Sales of Luxury Alcohol on the Rise Again in China

October 16 2015 - 10:49AM

Dow Jones News

By Jason Chow in Paris and Laurie Burkitt in Beijing

After nearly three years nursing a hangover, China is hitting

the bottle again.

Sales of expensive alcohol took a massive hit in China in 2012,

when President Xi Jinping took aim at boozy banquets and lavish

gift-giving. Now, cognac and wine sales are showing signs of life,

indicating that luxury consumption may be on the way back.

Shipments of the French brandy to China jumped 42% in the first

nine months of the year, according to industry association BNIC,

boosting the fortunes of industry stalwarts such as French luxury

giant LVMH Moët Hennessy Louis Vuitton and Rémy Cointreau SA.

The resurgence reveals a pocket of strength among Chinese luxury

consumers, who in recent years have determined the fortunes of

manufacturers of everything from expensive handbags, to

diamond-encrusted watches and pricey bottles of alcohol. LVMH and

Burberry Group reported earlier this week continued sluggish demand

among Chinese buyers for fashion and accessories due to slowing

growth and the summer's stock market crash. But others point out

that a rising young consumer class is emerging which has already

begun to drive future luxury spending.

"There is a significant change in who's consuming cognac today,"

said Trevor Stirling, a drinks analyst at Sanford C. Bernstein in

London, pointing out that businessmen and bureaucrats who used to

shell out $150 per bottle at hostess bars on expense accounts are

no longer the main drinkers, victims of the government crackdown on

corruption.

Taking their place are young, upper-middle-class drinkers who

are spending their own money and opting for lower-priced bottles.

While the young drinkers aren't splurging like their predecessors,

they represent a much larger group of consumers.

Some are already chasing this demographic: French drinks

conglomerate Pernod Ricard SA last year launched its Martell

Noblige line, a cognac with a lower price tag than other Martell

products that is less offensive in today's Chinese political

climate.

"When does the growth of new consumers more than compensate for

the loss of the old ones? We're not there yet, but we're getting

close," said Mr. Stirling.

Cognac was a popular status symbol during China's most recent

boom, a favorite drink served to impress at banquets and a frequent

gift bought at duty free shops to be exchanged between businessmen

and top bureaucrats.

The drink fell out of favor as the anticorruption campaign took

bite and liquor distributors and retailers in China were stuck with

large stockpiles of unsold bottles. Mr. Xi, in his message

promoting thriftiness was clear: He specifically told officials not

to serve drinks with the simple dinners he espoused. That inventory

slack has now been sold off, and cognac makers are resuming

shipments, showing that the downturn appears to have bottomed

out.

Drinks makers are cautiously optimistic. "Mainland China is

seeing some real improvement, said Rémy Cointreau Chief Financial

Officer Luca Marotta. The company, which makes Remy Martin cognac,

said Friday that its volume growth in China in the third-quarter

was flat, and the preference was for lower-priced bottles. Chinese

liquor wholesalers remained cautious given the uncertain economic

outlook, he said.

Earlier in the week, strong cognac sales were the surprise

bright spot for LVMH, with 12% more cognac shipped in the third

quarter of this year than in the same period a year earlier. Part

of the increase was due to stocking-up in anticipation of the busy

Golden Week shopping season--a week-long holiday period in early

October.

LVMH Chief Financial Officer Jean-Jacques Guiony said there was

"a clear sign that the market is bottoming out."

China's wine consumption is expected to jump 10% this year, up

from 1.58 billion liters in 2014, according to the EU SME Centre, a

research consultancy of the European Union.

Consultants say that younger consumers are picking up the slack

in alcohol sales. Much of the interest in wine is driven by the

younger generation born under China's one-child policy, who are now

entering their 30s, who aren't going for the top-flight grand cru

Bordeaux bottles, but for more modestly-priced bottles. Those born

since 1980 are expected to contribute to 35% of the country's total

consumption by 2020, up from 15% now, according to financial

services company Credit Suisse.

Write to Jason Chow at jason.chow@wsj.com and Laurie Burkitt at

laurie.burkitt@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 16, 2015 10:34 ET (14:34 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

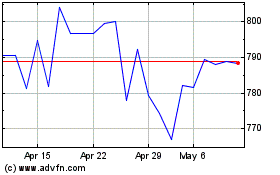

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Mar 2024 to Apr 2024

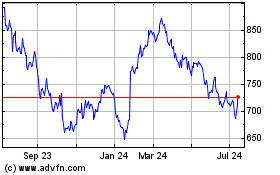

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2023 to Apr 2024