Royal Dutch Shell plc 3Q 2016 -- Forecast

October 27 2016 - 5:31AM

Dow Jones News

FRANKFURT--The following is a summary of analysts' forecasts for

Royal Dutch Shell plc (RDSA) third-quarter results, based on a poll

of 10 analysts conducted by Dow Jones Newswires. Figures in million

dollars, EPS and dividend in dollar, target price in pence,

production in thousand barrel of oil per day (kboe/d), according to

IFRS). Earnings figures are scheduled to be released November

1.

===

CCS Earnings CCS EPS Production

3rd Quarter adjusted(a) adj.(a) (kboe/d)

AVERAGE 1,757 0.24 3,541

Prev. Year 2,376 0.38 2,880

+/- in % -26 -38 +23

Prev. Quarter 1,045 0.13 3,508

+/- in % +68 +82 +0.9

MEDIAN 1,793 0.23 3,518

Maximum 2,238 0.28 3,720

Minimum 1,258 0.20 3,399

Amount 10 5 10

Barcalys 1,392 -- 3,445

Deutsche Bank 2,090 -- 3,429

Goldman Sachs 2,238 0.28 3,720

Jefferies 1,985 0.25 3,618

Kepler Cheuvreux 1,517 -- 3,510

Morgan Stanley 1,258 -- 3,399

Panmure 1,625 0.20 3,672

Santander 1,880 0.23 3,525

Societe Generale 1,782 0.22 3,591

UBS 1,804 -- 3,502

Target price Rating DPS 2016

AVERAGE 2,346 positive 8 AVERAGE 1.88

Prev. Quarter 2,210 neutral 2 Prev. Year 1.88

+/- in % +6.2 negative 0 +/- in % 0.0

MEDIAN 2,300 MEDIAN 1.88

Maximum 2,600 Maximum 1.88

Minimum 2,000 Minimum 1.88

Amount 9 Amount 5

Barcalys 2,600 Overweight --

Citi 2,000 Neutral 1.88

Deutsche Bank 2,220 Buy 1.88

Jefferies 2,400 Buy 1.88

Kepler Cheuvreux -- Buy 1.88

Morgan Stanley 2,600 Overweight --

Panmure 2,300 Buy --

Santander 2,248 Hold --

Societe Generale 2,500 Buy --

UBS 2,250 Buy 1.88

===

Year-earlier figures are as reported by the company.

(a) Clean cost of supplies.

DJG/err

(END) Dow Jones Newswires

October 27, 2016 05:16 ET (09:16 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

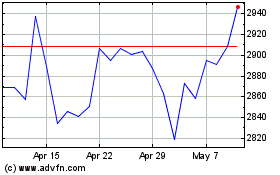

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

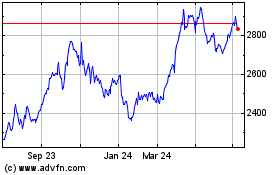

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024