SEC Set to Fast-Track Certain ETFs

July 22 2016 - 2:20PM

Dow Jones News

WASHINGTON—The Securities and Exchange Commission is moving to

expedite the approval of exchange-traded funds run by human stock

and bond pickers, according to people familiar with the matter, a

boost for the fast-expanding ETF industry.

The SEC on Friday was set to approve "generic" listing standards

for actively managed ETFs, guidelines that aim to cut months off

the process of bringing these funds to market.

The move is a win for Bats Global Markets Inc. and the New York

Stock Exchange, which asked the SEC to approve such standards last

year. Bats and the NYSE, a unit of Intercontinental Exchange Inc.,

compete for the listing of such funds.

At present, obtaining regulatory approval for such products

includes a time-consuming fund-by-fund evaluation by the SEC that

can take months. Friday's expected change will allow for regulatory

approval in a matter of weeks, said Chris Concannon, president and

chief executive officer of Bats.

Exchange-traded funds hold baskets of stocks, bonds or other

assets and trade on an exchange like a stock. Most are passive,

with holdings dictated by the rules and weightings of the index

they are designed to track. Generic listing standards already exist

for passive ETFs.

Active ETFs, in which a fund manager can change the holdings at

their discretion, represent a small portion of the more than $2

trillion invested in U.S. ETFs, with about $26 billion in assets,

according to Morningstar Inc. Still, the number of such funds sold

has mushroomed to 154 this year from 40 five years ago and just 14

in 2008.

Pacific Investment Management Co. manages some of the largest

such funds, including its $4.5 billion Pimco Enhanced Short

Maturity Active ETF and its $2.6 billion Pimco Total Return Active

ETF.

Some fund firms that focus on stock and bond picking have teamed

up with money managers that run large passive businesses to launch

actively managed ETFs in recent years with varying degrees of

success.

The SPDR DoubleLine Total Return Tactical ETF, a partnership

between West Coast money manager DoubleLine and Boston-based State

Street Global Advisors, was started early last year and now has

$2.7 billion in assets, according to its most recent fact sheet. It

is the second largest active ETF tracked by Morningstar.

However, three actively managed ETFs established in 2014 through

a partnership between State Street Global Advisors and MFS

Investment Management have only about $21 million in combined

assets.

Sponsors of active ETFs say they are more attractive than

actively managed mutual funds because they typically have lower

management fees and feature a tax structure that makes them less

costly than mutual funds.

Under Friday's expected guidelines, SEC staff would still have

to approve new actively managed ETFs. But the funds could skip a

separate process under which the SEC must sign off on their

exchange listings.

To qualify for expedited listing approval, the assets in a

fund's portfolio would have to fit certain characteristics, such as

limited use of over-the-counter derivatives.

Write to Andrew Ackerman at andrew.ackerman@wsj.com and Sarah

Krouse at sarah.krouse@wsj.com

(END) Dow Jones Newswires

July 22, 2016 14:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

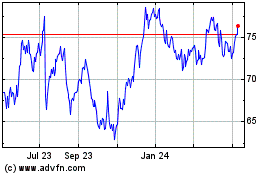

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

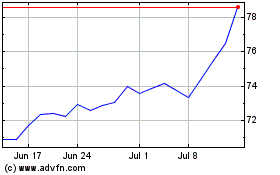

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024