Ryanair's Profit Feels Pressure From a Glut of Seats for Sale -- WSJ

February 07 2017 - 3:02AM

Dow Jones News

By Robert Wall

LONDON -- Ryanair Holdings PLC said its third-quarter net profit

fell nearly 8% -- a rare setback -- as overcapacity in the European

airline industry continues to depress ticket prices.

Ryanair said net profit for the quarter fell to EUR94.7 million

($102 million) from EUR102.7 million a year earlier.

The Dublin-based airline said sales for the quarter barely rose,

even as it carried 16% more passengers. Third-quarter sales of

EUR1.35 billion were just 1% better than the year-earlier figure.

Analysts expected Ryanair to deliver stronger sales and profit for

the period.

European airline earnings have been pressured by a glut of seats

for sale that has depressed ticket prices. Central European rival

Wizz Air Holdings PLC last week lowered its full-year net profit

figure and easyJet PLC, the No. 2 discounter after Ryanair, last

month signaled its profit would be lower due to fuel costs and

currency headwinds. And carrier SAS recently said it would move

some operations out of its Scandinavian home markets to cut costs

and better compete with rivals.

The sharp fall in the British currency after the country's vote

to leave the European Union has also hurt carriers exposed to the

pound. Ryanair, which generates about a quarter of its sales in the

U.K., said the pound's weakness contributed to the profit drop.

A shift in popular tourism hot spots due to political

instability in Turkey, Egypt and North Africa has also weighed on

fares.

"We expect the uncertainty post Brexit, weaker Sterling and the

switch of charter capacity from Turkey, Egypt and North Africa into

Spain and Portugal will continue to put downward pressure on

pricing for the remainder of this year" and into next fiscal year,

Ryanair Chief Executive Officer Michael O'Leary said in a

statement. "Our prices are falling faster than we initially

planned," he added.

Ryanair said ticket prices in the fourth quarter are expected to

fall as much as 15%. Still, the airline maintained its full-year

guidance of profit between EUR1.3 billion to EUR1.35 billion. The

carrier's view that ticket prices will remain weak through this

year echoes sentiments of other carriers.

Ryanair Chief Financial Officer Neil Sorahan said there was

limited visibility on even close-in bookings through March.

Overcapacity is likely to persist at least until the summer, he

said, with no signs of slowing growth.

Mr. Sorahan said rising fuel prices could start to hurt carriers

that haven't locked them in with hedges.

Currency volatility involving the pound will also persist.

Ryanair added that "we may see a slowdown in economic growth in

both the U.K. and Europe as we move closer to Brexit."

Ryanair lessened the effect of fare weakness with cost cuts.

Nonfuel per-seat costs declined 6% in the period.

Ryanair also said it expected to complete a EUR550 million share

buyback program by the end of March and that 90% of that repurchase

commitment has already been carried out.

Mr. Sorahan said Ryanair, a big buyer of Boeing Co. 737 planes,

would consider taking more if other airlines defer orders and if

the aircraft are cheap. That isn't happening yet, he said, even

after Boeing reported a slowdown in new orders last year.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

February 07, 2017 02:47 ET (07:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

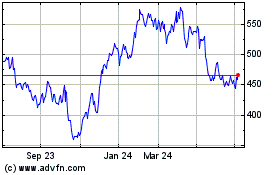

Easyjet (LSE:EZJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

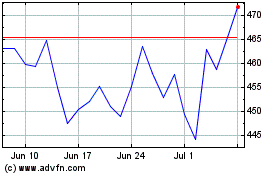

Easyjet (LSE:EZJ)

Historical Stock Chart

From Apr 2023 to Apr 2024