SSGA Debunks 5 Retirement Savings Myths about Generation X and Millennials

January 27 2016 - 12:37PM

Business Wire

New research from State Street Global Advisors, the asset

management arm of State Street Corporation (NYSE: STT), challenges

generational assumptions about employees who participate in

workplace Defined Contribution retirement plans and recommends

different actions employers can take to better engage their

employees. The research also highlights surprising similarities

across “Gen Xers” (aged 33-50) and Millennials (aged 22-32) as it

relates to retirement readiness. For example, regardless of age

over 80% of employees understand that creating a successful

retirement depends on making it a priority and starting early.

“Many long held beliefs about how Millennials and Gen Xers want

to engage with their DC plan are off base and call for some

myth-busting,” says Fredrik Axsater, senior managing director and

head of Global Defined Contribution at SSGA. “When employers

combine a deeper understanding of employees’ views about retirement

and focus their engagement efforts around important life stages,

like starting a career or starting a family, savings programs can

be far more successful.”

The research surveyed plan employees aged 22-50, a group SSGA

has named “Generation DC.” This group is the first cohort to rely

predominantly on a defined contribution plan as their primary

source of retirement funding. SSGA believes that by studying

Generation DC, employers can better understand how to improve the

experience and structure of DC plans.

According to the SSGA research, there are five myths to debunk

as a result of their research.

- Myth 1: Millennials would rather

interact with apps than humansReality: Although

Millennials are most likely to say they want apps to help them

prepare for retirement, they also want an annual human interaction

– even more than older employees do. 59% of those aged 22-25 say

they “want an in-person meeting once a year and technology isn’t

really going to help,” compared to 38% for Gen Xers aged

45-50.Action: Employers should recognize that younger

employees may need more guidance than can be solved by an app.

- Myth 2: Millennials don’t care about

planning for retirement—it’s too far awayReality: 88% of

Millennials agree it’s important to start saving for retirement

early similar to the 86% for their more experienced Gen X

counterparts. Additionally both Millennials and Gen Xers agree that

saving for retirement is a priority (83%).Action: Harness

younger employees’ awareness of the importance of retirement

preparation and connect that to a specific action such as

enrollment or saving a little more.

- Myth 3: Most people are “over” the

financial crisisReality: Risk averse beliefs are still

rampant today. Over half of millennials (54%) admitted that their

parents’ experience with the financial crisis that began in 2008

has impacted their confidence as investors. That increases to 60%

for those who are 33-39 years old.Action: If market

volatility rears its ugly head, don’t avoid it. Speak to employees

rationally about volatility and the reality of long-term investing

and importance of “staying the course”.

- Myth 4: Employers hold the reins

when it comes to informing and influencing

employeesReality: Friends and family come first when it

comes to influence. 68% of Generation DC said that friends and

family are the ones who told them to start saving. Additionally,

over 90% indicated that their spouse/partner’s annual salary played

an important role in their financial wellbeing.Action:

Employers can find ways to engage both employees and their family

members with simple, jargon-free messages about retirement planning

that stimulate healthy conversations.

- Myth 5: We need to educate people

more about retirement and investingReality: Experience

is a significant contributor to literacy. SSGA used a standard

battery of questions to test literacy and the results indicate that

as people hit their 40’s their literacy about basic financial and

investing improves. For example, when asked if buying a single

company stock provided a safer return than a stock mutual fund,

only 46% of millennials correctly answered that the stock was more

risky. However, 57% of Gen Xers answered correctly and that

increased to 77% for the 45+ group.Action: Be consistent

with core “rules of thumb” messaging about retirement preparedness

and recognize that the 40 and over population is more prepared to

talk comprehensively about retirement planning. Employers should

engage them more fully on their life journey while they can still

make a difference, instead of waiting until they are 50.

“Our research highlights numerous opportunities where employers

can tailor approaches to meet employees where they are in their

life, not necessarily where we believe their generational

preferences may exist,” continued Axsater. “Employers can reach

employees well ahead of retirement by targeting the 40 plus age

group with clear, actionable steps for a better retirement

including communications on how to save more, diversify investments

and spend down savings in retirement. For younger employees, an

over-emphasis on auto-enrollment may be causing employers to miss

an opportunity to discuss savings goals and strategies. We

recommend rethinking those assumptions.”

This survey was fielded in partnership with Boston Research

Technologies, an independent marketing research firm. Data were

collected in October 2015 using a panel of 1,500 U.S. workers, aged

22-50, who were employed on at least a part-time basis and offered

a DC plan by their employer.

For more information on The Participant, click here.

About State Street Global Advisors

For nearly four decades, State Street Global Advisors has been

committed to helping our clients, and those who rely on them,

achieve financial security. We partner with many of the world’s

largest, most sophisticated investors and financial intermediaries

to help them reach their goals through a rigorous, research-driven

investment process spanning both indexing and active disciplines.

With trillions* in assets, our scale and global reach offer clients

unrivaled access to markets, geographies and asset classes, and

allow us to deliver thoughtful insights and innovative

solutions.

State Street Global Advisors is the investment management arm of

State Street Corporation.

*Assets under management were $2 trillion as of December 31,

2015. Please note that AUM totals are unaudited.

Investing involves risk including the risk of loss of

principal.

The views expressed in this material are the views of SSGA

Defined Contribution through the period ended November 30, 2015 and

are subject to change based on market and other conditions.

The information provided does not constitute investment advice

and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied

or transmitted or any of its contents disclosed to third parties

without State Street Corporation express written consent.

Web: www.SSGA.com

© 2016 State Street Corporation - All Rights Reserved

CORP-1772

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160127006089/en/

State Street CorporationAndrew Hopkins, +1

617-664-2422Ahopkins2@StateStreet.comorElizabeth Powell, +1

202-468-0908powell@daicommunications.com

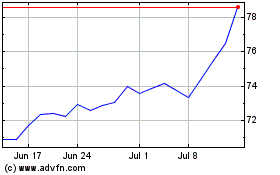

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

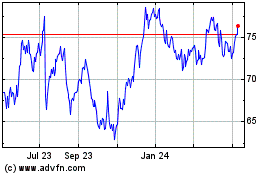

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024