By John Letzing in Zurich and Max Colchester in London

HSBC Holdings PLC has been drawn into a high-profile fight

between an art dealer and one of the bank's billionaire

clients.

Earlier this year, Swiss art dealer Yves Bouvier was detained in

Monaco after being accused of overcharging Russian collector Dmitry

Rybolovlev for paintings, and conspiring to launder the proceeds

with a resident of the Mediterranean principality, Tania Rappo.

Both have denied the allegations.

News of the alleged $1 billion fraud caused a sensation in the

art world, and a bitter legal and public-relations battle broke out

between the two sides.

Last week, Mr. Bouvier's motion to have the proceedings against

him dropped was denied in a Monaco appeals court. And on Tuesday,

Mr. Rybolovlev was questioned by Monaco authorities about a

complaint filed by Ms. Rappo alleging that he had invaded her

privacy, by secretly making an audio recording of her in a bid to

gather incriminating evidence. Mr. Rybolovlev's attorney said in a

statement that the allegation is "ridiculous."

In February, HSBC responded to a query from Monaco police

investigating the money-laundering allegations against Mr. Bouvier

with a letter stating that the art dealer jointly held accounts at

the bank with Ms. Rappo. The two were detained and questioned. But

an HSBC official called authorities and said the bank had made a

mistake, Mr. Bouvier and Ms. Rappo didn't share the accounts after

all. They were both subsequently released.

HSBC has said the error was unintentional and clerical,

according to legal filings. An HSBC spokesman declined to

comment.

Ms. Rappo and Mr. Bouvier are pressing for a fuller explanation.

They allege that HSBC may have been acting under the influence of

Mr. Rybolovlev, one of HSBC's major clients in Monaco. In June, Ms.

Rappo filed a complaint asking an investigative judge to look into

the matter.

A spokesman for Mr. Bouvier said he wants a thorough

investigation of what he deems an "incredible" mistake made by the

bank.

A spokesman for the Rybolovlev family office called the

HSBC-related allegations "a diversionary tactic."

The investigative judge who received the June complaint, Pierre

Kuentz, didn't respond to requests for comment.

HSBC bought its Monaco private-bank businesses in 1999 through

the acquisition of financier Edmond Safra's Republic New York Corp.

and Safra Republic Holdings SA. Mr. Safra, a Lebanese billionaire,

died in 1999 after a fire was started in his Monaco penthouse,

which is located above HSBC's Monaco office. That penthouse, dubbed

"La Belle Epoque," was bought by Mr. Rybolovlev and is now his

residence.

For over a decade, Mr. Rybolovlev, who made his fortune in

Potash mining, worked with Mr. Bouvier to build a vast art

collection that included Picassos and Rothkos.

Between October 2013 and September 2014, Accent Delight, a

company based in the British Virgin Islands and owned by a trust

tied to Mr. Rybolovlev, paid EUR257.5 million ($274.2 million) from

an HSBC Monaco account to a company controlled by Mr. Bouvier,

according to documents seen by The Wall Street Journal. The

payments were for three pieces of art, according to people familiar

with the matter. The sales are just part of the roughly $1 billion

that Mr. Rybolovlev believes he may have been overcharged for

artworks sold by Mr. Bouvier, according to legal filings.

In January, a trust tied to Mr. Rybolovlev filed a complaint in

Monaco alleging that Mr. Bouvier was selling him paintings at a

significant markup. Mr. Bouvier said in a Wall Street Journal

interview earlier this year that the market determines prices for

paintings. Mr. Bouvier is alleged to have conspired with Ms. Rappo

to launder the proceeds of the art sales via real-estate

investments, according to legal filings. In a statement given to

the Monaco police in February, Mr. Rybolovlev noted that Ms. Rappo

was a family friend, who had introduced him to Mr. Bouvier,

according to a transcript.

On Feb. 17, HSBC sent an initial letter to Monaco police listing

three accounts linked to companies that invested in properties that

Ms. Rappo held. The letter said Mr. Bouvier's name was also on

those accounts and he was either a proxy in the related companies

or received profits from them.

On Feb. 25, Mr. Bouvier was detained in Monaco after traveling

there to visit to his Russian client. Ms. Rappo was also detained,

and told the police that HSBC must have erased her husband's name

on the accounts and pasted in Mr. Bouvier's name instead, according

to legal filings.

On Feb. 27, after the bank's phone call, HSBC wrote to the head

of Monaco's police force, to clarify that Mr. Bouvier wasn't linked

to the accounts. The bank apologized for its error, according to a

copy of the letter seen by the Journal.

Ms. Rappo's attorney filed an initial complaint regarding the

bank's error in April, with Monaco's public prosecutor, according

to court filings. That complaint was later closed without any

finding of wrongdoing, filings indicate.

In June, Ms. Rappo's attorney filed a second complaint about the

error with the investigative judge, Mr. Kuentz. The attorney wrote

that, "It is impossible to exclude the possibility that [HSBC's]

false statement was made at the request of Mr. Rybolovlev, who is

furthermore one of the biggest customers of the bank."

Last month, Mr. Bouvier applied to become a co-plaintiff in the

June complaint. His application was rejected on the grounds that

the bank's errant letter didn't do him harm. He is appealing that

ruling, his attorney said.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 19, 2015 17:36 ET (22:36 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

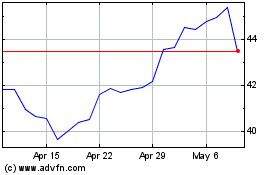

HSBC (NYSE:HSBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

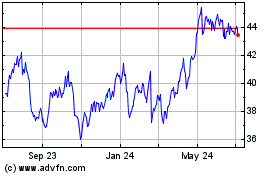

HSBC (NYSE:HSBC)

Historical Stock Chart

From Apr 2023 to Apr 2024