Ryanair CEO Says Big Drop in Winter Fares Could Affect Full-Year Guidance

August 31 2016 - 8:50AM

Dow Jones News

LONDON—Ryanair Holdings PLC on Wednesday said a further

deterioration in fares during the winter period could threaten the

airline's full-year guidance after slightly higher passenger

numbers in the summer offset a sharper-than-expected drop in ticket

prices.

Europe's largest airline by passenger numbers last month

reaffirmed its earnings outlook for full-year profit in the range

of €1.375 billion euros ($1.53 billion) to €1.425 billion, though

it said it harbored risk. Ryanair expects to transport 117 million

passengers in the financial year ending March 31, up one million

from its initial projection.

Chief Executive Michael O'Leary warned, however, that if fares

in the October-through-March period fall more than the 10% to 12%

projected, the target could be at risk: "If it gets worse than that

we will have to adjust our full-year guidance."

Mr. O'Leary said fares in the April-through-September period are

down 9%, more than the 6% to 8% decline previously expected. Cost

savings and stronger traffic numbers are keeping the Dublin-based

airline on track to meet its profit target.

There is still much uncertainty over winter bookings, he

said.

Other European airlines have issued a profit warning in recent

months, blaming demand weakness from terrorism and the effect of

the British referendum in June to leave the European Union.

Ryanair on Wednesday said it planned to grow U.K. capacity next

year by around 6%, down from the 15% growth this year. Mr. O'Leary

said the drop was driven by the so-called Brexit decision.

The airline had planned to base 10 more planes in the U.K. next

year and now will position them elsewhere. Most of the capacity

will instead go into Germany, Poland, Italy, Spain and Portugal,

Mr. O'Leary said.

The Brexit vote has put into question traffic rights that

Ryanair and other European carriers use to fly freely across the

EU. Mr. O'Leary said issues that need to be resolved go beyond

traffic rights and include how to deal with British shareholders in

European companies. The EU requires its carriers to be

majority-owned by Europeans.

Mr. O'Leary said the airline should see further benefit from

lower fuel costs next year. The airline's fuel bill this year

should be €200 million below the prior year and fall another €150

million in the financial year starting April 1.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

August 31, 2016 08:35 ET (12:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

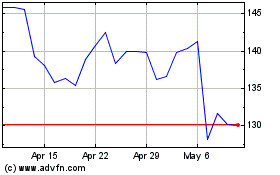

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

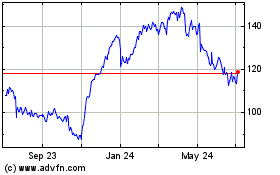

Ryanair (NASDAQ:RYAAY)

Historical Stock Chart

From Apr 2023 to Apr 2024