SJW Corp. (NYSE:SJW) today reported financial results for the

second quarter ended June 30, 2015. Operating revenue was $72.4

million in the quarter compared to $70.4 million in 2014. The $2

million increase in revenue was primarily attributable to $11.8

million in cumulative rate increases and $300,000 in revenue from

new customers, offset by $9.3 million in lower customer water usage

and a decrease in the net recognition of certain balancing and

memorandum accounts of $800,000.

Water production expenses for the second quarter of 2015 were

$26.8 million versus $33.1 million for the same period in 2014, a

decrease of $6.3 million. The decrease in water production expenses

was attributable to $7.4 million in lower customer water usage and

$1.2 million in lower expenses due to an increase in the use of

available surface water supply. These decreases were partially

offset by $2.3 million in higher per unit costs for purchased

water, groundwater extraction and energy charges. Operating

expenses, excluding water production expenses, increased $3.2

million to $28.4 million from $25.2 million. The increase was due

to $1.9 million in higher administrative and general expenses,

$707,000 of higher depreciation expense, $315,000 in higher

property taxes and other non-income taxes, and an increase of

$271,000 in maintenance expenses. The increase in administrative

and general expenses was primarily attributable to higher pension

costs and costs related to the California General Rate Case

proceeding and other activities.

Other expense and income in the second quarter of 2014 included

a pre-tax gain on the sale of 125,969 shares of California Water

Service Group stock of $2 million and a sale of a real estate

investment property in Texas of approximately $300,000. No similar

sales occurred in 2015.

The effective consolidated income tax rates were 37% and 31% for

the quarters ended June 30, 2015 and 2014, respectively. The

change in effective consolidated income tax rate was primarily due

to a credit of $880,000 related to State of California enterprise

zone sales and use tax credits in 2014.

Net income was $7.5 million for the quarter ended June 30,

2015, compared to $6.8 million for the same period in 2014. Diluted

earnings per share were $0.36 and $0.34 for the quarters ended

June 30, 2015 and 2014, respectively.

Year-to-date operating revenue increased by $9.5 million to

$134.5 million from $125.0 million in the first six months of 2015.

The increase was attributable to $20.8 million in cumulative rate

increases, $700,000 in revenue from new customers and a net

increase in the recognition of certain balancing and memorandum

accounts of $1.2 million. These increases were offset by $13.2

million in lower customer water usage.

Year-to-date water production expenses decreased to $48.2

million from $56.6 million in 2014. The $8.4 million decrease was

attributable to $8.9 million in lower customer water usage, $3.3

million in lower expenses due to an increase in the use of

available surface water supply, offset by $3.8 million in higher

per unit costs for purchased water, groundwater extraction and

energy charges. Operating expenses, excluding water production

costs, increased $6.2 million to $56.3 million from $50.1 million.

The increase was due to $3.8 million of higher administrative and

general expenses, $1.4 million of higher depreciation expenses,

$606,000 in higher property taxes and other non-income taxes and

$365,000 in higher maintenance expenses. The increase in

administrative and general expenses was primarily attributable to

higher pension costs and costs related to California General Rate

Case proceeding and other activities.

Other expense and income in 2015 included interest on our Series

L Senior Note which was funded in August 2014. Other expense and

income in 2014 included a pre-tax gain on the sale of 125,969

shares of California Water Service Group stock of $2 million and a

sale of real estate investment property in Texas of approximately

$300,000. No similar sales occurred in 2015.

The effective consolidated income tax rates were 37% and 32% for

the six-month periods ended June 30, 2015 and 2014,

respectively. The change in effective consolidated income tax rate

for the six-month period ended June 30, 2015 compared to the

same period in 2014 was due to a credit of $880,000 related to

State of California enterprise zone sales and use tax credits in

2014.

Year-to-date net income was $12.2 million, compared to $7.8

million in 2014. Diluted earnings per share were $0.59 in the first

six months of 2015, compared to $0.38 per diluted share for the

same period in 2014.

The Directors of SJW Corp. today declared a quarterly dividend

on common stock of $0.195 per share. The dividend is payable on

September 1, 2015 to shareholders of record on August 10, 2015.

SJW Corp. is a publicly traded holding company headquartered in

San Jose, California. SJW Corp. is the parent company of San Jose

Water Company, SJWTX, Inc., Texas Water Alliance Limited, SJW Land

Company, and SJW Group, Inc. Together, San Jose Water Company

and SJWTX, Inc. provide water service to more than one million

people in San Jose, California and nearby communities and in Canyon

Lake, Texas and nearby communities. SJW Land Company owns and

operates commercial real estate investments.

This press release may contain certain forward-looking

statements including but not limited to statements relating to SJW

Corp.'s plans, strategies, objectives, expectations and intentions,

which are made pursuant to the safe harbor provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance or achievements of SJW Corp. to be materially different

from any future results, performance or achievements expressed or

implied by such forward-looking statements. Results for a

quarter are not indicative of results for a full year due to

seasonality and other factors. Other factors that may cause

actual results, performance or achievements to materially differ

are described in SJW Corp.'s most recent reports on Form 10-K, Form

10-Q and Form 8-K filed with the Securities and Exchange

Commission. SJW Corp. undertakes no obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise.

SJW Corp.

Condensed Consolidated Statements of

Comprehensive Income

(Unaudited)

(in thousands, except per share data)

Three months ended June 30,

Six months ended June 30, 2015 2014

2015 2014 OPERATING REVENUE $ 72,402

70,356 $ 134,514 124,952 OPERATING EXPENSE:

Production Expenses: Purchased water 16,002 11,942 25,286 21,672

Power 1,528 2,623 2,700 4,112 Groundwater extraction charges 6,197

15,516 14,133 24,964 Other production expenses 3,065 3,001

6,062 5,863 Total production expenses 26,792

33,082 48,181 56,611 Administrative and general 11,464 9,510 22,760

18,960 Maintenance 3,844 3,573 7,212 6,847 Property taxes and other

non-income taxes 2,890 2,575 5,985 5,379 Depreciation and

amortization 10,202 9,495 20,361 18,980

Total operating expense 55,192 58,235 104,499

106,777 OPERATING INCOME 17,210 12,121 30,015 18,175 OTHER

(EXPENSE) INCOME: Interest expense (5,618 ) (4,954 ) (11,270 )

(9,824 ) Gain on sale of California Water Service Group stock —

2,017 — 2,017 Other, net 274 754 610 1,037

Income before income taxes 11,866 9,938 19,355 11,405

Provision for income taxes 4,405 3,092 7,199

3,653 NET INCOME 7,461 6,846 12,156

7,752 Other comprehensive (loss) income, net (255 ) 41 (270

) 239 Reclassification adjustment for gain realized on sale of

investments, net — (1,171 ) — (1,171 ) COMPREHENSIVE

INCOME $ 7,206 5,716 $ 11,886 6,820

EARNINGS PER SHARE Basic $ 0.37 0.34 $ 0.60 0.38 Diluted $

0.36 0.34 $ 0.59 0.38 DIVIDENDS PER SHARE $ 0.20 0.19 $ 0.39 0.38

WEIGHTED AVERAGE SHARES OUTSTANDING Basic 20,357 20,214 20,342

20,205 Diluted 20,501 20,398 20,491 20,392

SJW Corp.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands)

June 30, 2015 December

31, 2014 ASSETS Utility plant: Land $ 16,839 16,838

Depreciable plant and equipment 1,388,775 1,353,772 Construction in

progress 34,694 23,208 Intangible assets 22,182 19,333 Total

utility plant 1,462,490 1,413,151 Less accumulated depreciation and

amortization 469,236 450,137 Net utility plant 993,254

963,014 Real estate investments 73,893 73,794 Less

accumulated depreciation and amortization 12,371 11,593 Net

real estate investments 61,522 62,201 CURRENT ASSETS: Cash

and cash equivalents 5,238 2,399 Accounts receivable and accrued

unbilled utility revenue 43,552 45,327 Current regulatory assets,

net 16,971 16,853 Prepaid expenses and other 4,251 3,514

Total current assets 70,012 68,093 OTHER ASSETS: Investment

in California Water Service Group 5,922 6,378 Debt issuance costs

and other, net of accumulated amortization 4,970 5,218 Regulatory

assets, net 153,718 158,010 Other 6,459 6,390 171,069

175,996 $ 1,295,857 1,269,304 CAPITALIZATION AND

LIABILITIES CAPITALIZATION: Common stock $ 10,606 10,567 Additional

paid-in capital 67,344 66,298 Retained earnings 284,498 280,773

Accumulated other comprehensive income 2,247 2,517 Total

shareholders' equity 364,695 360,155 Long-term debt, less current

portion 384,038 384,365 Total capitalization 748,733

744,520 CURRENT LIABILITIES: Line of credit 20,200 13,200 Current

portion of long-term debt 597 584 Accrued groundwater extraction

charge, purchased water and purchased power 8,599 6,030 Accounts

payable 13,037 7,001 Accrued interest 6,191 6,361 Other current

liabilities 10,413 11,518 Total current liabilities 59,037

44,694 DEFERRED INCOME TAXES AND CREDITS 188,595

186,821 ADVANCES FOR CONSTRUCTION AND CONTRIBUTIONS IN AID OF

CONSTRUCTION 215,284 211,805 POSTRETIREMENT BENEFIT PLANS 76,828

74,187 OTHER NONCURRENT LIABILITIES 7,380 7,277 $ 1,295,857

1,269,304

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150729006793/en/

SJW Corp.Suzy Papazian, 408-279-7961General Counsel and

Corporate Secretary

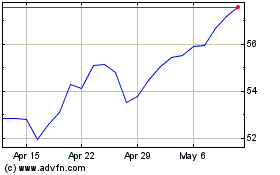

SJW (NYSE:SJW)

Historical Stock Chart

From Mar 2024 to Apr 2024

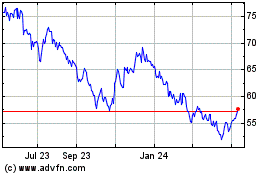

SJW (NYSE:SJW)

Historical Stock Chart

From Apr 2023 to Apr 2024