Rolls-Royce CEO East Promises Cost Cuts, Management Pruning -- 3rd Update

November 24 2015 - 2:20PM

Dow Jones News

By Robert Wall

LONDON-- Rolls-Royce Holdings PLC Chief Executive Warren East on

Tuesday promised far-reaching restructuring at the British engine

maker after a series of earnings missteps, and he signaled some

activities could be shed even while the company remains

diversified.

The maker of engines for Boeing Co. and Airbus Group SE

jetliners plans more layoffs as the company prunes management to

streamline decision-making, which Mr. East said is overly

cumbersome.

Rolls-Royce, which previously announced 3,600 jobs would be cut

in its aerospace and marine businesses, wouldn't quantify the scale

of additional job losses. The company is promising savings of 150

million pounds ($226.9 million) to GBP200 million a year beginning

in 2017, though it still is assessing upfront costs to reach those

targets.

Mr. East faces pressure to show results from the turnaround

effort. The share price at the FTSE 100 blue-chip company has

declined 32% this year. U.S. activist investor ValueAct Capital

Management LP has become its largest shareholder and is seeking a

board seat.

Mr. East has repeatedly stressed that the review was focused on

operations. Strategic decisions, such as whether to divest business

lines, weren't on the agenda, he has said, despite concerns outside

the company that its land and sea engine operations are a drag on

its aerospace activities, the company's largest profit

contributor.

"The notion we are going to sell big chunks is just wrong," he

told reporters.

That doesn't mean the company wouldn't shed some activities. "A

bit of portfolio optimization could be done," he said, without

identifying possible targets for disposal.

Rolls-Royce has struggled to deliver on previous cost-cutting

efforts and been hit by weakening demand for some civil aircraft

engines, including aftermarket support. It also has lost market

share in the business jet engine market. Its marine engine business

has suffered from falling demand.

Rolls-Royce said earlier this month it may cut its dividend,

prompting the worst selloff in the company's stock in 15 years.

Chief Financial Officer David Smith said the company's debt rating

may also face a downgrade.

Mr. East, who became chief executive in July and then issued a

profit warning on his second day in the job, wouldn't rule out a

further downgrade in expectations Tuesday.

Rolls-Royce also indicated the restructuring would take time.

The company is still determining what the simplified structure

should look like. Mr. East said a top-level structure should be

defined by year-end. Details on the costs of restructuring should

be available in February when the company releases full-year

results. Other measures will be detailed later, Mr. East said.

After the latest profit warning issued earlier this month,

Rolls-Royce suspended its medium-term earnings outlook introduced

only a year ago to give investors greater clarity. It will not be

restored for at least a year, Mr. East said, as the company tries

to fix excessively complex internal accounting systems. Still, he

promised the company should generating cash "comfortably" before

2020.

One example of simplification Rolls-Royce plans is the paring of

its 27 key technologies to around eight themes, Mr. East said. That

will reduce the number of people needed to manage those efforts,

while also allowing more regular reviews.

In Rolls-Royce's critical civil aerospace business, Mr. East

said, the focus is on driving profitability by delivering the big

backlog of ordered large engines for such planes as the Airbus A350

long-haul jet. Regaining business jet market share also is a

priority.

Mr. East played down expectations Rolls-Royce would mount a push

to re-enter the market to power narrowbody jets, the backbone of

global airline fleets.

The company doesn't have to be in that segment, he told

investors. Mr. East's predecessor signaled Rolls-Royce was keen on

re-entering the market, possibly through a partnership with Pratt

& Whitney, the engine unit of United Technology Corp.

Absent new single-aisle plane programs at Airbus and Boeing, Mr.

East said, there are no near-term opportunities to break into that

segment in the immediate future. "This is not something we should

be wasting our time on debating," he said.

He also said the company should "harvest" earnings in its

declining market to power regional jets, where an opportunity to

power new models also is lacking. Those sales could fall by a third

over the next five years, the company projects.

Write to Robert Wall at robert.wall@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 24, 2015 14:05 ET (19:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

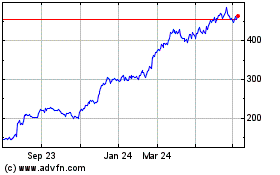

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Mar 2024 to Apr 2024

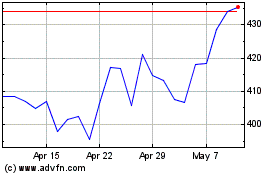

Rolls-royce (LSE:RR.)

Historical Stock Chart

From Apr 2023 to Apr 2024