STANDARD LIFE INVESTMENTS PROPERTY INCOME TRUST LTD - Intention to issue equity

February 12 2015 - 4:08AM

PR Newswire (US)

To: Company Announcements

Date: 12 February 2015

Company: Standard Life Investments Property Income Trust Limited

Subject: Intention to issue equity

The Board of Standard Life Investments Property Income Trust Limited (the

"Company") announces that, pursuant to the Placing Programme announced on 6

June 2014 and the Company's ability to issue shares under its existing

disapplication of pre-emption rights authority, the Company is seeking to raise

in excess of £16 million through a cash placing to institutional investors of

new ordinary shares of 1 pence each in the Company (the "New Shares") (the

"Placing").

The Company has entered into an agreement that provides it with exclusivity to

purchase a modern freehold retail warehouse property, located in Preston, for

£16m (excluding costs) subject to an equity fund raise. This retail warehouse

offers a yield of 7 per cent. with 16 years remaining on the lease and is

located adjacent to a major foodstore and next to the dominant retail warehouse

park in Preston. The tenant is DSG and the lease is subject to fixed increases

every 5 years.

The Placing is expected to close at 2.00 p.m. (London time) on 19th February

2015 butmay close earlier or later at the absolute discretion of the Company.

The issue price per New Share will be 78.1 pence, representing a 5 per cent.

premium to the Company's unaudited net asset value per share as at 31 December

2014 (adjusted for the dividend payable on 20 February 2015 to which the New

Shares will not be entitled).

The Placing will be made to Qualified Investors (as defined in section 86(7) of

the Financial Services and Markets Act 2000 (as amended)) through Winterflood

Securities Limited ("Winterflood").The decision to allot New Shares to any

Qualified Investor and the actual issue size shall be at the absolute

discretion of the Company and Winterflood.

Application will be made for the New Shares to be admitted to the premium

segment of the Official List and to trading on the Main Market of the London

Stock Exchange. It is expected that dealings in the New Shares will commence at

8.00 a.m. on 25 February 2015.

The New Shares will, when issued, be credited as fully paid and rank pari passu

with the existing ordinary shares of 1 pence each in the capital of the

Company, including the right to receive all future dividends and distributions

declared, made or paid save for the dividend payable on 20 February 2015 to

shareholders on the register on 6 February 2015.

Any remaining net proceeds of the issue after the proposed acquisition will be

invested in accordance with the Company's investment policy.

Enquiries:

Standard Life Investments +44 (0) 131 245 2735

Gordon Humphries, Head of Investment Companies

Winterflood Investment Trusts +44 (0) 20 3100 0268

Graeme Caton +44 (0) 20 3100 0258

Darren Willis

Copyright y 12 PR Newswire

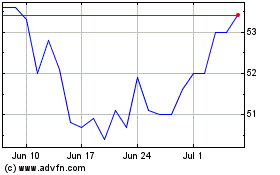

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abrdn Property Income (LSE:API)

Historical Stock Chart

From Apr 2023 to Apr 2024