TIDMRR.

RNS Number : 1547C

Rolls-Royce Holdings plc

17 January 2018

17 January 2018

ROLLS-ROYCE ANNOUNCES FURTHER SIMPLIFICATION OF BUSINESS,

STRATEGIC REVIEW OF COMMERCIAL MARINE OPERATION

AND PLANS TO RESTRUCTURE SUPPORT AND MANAGEMENT FUNCTIONS

Rolls-Royce announces that it is embarking on a further

simplification of the business, including the evaluation of

strategic options for our Commercial Marine operation and a

reduction from five operating businesses to three core units based

around Civil Aerospace, Defence and Power Systems. As part of this

exercise, we plan to consolidate our Naval Marine and Nuclear

Submarines operations within our existing Defence business, and

Civil Nuclear operations within our Power Systems business. This

will facilitate a more fundamental restructuring of support and

management functions in particular.

These actions are designed to align our business more closely

with our strategic vision to pioneer cutting-edge technologies that

deliver vital power. It will allow us to better capitalise on our

relationships with Defence customers and our market leading

widebody position within Civil Aerospace, while strengthening our

technology capabilities across a broad range of power generation

applications. We would expect the subsequent restructuring to

deliver an additional reduction in costs and assist us in improving

performance from our core businesses and the whole Group. We are in

the process of defining this restructuring and further details will

be given at the time of our 2017 financial results on 7 March 2018

and a fuller discussion at a Capital Markets event later this

year.

Chief Executive Warren East said: "Building on our actions over

the past two years, this further simplification of our business

means Rolls-Royce will be tightly focused into three operating

businesses, enabling us to act with much greater pace in meeting

the vital power needs of our customers. It will create a Defence

operation with greater scale in the market, enabling us to offer

our customers a more integrated range of products and services. It

will also strengthen our ability to innovate in core technologies

and enable us to take advantage of future opportunities in areas

such as electrification and digitalisation."

"Alongside the simplification into three operating businesses,

we must continue to address the cost and complexity of the

structures that support and serve these businesses, including our

corporate head office, with greater decisiveness. Taking this

action now will help secure the long-term benefit for our business

and stakeholders of the growing cash flows that will be generated

over the coming years. At the same time, our operational teams must

continue to focus on managing in-service issues within Civil

Aerospace and delivering the current increase in engine

production."

Strategic review of Commercial Marine

Since 2015 our Marine business has responded to weak demand for

products and services for the offshore oil and gas market, which

significantly impacted its profitability. It has divested non-core

businesses and reduced the number of sites from 27 to 15 - an

overall reduction in footprint of 40%. It has managed a reduction

in its workforce by 30% to 4,200, with the majority now based in

the Nordic region. At the same time, the business has been

investing in new facilities and new technologies and become an

industry leader in the fields of ship intelligence and autonomous

vessels, culminating in June 2017 with the successful

demonstration, in Copenhagen harbour, of the world's first remotely

operated commercial vessel. Given the progress the business has

already made, it is now an appropriate time to conduct a strategic

review of Commercial Marine. This review will be undertaken during

2018 and we will update the market of the outcome at the

appropriate time.

Warren East said: "This is the right time to be evaluating the

strategic options for our Commercial Marine operation. The team

there has responded admirably to a significant downturn in the

offshore oil and gas market to reduce its cost base. At the same

time, we have carved out an industry-leading position in ship

intelligence and autonomous shipping and it is only right that we

consider whether its future may be better served under new

ownership."

Regardless of the outcome of this strategic review, Rolls-Royce

will retain the Marine operations which supply complex power and

propulsion systems to Naval customers, including the Royal Navy and

US Navy. During the first quarter of 2018, these Naval operations

will become part of an enlarged Defence business named Rolls-Royce

Defence, comprising the current Defence Aerospace business and our

Nuclear Submarines operation. We will also continue to have a

successful engine business serving marine customers within Power

Systems.

In 2016, Marine contributed GBP1,114m revenue and generated a

loss of GBP27m. Within this, the Commercial Marine business, which

supplies equipment and vessel design across the oil and gas,

merchant and other commercial markets, accounted for 75% of

revenues while the Naval operations accounted for 25% and achieved

a small profit. Marine continues to be impacted by weak demand for

products and services for the off-shore oil and gas market, as we

said on 9 November 2017, and will continue to pursue cost reduction

opportunities.

Integration of Nuclear business

In order to further simplify our business from five operating

businesses to three focused units, we intend to integrate our

existing Nuclear operations into our Defence and Power Systems

businesses. Our Nuclear Submarines operation, which is the sole

provider and technical authority for the Royal Navy's nuclear

submarine fleet, will form part of Rolls-Royce Defence, while our

Civil Nuclear operations will be placed within Rolls-Royce Power

Systems, which already provides services to the nuclear industry

such as emergency diesel generators.

We expect these changes to take effect during the first quarter

of 2018. In 2016, our Nuclear business reported revenues of GBP777m

and generated a profit of GBP45m. Our Submarines operation

accounted for 79% of revenues and our Civil Nuclear operations

accounted for 21%.

Restructuring of support and management functions

The simplification of our operating businesses into three

focused units will enable them to operate at greater pace, but the

full benefits can only be realised if we undertake a more

fundamental restructuring, in particular of our support and

management functions, and take a highly disciplined approach to

capital allocation on investment expenditure and R&D spend. We

will also be taking further measures to streamline processes and

reinforce behavioural change, accelerating the work we have already

done to drive simplicity.

Chief Financial Officer Stephen Daintith, said: "We must address

the imbalance and duplication between our corporate functions and

our three business units, as well as the cost of our corporate head

office. Costs and complexity within our business remain too high,

despite the delivery of the transformation activities announced in

November 2015 which will achieve the committed fixed cost reduction

rate of over GBP200m from the end of 2017. We are taking decisive

action now in order to secure and enhance the long-term benefit of

the cash flows that will be generated over the coming years."

Although the potential impact on our workforce remains to be

quantified, we do not anticipate any reduction in the skilled

operational and engineering roles that we require to support our

current ramp-up in Civil Aerospace engine production. We will

honour commitments made to workers' representatives in the UK and

elsewhere, including those which enabled last year's GBP150m

investment in new and existing Civil Aerospace facilities.

Further broad details of the restructuring will be given

alongside our 2017 financial results. Within those results we will

report our Marine and Nuclear businesses as separate units, as in

prior years. In addition, we plan to hold a Capital Markets event

later this year at which we will be in a position to provide a

fuller discussion of the expected benefits of the restructuring

programme.

Finally, as noted above, Rolls-Royce will be announcing its

final results for the year ending 31 December 2017 on 7 March 2018.

We remain comfortable with market expectations.

About Rolls-Royce Holdings plc

1. Rolls-Royce pioneers cutting-edge technologies that deliver

the cleanest, safest and most competitive solutions to our planet's

vital power needs.

2. Rolls-Royce has customers in more than 150 countries,

comprising more than 400 airlines and leasing customers, 160 armed

forces, 4,000 marine customers including 70 navies, and more than

5,000 power and nuclear customers.

3. Annual underlying revenue was GBP13.8 billion in 2016, around

half of which came from the provision of aftermarket services. The

firm and announced order book stood at GBP82.7 billion at the end

of June 2017.

4. In 2016, Rolls-Royce invested GBP1.3 billion on research and

development. We also support a global network of 31 University

Technology Centres, which position Rolls-Royce engineers at the

forefront of scientific research.

5. Rolls-Royce employs almost 50,000 people in 50 countries.

More than 16,500 of these are engineers.

6. The Group has a strong commitment to apprentice and graduate

recruitment and to further developing employee skills. In 2016 we

recruited 274 graduates and 327 apprentices through our worldwide

training programmes.

For further information, please contact:

Investors:

Jennifer Ramsey

+44 7825 903206

jennifer.ramsey@rolls-royce.com

Helen Harman

+44 7968 906645

helen.harman@rolls-royce.com

Ross Hawley

+44 7920 822534

ross.hawley@rolls-royce.com

Media:

Richard Wray

+44 7810 850055

richard.wray@rolls-royce.com

www.Rolls-Royce.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDZMGMMZNMGRZM

(END) Dow Jones Newswires

January 17, 2018 08:00 ET (13:00 GMT)

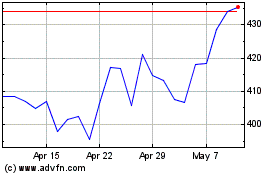

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

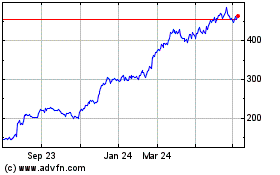

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024