Royal Bank of Canada's Profit Increases

August 24 2016 - 7:40AM

Dow Jones News

Royal Bank of Canada, one of Canada's largest lenders by assets,

said revenue and profit rose in its third quarter.

Toronto-based RBC said results were driven by earnings increases

in its wealth management, capital markets and personal &

commercial banking divisions. They were partially offset by

declines in insurance and in the investor & treasury services

segments.

In all for the quarter, RBC's net profit rose to 2.89 billion

Canadian dollars ($2.24 billion), or C$1.88 a share, compared with

net income of C$2.45 billion, or C$1.66 a share, in the same

quarter last year.

Earlier this year, RBC sold its home and auto-insurance

operations to the Canadian arm of U.K. insurance provider Aviva PLC

for about C$582 million.

When excluding the gains for that sale and other items, RBC said

adjusted earnings per share were C$1.72 a share in the latest

quarter.

Revenue rose 16.2% to C$10.26 billion.

Analysts polled by Thomson Reuters had expected C$1.71 in

adjusted earnings per share on revenue of C$9.35 billion.

The bank also increased its quarterly dividend by 2 Canadian

cents to 83 cents per share.

RBC set aside less money in the quarter to cover impaired loans

stemming from the low energy prices. That figure, its provision for

credit losses, was C$318 million, down from C$460 in the prior

quarter and up from C$270 million last year.

Net interest income rose 9% to C$4.12 billion as fee-based

income jumped 22% to C$6.13 billion.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

August 24, 2016 07:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

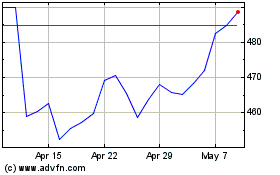

Aviva (LSE:AV.)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aviva (LSE:AV.)

Historical Stock Chart

From Apr 2023 to Apr 2024