SBM OFFSHORE 2016 YEAR END UPDATE

December 07 2016 - 12:03PM

December 7, 2016

As the Company nears its year end, and ahead of

the scheduled FY2016 earnings announcement, the Management Board

announces the following non-cash adjustments to its accounts, which

are the result of its regular year-end review taking into account

uncertainties in outlook for certain areas of its operations

reflected in its updated business planning assumptions1:

Summary

- Impairment of net investment in construction yard Paenal in

Angola of approximately US$60 million

- Recognition of DSCV SBM Installer long term charter as onerous

contract at a cost of approximately US$30 million

Investment in JV holding Construction Yard

Paenal

The activity outlook for SBM Offshore's

investment (30% ownership) in the Joint Venture owning the Paenal

construction yard operating in Angola has deteriorated. As a

result, the Company's carrying amount for the net investment in

this entity is to be impaired by approximately US$60 million.

Because this investment is consolidated using the equity method,

this non-cash impairment is recognized in the Company's

Consolidated Income Statement on the line item share of profit of

equity-accounted investees.

DSCV SBM Installer Charter Contract

SBM Offshore has a long-term charter contract

with the Diving Support and Construction Vessel (DSCV) SBM

Installer. Due to the ongoing industry downturn, which has

created significant over-supply in offshore markets, the vessel's

projected utilisation has decreased. As a result, the contract is

classified as onerous and a non-cash provision of approximately

US$30 million is to be recognized in the Gross Margin of the

Turnkey segment. SBM Offshore's investment (25% ownership) in the

Joint Venture which owns the vessel is consolidated using equity

accounting.

Outlook and Guidance

The Company confirms its FY2016 Directional2

revenue guidance of at least US$2.0 billion. Including the above

charter contract provision of approximately US$30 million

Directional2 FY2016 EBITDA guidance is around US$720 mln, compared

to the previous guidance of around US$750 million. However on an

underlying basis, adjusting for the aforementioned provision and

the increase in compliance related settlement provision of US$22

million reported in the 2016 Half Year Earnings, underlying

Directional2 FY2016 EBITDA guidance is around US$ 770 million.

Corporate Profile

SBM Offshore N.V. is a listed holding company

that is headquartered in Amsterdam. It holds direct and indirect

interests in other companies that collectively with SBM Offshore

N.V. form the SBM Offshore group ("the Company").

SBM Offshore provides floating production

solutions to the offshore energy industry, over the full product

life-cycle. The Company is market leading in leased floating

production systems with multiple units currently in operation and

has unrivalled operational experience in this field. The

Company's main activities are the design, supply, installation,

operation and the life extension of Floating Production, Storage

and Offloading (FPSO) vessels. These are either owned and

operated by SBM Offshore and leased to its clients or supplied on a

turnkey sale basis.

As of December 31, 2015, Group companies employ

approximately 7,000 people worldwide. Full time company

employees totaling 4,900 are spread over five regional centres,

eleven operational shore bases and the offshore fleet of

vessels. A further 2,100 are working for the joint ventures

with several construction yards. Please visit our website at

www.sbmoffshore.com.

The companies in which SBM Offshore N.V.

directly and indirectly owns investments are separate

entities. In this communication "SBM Offshore" is sometimes

used for convenience where references are made to SBM Offshore N.V.

and its subsidiaries in general, or where no useful purpose is

served by identifying the particular company or companies.

The Management BoardAmsterdam, the Netherlands,

December 7, 2016

|

Financial Calendar |

Date |

Year |

|

Full-Year 2016 Earnings - Press Release |

February 8 |

2017 |

|

Annual General Meeting of Shareholders |

April 13 |

2017 |

|

Trading Update 1Q 2017 - Press Release |

May 10 |

2017 |

|

Half-Year 2017 Earnings - Press Release |

August 8 |

2017 |

|

Trading Update 3Q 2017 - Press Release |

November 7 |

2017 |

For further information, please

contact:

Investor RelationsBert-Jaap

DijkstraInvestor Relations Director

|

Telephone: |

+31 (0)

20 236 3222 |

| Mobile

NL:Mobile MC: |

+31 6

2114 1017+33 6 4391 9302 |

|

E-mail: |

bertjaap.dijkstra@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Media RelationsVincent KempkesHead of

Communications

|

Telephone: |

+31 (0)

20 2363 170 |

|

Mobile: |

+31 (0)

6 25 68 71 67 |

|

E-mail: |

vincent.kempkes@sbmoffshore.com |

|

Website: |

www.sbmoffshore.com |

Disclaimer

This press release contains inside information

within the meaning of Article 7(1) of the EU Market Abuse

Regulation. Some of the statements contained in this release

that are not historical facts are statements of future expectations

and other forward-looking statements based on management's current

views and assumptions and involve known and unknown risks and

uncertainties that could cause actual results, performance, or

events to differ materially from those in such statements. Such

forward-looking statements are subject to various risks and

uncertainties, which may cause actual results and performance of

the Company's business to differ materially and adversely from the

forward-looking statements. Certain such forward-looking statements

can be identified by the use of forward-looking terminology such as

"believes", "may", "will", "should", "would be", "expects" or

"anticipates" or similar expressions, or the negative thereof, or

other variations thereof, or comparable terminology, or by

discussions of strategy, plans, or intentions. Should one or more

of these risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those described in this release as anticipated, believed, or

expected. SBM Offshore NV does not intend, and does not assume any

obligation, to update any industry information or forward-looking

statements set forth in this release to reflect subsequent events

or circumstances. . Nothing in this press release shall

be deemed an offer to sell, or a solicitation of an offer to buy,

any securities.

1 Updates reflect recent events and insights acquired since the

publication of the 1H16 results and 3Q16 Trading Update

2 Directional view is a non-IFRS disclosure, which treats all

leases as operating leases and consolidates the vessel joint

ventures proportionally

Attachments:

http://www.globenewswire.com/NewsRoom/AttachmentNg/83eb7edf-1c3e-4382-aa47-d7a8570f7c3f

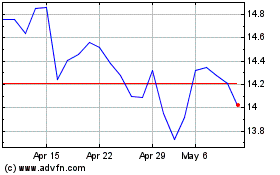

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Mar 2024 to Apr 2024

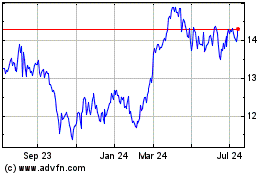

SBM Offshore NV (EU:SBMO)

Historical Stock Chart

From Apr 2023 to Apr 2024