately 30 basis points, full year adjusted

SG&A in the range of 34.2% to 34.4% of sales, and full year

reported and adjusted operating income growth of approximately flat

to the prior year. Taking further into account the expected

benefits from the recent debt refinancing and the year to date

share repurchases, the Company expects solid growth in both

reported and adjusted full year earnings per share.

Fiscal 2017 Third Quarter Segment Results

Sally Beauty Supply (“Sally”)

- Sales were $594.9 million in the third

quarter, down 1.3% vs. the prior year. Sales growth was partially

offset by unfavorable foreign currency translation of 150 basis

points and the impact of the shift of the Easter holiday of 70

basis points. Same store sales were down 0.8%. The Easter calendar

shift negatively impacted same store sales by approximately 70

basis points.

- Net store count at quarter end

increased by 76, to 3,826, from the prior year’s third

quarter.

- Gross margin increased 80 basis points

to 56.0% in the third quarter. Gross margin benefitted from

strategic pricing initiatives and a reduced reliance on promotional

activity in the U.S.

- Operating earnings were $104.9 million

in the third quarter, essentially flat vs. the prior year.

Operating earnings were negatively impacted by the sales decline,

labor inflation and new store opening costs, offset by the strong

gross margin expansion and reduction of discretionary operating

expenses. Operating margin was 17.6%, a 20 basis point improvement

from the prior year.

Beauty Systems Group (“BSG”)

- Sales were $403.2 million in the third

quarter, up 1.9% vs. the prior year, driven by growth in same store

sales, incremental sales from acquisitions and net new stores.

Sales growth was partially offset by unfavorable foreign currency

translation of 30 basis points and the impact of the shift of the

Easter holiday of 40 basis points. Same store sales growth was

2.8%. The Easter calendar shift negatively impacted same store

sales by approximately 50 basis points.

- Net store count at quarter end

increased by 40, to 1,362, from the prior year’s third

quarter.

- Gross margin in the third quarter was

42.0%, flat when compared to the prior year.

- Operating earnings were $67.3 million

in the third quarter, up 3.3% from the prior year, driven by the

modest revenue growth and SG&A leverage. Operating margin was

16.7%, a 20 basis point improvement from the prior year.

- Total distributor sales consultants at

quarter end were 839 vs. 925 at the end of the prior year’s third

quarter. This decrease is due primarily to a decline in the number

of distributor sales consultants employed by the Company’s

Armstrong McCall franchise business.

Conference Call and Where You Can Find Additional

Information

The Company will hold a conference call and audio webcast today

to discuss its financial results and its business at approximately

7:30 a.m. (Central). During the conference call, the Company may

discuss and answer one or more questions concerning business and

financial matters and trends affecting the Company. The Company’s

responses to these questions, as well as other matters discussed

during the conference call, may contain or constitute material

information that has not been previously disclosed. Simultaneous to

the conference call, an audio webcast of the call will be available

via a link on the Company’s website,

investor.sallybeautyholdings.com. The conference call can be

accessed by dialing 800-230-1093 (International: 612-332-0228). The

teleconference will be held in a “listen-only” mode for all

participants other than the Company’s current sell-side and

buy-side investment professionals. If you are unable to listen to

this conference call, the replay will be available at about 9:30

a.m. (Central) August 3, 2017, through August 10, 2017, by dialing

800-475-6701 or if international dial 320-365-3844 and reference

the conference ID number 427540. Also, a website replay will be

available on investor.sallybeautyholdings.com

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH) is an international

specialty retailer and distributor of professional beauty supplies

with revenues of approximately $4.0 billion annually. Through the

Sally Beauty Supply and Beauty Systems Group businesses, the

Company sells and distributes through over 5,000 stores, including

approximately 182 franchised units, throughout the United States,

the United Kingdom, Belgium, Chile, Peru, Colombia, France, the

Netherlands, Canada, Puerto Rico, Mexico, Ireland, Spain and

Germany. Sally Beauty Supply stores offer up to 9,000 products for

hair, skin, and nails through professional lines such as OPI®,

China Glaze®, Wella®, Clairol®, Conair® and Hot Shot Tools®, as

well as an extensive selection of proprietary merchandise. Beauty

Systems Group stores, branded as CosmoProf or Armstrong McCall

stores, along with its outside sales consultants, sell up to 10,000

professionally branded products including Paul Mitchell®, Wella®,

Matrix®, Schwarzkopf®, Kenra®, Goldwell®, Joico® and Aquage®,

intended for use in salons and for resale by salons to retail

consumers. For more information about Sally Beauty Holdings, Inc.,

please visit sallybeautyholdings.com.

Cautionary Notice Regarding Forward-Looking

Statements

Statements in this news release and the schedules hereto which

are not purely historical facts or which depend upon future events

may be forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Words such as

“anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,”

“project,” “target,” “can,” “could,” “may,” “should,” “will,”

“would,” or similar expressions may also identify such

forward-looking statements.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements, including, but not limited to, risks

and uncertainties related to: anticipating and effectively

responding to changes in consumer and professional stylist

preferences and buying trends in a timely manner; the success of

our strategic initiatives, including our store refresh program and

increased marketing efforts, to enhance the customer experience,

attract new customers, drive brand awareness and improve customer

loyalty; our ability to efficiently manage and control our costs

and the success of our cost control plans, including our recently

announced restructuring plan; our ability to implement our

restructuring plan in various jurisdictions; our ability to manage

the effects of our cost reduction plans on our employees and other

operations costs; charges related to the restructuring plan;

possible changes in the size and components of the expected costs

and charges associated with the restructuring plan; our ability to

realize the anticipated cost savings from the restructuring plan

within the anticipated time frame, if at all; the highly

competitive nature of, and the increasing consolidation of, the

beauty products distribution industry; the timing and acceptance of

new product introductions; shifts in the mix of product sold during

any period; potential fluctuation in our same store sales and

quarterly financial performance; our dependence upon manufacturers

who may be unwilling or unable to continue to supply products to

us; our dependence upon manufacturers who have developed or could

develop their own distribution businesses which compete directly

with ours; the possibility of material interruptions in the supply

of products by our third-party manufacturers or distributors or

increases in the prices of products we purchase from our

third-party manufacturers or distributors; products sold by us

being found to be defective in labeling or content; compliance with

current laws and regulations or becoming subject to additional or

more stringent laws and regulations; the success of our e-commerce

businesses; diversion of professional products sold by Beauty

Systems Group to mass retailers or other unauthorized resellers;

the operational and financial performance of our franchise-based

business; successfully identifying acquisition candidates and

successfully completing desirable acquisitions; integrating

acquired businesses; the success of our initiatives to expand into

new geographies; the success of our existing stores, and our

ability to increase sales at existing stores; opening and operating

new stores profitably; the volume of traffic to our stores; the

impact of the general economic conditions upon our business; the

challenges of conducting business outside the United States; the

impact of Britain’s recent decision to leave the European Union and

related or other disruptive events in the European Union or other

geographies in which we conduct business; rising labor and rental

costs; protecting our intellectual property rights, particularly

our trademarks; the risk that our products may infringe on the

intellectual property rights of others; successfully updating and

integrating our information technology systems; disruption in our

information technology systems; a significant data security breach,

including misappropriation of our customers’, or employees’ or

suppliers’ confidential information, and the potential costs

related thereto; the negative impact on our reputation and loss of

confidence of our customers, suppliers and others arising from a

significant data security breach; the costs and diversion of

management’s attention required to investigate and remediate a data

security breach and to continuously upgrade our information

technology security systems to address evolving cyber-security

threats; the ultimate determination of the extent or scope of the

potential liabilities relating to our past or any future data

security incidents; our ability to attract or retain highly skilled

management and other personnel; severe weather, natural disasters

or acts of violence or terrorism; the preparedness of our

accounting and other management systems to meet financial reporting

and other requirements and the upgrade of our existing financial

reporting system; being a holding company, with no operations of

our own, and depending on our subsidiaries for our liquidity needs;

our ability to execute and implement our common stock repurchase

program; our substantial indebtedness; the possibility that we may

incur substantial additional debt, including secured debt, in the

future; restrictions and limitations in the agreements and

instruments governing our debt; generating the significant amount

of cash needed to service all of our debt and refinancing all or a

portion of our indebtedness or obtaining additional financing;

changes in interest rates increasing the cost of servicing our

debt; and the costs and effects of litigation.

Additional factors that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements can be found in our filings with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K for the year ended September 30, 2016,

as filed with the Securities and Exchange Commission. Consequently,

all forward-looking statements in this release are qualified by the

factors, risks and uncertainties contained therein. We assume no

obligation to publicly update or revise any forward-looking

statements

Use of Non-GAAP Financial Measures

This news release and the schedules hereto include the following

financial measures that have not been calculated in accordance with

accounting principles generally accepted in the United States, or

GAAP, and are therefore referred to as non-GAAP financial measures:

(1) Adjusted EBITDA; (2) adjusted operating income and operating

margin; and (3) adjusted diluted earnings per share. We have

provided definitions below for these non-GAAP financial measures

and have provided tables in the schedules hereto to reconcile these

non-GAAP financial measures to the comparable GAAP financial

measures.

Adjusted EBITDA - We define the measure Adjusted EBITDA as GAAP

net earnings before depreciation and amortization, interest

expense, income taxes, share-based compensation, and costs related

to the Company’s previously announced Restructuring Plan, data

security incidents, management transition plan and asset impairment

for the relevant time periods as indicated in the accompanying

non-GAAP reconciliations to the comparable GAAP financial

measures.

Adjusted Operating Earnings and Operating Margin – Adjusted

operating earnings are GAAP operating earnings that excludes costs

related to the Company’s previously announced Restructuring Plan,

management transition plan, data security incidents and asset

impairment charges for the relevant time periods as indicated in

the accompanying non-GAAP reconciliations to the comparable GAAP

financial measures. Adjusted Operating Margin is Adjusted Operating

Earnings as a percentage of net sales.

Adjusted Diluted Net Earnings Per Share – Adjusted diluted net

earnings per share is GAAP diluted earnings per share that exclude

costs related to the Company’s previously announced Restructuring

Plan, loss on debt extinguishment and related interest overlap,

management transition plan, data security incidents and asset

impairment as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures.

Operating Free Cash Flow – We define the measure Operating Free

Cash Flow as GAAP net cash provided by operating activities less

capital expenditures. We believe Operating Free Cash Flow is an

important liquidity measure that provides useful information to

investors about the amount of cash generated from operations after

taking into account capital expenditures.

We believe that these non-GAAP financial measures provide

valuable information regarding our earnings and business trends by

excluding specific items that we believe are not indicative of the

ongoing operating results of our businesses; providing a useful way

for investors to make a comparison of our performance over time and

against other companies in our industry.

We have provided these non-GAAP financial measures as

supplemental information to our GAAP financial measures and believe

these non-GAAP measures provide investors with additional

meaningful financial information regarding our operating

performance and cash flows. Our management and Board of Directors

also use these non-GAAP measures as supplemental measures to

evaluate our businesses and the performance of management,

including the determination of performance-based compensation, to

make operating and strategic decisions, and to allocate financial

resources. We believe that these non-GAAP measures also provide

meaningful information for investors and securities analysts to

evaluate our historical and prospective financial performance.

These non-GAAP measures should not be considered a substitute for

or superior to GAAP results. Furthermore, the non-GAAP measures

presented by us may not be comparable to similarly titled measures

of other companies.

Supplemental Schedules Segment Information

1 Non-GAAP Financial Measures Reconciliations 2-3 Non-GAAP

Financial Measures Reconciliations; Adjusted EBITDA and Operating

Free Cash Flow 4 Store Count and Same Store Sales 5

SALLY BEAUTY

HOLDINGS, INC. AND SUBSIDIARIES Consolidated Statements of

Earnings (In thousands, except per share data) (Unaudited)

Three Months Ended June 30,

Nine Months Ended June 30, 2017

2016 (1)

% Chg 2017

2016 (1)

% Chg Net sales $ 998,043 $ 998,161 0.0

% $ 2,964,122 $ 2,976,260 -0.4 % Cost of products sold and

distribution expenses 495,404

499,185 -0.8 % 1,481,669

1,495,761 -0.9 % Gross profit

502,639 498,976 0.7 % 1,482,453 1,480,499 0.1 % Selling, general

and administrative expenses (2) 337,992 339,459 -0.4 % 1,017,383

1,020,497 -0.3 % Depreciation and amortization 29,255 25,433 15.0 %

83,972 72,524 15.8 % Restructuring charges 5,054

- 100.0 % 14,265

- 100.0 %

Operating earnings 130,338 134,084 -2.8 % 366,833 387,478 -5.3 %

Interest expense (3) 26,969

26,703 1.0 % 80,616

117,617 -31.5 % Earnings before

provision for income taxes 103,369 107,381 -3.7 % 286,217 269,861

6.1 % Provision for income taxes 36,830

39,462 -6.7 % 106,860

99,540 7.4 % Net earnings

$ 66,539 $ 67,919 -2.0 %

$ 179,357 $ 170,321 5.3 %

Earnings per share: Basic $ 0.49 $ 0.47 4.3 % $ 1.28 $ 1.15

11.3 % Diluted $ 0.49 $ 0.46

6.5 % $ 1.28 $ 1.14

12.3 % Weighted average shares: Basic 135,450 145,957

139,888 147,741 Diluted 136,159

147,837 140,634

149,476

Basis Pt

Chg Basis Pt Chg

Comparison as a % of

Net sales

Sally Beauty Supply Gross Margin 56.0 % 55.2 % 80 55.8 % 55.1 % 70

BSG Gross Margin 42.0 % 42.0 % 0 41.6 % 41.5 % 10 Consolidated

Gross Margin 50.4 % 50.0 % 40 50.0 % 49.7 % 30 Selling, general and

administrative expenses 33.9 % 34.0 % (10 ) 34.3 % 34.3 % 0

Consolidated Operating Margin 13.1 % 13.4 % (30 ) 12.4 % 13.0 % (60

)

Effective Tax

Rate

35.6 % 36.7 % (110 )

37.3 % 36.9 % 40

(1) Certain amounts for the prior fiscal periods have been

reclassified to conform to the current period presentation in

connection with the realignment of a business unit from the BSG

segment to the Sally Beauty Supply segment. (2) For the

three months ended June 30, 2017 and 2016, selling, general and

administrative expenses include share-based compensation expense of

$2.4 million and $2.8 million, respectively, and, for the three

months ended June 30, 2016, $1.4 million of expenses incurred in

connection with the data security incidents disclosed earlier. For

the nine months ended June 30, 2017 and 2016, selling, general and

administrative expenses include share-based compensation expense of

$8.6 million and $10.0 million, respectively, and, for the nine

months ended June 30, 2016, $2.6 million of expenses incurred in

connection with the data security incidents. In addition, for the

nine months ended June 30, 2016, selling, general and

administrative expenses include $1.3 million of expenses related to

the management transition plan disclosed in the fiscal year 2016,

and an asset impairment charge of $0.6 million. (3) For the

nine months ended June 30, 2016, interest expense includes a loss

on extinguishment of debt of $33.3 million (including call premiums

of $25.8 million) in connection with the Company's December 2015

redemption of certain senior notes.

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets (In thousands)

June 30, 2017 September 30, 2016 (Unaudited)

Cash and cash equivalents $ 54,100 $ 86,622 Trade and other

accounts receivable 88,407 83,983 Inventory 947,623 907,337 Other

current assets 49,984 54,861 Deferred income tax assets

40,126 40,024 Total current assets 1,180,240

1,172,827 Property and equipment, net 310,176 319,558 Goodwill and

other intangible assets 617,255 625,677 Other assets 12,808

14,001 Total assets $ 2,120,479 $

2,132,063 Current maturities of long-term debt $

82,246 $ 716 Accounts payable 291,878 271,376 Accrued liabilities

166,484 214,584 Income taxes payable 1,413

1,989 Total current liabilities 542,021 488,665 Long-term

debt, including capital leases (1) 1,784,480 1,783,294 Other

liabilities 19,012 21,614 Deferred income tax liability

127,242 114,656 Total liabilities 2,472,755

2,408,229 Total stockholders' deficit (352,276 )

(276,166 ) Total liabilities and stockholders' deficit $ 2,120,479

$ 2,132,063 (1) Long-term debt, including

capital leases is reported net of unamortized debt issuance costs

of $21.2 million at June 30, 2017 and $23.7 million at September

30, 2016.

Supplemental Schedule 1

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Segment

Information (In thousands) (Unaudited)

Three

Months Ended June 30, Nine Months Ended June 30,

2017

2016 (1)

% Chg 2017

2016 (1)

% Chg Net sales: Sally Beauty Supply $ 594,880

$ 602,632 -1.3 % $ 1,760,732 $ 1,797,068 -2.0 % Beauty Systems

Group 403,163 395,529

1.9 % 1,203,390

1,179,192 2.1 % Total net sales $ 998,043

$ 998,161 0.0 % $

2,964,122 $ 2,976,260

-0.4 % Operating earnings: Sally Beauty Supply $ 104,880 $

104,908 0.0 % $ 294,245 $ 313,792 -6.2 % Beauty Systems Group

67,327 65,196

3.3 % 193,630 191,649

1.0 % Segment operating earnings 172,207

170,104 1.2 % 487,875 505,441 -3.5 % Unallocated expenses

(2) (34,437 ) (33,182 ) 3.8 % (98,187 ) (107,952 ) -9.0 %

Restructuring charges (5,054 ) - 100.0 % (14,265 ) - 100.0 %

Share-based compensation (2,378 ) (2,838 ) -16.2 % (8,590 ) (10,011

) -14.2 % Interest expense (3) (26,969 )

(26,703 ) 1.0 % (80,616 )

(117,617 ) -31.5 % Earnings before provision

for income taxes $ 103,369 $ 107,381

-3.7 % $ 286,217 $ 269,861

6.1 % Segment operating margin:

Basis Pt Chg Basis Pt Chg Sally Beauty Supply 17.6 %

17.4 % 20 16.7 % 17.5 % (80 ) Beauty Systems Group 16.7 % 16.5 % 20

16.1 % 16.3 % (20 ) Consolidated operating margin 13.1 %

13.4 % (30 ) 12.4 %

13.0 % (60 ) (1) Certain

amounts for the prior fiscal periods have been reclassified to

conform to the current period presentation in connection with the

realignment of a business unit from the BSG segment to the Sally

Beauty Supply segment. (2) Unallocated expenses consist of

corporate and shared costs, and are included in selling, general

and administrative expenses. For the three and nine months ended

June 30, 2016, unallocated expenses include $1.4 million and $2.6

million, respectively, of expenses incurred in connection with the

data security incidents disclosed earlier and, for the nine months

ended June 30, 2016, $1.3 million of expenses incurred in

connection with the management transition plan disclosed in the

fiscal year 2016. (3) For the nine months ended June 30,

2016, interest expense includes a loss on extinguishment of debt of

$33.3 million (including call premiums of $25.8 million) in

connection with the Company's December 2015 redemption of certain

senior notes.

Supplemental Schedule 2

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP

Financial Measures Reconciliations, Continued (In thousands)

(Unaudited)

Three Months Ended June 30, 2017

As Reported

RestructuringCharges (1)(3)

As Adjusted(Non-GAAP)

Selling, general and administrative expenses $ 337,992 $

337,992 SG&A expenses, as a percentage of sales 33.9 % 33.9 %

Operating earnings 130,338 $ 5,054 135,392 Operating Margin 13.1 %

13.6 % - Earnings before provision for income taxes 103,369 5,054

108,423 Provision for income taxes (3) 36,830

1,162

37,992 Net earnings $ 66,539

$ 3,892 $

70,431 Earnings per share: Basic $ 0.49 $ 0.03 $ 0.52

Diluted $ 0.49 $ 0.03

$ 0.52

Three Months

Ended June 30, 2016 As Reported

Charges fromData SecurityIncidents (2)

As Adjusted(Non-GAAP)

Selling, general and administrative expenses $ 339,459 $

(1,375 ) $ 338,084 SG&A expenses, as a percentage of sales 34.0

% 33.9 % Operating earnings 134,084 1,375 135,459 Operating Margin

13.4 % 13.6 % - Earnings before provision for income taxes 107,381

1,375 108,756 Provision for income taxes (3) 39,462

523

39,985 Net earnings $ 67,919

$ 852

$ 68,771 Earnings per share: Basic $

0.47 $ 0.01

$ 0.47 Diluted $ 0.46 $ 0.01

$ 0.47 (1) For the three months ended

June 30, 2017, results include pre-tax expenses of $5.1 million

incurred in connection with the restructuring plan disclosed

earlier this year. (2) For the three months ended June 30,

2016, selling, general and administrative expenses include pre-tax

expenses of $1.4 million incurred in connection with the data

security incidents disclosed earlier this year. (3) The

income tax provision associated with our Fiscal 2016 adjustments to

net earnings was calculated using an effective tax rate of 38.0%.

The income tax provision associated with the restructuring charges

was calculated using a 23.0% tax rate since, currently, realization

of a tax benefit for portions of this expense is not deemed

probable.

Supplemental Schedule 3

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Non-GAAP Financial Measures Reconciliations, Continued (In

thousands) (Unaudited)

Nine Months Ended June 30,

2017 As Reported

RestructuringCharges (1)(4)

As Adjusted(Non-GAAP)

Selling, general and administrative expenses $ 1,017,383 $

1,017,383 SG&A expenses, as a percentage of sales 34.3 % 34.3 %

Operating earnings 366,833 $ 14,265 381,098 Operating Margin 12.4 %

12.9 %

Earnings before provision for income taxes 286,217 14,265 300,482

Provision for income taxes (4) 106,860

4,493

111,353

Net earnings $ 179,357 $ 9,772

$ 189,129 Earnings per

share: Basic $ 1.28 $ 0.07 $ 1.35 Diluted $ 1.28

$ 0.07

$ 1.34

Nine Months Ended June 30, 2016 As Reported

Loss onExtinguishmentof Debt (2)

OverlappingInterestExpense (2)

Charges fromData SecurityIncidents (3)

ManagementTransitionExpenses (3)

AssetImpairmentCharge (3)

As Adjusted(Non-GAAP)

Selling, general and administrative expenses $ 1,020,497 $

(2,621 ) $ (1,318 ) $ (571 ) $ 1,015,987 SG&A expenses, as a

percentage of sales 34.3 % 34.1 % Operating earnings 387,478 2,621

1,318 571 391,988 Operating Margin 13.0 % 13.2 %

Earnings before provision for income taxes 269,861 $ 33,296 $ 2,148

2,621 1,318 571 309,815 Provision for income taxes (4)

99,540 12,652 816

996 501

217 114,722

Net earnings $ 170,321 $ 20,644

$ 1,332 $ 1,625 $ 817

$ 354 $ 195,093

Earnings per share: Basic $ 1.15 $ 0.14 $ 0.01 $ 0.01 $ 0.01 $ 0.00

$ 1.32 Diluted $ 1.14 $ 0.14 $

0.01 $ 0.01 $ 0.01

$ 0.00 $ 1.31 (1) For the

nine months ended June 30, 2017, results include pre-tax expenses

of $14.3 million incurred in connection with the restructuring plan

disclosed earlier this year. (2) For the nine months ended

June 30, 2016, interest expense includes a loss on extinguishment

of debt of $33.3 million in connection with the Company's December

2015 redemption of certain senior notes and interest in the amount

of $2.1 million on such senior notes after December 3, 2015 and

until their redemption, as well as interest on the Company's senior

notes due 2025 issued on December 3, 2015. These pro-forma

adjustments assume the redeemed senior notes were repaid on

December 3, 2015. (3) For the nine months ended June 30,

2016, selling, general and administrative expenses include pre-tax

expenses of $2.6 million incurred in connection with the data

security incidents disclosed earlier, pre-tax expenses of $1.3

million incurred in connection with management transition plan

disclosed in the fiscal year 2016, and an asset impairment charge

of $0.6 million, before tax. (4) The income tax provision

associated with our Fiscal 2016 adjustments to net earnings was

calculated using an effective tax rate of 38.0%. The income tax

provision associated with the restructuring charges was calculated

using a 31.5% tax rate since, currently, realization of a tax

benefit for portions of this expense is not deemed probable.

Supplemental

Schedule 4

SALLY

BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP Financial

Measures Reconciliations (In thousands) (Unaudited)

Three Months Ended June 30, Nine Months Ended June

30, Adjusted EBITDA: 2017

2016 % Chg 2017

2016 % Chg Net earnings $ 66,539

$ 67,919 -2.0 % $ 179,357 $ 170,321 5.3 % Add: Depreciation and

amortization 29,255 25,433 15.0 % 83,972 72,524 15.8 % Share-based

compensation (1) 2,378 2,838 -16.2 % 8,590 10,011 -14.2 %

Restructuring charges 5,054 - 100.0 % 14,265 - 100.0 % Assets

impairment charge - - 0.0 % - 571 -100.0 % Loss from data security

incidents (2) - 1,375 -100.0 % - 2,621 -100.0 % Management

transition expenses (2) - - -100.0 % - 1,318 -100.0 % Interest

expense (3) 26,969 26,703 1.0 % 80,616 117,617 -31.5 % Provision

for income taxes 36,830 39,462

-6.7 % 106,860

99,540 7.4 % Adjusted EBITDA (Non-GAAP)

$ 167,025 $ 163,730 2.0 %

$ 473,660 $ 474,523 -0.2

%

Basis Pt Chg Basis Pt Chg

Comparison as a % of

Net Sales

Adjusted EBITDA Margin 16.7 % 16.4 %

30 16.0 % 15.9 %

10

Operating Free Cash

Flow: 2017 2016 %

Chg 2017 2016 %

Chg Net cash provided by operating activities $ 63,921 $ 36,605

74.6 % $ 223,415 $ 248,813 -10.2 % Less: Capital expenditures, net

(17,209 ) (36,360 ) -52.7

% (66,529 ) (108,270 )

-38.6 % Operating Free Cash Flow (Non-GAAP) $ 46,712

$ 245 100.0 % $ 156,886

$ 140,543 11.6 % (1) For the

nine months ended June 30, 2017 and 2016, share-based compensation

includes $1.1 million and $1.3 million, respectively, of

accelerated expense related to certain retirement-eligible

employees who are eligible to continue vesting awards upon

retirement. (2) For the three and nine months ended June 30,

2016, selling, general and administrative expenses include $1.4

million and $2.6 million, respectively, of expenses incurred in

connection with the data security incidents disclosed earlier and,

for the nine months ended June 30, 2016, $1.3 million of expenses

related to the management transition plan disclosed in the fiscal

year 2016.

(3) For the nine months ended June 30,

2016, interest expense includes a loss on extinguishment of debt of

$33.3 million (including call premiums of $25.8 million) in

connection with the Company's December 2015 redemption of certain

senior notes.

Supplemental Schedule 5

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES

Store Count and Same Store Sales (Unaudited)

As of

June 30, 2017 2016

Chg Number of stores (at end of period): Sally Beauty

Supply: Company-operated stores 3,807 3,732 75 Franchise stores 19

18 1 Total Sally

Beauty Supply 3,826 3,750 76 Beauty Systems Group ("BSG"):

Company-operated stores 1,196 1,157 39 Franchise stores 166

165 1 Total Beauty System

Group 1,362 1,322 40

Total 5,188 5,072

116 BSG distributor sales consultants (end of period)

(1) 839 925 (86 )

2017 2016

Basis Pt Chg Third quarter company-operated

same store sales growth (decline) (2) Sally Beauty Supply -0.8 %

1.3 % (210 ) Beauty Systems Group 2.8 % 5.4 % (260 ) Consolidated

0.3 % 2.5 % (220 ) Nine months

ended June 30 company-operated same store sales growth (decline)

(2) Sally Beauty Supply -1.3 % 2.0 % (330 ) Beauty Systems Group

1.4 % 6.8 % (540 ) Consolidated -0.4 % 3.5 %

(390 ) (1) Includes 257 and 318 distributor sales

consultants as reported by our franchisees at June 30, 2017 and

2016, respectively. (2) For the purpose of calculating our

same store sales metrics, we compare the current period sales for

stores open for 14 months or longer as of the last day of a month

with the sales for these stores for the comparable period in the

prior fiscal year. Our same store sales are calculated in constant

U.S. dollars and include internet-based sales and the effect of

store expansions, if applicable, but do not generally include the

sales from stores relocated until 14 months after the relocation.

The sales from stores acquired are excluded from our same store

sales calculation until 14 months after the acquisition.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170803005242/en/

Sally Beauty Holdings, Inc.Karen Fugate, 940-297-3877Investor

Relations

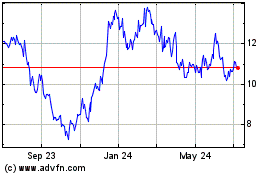

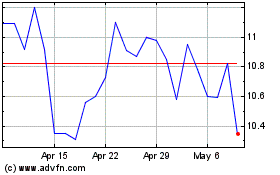

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024