Royal Bank of Scotland Sells Loan Portfolio for GBP400 Million

July 23 2015 - 2:54AM

Dow Jones News

By Ian Walker

LONDON--Royal Bank of Scotland Group PLC (RBS.LN) said Thursday

it is selling a portfolio of loans to an entity funded by Deutsche

Bank AG (DB) and funds affiliated with Apollo Global Management,

LLC (APO) for 400 million pounds ($621 million).

RBS, which is 80%-owned by the U.K. government, said it will use

the money raised for general corporate purposes. It expects the

deal to be completed in September.

The carrying value of the loans at Dec. 31, 2014 was GBP376

million and the sale is expected to generate a profit of GBP24

million after costs, RBS said.

-Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

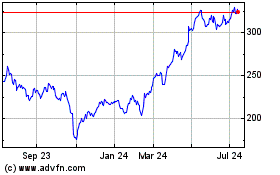

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024