Royal Bank of Scotland Group PLC Annual Report and Accounts 2014 (0840J)

March 31 2015 - 1:27PM

UK Regulatory

TIDMRBS

RNS Number : 0840J

Royal Bank of Scotland Group PLC

31 March 2015

The Royal Bank of Scotland Group plc

31 March 2015

Annual Report and Accounts 2014

Strategic Report 2014

Pillar 3 Disclosure 2014

Copies of the Annual Report and Accounts 2014 and Strategic

Report 2014 for The Royal Bank of Scotland Group plc (RBS) have

been submitted to the National Storage Mechanism and will shortly

be available for inspection at: www.Hemscott.com/nsm.do.

These documents are available on our website at

www.rbs.com/annualreport. Printed copies will be mailed to

shareholders ahead of the Annual General Meeting (AGM) which it is

intended will be held on 23 June 2015 and for which formal Notice

will be given in due course.

The Pillar 3 Disclosure 2014 will also be published on our

website at www.rbs.com/annualreport.

Information on related party transactions

For the purpose of compliance with the Disclosure and

Transparency Rules, this announcement also contains details of

related party transactions extracted from the Annual Report and

Accounts 2014 in full unedited text. Page references in the text

refer to page numbers in the Annual Report and Accounts 2014.

Related parties

UK Government

On 1 December 2008, the UK Government through HM Treasury became

the ultimate controlling party of The Royal Bank of Scotland Group

plc. The UK Government's shareholding is managed by UK Financial

Investments Limited, a company wholly owned by the UK Government.

As a result, the UK Government and UK Government controlled bodies

became related parties of the Group.

The Group enters into transactions with many of these bodies on

an arm's length basis. The principal transactions during 2014, 2013

and 2012 included: Bank of England facilities and the issue of debt

guaranteed by the UK Government discussed below and the Asset

Protection Scheme which the Group exited on 18 October 2012 having

paid total premiums of GBP2.5 billion. In addition, the redemption

of non-cumulative sterling preference shares and the placing and

open offer in April 2009 was underwritten by HM Treasury and, in

December 2009, B shares were issued to HM Treasury and a contingent

capital agreement concluded with HM Treasury (see Note 27). Other

transactions include the payment of: taxes principally UK

corporation tax (page 373) and value added tax; national insurance

contributions; local authority rates; and regulatory fees and

levies (including the bank levy (page 363) and FSCS levies (page

429)) together with banking transactions such as loans and deposits

undertaken in the normal course of banker-customer

relationships.

Bank of England facilities

The Group may participate in a number of schemes operated by the

Bank of England in the normal course of business.

Members of the Group that are UK authorised institutions are

required to maintain non-interest bearing (cash ratio) deposits

with the Bank of England amounting to 0.18% of their eligible

liabilities in excess of GBP600 million. They also have access to

Bank of England reserve accounts: sterling current accounts that

earn interest at the Bank of England Rate.

National Loan Guarantee Scheme

The Group participated in the National Loan Guarantee Scheme

(NLGS), providing loans and facilities to eligible customers at a

discount of one percent. It did not issue any guaranteed debt under

the scheme and consequently, it was not committed to providing a

particular volume of reduced rate facilities. At 31 December 2014,

the Group had no amounts outstanding under the scheme (2013 - nil;

2012 - GBP898 million). The NLGS was superseded by the Funding for

Lending Scheme.

The Funding for Lending Scheme

The Funding for Lending Scheme was launched in July 2012. Under

the scheme UK banks and building societies are able to borrow UK

treasury bills from the Bank of England at a price that depends on

the participant's net lending to the UK non-financial sector. As at

31 December 2014, the Group had no amounts outstanding under the

scheme (2013 - nil; 2012 - GBP749 million).

Other related parties

(a) In their roles as providers of finance, Group companies

provide development and other types of capital support to

businesses. These investments are made in the normal course of

business and on arm's length terms. In some instances, the

investment may extend to ownership or control over 20% or more of

the voting rights of the investee company. However, these

investments are not considered to give rise to transactions of a

materiality requiring disclosure under IAS 24.

(b) The Group recharges The Royal Bank of Scotland Group Pension

Fund with the cost of administration services incurred by it. The

amounts involved are not material to the Group.

(c) In accordance with IAS 24, transactions or balances between

Group entities that have been eliminated on consolidation are not

reported.

(d) The captions in the primary financial statements of the

parent company include amounts attributable to subsidiaries. These

amounts have been disclosed in aggregate in the relevant notes to

the financial statements.

For further information, please contact:-

RBS Media Relations

+44 (0) 131 523 4205

Investors

Richard O'Connor

Head of Investor Relations

+44 (0) 207 672 1758

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACSEAXDFDASSEFF

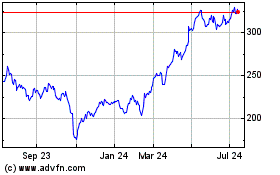

Natwest (LSE:NWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Natwest (LSE:NWG)

Historical Stock Chart

From Apr 2023 to Apr 2024