Sainsbury Reports Slump in Half-Year Profit--Update

November 11 2015 - 12:44PM

Dow Jones News

By Saabira Chaudhuri

LONDON-- J Sainsbury PLC reported a fall in half-year profit as

the British supermarket chain blamed food-price deflation and

changing customer habits for lower supermarket sales.

Sainsbury's results are strongly indicative of trends that have

been hammering Britain's mainstream grocers for several quarters

now. Customers have been shopping more frequently, in smaller

amounts and across a variety of retailers to get the best bargains,

leaving the country's large supermarkets with fewer customers.

"Whilst people have more money in their pockets, they are not

yet choosing to spend it on groceries," said the company in a

statement, adding that the growth of discounters like Aldi and Lidl

in addition to changing consumer habits has pressured mainstream

supermarkets.

The U.K.'s No. 3 grocer by market share reported a pretax profit

for the six months to Sept. 26 of GBP339 million ($512 million),

compared with a pretax loss of GBP290 million in the same period a

year earlier.

Stripping out one-time items, pretax profit for the first half

totaled GBP308 million, down 18% from GBP375 million a year earlier

but higher than estimates of GBP294 million.

After gaining in early trading, shares plunged following a

conference call the company held with analysts, closing the day

down 7.1%.

"The near-term outlook remains dark," said Exane BNP Paribas

analyst John Kershaw, pointing to Sainsbury's view that deflation

will now last well into the next financial year and its admission

that the discounters have grown faster than expected.

Sainsbury's Chief Executive Mike Coupe on the call said

customers, despite being about GBP20 better off a week than a year

ago, are spending on travel and eating out rather than on

groceries, and that price deflation is about 2%.

Sainsbury and its peers have been battling the march of Aldi and

Lidl by cutting prices to protect market share, but the actions

have eaten into profits.

Ahead of the key Christmas season, Sainsbury is testing new

formats at six supermarkets in an effort to adapt to changing

shopper habits.

The company has reshuffled its store layout to create a

food-to-go section at the front near the checkouts, increased

nonfood space by 30%, and is testing new checkout options. It is

also piloting a shopping app in two stores: After customers scan

their shopping lists, the app shows them a map locating their items

around the store and allows them to pay via smartphone.

Separately, the company is also testing its smallest Sainsbury's

convenience store to date at just under 1,000 square feet. That

store is aimed at working people who quickly want to buy food for

breakfast or lunch or pick up ingredients for dinner.

While sales at Sainsbury's supermarkets declined by over 2%, the

grocer said its convenience stores saw sales growth of close to 11%

while online grocery sales rose by 7%.

Underlying sales excluding value added tax came in at GBP12.41

billion, which is down 1.9% from the GBP12.66 billion reported a

year earlier and slightly below the estimates of analysts polled by

FactSet for GBP12.47 billion.

Like-for-like sales, including VAT and excluding fuel, were down

1.6% for the period.

Sainsbury has been working on striking property deals, building

homes on its properties. Earlier this year the company opened a

refurbished supermarket in London, which increased the size of the

store by 50% while also creating the space to build 463 homes.

Sainsbury said the estimated market value of its properties

declined by GBP300 million during the first half, to GBP10.8

billion.

Sainsbury said cost savings for the first half totaled GBP115

million. It expects full year cost savings of around GBP225 million

and said it remains on track to deliver GBP500 million savings over

the next three years.

The FTSE100-listed company declared an interim dividend of 4

pence a share, down from the 5 pence paid a year ago.

Sainsbury said its clothing line's sales grew by close to 10%

over the half-year, and described growth opportunities for its

nonfood business as "significant." Overall general merchandise

sales climbed by 1.4%.

Tapan Panchal contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 12:29 ET (17:29 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

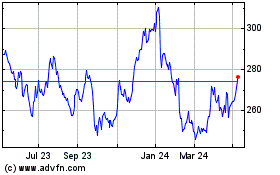

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

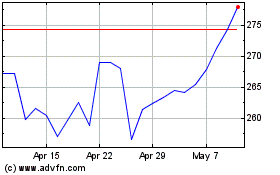

Sainsbury (j) (LSE:SBRY)

Historical Stock Chart

From Apr 2023 to Apr 2024