TIDMRBS

RNS Number : 1397O

Royal Bank of Scotland Group PLC

04 February 2016

The Royal Bank of Scotland Group plc

Restatement

Document

February 2016

Contents

Page

=========================================================== ====

Introduction 1

Customer segments 4

Appendix 1 Financial statement reconciliations

Financial statement reconciliations 11

Appendix 2 Components of customer segments

Operating profit/(loss) by segment 17

UK PBB 18

Ulster Bank RoI 21

Commercial Banking 24

Private Banking 27

RBS International 30

Corporate & Institutional Banking 33

Capital Resolution 36

Williams & Glyn 39

Appendix 3 Allocation of previous segments to new customer

segments

Introduction 43

UK PBB 44

Ulster Bank 47

Commercial Banking 50

Private Banking 53

Corporate & Institutional Banking 56

RCR 59

Central items & other 62

=========================================================== ====

Forward-looking statements

Certain sections in this document contain 'forward-looking

statements' as that term is defined in the United States Private

Securities Litigation Reform Act of 1995, such as statements that

include the words 'expect', 'estimate', 'project', 'anticipate',

'believes', 'should', 'intend', 'plan', 'could', 'probability',

'risk', 'target', 'goal', 'objective', 'will', 'endeavour',

'outlook', 'optimistic', 'prospects' and similar expressions or

variations on such expressions. These statements concern or may

affect future matters, such as RBS's future economic results,

business plans and current strategies. Forward-looking statements

are subject to a number of risks and uncertainties that might cause

actual results and performance to differ materially from any

expected future results or performance expressed or implied by the

forward-looking statements. Factors that could cause or contribute

to differences in current expectations include, but are not limited

to, legislative, fiscal and regulatory developments, accounting

standards, competitive conditions, technological developments,

exchange rate fluctuations and general economic conditions. These

and other factors, risks and uncertainties that may impact any

forward-looking statement or RBS's actual results are discussed in

RBS's 2015 Annual Report and Accounts (ARA). The forward-looking

statements contained in this document speak only as at the date

hereof, and RBS does not assume or undertake any obligation or

responsibility to update any forward-looking statement to reflect

events or circumstances after the date hereof or to reflect the

occurrence of unanticipated events.

The Royal Bank of Scotland Group plc (RBS)

Business reorganisation and reporting changes

This announcement sets out changes to RBS's financial reporting:

a change in accounting policy for pensions; revised operating

segments; and changes in results presentation. The announcement

contains restated financial results for the year ended 31 December

2014 and, to aid comparison of RBS's fourth quarter 2015 results

with prior periods, restated financial information for the quarters

ended 30 September 2015 and 31 December 2014.

Pension accounting policy

In light of developments during 2015, in particular publication

by the International Accounting Standards Board of its exposure

draft of amendments to IFRIC 14 'IAS 19 - The Limit on a Defined

Benefit Asset, Minimum Funding Requirements and their Interaction',

RBS has revised its accounting policy for determining whether or

not it has an unconditional right to a refund of surpluses in its

employee pension funds. Previously, where trustees have the power

to use a scheme surplus to enhance benefits for members, RBS did

not regard such power, in and of itself, as undermining the bank's

unconditional legal right to a refund of a surplus existing at that

point in time. Under the new policy, where RBS has a right to a

refund, this is no longer regarded as unconditional if pension fund

trustees can use a scheme surplus to enhance benefits for plan

members. As a result of this policy change, a minimum funding

requirement to cover an existing shortfall in a scheme may give

rise to an additional liability and surpluses may not be recognised

in full. The accounting policy change is being applied

retrospectively and comparatives restated.

Segmental reorganisation

RBS continues to deliver on its plan to build a stronger,

simpler and fairer bank for both customers and shareholders. To

support this and reflect the progress made, the previously reported

operating segments will now realign as follows:

Personal & Business Banking (PBB) comprises two reportable

segments:

-- UK PBB serves individuals and mass affluent customers in the

UK together with small businesses (generally up to GBP2 million

turnover). UK PBB includes Ulster Bank customers in Northern

Ireland.

-- Ulster Bank RoI serves individuals and businesses in the

Republic of Ireland (RoI).

Commercial & Private Banking (CPB) comprises three

reportable segments:

-- Commercial Banking serves commercial and mid-corporate

customers in the UK.

-- Private Banking serves high net worth individuals in the

UK.

-- RBS International (RBSI) serves retail, commercial, corporate

and financial institution customers in Jersey, Guernsey, Isle of

Man and Gibraltar.

Corporate & Institutional Banking (CIB) serves UK and

western European customers, both corporates and financial

institutions, supported by trading and distribution platforms in

the UK, US and Singapore.

Capital Resolution includes CIB Capital Resolution and the

remainder of RBS Capital Resolution (RCR).

Williams & Glyn (W&G) comprises RBS England and Wales

branch-based businesses, along with certain small and medium

enterprises and corporate activities across the UK.

Central items & other includes corporate functions, such as

treasury, finance, risk management, compliance, legal,

communications and human resources. Central functions manages RBS

capital resources and RBS-wide regulatory projects and provides

services to the reportable segments. Balances in relation to

Citizens and the international private banking business are

included in Central items in the relevant periods.

The Royal Bank of Scotland Group plc (RBS)

Reporting changes

In line with RBS's strategy to be a simpler bank the following

reporting changes have been implemented in relation to the

presentation of the results.

One-off and other items

The following items were previously reported separately after

operating profit; they are now reported within operating

profit:

-- Own credit adjustments;

-- Gain/(loss) on redemption of own debt;

-- Write-down of goodwill;

-- Strategic disposals; and

-- RFS Holdings minority interest (RFS MI) (restated for periods up to and

including Q4 2014 only; this has been reported within operating profit since

Q1 2015).

Own credit adjustments are included within segmental results in

CIB, Capital Resolution and Central items (Treasury) in line with

where the related liabilities are recorded. The non-statutory

results will continue to show these items and restructuring costs

and litigation and conduct costs as separate line items within the

relevant caption of the income statement where significant.

Allocation of central balance sheet items

RBS allocates all central costs relating to Services and

Functions to the business using appropriate drivers; these are

reported as indirect costs in the segmental income statements.

However, previously central balance sheet items have not been

allocated. The assets (and risk-weighted assets) held centrally,

mainly relating to Treasury, are now allocated to the business

using appropriate drivers.

Revised treasury allocations

Treasury allocations which are included within segmental net

interest income and segmental net interest margins, have been

revised to reflect the following:

-- In preparation for the separation of W&G, the element of treasury allocations

previously charged to UK PBB is now retained centrally.

-- To reflect the impact of changes to the notional equity allocation detailed

below.

Revised segmental return on equity

RBS's CET 1 target is 13% but for the purposes of computing

segmental return on equity (ROE), to better reflect the

differential drivers of capital usage, segmental operating profit

after tax and adjusted for preference dividends is divided by

notional equity allocated at different rates of 11% (Commercial

Banking and Ulster Bank RoI), 12% (RBS International) and 15% for

all other segments, of the monthly average of segmental

risk-weighted assets after capital deductions (RWAes). This

notional equity was previously 13% for all segments. In addition,

due to changes in UK tax rules enacted in the Finance Act 2015, RBS

has increased its longer-term effective 31 December tax rate. The

notional tax rate used in the segmental ROE has been revised from

25% to 28% (Ulster Bank RoI - 15%; RBS International - 10%). RBS's

forward planning tax rate is 26%.

The Royal Bank of Scotland Group plc (RBS)

Annual results 2015

February 04, 2016 11:00 ET (16:00 GMT)

Total income - adjusted (2) 45 - 45

Operating expenses - adjusted (3) (356) - (356)

Operating profit - adjusted (2,3) 995 - 995

========================================== ---------- =========== ==========

31 December 2014

===================================

Allocated

to

Previously Reporting Capital

reported changes (1) Resolution

Capital and balance sheet GBPbn GBPbn GBPbn

========================================== ========== =========== ==========

Loans and advances to customers (gross) 21.9 - 21.9

Loan impairment provisions (10.9) - (10.9)

========================================== ========== =========== ==========

Net loans and advances to customers 11.0 - 11.0

Funded assets 14.9 - 14.9

Risk elements in lending 15.4 - 15.4

Customer deposits (excluding repos) 1.2 - 1.2

Provision coverage (4) 71% - 71%

Risk-weighted assets 22.0 - 22.0

========================================== ========== =========== ==========

Notes:

(1) Refer to page 2 for further details.

(2) Excluding own credit adjustments.

(3) Excluding restructuring costs.

(4) Provision coverage represents loan impairment provisions as

a percentage of risk elements in lending.

Central items & other

Impact

Income statement of

Pension revised Re-presentation Allocated to

==================

of one-off

Previously accounting treasury and Capital

policy other items Centre

reported impact allocations (1) (2) Resolution

Quarter ended 30 September

2015 GBPm GBPm GBPm GBPm GBPm GBPm

============================ ========== ========== =========== =============== ====== ==========

Central items not allocated (285) (16) (10) 20 (317) 26

============================ ========== ========== =========== =============== ====== ==========

Quarter ended 31 December

2014

============================ ========== ========== =========== =============== ====== ==========

Central items not allocated (620) (6) (50) (703) 27

============================ ========== ========== =========== =============== ====== ==========

Year ended 31 December

2014

============================ ========== ========== =========== =============== ====== ==========

Central items not allocated (860) (33) 86 (904) 97

============================ ========== ========== =========== =============== ====== ==========

Balance sheet

Impact

of

Pension revised Allocated to

==================

Previously accounting treasury Capital

policy Centre

reported impact allocations (2) Resolution

As at 30 September 2015 GBPbn GBPbn GBPbn GBPbn GBPbn

============================== ========== ========== =========== ====== ==========

Central items not allocated -

risk-weighted assets 87.7 (8.7) 72.1 6.9

Central items not allocated -

funded assets 116.9 0.4 (89.5) 26.7 1.1

============================== ========== ========== =========== ====== ==========

As at 31 December 2014

============================== ========== ========== =========== ====== ==========

Central items not allocated -

risk-weighted assets 84.7 (9.8) 68.8 6.1

Central items not allocated -

funded assets 169.2 0.3 (83.1) 85.4 1.0

============================== ========== ========== =========== ====== ==========

Notes:

(1) Refer to page 2 for further details.

(2) Centre includes unallocated costs.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDMGGZKDVGVZM

(END) Dow Jones Newswires

February 04, 2016 11:00 ET (16:00 GMT)

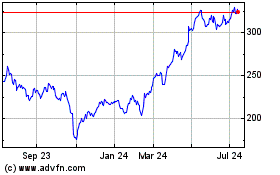

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024