Rolls-Royce Posts Big First-Half Loss -- Update

July 28 2016 - 4:13AM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC said a plan to boost its

profitability was starting to show results even as the British

aircraft engine maker on Thursday posted a big first-half loss

because of an accounting hit from the weakness of the pound.

The London-based company posted a 1.8 billion pound ($2.37

billion) net loss following the revaluation of U.S. currency

hedges. The noncash GBP2.2 million mark-to-market adjustment came

midyear just days after Britain's vote to exit the European Union

caused the British currency to plunge. Net profit the year-prior

was GBP360 million.

Rolls-Royce, which makes engines for Boeing Co. and Airbus Group

SE's long-range jetliners said underlying profit was GBP77 million

as sales retreated 1% to GBP6.5 billion. The currency weakness was

a slight tailwind at the operational level as dollar-deals

translated into more pounds.

The company left its full-year earnings outlook unchanged, with

expectations of a decline in sales and revenue. Rolls-Royce in May

said its profit would mostly be made in the second half of the

year.

Rolls-Royce shares rose 5.53% in early London trading.

Rolls-Royce, no longer affiliated with the luxury car maker, is

recovering from several profit warnings that led it to cut its

dividend for the first time since 1992 after profit slumped. The

company has suffered lower demand for some of its most profitable

products and struggled with the impact on demand from low crude

prices on its marine and power-systems operations.

"Order intake has been good and, although known headwinds

constrained revenue and profit in the first half, the business

remains well positioned to deliver a solid second-half

performance," said Chief Executive Warren East, who has just

completed his first year in the job.

Mr. East has been trying to trim costs and cut management

layers. Mr. East said 270 manager of 400 expected to leave the

business this year had already departed.

The focus now is shifting to simplifying business process to

boost efficiency, he said.

Mr. East said the turnaround program put in place last year was

starting to deliver results. Savings generated this year should

come in at the top-end of the GBP30 million to GBP50 million

projection, he said. The company still targets up to GBP200 million

in savings at the end of next year. Costs for the program are

unchanged, he said.

Mr. East said the Brexit vote shouldn't have a major impact on

the company.

The interim dividend payment was cut to 4.6 pence from 9.27

pence in the year-prior.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

July 28, 2016 03:58 ET (07:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

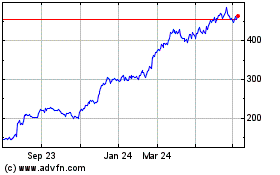

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

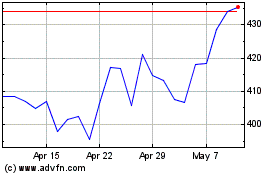

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024